Summary:

- Qualcomm’s recent underperformance seems to be temporary; strong financials and valuation provide a margin of safety and excellent upside for future business expansion.

- Q4 FY2024 saw robust revenue and EPS growth, driven by QCT segment’s success in handsets, automotive, and IoT devices.

- Qualcomm’s strategic diversification into AI, automotive, and IoT, along with strong partnerships, positions it well for future growth despite cyclical industry risks.

- I believe the market has been slow to reflect QCOM’s true EPS growth potential in its current stock price. I think QCOM seems setting up for a jump-up.

JHVEPhoto

My Thesis

The recent underperformance by one of the largest companies in the semiconductor sector – QUALCOMM Incorporated (NASDAQ:QCOM) – seems to be a temporary phenomenon. I think that the stock’s negative momentum should soon be reversed, as a strong margin of safety has developed in the firm’s valuation. Additionally, the latest financials and prospects suggest excellent upside for future business expansion.

My Reasoning

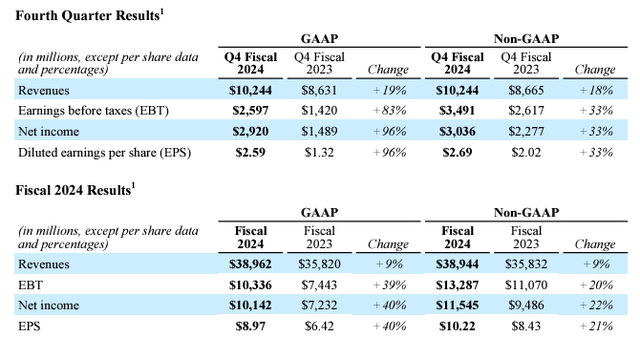

Qualcomm Incorporated posted strong performance in its fourth fiscal quarter and full fiscal 2024, reporting solid growth in its key segments driven by robust demand and strategic diversification activities. It appears Qualcomm’s journey from a wireless communications provider to a connected computing leader for the AI frontier is paying off, both financially and in its operational performance. As of note, Qualcomm churned out non-GAAP revenues of ~$10.2 billion during fiscal Q4, an increase of 19% compared to the same period last year. That growth was driven by the QCT (Qualcomm CDMA Technologies) business, which generated ~$8.7 billion in revenue, an 18% YoY increase.

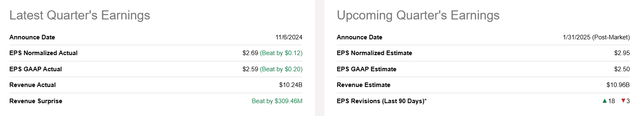

QCOM’s press release for Q4 FY2024

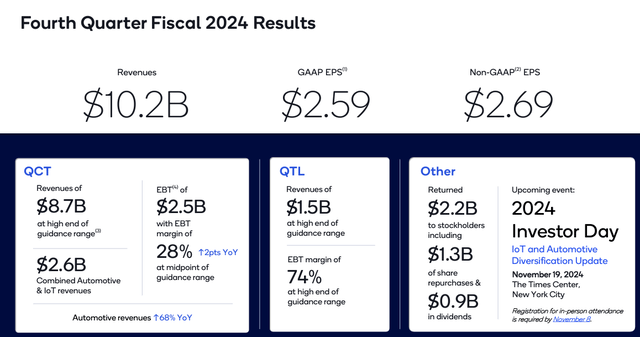

As a result, QCOM’s consolidated non-GAAP EPS came in at $2.69, an increase of 33% year over year. The revenue and EPS figures were both above and beyond Qualcomm’s expectations and the market consensus, fueling further Q1 FY2025 earnings estimates revisions to the upside:

QCT products – including handsets, automobiles, and IoT devices – experienced significant growth. In particular, the handset revenue jumped by 12% YoY to $6.1 billion, “driven by the introduction of the Snapdragon 8 Elite platform”, which is once again the performance leader in Android. But it was the auto industry that came out on top, growing revenue by 68% YoY to $899 million coming from rising demand for leading-edge automotive chips as Qualcomm’s Snapdragon Cockpit Elite and Snapdragon Ride Elite platforms become popular with automotive OEMs such as Li Auto (LI) and Mercedes-Benz (OTCPK:MBGAF), the management commented.

Qualcomm’s IoT business also saw huge growth, driving revenue up 24% QoQ being fueled by “new product launches and continued normalization of channel inventory.” The company’s strategic move into AI-based edge computing and industrial IoT solutions is clearly meeting the market needs as far as I can see, following the launch of the Qualcomm IQ Series and the Qualcomm IoT Solutions Framework.

