Summary:

- Accenture has seen weak performance recently, despite its strong historical record, due to slow growth and reallocation of IT budgets towards AI.

- The asset-light, labor-intensive business model ensures predictable revenue and earnings, with a significant increase in AI-specific bookings expected to boost growth in 2025.

- Despite high free cash flow and potential for acquisitions, ACN’s premium valuation and moderate growth prospects limit substantial upside, leading to a Sell rating.

- The main risks include hiring challenges, potential overpayment for acquisitions, and the impact of AI cannibalization on existing business.

portishead1

Introduction

The generative AI evolution has already driven the data center supply chain stocks through the roof, which I have covered in detail. The second stage is harnessing the productivity potential of AI by large and medium-sized companies that need tailored solutions or agents for front and back-office operations, and this is where companies like Globant (GLOB), and EPAM Systems (EPAM) that I have covered in the past, come in. However, perhaps the king or queen of IT consulting is Accenture (NYSE:ACN), whose nearly 800,000 army of IT engineers and consultants has a massive global reach. A year ago, in a meeting with a large US bank, I asked how they viewed AI’s potential and implementation. The response was surprising; they said we called Accenture and that we’ll have something for you in about a year.

Performance

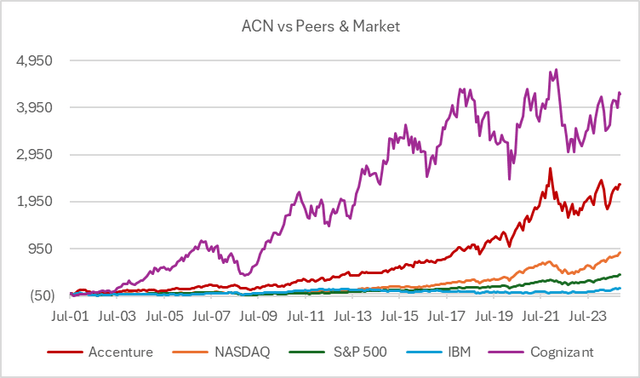

ACN has been a long-term star, massively outperforming the market since its spinoff from Arthur Anderson and IPO in 2001, but very weak in the last 3 years, almost flat, while the S&P 500 (SPX) gained 28%. Part of this underperformance is due to slow growth, where earnings crashed from a 16% growth range to under 5% in a veritable desert of new business, which may be attributed to the advent of Gen AI itself as corporates needed to rethink where IT budgets got allocated.

Created by author with data from Capital IQ

Operating Model

The ACN business model is light on assets and labor-intensive, with a high degree of forward revenue and earnings predictability. Typically, the company wins new contracts or bookings to analyze and implement processes, etc., at companies for an estimated fee for hours worked and, in some cases, a percentage of productivity or cost savings. The bookings then become revenue throughout the life of the contract, and thus, forward revenue growth is well indicated by a book-to-bill ratio. The higher the ratio, the greater future revenue should be, and since costs are largely a function of man-hours, the operating margin and EPS figures are also predictable.

