Summary:

- Agnico Eagle Mines excels with strategic acquisitions, cost control, and strong free cash flow, making it a top-tier gold miner with long-term growth potential.

- The recent C$204 million acquisition of Canadian O3 Mining enhances its footprint and offers significant synergy opportunities.

- Despite gold price volatility and geopolitical risks, Agnico Eagle’s operations in low-risk jurisdictions and consistent production growth are impressive.

- Valuation suggests upside potential, but investors should be prepared for market fluctuations and the inherent risks of gold mining stocks.

Anthony Bradshaw

Introduction

Being bullish on gold was one of my best calls this year. While I had my fair share of mistakes, being bullish on the world’s favorite precious metal wasn’t one of them.

As we can see below, COMEX gold worked its way to $2,800, rising more than 30% since the end of 2023, making it one of the best years in a long time.

This rally was driven by a number of factors. I believe the quote below hits the nail on the head (emphasis added):

Bullion’s rally in the early part of 2024 was driven by large purchases by central banks, especially the People’s Bank of China and others in emerging markets. It got a further boost from the Federal Reserve’s recent monetary easing and haven demand during periods of heightened geopolitical tensions including wars in the Middle East and Ukraine. However, gains have stalled due to a rally in the dollar following Trump’s election win. – Bloomberg

Although I prefer to play the gold/silver thesis through high-margin streamers who finance mining operations in return for the right to buy a portion of the production below the spot price, there are a number of gold miners I like.

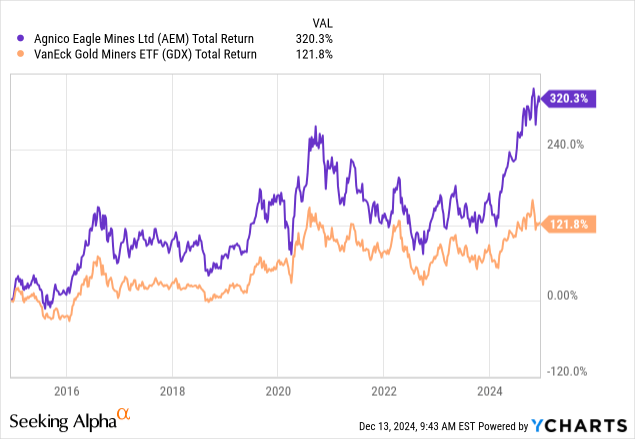

One of them is Agnico Eagle Mines (NYSE:AEM), a mining giant with a terrific track record, as it has returned 320% over the past ten years, “crushing” the 122% return of the VanEck Gold Miners ETF (GDX).

My most recent article on the company was written on March 12. Since then, shares have returned 58%, substantially more than the S&P 500’s 18% return.

Hence, it’s time for an update!

In this article, I’ll do just that, using its latest earnings and a very interesting takeover proposal, which tells us a lot about how Agnico Eagle is allocating its capital.

So, as we have a lot to discuss, let’s get to it!

Agnico Eagle Is Expanding

Canadian O3 Mining shares soared 55% on Thursday, as it signed an agreement for Agnico Eagle Mines to acquire it for roughly C$204 million.

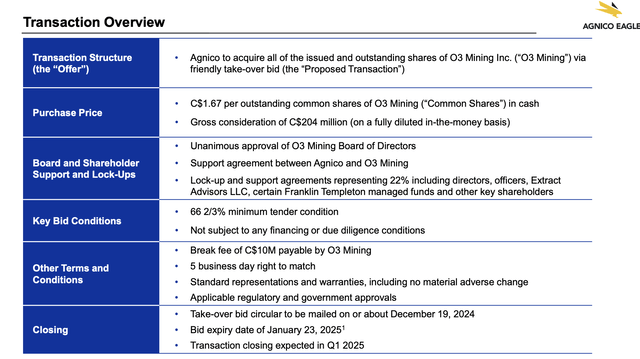

As we can see in the overview below, it’s an all-cash deal that pays C$1.67 per share and comes with a C$10 million break fee. The deal is expected to close in the first quarter of the upcoming year.

