Summary:

- Sterling Infrastructure’s stock has surged from $59.11 to over $188, driven by strong business growth and margin expansion, but now appears overvalued.

- Despite a robust backlog and impressive margin gains, the stock’s recent price increase is mainly due to multiple expansions rather than business growth.

- Management’s optimistic outlook and healthy balance sheet support future growth, especially in e-infrastructure, but EPS growth is expected to slow significantly.

- I’m downgrading STRL to ‘Hold’ as it seems already overvalued by ~6% in my base case scenario.

We Are

Intro & Thesis

I initiated coverage of Sterling Infrastructure, Inc. (NASDAQ:STRL) stock here on Seeking Alpha in July 2023 when it was trading at $59.11 a share. Today, STRL trades at over $188/sh. and as you can guess, it has since strongly beaten the broader market thanks to its quality business growth (i.e. growth of the top line against a backdrop of margin expansion). The last time I looked at STRL’s business was in mid-April 2024. Back then, I concluded that the company seemed to have an “uncovered growth upside for margin expansions” as its EBITDA margin of just 14% at the time looked insufficiently low.

The qualitative business growth was continuing, and so the stock followed suit:

Seeking Alpha, the author’s coverage of STRL stock

The stock has doubled since the end of April, achieving this impressive growth in less than three calendar quarters. However, I believe that Sterling Infrastructure stock will face more challenges in sustaining this growth moving forward – its current valuation has become too high to provide new investors with a sufficient margin of safety. Hence, my downgrade to “Hold” today.

Why Do I Think So?

Sterling Infrastructure reported strong Q3 FY2024 numbers with a backlog at ~$2.1 billion, up 2% from a year earlier. While the growth in the backlog doesn’t seem significant, it’s truly a testament to Sterling’s strategy of re-focusing on large multiphase transportation and e-infrastructure projects to have more visibility into the next phase of work. The high-probability work pipeline is strong still over $0.5 billion with a huge upside to come in the e-infrastructure sector, especially data centers, which now comprise more than half of the e-infrastructure backlog. The past award rate of these further stages is almost 100% for the company, which suggests very strong potential in the future.

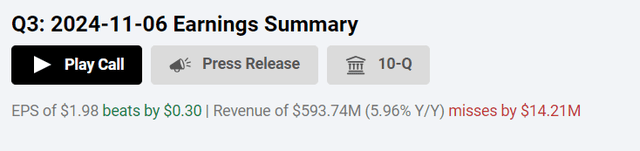

In Q3, STRL reported an amazing margin expansion, generating a gross profit margin of 22% as the company moves further into higher-margin services. Operating income also increased more than 50% YoY, driven by strong operating leverage. So it all helped STRL have a record earnings per share of $1.97, which was a 56% rise from the year ago, beating the consensus quite meaningfully:

In the e-infrastructure segment, STRL’s revenue rose by 4% while operating profit increased by 89% as the EBIT margin went up by more than 1100 basis points (to 25.8%). This record margin increase comes from the data center market, which grew revenue by 90% YoY. Technology like AI also drives the need for more data centers, so more capacity is needed – Sterling has clearly been able to leverage its assets to scale e-infrastructure into the Rocky Mountain area, and thus it has had greater growth thanks to those market needs.

Likewise, the transportation solutions business delivered 18% YoY revenue growth and a 28% YoY operating profit growth in Q3. The EBIT margin there grew by 67 bps to 8.2%, showing the end-market’s strength. Backlog in the category was unchanged at $1.4 billion, with third-quarter awards at $150 million and unsigned awards at $308 million. The firm is currently in the early design phase of some progressive design-build highway projects, which should make up a big portion of future revenues, the management said during the earnings call.

On the other hand, the building solutions line was down by -10% YoY in revenue and -12% YoY in operating income, mainly “due to softer Dallas market revenue” (revenue from residential concrete slabs declined by 29% YoY). Purchasing power has been muted “due to affordability issues and low-interest rates”, but builders are projecting a massive comeback in 2025. So Sterling’s management is still bullish on the long-term demand dynamics in its key residential markets, even though these are currently struggling.

Overall, the prospective growth rates in the company’s key end markets seem to be quite impressive, so I have few doubts that Sterling will continue to expand in the foreseeable future.