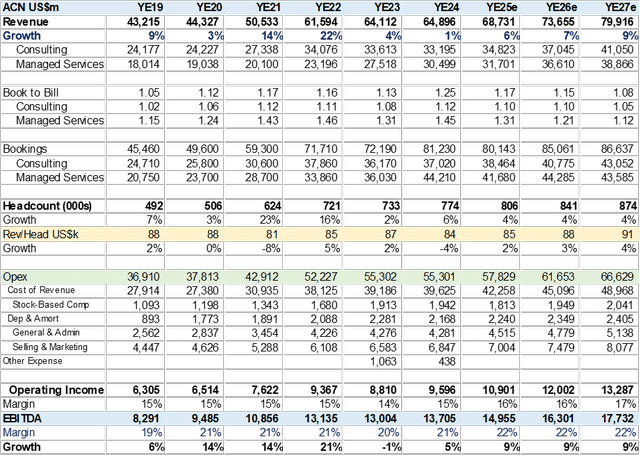

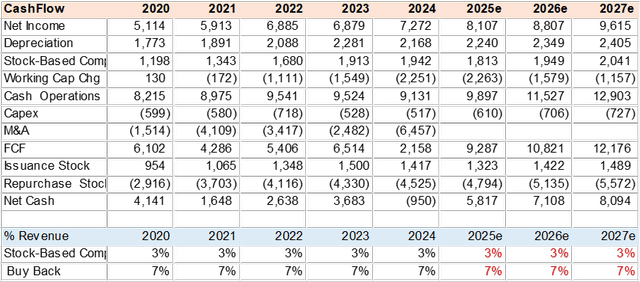

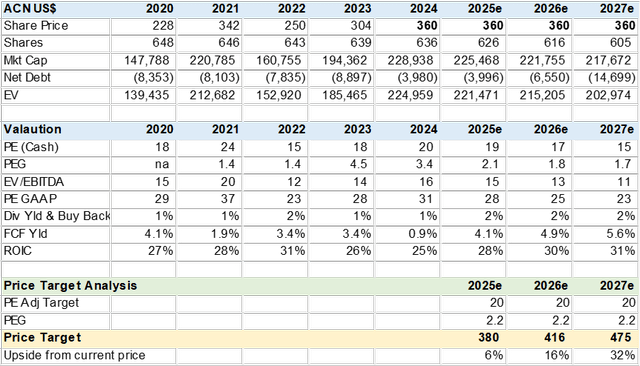

During fiscal year 2024 (ends August 2024), the company saw a large increase in bookings, to 1.25x current revenue, with AI-specific contracts increasing to US$3bn from US$500m. This should translate into an acceleration of revenue and EPS growth in 2025 forward. The operating model below is based on consensus data and points to an EBITDA growth rate of 9% for the 2025-2027 period. There are some productivity or pricing gains embedded in the estimates, as revenue per headcount is accelerating. While the market is positive on ACN’s prospects, it’s not estimating anything like that seen in the AI infrastructure supply chain. The main bottleneck is hiring or subcontracting 10s of thousands of IT/consultants to meet demand.

Created by author with data from Capital IQ & Bloomberg Created by author with data from Capital IQ & Bloomberg

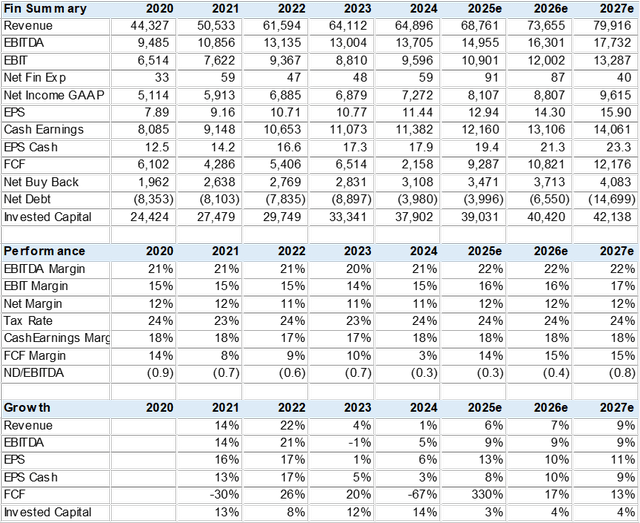

High FCF

As mentioned earlier, the ACN business model is asset-light, requiring low capex and generating high free cash flow (FCF), which has been used for acquisitions and share buybacks in the past. Given the need to grow its AI services, it is plausible that the company looks to acquire companies that can speed up its penetration. The risk of overspending and/or making a bad acquisition is always possible, especially in a heated market.