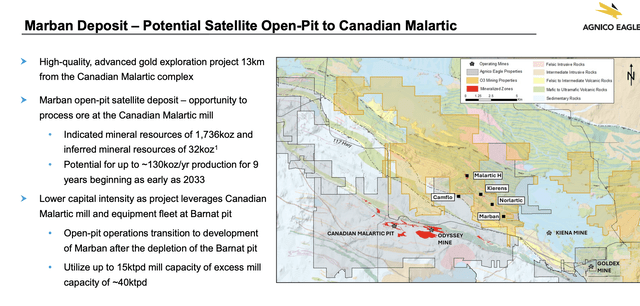

The company’s main asset is the pre-feasibility-stage Marban Alliance project close to Val-D’Or, Quebec. This mine is just 13 kilometers east of Agnico’s Canadian Malartic open-pit mine.

Essentially, this is a fantastic opportunity to generate synergies and improve the lifespan of these core assets.

“Consistent with our regional strategy, this transaction is a tuck-in of the Marban deposit to our Canadian Malartic complex,” Agnico president and CEO Ammar Al-Joundi said in a release on Thursday. “The Marban deposit is expected to be complementary to other ‘Fill-the-Mill’ opportunities at Canadian Malartic, further improving the production profile at a long-life world class asset.” – Via Mining.com

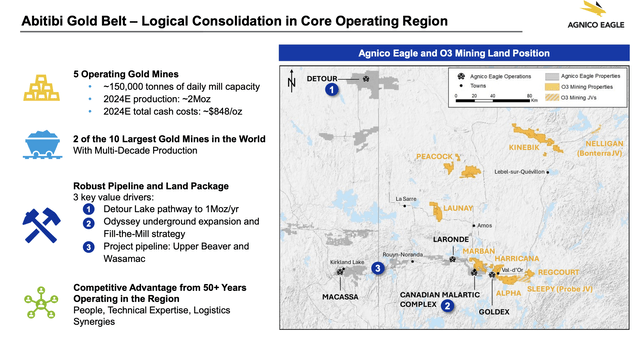

As we can see below, this consolidation makes a lot of sense, as the Abitibi Gold Belt is home to five operating mines, including two of the ten biggest gold mines in the world.

By 2033, Agnico Eagle expects to see its first production at the Marban Project. Until late 2025, it will work on studies and permitting activities.

Although this is not a major life-changing deal, it’s a smart move that allows the company to boost its footprint, generate synergies, and build long-term shareholder value.

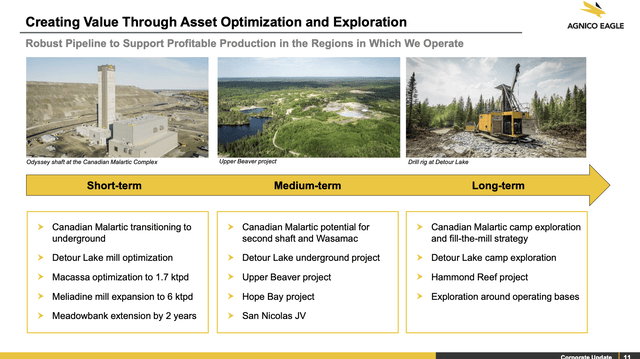

So far, excluding the takeover, the company has a number of very promising projects. This includes the aforementioned Canadian Malartic, where the company is running more than 100 drill rigs.

Other success areas include Detour Lake, where substantial progress has been made:

As we continue to integrate those new results into updated mineral resources and mineral reserves, we see though the potential for those recent results and the overall underground project addition to the current open pit mine to bring the Detour Lake mine to our vision of the 1 million ounces of gold per year operation in the future. – AEM 3Q24 Earnings Call

A Top-Tier Gold Miner

In general, the company is doing a fantastic job. Someone even called it “the CNQ of gold” on X (formerly known as Twitter). CNQ is Canadian Natural Resources (CNQ), a company I consider to be the best oil producer in Canada because of its fantastic operations, low-cost profile, and shareholder returns track record.