Sterling’s IR materials for Q3 2024

Sterling’s balance sheet is also still quite healthy with $326 million in net cash and there’s enough liquidity left to go after acquisitions that can fuel growth. Operating cash flow during the quarter was $152 million (that’s ~$222.8 million in OCF for the year). STRL has also been doing repurchases of shares, with $50.6 million bought year to date and $149.4 million left in repurchase authorization. I think that high cash cushion fuels Sterling’s approach of on-the-run share buybacks and acquisitions, especially in the e-infrastructure space.

Sterling’s IR materials for Q3 2024

The management also remains confident about the future, especially in the e-infrastructure area, where demand for data centers will continue to rise. It too predicts continuous onshoring-related projects in the manufacturing segment from 2025 and a huge pipeline of mega projects in 2026 and 2027.

So the management recently provided new year-end guidance for revenue between $2.15-2.175 billion with a gross profit margin between 19-20%. They expect an EBITDA of $310-315 million for the year owing to its broad business diversity and strength and healthy liquidity position. At the same time, the net income is estimated to be between $180-185 million (NI margin effectively should be ~8.43%) and diluted EPS between $5.85-6.00.

Sterling’s IR materials for Q3 2024

The issue with this outlook is that the market is already pricing in a small premium (~60 bps) to the midpoint of the management’s forecast range for FY2024. As STRL’s margins approach their natural peak, a risk that wasn’t apparent back in April is now emerging as of November 2024 from what I can see. Analysts predict that the EPS growth in FY2025 will be approximately 8.14%, indicating a significant slowdown in the bottom-line expansion despite all the buybacks that might be executed during the period.

Seeking Alpha, STRL’s Earnings Estimates

If we examine the company’s current valuation and compare it to the end of April 2024, the doubling of the stock price appears to be driven primarily by multiple expansions rather than business expansion. This raises some concerns, and I’d be more optimistic about the current multiples if the forwarding multiples hadn’t increased so significantly. For instance, the PEG ratio (FWD) was around 1x less than a year ago, but based on the EPS forecasts for the next year, it now exceeds 2x. As a result, there’s no longer any discount compared to the sector, and so there’s no margin of safety for today’s buyers.

Seeking Alpha data, the author’s notes

According to Morningstar Premium’s fair value model (proprietary source), the STRL stock was trading at a discount to its estimated fair value over the past couple of years. However, due to a rapid increase in valuation multiples and insufficient forecasted EPS/EBITDA growth as of late, that discount has quickly turned into a premium. Currently, the stock is trading at nearly a 30% premium to its fair value, based on Morningstar’s calculations:

Morningstar Premium (proprietary source), STRL

I don’t believe the premium is as wide as it’s shown above. It’s important to recognize that Sterling Infrastructure has consistently exceeded analysts’ forecasts over the past three years. Anyway, if we assume a 10% earnings beat in FY2025, with an EPS of ~$7.1 and a P/E multiple of 25x, the fair value would be $177.50 per share. This is about 6% lower than the current stock price, indicating a slight overvaluation based on my calculations. However, we shouldn’t underestimate the potential for EPS growth if margins exceed current levels and Wall Street analysts’ estimates. In such a scenario, the EPS could be significantly higher, potentially making the stock undervalued even at its current price levels. Nonetheless, I believe there’s no longer a margin of safety in Sterling Infrastructure’s stock, which is why I have decided to lower my rating from “Buy” to “Hold”.

The Bottom Line

I think Sterling in transportation solutions can easily maintain strong growth by leveraging its strong backlog and using the overall market environment in its favor. As management’s positive outlook combined with a strong backlog and pipeline of high-probability work implies, Sterling will likely be able to profit from “America’s infrastructure renaissance” in the years ahead.

But I also believe that a significant portion of that growth upside is already reflected in the stock price. While I appreciate the direction in which the business is heading, I’ve observed that Sterling has lost its margin of safety in terms of valuation. Any unexpected slowdown in margins and EPS expansion could negatively impact the stock price, affecting what investors see in their portfolios. Considering this risk, I’m downgrading STRL to “Hold” as it seems already overvalued by ~6% in my base case scenario.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!