Created by author with data from Capital IQ

Valuation

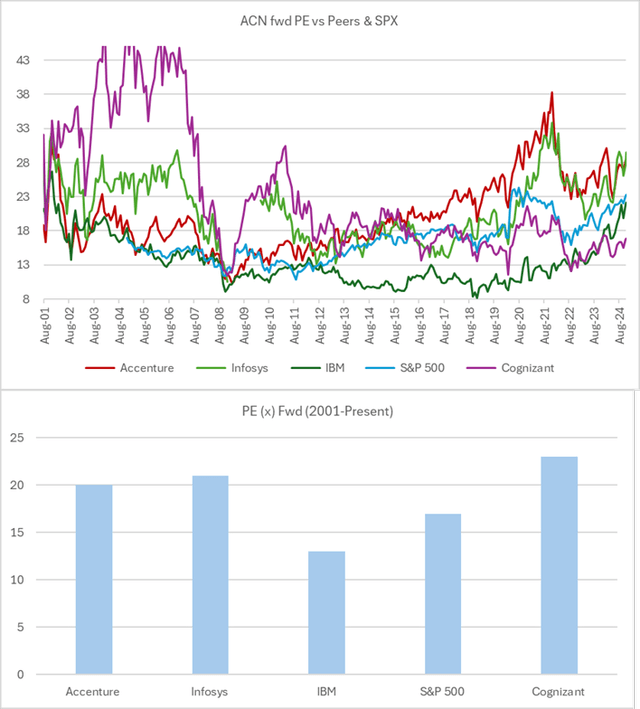

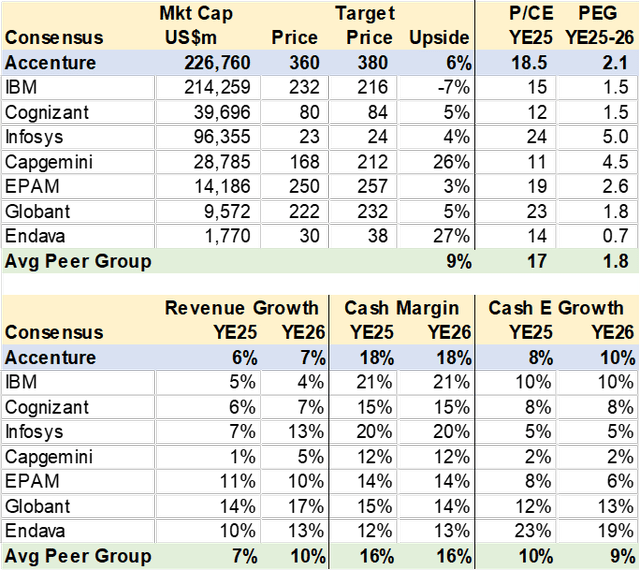

At first glance, ACN looks expensive at 28x PE. However, adjusting for the near US$2bn stock-based compensation, the cash EPS is closer to 19x or about 2.1x PEG (PE to Growth) on 2025 estimates, which is still not a bargain. ACN is a premium-valued stock with a world-class business and a very high return on capital (ROIC). The IT consultant stocks are well valued at over 20x PE, as seen in the chart and table below.

In my view, the consensus price target for 2025 of US$380 does not provide much upside, and the market will need to see an acceleration in bookings during 2025 to buy into the stock. On current 2026 estimates, applying the same 2.2 PEG, I calculate a US$416 price target. On current forecasts, this is not a stock with a spectacular upside. It’s more akin to a consumer staple company with an added tech kick.

Created by author with data from Capital IQ Created by author with data from Capital IQ

Peer Comps

I gathered consensus estimates for several of ACN’s larger and smaller peers or competitors to compare growth and valuation metrics. As can be seen in the table below, ACN has sector-average growth, while valuations are on the premium side, but only moderately. However, earnings surprises are far more likely to occur at smaller peers such as Cognizant (CTSH) or Globant, where new contacts can have a far more meaningful impact.

Created by author with data from Capital IQ

Risk

The main bottleneck in meeting customer demand is hiring, retraining, or subcontracting AI-specific services. This may increase costs or lead to lost or delayed sales execution. Finally, what is on many investors’ minds is the cannibalization impact, how much business may be lost (and replaced) due to AI implementation. Also, in a race to gain AI service share, the company may overpay for acquisitions.

Conclusion

I rate ACN a Sell. This is not an expensive stock, nor is the company facing a growth decline; the main drawback is the apparent inability to meaningfully accelerate growth even when faced with substantial demand. The labor-intensive nature of the IT consultant business makes high growth challenging. ACN would need to hire 60k new professionals to reach 12% revenue growth; the human capital challenge is daunting, in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.