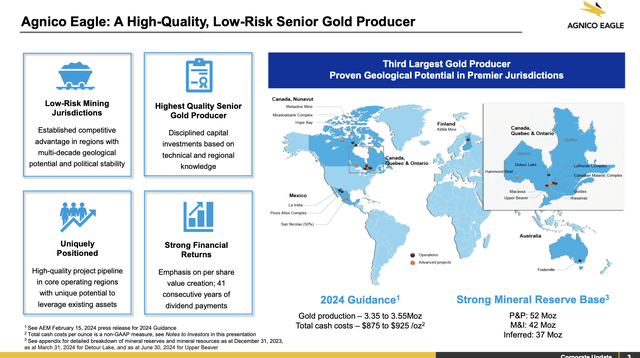

One of the things I love is the fact that its assets are in low-risk jurisdictions. As we can see below, most of its 3.55 million ounce per year production comes from Canada, Mexico, and Australia, with zero exposure to South America and Africa. Geopolitical risks are one of the reasons why I am not a huge fan of the mining sector, in general, as a lot of resources are found in nations with elevated political risks.

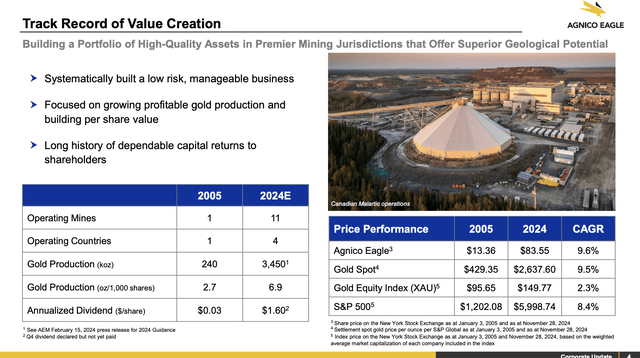

Moreover, as we can see below, the company has done a great job expanding, as it owned just one operating mine in 2005. Since then, it has boosted its gold production from 240 thousand ounces per year to 3.5 million ounces per year.

However, even more important is that this expansion did not hurt shareholders. Because many mines issue stock to finance expansions, the risks of negative shareholder dilution are high.

Agnico Eagle, however, has increased the per-share gold production from 2.7 ounces (per 1,000 shares) to 6.9 ounces. This allowed it to substantially outperform the Gold Equity Index over the past 20-ish years.

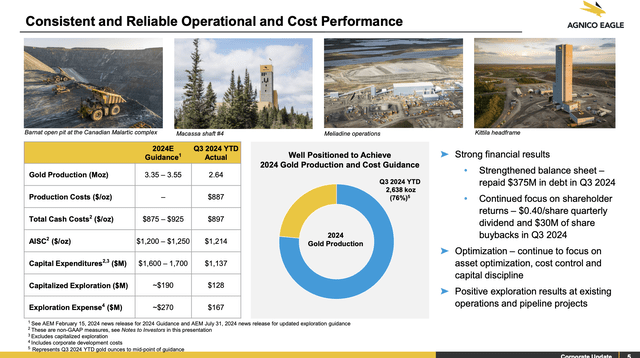

Moreover, with regard to current operations, the company is satisfied, as it achieved 76% of its full-year production guidance in 3Q24, perfectly in line with expectations.

One of its success stories is Meadowbank, where the company found a bottleneck in long-haul trucking, which is essential for transporting ore from the mine to the mill. According to the company, in the first three quarters of 2024, improvements in this area resulted in an 18% increase in trucking efficiency.