The QTL (Qualcomm Technology Licensing) unit also did very well, seeing a 21% growth in revenue to $1.5 billion, reflecting the tremendous appetite for Qualcomm’s patented tech across multiple verticals as Qualcomm was able to win multiple licensing renewals over the course of the year. So as a result, QTL’s EBT margin of 74% surpassed internal expectations.

On the balance sheet side, we see ~$13.3 billion in short-term liquidity, 17.4% more than last year. They achieved an all-time free cash flow of ~$11.2 billion in fiscal 2024, so it has helped Qualcomm return ~$2.2 billion to shareholders during Q4, with $1.3 billion spent on stock repurchases and $947 million in dividends, which seems like a wise capital allocation management. In addition, Qualcomm announced a $15 billion stock buyback plan – that’s about 8-9% of the whole market cap.

Leaning on stronger-than-expected Q4 data and a healthy balance sheet, Qualcomm expects $10.5 billion to $11.3 billion in revenue in Q1 FY2025, slightly above analysts’ previous estimates. The company is projecting that its QCT segment will remain robust, and handset revenues are projected to increase by a mid-single-digit percentage over the forecast period. Meanwhile, QCOM forecasts QCT IoT revenue to grow over 20% YoY with consumer, industrial, and networking growth. I believe Qualcomm’s strategic alliances with partners such as Meta Platforms (META), Amazon (AMZN), and Microsoft (MSFT) further strengthen its position in the AI-based edge computing space and provide significant opportunities for future growth.

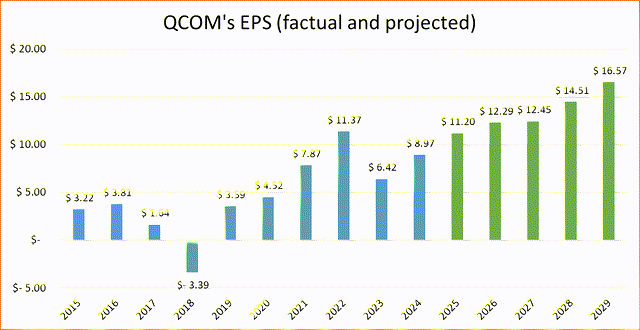

That’s why analysts anticipate that, despite the cyclical nature of the semiconductor industry, QCOM will rapidly increase its EPS in the next few years at least. According to the current consensus data, over the next 5 forecasted years, its EPS is expected to grow annually by 8.15% (CAGR), which is quite significant for a large corporation:

Seeking Alpha data, Oakoff’s calculations

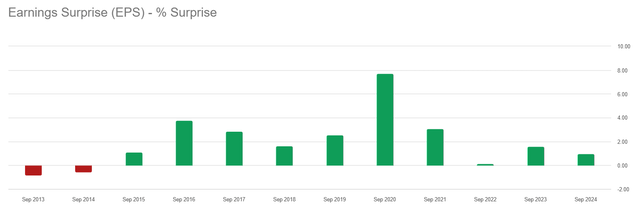

At the same time, QCOM has beaten Wall Street consensus estimates in all of the 8 years (the EPS surprise, for example, ranges from 0.15% to 7.7%):

My bullish thesis is actually quite straightforward. After EPS fell in 2023, it began to show signs of growth in 2024, initially driving strong stock growth before a decline from $230 to $160 (this year). Given the current EPS forecasts, the market should logically gradually reassess its sentiment on QCOM. When considering the stock market and individual companies, they often serve as predictive indicators of economic conditions and business performance in particular. You know, stock prices are leading indicators from a financial theory perspective. So if the current EPS consensus is close to being accurate and QCOM continues to meet these forecasts, its stock should eventually reflect this expectation. Also, historically speaking, the 1st calendar quarters are quite positive for QCOM stock’s price dynamic, as it has been over the past 15 years, providing a favorable backdrop for QCOM to begin its recovery shortly:

