Summary:

- I’m reiterating my sell rating on Etsy after its Q3 results showed a continued weakening in its GMS trends, which declined -4% y/y (2 points worse than in Q2).

- Etsy is guiding to a potential worsening of GMS trends in Q4 as well, signaling a low to mid-single digit decline.

- These reductions in GMS are coming amid an increase in marketing spend for Etsy, which is proving ineffective at winning customers back.

- Sell Etsy and invest elsewhere, as it struggles to compete with giants like Amazon and faces waning demand post-pandemic. Though cheap at <10x forward adjusted EBITDA, Etsy is a value trap.

Alistair Berg/DigitalVision via Getty Images

As we approach the end of the year, careful stock-picking has to be top on every investor’s mind: richly valued and poor performing stocks have to be pruned from our portfolios. We should be especially careful with companies that enjoyed a temporary pandemic-era demand lift, but have since seen weak trends take hold.

Etsy (NASDAQ:ETSY) is a major example of this. The online crafts marketplace continues to frame its current declines as entirely driven by macro headwinds: yet the company’s decline in active buyers, its consistent tapering down of GMS, and weakening profitability all have company execution elements to blame as well. Year to date, shares of Etsy have lost more than 25%, but in my view, the stock has even more value to unwind in 2025.

I last wrote a bearish note on Etsy in August, when the stock was still trading in the low $50s. Since then, Etsy has rebounded modestly, mostly in sympathy with the rest of the stock market. But in spite of the upward momentum in Etsy’s stock, fundamentals have continued to decline, as evidenced by the company’s poor showing in its recently released Q3 results. As a result of this, I’m reiterating my sell rating on Etsy.

What worries me especially is that Etsy is spending aggressively to try to revive its growth prospects (at the very least, we can give the company credit for not taking its losses lying down). It has attempted to overhaul its app experience, trying to improve the search process so that a user is presented with more unique items in one page rather than many similar multiples. It features new content more prominently, and is also giving sellers more insights on what keywords and images are working in search.

And perhaps more potently: Etsy is spending more on marketing to try to regain share. In Q3, the company boosted marketing spend by 8% y/y to $197 million, with the percentage of revenue dedicated to marketing rising by 140bps. The company is also shifting more of its spending to social media.

Etsy marketing spend (Etsy Q3 earnings deck)

And yet, none of these efforts: whether by rehauling its app experience, or spending materially more on marketing, is seeming to have any impact on the company’s GMS (gross merchandise sales decline). This highlights my biggest concern on Etsy: that it has reverted to becoming a niche brand with a shrinking pool of buyers and sellers that is unable to compete with behemoths like Amazon (AMZN). COVID may have given Etsy a temporary boost as many people took advantage of remote work and closed cities to move homes to more suburban areas, creating a one-time need to decorate and furnish new homes: but as peers like Wayfair (W) are experiencing, this tailwind has run out and sapped demand from current times.

Steer clear and invest elsewhere.

Q3 download

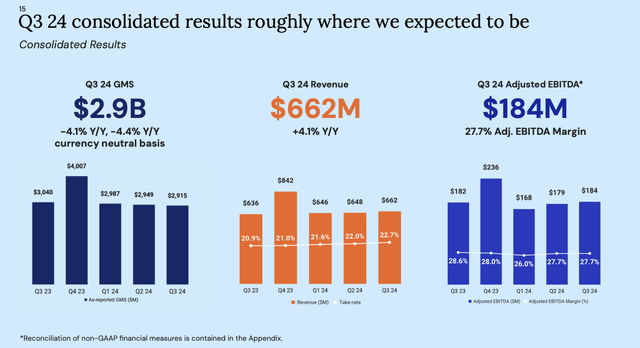

Let’s now go through Etsy’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Etsy Q3 results (Etsy Q3 earnings deck)

Now, the confusing portion of Etsy’s story is that revenue is still growing, up 4.1% y/y to $662.4 million in the quarter, ahead of Wall Street’s expectations of $652.4 million (2.5% y/y).

However, as shown in the chart below, GMS declined -4.1% y/y in the quarter. On a constant-currency basis, results would have been 30bps worse at -4.4% y/y. This decelerated 250bps versus a -1.9% constant-currency decline in Q2.

Etsy top line metrics (Etsy Q3 earnings deck)

The primary reason Etsy has been able to grow its own revenue in the wake of lower sales on its platform is via higher take rates, which jumped 180bps y/y to 22.7% of GMS. As shown in the chart below, this was driven primarily by higher attach rates on payments, with more sellers choosing to have Etsy process their transactions, as well as Etsy selling more premium ad space for its sellers.

