Summary:

- Tesla, Inc.’s Q3 2024 performance exceeded expectations with significant growth in vehicle deliveries, regulatory credit revenues, and reduced COGS, driving a 22% stock increase.

- CEO Elon Musk’s influence in the incoming administration and co-heading the Department of Government Efficiency is expected to favor Tesla in tariffs, credits, and regulations.

- Tesla’s dominance in the green transition, improved manufacturing efficiency, and its Robotaxi make it well-poised for future growth despite existing risks.

- Despite a decline in free cash flow due to rising capital expenditures, Tesla’s investments in new technologies and factories are anticipated to drive long-term cash flow growth.

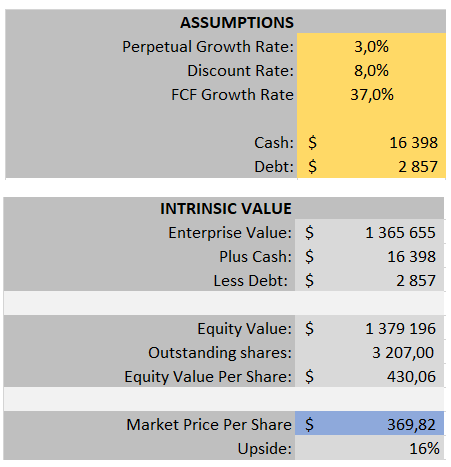

- Target price of $430 based on our proprietary DCF Model.

Sven Piper

Tesla’s Next Big Move: Market Continue to Underestimate Growth Potential

It’s been a year since we last covered Tesla, Inc. (NASDAQ:TSLA) in 2023. Since then, much has changed, and it’s time to revisit our analysis. In Q3, Tesla achieved year-over-year growth in vehicle deliveries, its second-highest quarter of regulatory credit revenues, and their lowest ever COGS levels at $35,100. This beat our expectations, with the stock having climbed roughly 22% on the news, and positions the stock well for future growth.

This does not even consider CEO Elon Musk’s newfound influence in the incoming administration thanks to the comically named DOGE (Department of Government Efficiency), which he will be co-heading. Like it or not, Musk will almost certainly use his position to gain better treatment for Tesla when it comes to tariffs, credits, and broader regulation. On the news of Trump’s election, Tesla stock jumped roughly 40% over the course of that week. Additionally, there are many topline growth opportunities for the business including expanding their vehicle line, monetizing infrastructure, and their long-awaited entrance to the $50B robotaxi industry. There is a lot of wind in the sails of Tesla to continue this growth going forward.

Growth Catalysts

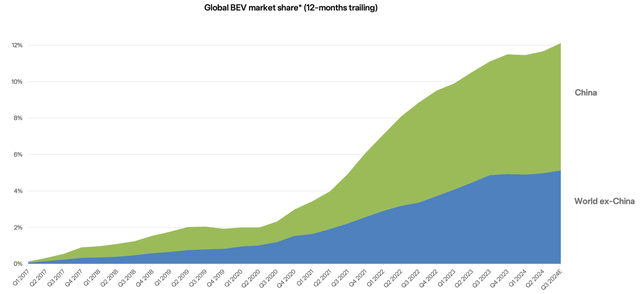

The green transition is inevitable and unstoppable. Tesla has dominated this transition when it comes to transportation. Batteries and green electric power will likely only continue to become cheaper as the science behind them, and manufacturing building them, gets better and better. Throughout this transition, Tesla has been THE player in the market. By maintaining, and even growing, their market share while continuing to reduce COGS, Tesla is well poised for growth.

Tesla Q3 2024 Investor presentation

While we prefer to focus on fundamentals in our analysis, it would be remiss not to mention the impact of Elon Musk. With Musk in the incoming President’s inner circle, and soon to oversee DOGE, Musk will accumulate even more influence with the new administration. There are multiple ways that the Trump administration could help the BEV industry in general and in particular Tesla.

