Summary:

- Agnico Eagle Mines Limited’s stock price hasn’t risen in the recent months owing to lacklustre gold prices, as tracked by SPDR Gold Shares ETF.

- Despite this, however, AEM’s fundamentals support the stock’s continued attractiveness. Its robust financials have led to upgraded projections and competitive market multiples.

- While there could be a drag on earnings next year due to its recent acquisition of O3 Mining, it’s not enough to weaken the case for AEM.

Liudmila Chernetska

Since I last wrote about the Canadian gold miner Agnico Eagle Mines Limited (NYSE:AEM) in September, its price has barely moved. This is at odds with my Buy rating on the stock. But there’s a good explanation for it. And that’s the loss of some investor interest in gold as such, which is discussed below. Further, here I point out that the miner’s fundamentals are still on solid ground and even with some expected drags on its earnings next year, the stock still looks good.

Gold loses its shine

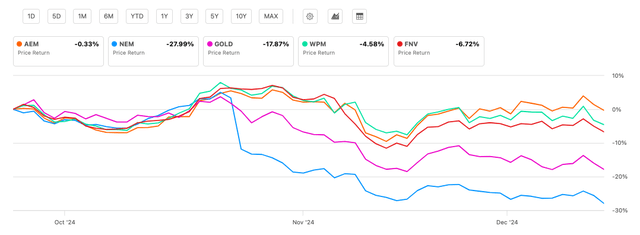

In the past couple of months, all the big five gold miners by market capitalisation have seen a price decline (see chart below). In fact, it’s worth noting that while AEM has seen the smallest drop among them. The biggest gold miner in the set, Newmont Corporation (NEM) has seen the biggest drop of 28% and even Barrick Gold (GOLD) has dropped by 18%.

Price Returns, Biggest Five Gold Miners By Market Cap (Seeking Alpha)

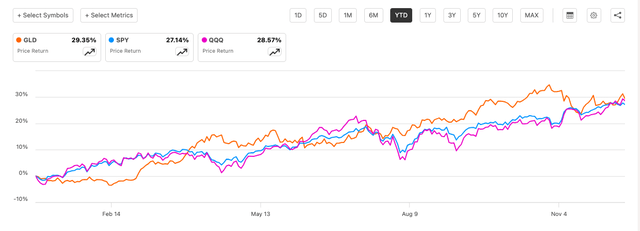

This can be directly linked to the lacklustre gold price trends in this time, with the SPDR Gold Shares ETF (GLD), which tracks the price of gold bullion, down by 0.7% during this time. It also needs to be noted that while year-to-date [YTD] it continues to look good, it’s now barely ahead of the S&P 500 (SP500) tracker, SPDR S&P 500 ETF Trust (SPY) and the NASDAQ-100 (NDX) tracker, Invesco QQQ Trust ETF (QQQ) (see chart below). By comparison, in September it had a 10 percentage point [pp] and 12 pp lead over them respectively.

Price Returns, GLD, SPY and QQQ (Seeking Alpha)

Continued positive momentum for financials

But the recent lacklustre price performance is actually a positive as AEM continues to show robust financials, resulting in yet another upgrade to projections and more attractive market multiples.

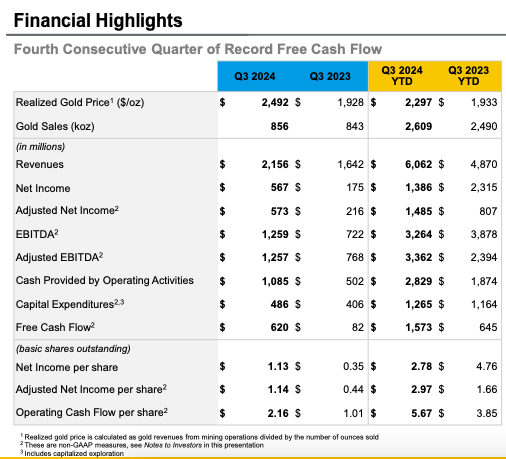

First, a look at its recent financials. The company’s revenue growth continued to be robust in the third quarter (Q3 2024) at 31.3% year-on-year (YoY), the fastest in seven quarters. The revenue increase for the first nine months of the year (9m 2024) has, as a result, risen to 24.5% YoY, up from 21% YoY for the first half of the year (H1 2024).

Further, the adjusted net income margin also continued to expand, rising to 26.6% in Q3 2024. The figure for 9m 2024 is now at 24.5%, up from 23.4% in H1 2024.

Agnico Eagle Mines

Outlook upgrade

With the company’s performance robust so far and the outlook for gold prices for Q4 2024 positive too, I’ve upgraded my full-year projections for AEM yet again, which are as follows:

- Revenues: The company has produced 2.64 million ounces (Moz) of gold in the 9m 2024, which is 0.88 Moz per quarter. For full-year projections, it’s assumed that the number remains constant at this level in Q4 2024 as well. This brings the full-year production to 3.52 Moz, which is close to the top end of the guidance range of 3.55 Moz. Next, the gold price for the quarter is assumed to be at USD 2,650 per ounce, which is both the current gold price and around the average of the level seen so far in the quarter. This results in Q4 2024 revenues of USD 2,332 million, a robust 32.8% YoY increase. For the full year, the revenue figure now comes to USD 8,394 million.

- Adjusted net profit: The adjusted net profit margin for the full year 2024 is expected to stay at 24.5%, the same as for 9m 2024. This is an upgrade from the expectation of 22% the last time, which was based on the average for 2023 and H1 2024. The absolute adjusted net income figure comes to USD 2,056 million.

Market multiples are attractive…

With the upgrade to the adjusted net income figure, AEM’s forward non-GAAP price-to-earnings (P/E) ratio is now at 20.7x, which is lower than the 23.9x level it was at the last I checked.

Further, as per analysts’ estimates available on Seeking Alpha, the forward P/E for 2025 is even lower at 16.6x. Both figures are substantially lower than the stock’s five-year average ratio of 26.3x.

…even after a drag from the recent acquisition

Note that there will be a drag on the company’s earnings next year as a result of its acquisition of O3 Mining for CAD 204 million (USD 143 million) in an all-cash deal earlier this week. The payout for the purchase, which is expected to close in the first quarter of next year, will reduce the earnings per share [EPS] by USD 0.29.

Further, O3 Mining is loss making at present, with a net loss attributable to shareholders of USD 30.6 million in the past trailing twelve months [TTM]. Assuming that the loss remains static at the TTM level, that would be another drag of USD 0.06 per share.

In total, then, there will be a negative impact of USD 0.35 in the next year. At present, analysts expect an adjusted EPS of USD 5.03 for next year. Assuming that the acquisition affects the non-GAAP figure, it would then decline to USD 4.68.

As a result, the figure might not see the 20.8% increase expected right now, but it still represents a healthy increase of 12.6% rise. Also, the forward P/E still remains competitive at 17.9x.

What next?

In the next year, then, a 47% increase in price is still possible in the next year, especially as gold price is expected to keep inching up. Supporting AEM are its strong fundamentals. The company’s production towards the higher end of its guidance range is particularly encouraging. Its expanding margins are impressive too.

The breather in price rise over the past couple of months, even as its third quarter results indicate the likelihood of better than expected financials for the full year along with a positive outlook for next year, only go in AEM’s favour. Its market multiples are attractive and confirm that the stock continues to merit a Buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AEM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.