Etsy take rate expansion (Etsy Q3 earnings deck)

To me, however, higher take rates are not an infinitely sustainable source of growth. The company can’t clog its site with ads, and neither can it continue to raise sellers’ fees without inciting outrage and a possible shift to Etsy’s many competitors, like Amazon and eBay (EBAY). The only real evergreen source of top-line growth for Etsy is to revive its GMS growth: something the company has struggled heavily with.

The company mostly blamed weaker GMS on outside factors, including weaker consumer spending and “mind-share events” such as the lead-up to the November election, as distracting consumers away from shopping. It did also acknowledge that the company’s stricter listing standards also may have contributed to weaker performance. Per CEO Rachel Glaser’s remarks on the Q3 earnings call:

Digging into this performance, there are three primary factors at play. First, overall macro conditions, which influence consumers’ budgets, continue to weigh on the wallet share we are able to win. As you can see from this chart, the percentage of U.S. personal consumption going to discretionary spend continues to decline versus the COVID peaks.

Second, there were a few discreet mind-share events during the quarter, which we believe created additional headwinds for our business. These included general elections in the U.K. and France, a host of major sporting events, including European football, the highly popular Olympics, events tied to U.S. politics and the general election, and Hurricane Helene at the end of September.

And third, as Josh described, we really focus on shoring up the core Etsy marketplace, leaning into item quality, and making sure we have a great cohesive experience, especially in the app. These are pretty large shifts in how we run the company, and they’re putting some pressure on in-session conversion and creating some modest headwinds to GMS.”

Again, we have to emphasize that Etsy’s multiple consecutive quarters of GMS declines are against the backdrop of higher marketing spend, which are having little impact on reviving Etsy’s sales trends. And against that higher spending, we note that Etsy’s adjusted EBITDA margins have slid 90bps y/y to 27.7%:

Etsy adjusted EBITDA (Etsy Q3 earnings deck)

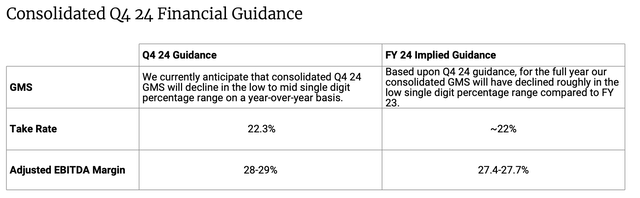

The company is also indicating that the GMS situation may get even worse, signaling that Q4 will see a “low to mid single digit decline” in GMS.

Etsy outlook (Etsy Q3 earnings deck)

There’s a broad interpretation as to what this range language might mean, but it’s helpful to note that Etsy guided to “low single digit” declines in Q3 and ended up at a -4% decline; in other words, Q4 declines could become even sharper.

Valuation and key takeaways

In my view, the compounded financial impact of lower GMS on top of higher spending/weaker adjusted EBITDA margins will start to snowball on Etsy’s bottom line, especially if its take rate expansion stops becoming a y/y revenue growth driver (it signaled that Q4 take rates would be 22.3%, 40bps weaker than in Q3). And yet despite these weaknesses, Etsy isn’t exactly trading at a cheap enough multiple to justify taking on the elevated risk.

At current share prices near $59, Etsy trades at a market cap of $6.64 billion. Netting off the $1.15 billion of cash and $2.29 billion of debt on Etsy’s latest balance sheet gives us an enterprise value of $7.78 billion.

Meanwhile, for next fiscal year FY25, Wall Street analysts are expecting Etsy to generate $2.62 in pro forma EPS (+15% y/y) on $2.92 billion in revenue, or 3% y/y growth (again: if GMS continues to decline, the company will have to rely on take rate expansion to achieve even single-digit revenue growth, which may be challenging). If we assume Etsy holds on to a 27.6% adjusted EBITDA margin next year (flat to this year’s full-year guidance, and aggressive considering the recent trend of higher marketing spend), adjusted EBITDA on this revenue profile would be $805.9 million. This puts Etsy’s valuation multiples at:

- 22x FY25 P/E

- 2.7x EV/FY25 revenue

- 9.7x EV/FY25 adjusted EBITDA

Now, Etsy’s valuation still lies on the cheaper end of the spectrum, especially in an expensive market environment (primarily on an adjusted EBITDA basis), but considering the double whammy of weakening adjusted EBITDA margins plus consistently declining GMS, this isn’t a bet I’m willing to take.

Continue to avoid Etsy and invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.