Summary:

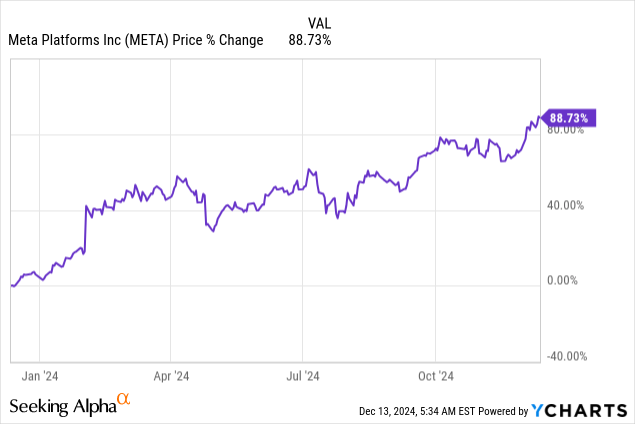

- Meta has rebounded significantly, returning over 88% in the last 12 months.

- The faced challenges, including slow user and revenue growth, of the last few years seem to be largely solved.

- Despite risks like heavy Metaverse investments and dependency on device manufacturers, the company could still be at attractive levels.

Kira-Yan

Meta (NASDAQ:META) has performed very well over the last 12 months, returning over 88%. In this article we will analyze if this recent run-up is exaggerated or well justified, making the company a compelling buy.

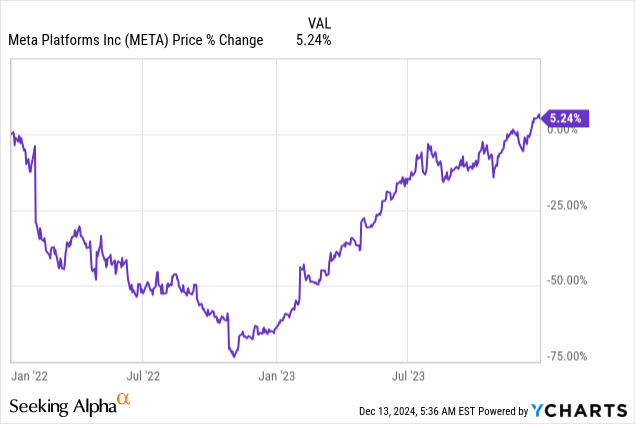

The company has seen way worse performance in the time frame of 2022 to 2023 due to several reasons.

Metaverse Pivot: The company has been investing massively into the Metaverse ecosystem, worrying investors that these investments potential won’t return any profits.

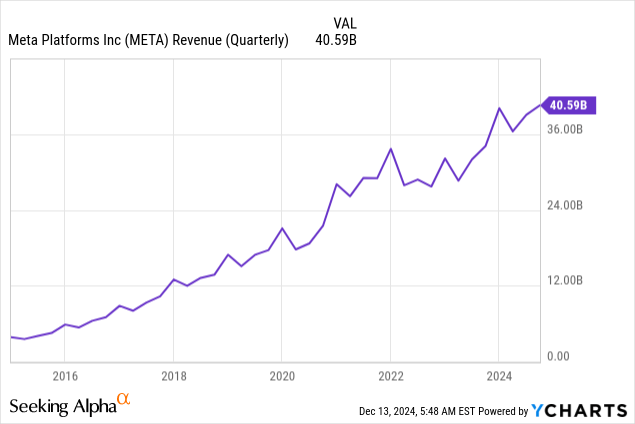

Revenue Growth Slowdown: Compared to the prior years, the top line growth for Meta has flat lined in 2022 and 2023. Apple’s (AAPL) privacy changes also didn’t help.