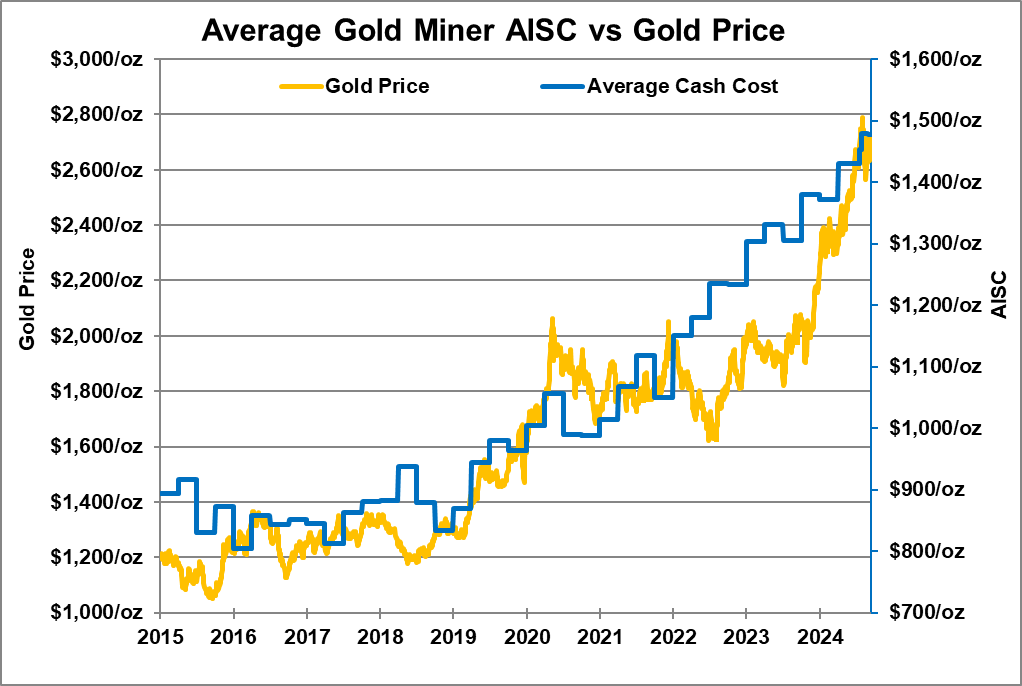

It is also doing a great job managing costs, something that’s extremely critical in an industry prone to elevated inflation risks (labor, fuel, materials, etc.). Despite higher gold prices that caused royalty payments to increase, the company’s year-to-date costs are $897, $3 below the midpoint of its guidance. Total all-in-sustaining costs (“AISC”) are $1,214 per ounce.

As the chart from Garrett Goggin below shows, AISC has risen to almost $1,500 per ounce. Since 2017, gold miners have consistently encountered higher costs.

Garrett Goggin

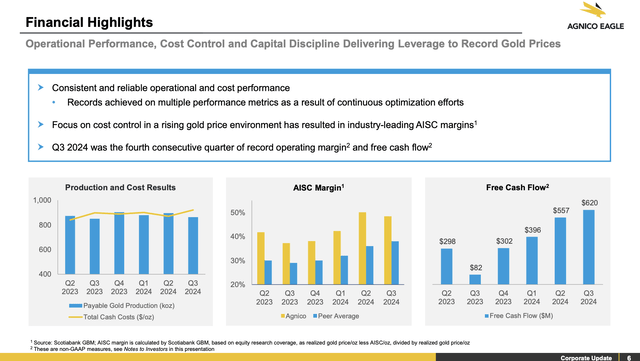

As I just mentioned, Agnico Eagle’s costs are lower. This is also reflected in the overview below, which shows substantially higher AISC margins compared to its peers.

When combining strong margins with rising gold prices and consistent production, we get $620 million in 3Q24 free cash flow, the best quarterly result ever.

Since the prior-year quarter, free cash flow has risen almost 8x, with every single quarter since then showing sequential growth.

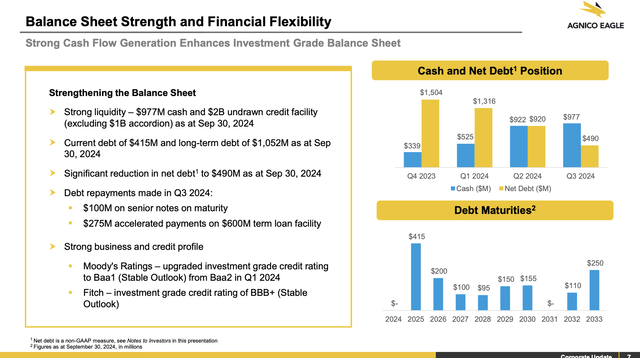

Needless to say, this is great for shareholders, as the company used free cash flow to reduce its net debt from $1.5 billion at the start of this year to $490 million. It has an investment-grade credit rating of BBB+ (one step below the A range), roughly $3 billion in available liquidity, and a well-laddered maturity schedule.

The miner also returned roughly 45% of its free cash flow to shareholders through dividends and buybacks.

