Summary:

- Broadcom’s valuation at 38x forward free cash flow is high, making me cautious despite its strong earnings and impressive profitability metrics.

- Revenue growth is expected to decelerate, with fiscal Q1 2025 projections lower than fiscal Q4 2024, raising concerns about future performance.

- Broadcom’s $58 billion net debt and competitive pressures, particularly from Nvidia, add to the risks of sustaining its premium valuation.

- While I admire Broadcom’s execution and innovation, I’ll remain on the sidelines until a more compelling risk-reward balance emerges.

JHVEPhoto

Investment Thesis

Broadcom (NASDAQ:AVGO) delivered a very strong fiscal Q4 2024 earnings report that was met with a resounding cheer from investors, as the stock is up 14% after hours.

But I’m not entirely sold on this stock. There was a time in the recent past when I was super bullish on Broadcom. But today, I’m a bit more cautious.

Perhaps, the reason is that I prefer to be early to the story and buy it cheap, when I don’t need to have all the answers, but just a vague idea of how it will play out. Because when you are late to the story, you need to have a lot more answers and much stronger conviction and to be a lot smarter than me.

Basically, at 38x forward free cash flow, I’m going to stick to the sidelines and cheer for more intelligent investors than me, that have the foresight I don’t.

Rapid Recap

Back in August 2023, I said,

While I acknowledge that the AI theme has taken a breather, I also declare that Broadcom isn’t a me-too AI play. I put the emphasis here on three different elements:

- Broadcom’s underlying prospects are set to accelerate in the next twelve months.

- Its strong free cash flows are being underappreciated by investors.

- And paying 17x next year’s free cash flow provides investors with a margin of safety.

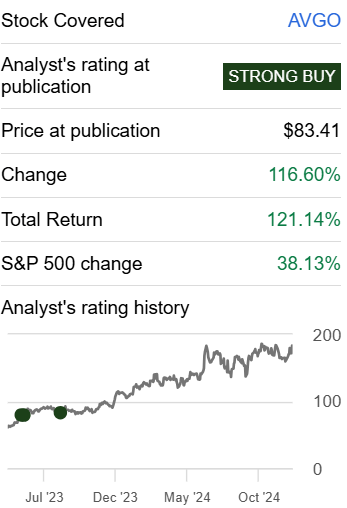

Author’s work on AVGO

Since that time, the stock is up about 120% vs the S&P500, at about 40%. See if you can spot the difference between my setup then, and the one now.

Broadcom’s Near-Term Prospects

Broadcom is a leading technology company specializing in semiconductor solutions and infrastructure software.

Its value proposition lies in its ability to provide cutting-edge products that address the most demanding requirements of hyperscale data centers and AI applications.

With its advanced semiconductor technologies, including AI accelerators (”XPUs”) and networking solutions, and its virtualization software through VMware, Broadcom delivers scalable, high-performance solutions for connectivity and data processing. Broadcom is a very well-managed company that integrates these technologies for customers seeking to optimize data centers and AI-driven workloads.

Broadcom’s prospects have been very strong. For example, its AI-related revenue has grown superfast, with a 220% increase y/y, and this trend is expected to continue as hyperscale customers deploy next-generation AI technologies.

On top of that, as we all know, Broadcom’s massive acquisition of VMware has also started to pay dividends, with operating margins reaching an eye-popping 70%.

With this background in mind, let’s now discuss its fundamentals.

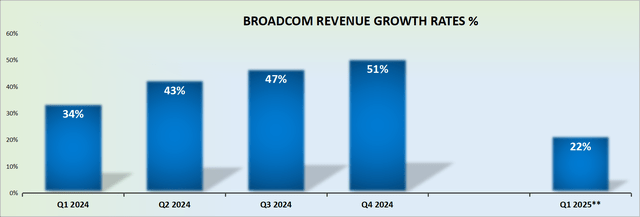

Revenue Growth Rates Will Start to Decelerate

As I look ahead, fiscal Q1 2025 is expected to significantly decelerate from fiscal Q4 2024. Even if one were to argue that management is being conservative with its guidance, this doesn’t detract from the glary fact that the outlook over the next twelve months is going to be an uphill battle.