The administration has already threatened significant tariffs on China and Mexico — massive vehicle manufacturers. Tariffs on non-Tesla BEVs and combustion engine vehicles and components would certainly help Tesla and hurt their competitors. Additionally, the administration could increase EV tax credits to make purchasing an EV more affordable, helping increase Tesla sales. Whatever your opinions on this may be, that’s good for Tesla shareholders.

However, what is good for Musk is not necessarily good for the stock. The fact that Musk’s pay package was refused to be reinstated by a Delaware judge is also likely a good thing for Tesla. This will keep $56B worth of equity in the company, and it is unlikely that this pay package would have served to incentivize Musk to put further efforts into Tesla given his other various ventures.

Another growth catalyst is of course the $50 billion market for its Robotaxi that is set to enter the market in 2025. We dedicate a section of this article especially for that.

Lastly, Tesla is getting, and will likely continue to become, more efficient at making cars. Combined with growing market share, this is a lethal combination. For the first three months of the year, 2024 total revenues grew nearly 8% whereas total costs of revenues grew by roughly only half that figures.

Autonomous Driving

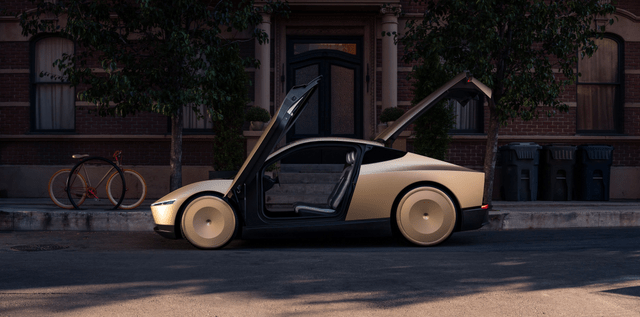

The upcoming release of Full Self-Driving (“FSD”) V13.2 is a major step in the right direction for Tesla in unlocking true autonomous vehicles. This will help Tesla on its stated path to deliver driverless cars, a market estimated to be $50B in size by 2032. FSD V13.2, while only available to early access members of the FSD program for now, is expected to be a major leap over FSD V12, with Tesla indicating V13.2 is 500% better than its predecessor.

The self-driving taxi space got a little less crowded recently, as General Motors (GM) decided to pull the plug on its autonomous taxi service, Cruise. Mary Barra, GM CEO, mentioned high costs and the fact it is not their core business as the reason for shuttering the venture, even though Barra once conceded this could be a $50B revenue opportunity. This essentially leaves just Google’s (GOOG) (GOOGL) Waymo and Tesla fighting for the market, a good thing for those two companies. Waymo currently completes 150,000 driverless rides per week, with Tesla planning to enter the market formally in 2025. This is a tiny sliver of the potential market, considering in NYC alone there are roughly 5.3m taxi and ride-hailing trips per week. There is a lot of room for both companies to grow, and Tesla has the manufacturing ability to enter the market in strength.

Risks

This is not to imply that Tesla is without risks — there are many. However, Tesla has positioned themselves well to mitigate these risks as much as possible. For one, Tesla is very dependent on the Chinese market, and tensions are rising between the US and China. There is always the risk that Tesla will face the fate of Google and be shut out of China, but we see it going more like Apple. Growing until an insurgent auto-maker is ready to take the mantle like Huawei did. This is because, like Apple, Tesla produces critical hardware that Chinese consumers love. Plus, they play nice with the CCP. Except in this case it is even better than it was for Apple because real competition is many years away and Musk will be able to sway policy from the West Wing.

True autonomous driving from a competitor could threaten Tesla. However, Tesla remains on the forefront here. We will discuss more about Waymo and Cruise shortly. Manufacturing, supply chain, forex and other risks all exist for Tesla as well, which investors need to be wary of, however, Tesla’s precautions around manufacturing processes and locations help to disseminate and mitigate some of those risk factors.