TrendSpider Software, QCOM, daily chart, Oakoff’s notes

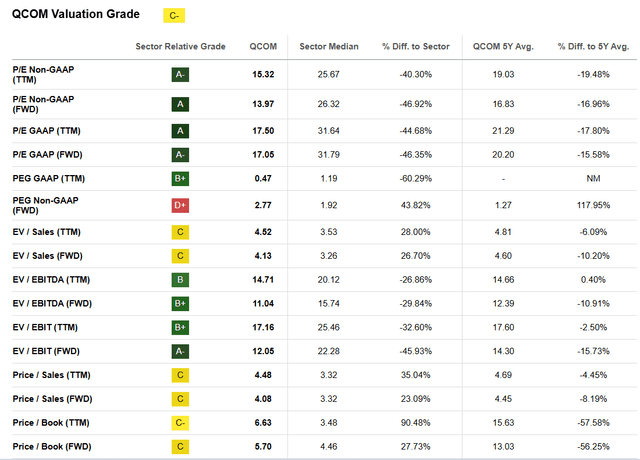

However, seasonality and the projected increase in EPS aren’t enough to establish a sufficient margin of safety for the stock, nor do they provide a clear upside for growth. Fortunately, in the case of QCOM, its valuation seems to be significantly lower compared to the median values of the IT sector:

Yes, the PEG ratio is a major outlier in the above list of multiples, but take a look at the forwarding EV/EBITDA or P/E ratios – they’re 30-47% below the median of the sector.

Again, we can’t ignore the impact of cyclicality, so over the next few years, it’s quite possible that the PEG ratio could easily exceed 1-2x. I think this doesn’t necessarily mean the stock becomes more expensive because the business itself continues to generate substantial profits/FCF and invests heavily in buybacks and dividends, maintaining its valuation premium due to its broad and difficult-to-replicate business moat.

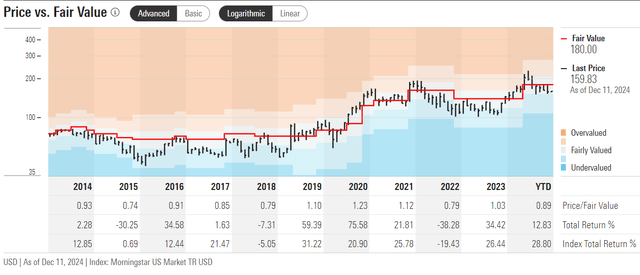

According to Morningstar’s valuation models (proprietary source, December 2024), QCOM’s stock is trading at a 12-13% discount to its fair intrinsic value per share. This suggests that the recent dip in the quotes may be largely unrelated to changes in the company’s intrinsic value.

Morningstar Premium’s fair value model for QCOM stock

For all these reasons, I believe that QCOM deserves a “Buy” rating today. As I said earlier, I expect the stock price to jump soon, triggered by a likely shift in market sentiment towards a recovery in QCOM’s earnings in FY2025-26.

Risks To My Thesis

Of course, there are some risks that I consider very important to consider before making any investment decision.

First, despite the stunning revenue and earnings growth in Q4 FY2024, the semiconductor market is always cyclical and demand may fluctuate. It’s unlikely that growth in Qualcomm’s primary verticals (handsets and automotive) will be sustainable if global macro conditions worsen or competition intensifies. The smartphone market, for example, is already maturing and its growth rates may drop significantly next year – this may hamper Qualcomm’s ability to continue along its current revenue-growth path.

Second, QCOM derives a big chunk of its revenue from Apple (AAPL), which poses a challenge because the computer giant designs its own modem chips. Even with Qualcomm’s contracts with Apple expiring in 2026, a change in Apple’s direction will likely have huge consequences for Qualcomm’s revenue base. Moreover, Qualcomm’s dependence on China – which accounts for almost half of its revenues – might be affected by geopolitical tensions and trade barriers. Increased tariffs or regulatory hurdles could tangle supply chains and suppress demand from Chinese manufacturers, negatively impacting Qualcomm’s balance sheet.

Third, though recent stock buybacks and cash flows are a testament to smart capital management, they may not be sufficient to secure an adequate buffer against volatility. The valuation ratios imply that the stock is trading at a discount to its peers, but this could indicate uncertainty about the prospects for growth rather than a potential upside.

Your Takeaway

Despite the above risks, I think Qualcomm’s latest earnings portrayed a positive outlook on future financials and operational growth. Through strong revenue and profit growth in all its key businesses, a strong balance sheet, and proactive shareholder return measures, Qualcomm seems to be well-positioned to continue to dominate the semis market. Their focus on diversification and innovation in high-growth markets such as automotive and AI-based processors should ensure future sustained growth and make Qualcomm a compelling investment for the medium term.

Analyzing the past months’ patterns, I believe the market has been slow to reflect QCOM’s true EPS growth potential in its current stock price. This potential, which we should see unfold over the next two years, is likely to be priced in shortly, in my opinion. I think QCOM seems setting up for a jump-up.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in QCOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.