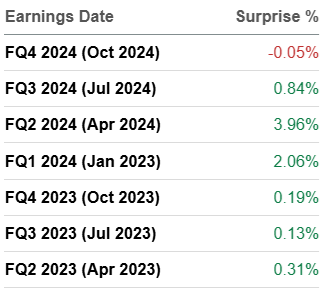

Furthermore, consider how Broadcom beats against analysts’ expectations each quarter:

SA Premium

Roughly, in the past two years, each time Broadcom has beaten by less than 5% on the top line. And in the majority of the cases by less than 1%. Its latest revenues missed analysts estimates by a hair.

So, my question is this. Is it a good setup for investors when you are practically requiring management to beat against their own expectations to be rewarded? I suppose the answer depends on the market. In a very strong bull market as we are now, the market is very forgiving.

But hypothetically speaking, if the market were to slow down slightly, would the market be as forgiving of a company that is just barely beating analysts’ expectations?

As we look ahead, beyond fiscal Q1 2025, there is a very high likelihood that Broadcom’s growth rates will moderate down to sub-20s CAGR.

Put another way, right now, the business just ended fiscal Q4 2024 +50% topline growth. How will the investors in the next 6 months think about this business, as they are eyeing up sub-20% guidance from Broadcom? Will they still be willing to pay a rich premium for this stock?

AVGO Stock Valuation — 38x forward free cash flow

In the past, I recommended AVGO because it had such a strong balance sheet that I believed good things could happen. It was supportive of the bull thesis.

Today, Broadcom carries around $58 billion of net debt. That’s just over 5% of its market cap being made up of debt. It’s not a dealbreaker for me, but it’s not a great setup either.

Indeed, as I say to Deep Value Return members, if you buy into lukewarm ideas, you’ll end up with a lukewarm performance. And if you buy into top ideas, you get top performance.

Moving on, the one aspect of this earnings report that is unquestionably positive is that Broadcom is still able to expand its underlying profitability. Case in point, fiscal Q1 2025 points to 66% EBITDA margins. This is astounding.

This amounts to a 60 basis point increase from the same period a year ago. What’s more, Broadcom has a very EBITDA to free cash flow conversion.

Indeed, I believe that it’s possible for Broadcom to see roughly 42% of its revenues ending up as free cash flow. Accordingly, it looks possible that in the coming twelve months, at some point, Broadcom could be on a path toward $26 billion of free cash flow.

This would put the stock priced at 38x forward free cash flow. That’s not an exuberant valuation, but I believe that most investors would agree, it’s not cheap either.

Potential Investment Risks

Depending on how much investors continue to buy into the need for AI, investors could easily be willing to pay a lot higher multiple than 38x forward free cash flow for Broadcom. Indeed, when the market is running particularly hot, paying 50x forward free cash flow is often even considered a bargain!

Furthermore, despite its current growth trajectory, Broadcom faces challenges, particularly in the competitive semiconductor market.

Case in point, non-AI semiconductor revenue has declined, reflecting cyclical headwinds in traditional segments.

Additionally, Broadcom competes against the formidable Nvidia (NVDA), especially in the XPU market for AI and data center applications. Nvidia’s dominance in GPU and rack-scale solutions presents a significant challenge, as does the evolving architecture for large-scale XPU clusters. For now, investors are throwing caution to the wind, and the competition is a distraction. But will this still be the case over the next 6 to 12 months? I don’t know how it will play out.

The Bottom Line

After thoroughly evaluating Broadcom’s latest earnings report and financial standing, I’ve decided to remain cautious and stick to the sidelines.

While the company boasts impressive profitability metrics and exciting growth in AI-driven revenues, its valuation at 38x forward free cash flow leaves little room for error.

Additionally, the $58 billion in net debt, coupled with decelerating revenue growth projections, raises concerns about the sustainability of its premium valuation.

I admire Broadcom’s execution and innovation but prefer to err on the side of caution until I see a more compelling risk-reward balance in its fundamentals. For now, I’ll watch from the sidelines, cheering on those with stronger conviction and sharper foresight.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.