Market competition is also heating up. Although Rivian, Lucid, and other start-ups promised us mass-produced BEVs, they have fallen short. Outside of China, Volkswagen (OTCPK:VWAGY) and GM are still the two largest makers besides Tesla, having ramped up their 2023 production numbers to a total of 1.4 million units. These two automakers combined now only trail Tesla by 400,000 units. This shift has been inevitable, and Tesla is still technologically ahead of competitors in terms of battery power and autonomous capabilities. We continue to expect they will lead the pack and that the growing market is good for all players, especially the number 1 player.

This increasing competition is also generating pricing pressure. Earlier this year, Tesla cut prices in China, Germany, and some other countries around the world. According to Reuters, Tesla cut the starting price of the revamped Model 3 in China by 14,000 yuan ($1,930) to 231,900 yuan ($32,000). In Germany, the price of the Model 3 rear-wheel-drive was trimmed to 40,990 euros ($43,670.75) from 42,990 euros. While this will put pressure on margins, it does not change our guidance position given we anticipate price cuts, especially on lower end vehicles, as the BEV market matures. This should be offset by increased manufacturing efficiency, market growth, and the introduction of more premium vehicles such as the Cybertruck.

Topline Growth

Despite the previously mentioned price cuts, which we continue to view as a natural and expected market evolution, there are many topline growth opportunities we expect will drive continued growth. This includes previously aforementioned robotaxis, estimated to grow to over $50B, with the possibility of going higher. EV line expansion will make EVs appeal to more individuals and enable Tesla to fight back against declining average sale prices through more luxury vehicles such as the Cybertruck. Additionally, while Tesla does not currently charge for access to its Supercharger network if you are a non-Tesla EV owner, as the market matures and BEV adoption grows, monetizing this massive amount of infrastructure could also serve to grow revenues.

Valuation

Revenue

Total revenue has grown every year, and 2024 revenues are expected to beat 2023’s numbers. While this growth has been inconsistent, it has averaged roughly 40% growth since 2019. While declining Average Sales Price (ASP) does put pressure on revenue, as vehicle sales are the leading driver of revenues, we believe this is a natural motion in a market that is becoming more mature and accessible. The key driver to growth over the next ten years will be increasing adoption of electric vehicles overall as infrastructure continues to be built out and prices fall. Tesla is poised to be the biggest beneficiary of this transition.

HedgeMix

In Millions of United States Dollar (USD) except per share items.

Free Cash Flow

Tesla free cash flow declined 48.74% from 2022 to $4.385B due to rising capital expenditures. However, investments in new factories and technologies should help drive Tesla cash flow higher, even if it continues to fall in the immediate future. In our discounted cash flow (“DCF”) model, we conservatively anticipate cash flow will grow at 37%, a 5% haircut to the past 4 years FCF CAGR. Enhanced operational efficiencies, demand, and prudent operations will continue growth and drive strong cash flows, yielding a Fair Value of $430 for Tesla stock. We continue to be strongly bullish on the stock.

Conclusion

Since last covering Tesla a year ago, much has changed for the company, which we believe presents an even stronger case for growth and a reasonable price target of $430 per share. First, Tesla’s operating metrics have improved, achieving both revenue and COGS improvements since last year. Second, Elon Musk’s growing governmental influence may lead to favorable treatment of the company. The Trump administration has already threatened broad tariffs on Mexico and China, which would hurt many of Tesla’s competitors in America. Additionally, more aggressive EV tax credits would also be a boon to Tesla. Third, while price pressure is forcing prices down abroad, we view this as a fundamental evolution in a maturing market that we expect. Improved manufacturing efficiency and the introduction of more premium cars like the Cybertruck will help to combat this.

It would be remiss not to further stress the significance of self-driving cars to Tesla and its future. FSD V13.2 is a major step in the right direction for Tesla as they expand self-driving capabilities and push to release a robotaxi service in 2025. With Cruise shuttering its operations in this space, Waymo and Tesla are the two remaining players duking it out over this $50B market. While we believe Tesla will be the number one player given its manufacturing and infrastructure advantages, being number 2 in a $50B is still very nice.

Given the tangible improvements from Tesla and growth opportunities, we feel that $430 per share is an appropriate price target.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Business relationship disclosure: This article was written by a consultant in collaboration with HedgeMix.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.