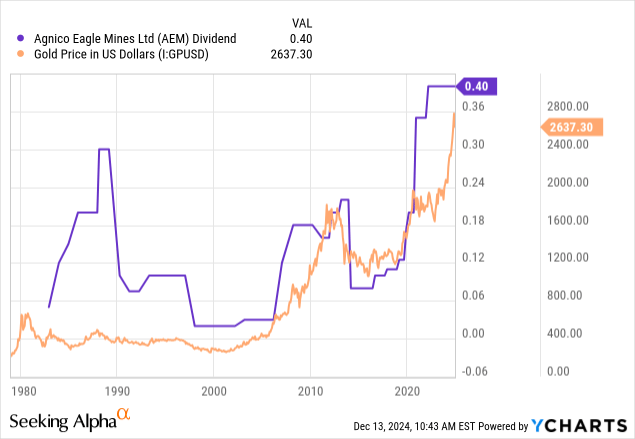

Currently yielding 1.9%, the company has paid a dividend since 1983. However, please be aware that the dividend has not been consistent, as it has a relatively high correlation to the price of gold, which obviously makes sense.

So, what about its valuation?

Valuation

Putting a valuation on commodity-focused companies is tough. After all, their outlook is highly dependent on the commodities they produce. Moreover, analysts are often unwilling to incorporate a specific commodity thesis in their models, which means consensus estimates are often based on current conditions.

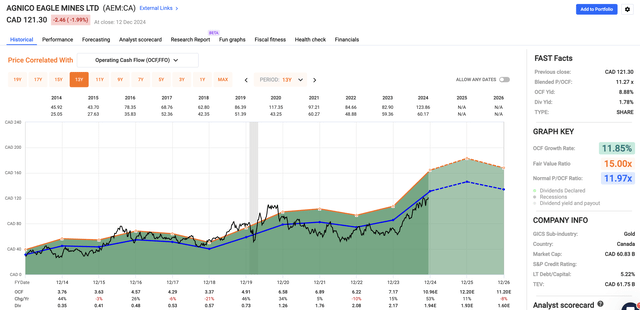

Currently, AEM trades at a blended P/OCF (operating cash flow) ratio of 11.3x, slightly below its ten-year average of 12.0x. Analysts expect 11% per-share OCF growth next year, which implies a fair stock price of roughly $146, 20% above the current price.

On a longer-term basis, I expect AEM to move much higher.

However, please be aware that this uptrend is unlikely to be without risks.

Depending on central bank demand and inflation expectations, we could be in for a gold correction. With that said, I refrain from guessing when that may be, as I like to focus on the bigger picture, which continues to bode well for gold.

The key thing to keep in mind is the volatility that comes with buying miners. Please be aware of the risks before buying Agnico Eagle or any of its peers.

Takeaway

Agnico Eagle Mines continues to impress with its strategic acquisitions, like the recent C$204 million deal for Canadian O3 Mining, and steady growth in low-risk jurisdictions.

The company’s focus on reducing costs, boosting production, and maintaining strong free cash flow has paid off, with a significant 8x increase in quarterly free cash flow and a substantial decline in its debt.

However, while the stock’s valuation suggests more stock price upside potential, it’s important to remember that gold miners come with elevated volatility.

If you’re willing to ride out the market fluctuations, Agnico Eagle remains a top-tier player in the gold mining space, offering solid long-term growth potential for shareholders.

Pros & Cons

Pros:

- Solid track record: Agnico Eagle has outperformed its peers over the long term, with impressive production growth and strong shareholder returns.

- Smart acquisitions: The Canadian O3 Mining deal expands its footprint and comes with synergy opportunities.

- Cost control: AEM has excellent cost management, as it maintains low all-in-sustaining costs compared to its peers.

- Cash flow and dividends: The company has strong free cash flow generation and a history of returning capital to shareholders through dividends and buybacks.

Cons:

- Gold price volatility: Like all gold miners, AEM is exposed to gold price volatility, which can affect its earnings and stock price.

- Geopolitical risk: While AEM operates in low-risk regions, the broader mining sector still faces geopolitical uncertainties that could impact operations. This also includes potential supply growth in other areas that could pressure the price of gold.

- Inconsistent dividends: AEM’s dividend usually fluctuates with gold prices, making it less predictable for income-focused investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CNQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.