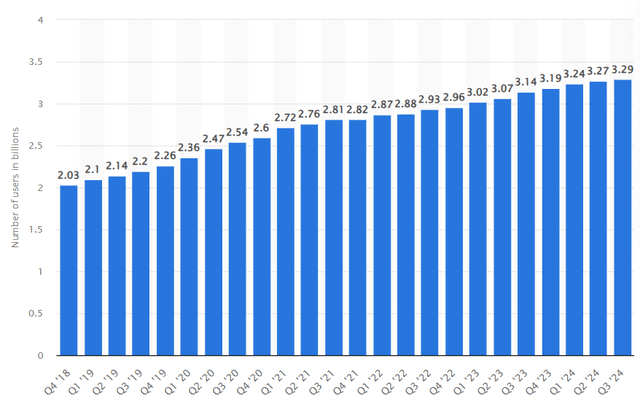

User Growth Slowdown: Same can be said for Meta’s user statistics in 2022 and 2023, growing lesser users in this time frame compared to prior and later quarters.

Cumulative number of daily Meta product users as of 3rd quarter 2024 (statista.com)

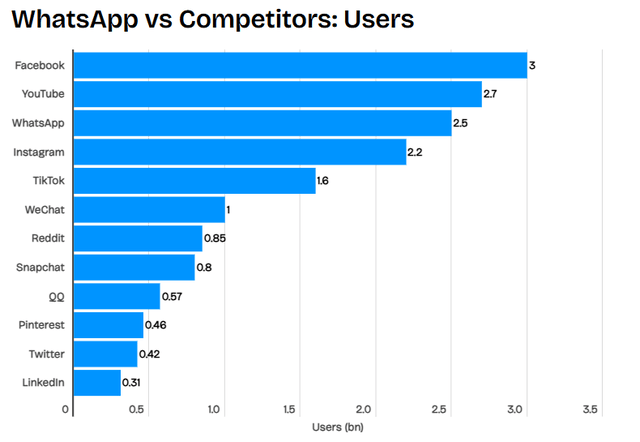

In the past, the company also somewhat failed to effectively monetize WhatsApp’s 2.5 billion users.

WhatsApp vs Competitors: Users (businessofapps.com)

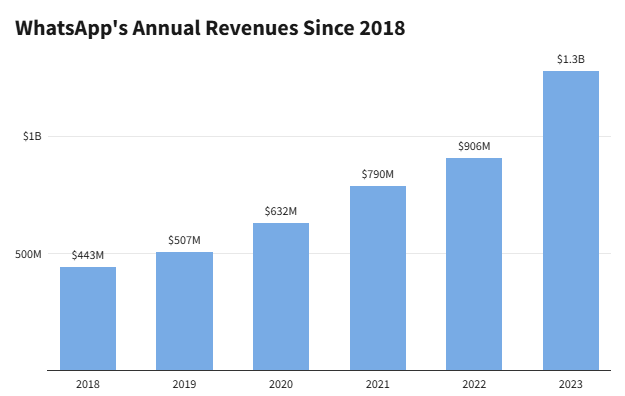

WhatsApp’s Annual Revenues Since 2018 (investopedia)

This also changed in the last few months as the company is exploring several monetization strategies.

Most of WhatsApp’s revenue currently comes from the business API, where Meta is charging companies for communication with customers through the App. This can be used for marketing communication and authentication for example. The company is currently charging ~5 cents per conversation.

The new “Click-to-WhatsApp” Ad format, where business directly initiate conversations on WhatsApp trough ads in Facebook and Instagram have been growing very solid according to Mark Zuckerberg reaching a “$1.5 billion run rate, growing more than 80% year over year.”

Meta also launched WhatsApp Pay as a pilot-project in a few countries to explore the capabilities of WhatsApp as a digital payment processors, just like Tencent’s (OTCPK:TCEHY) WeChat.

They also introduced Channels in 2023, where users can follow influencers and corporations that they are interested in. This also opens up potential monetization opportunities in the future, for example subscriptions or ads – which seems rather unrealistic considering Meta’s general hesitation to place ads on WhatsApp.

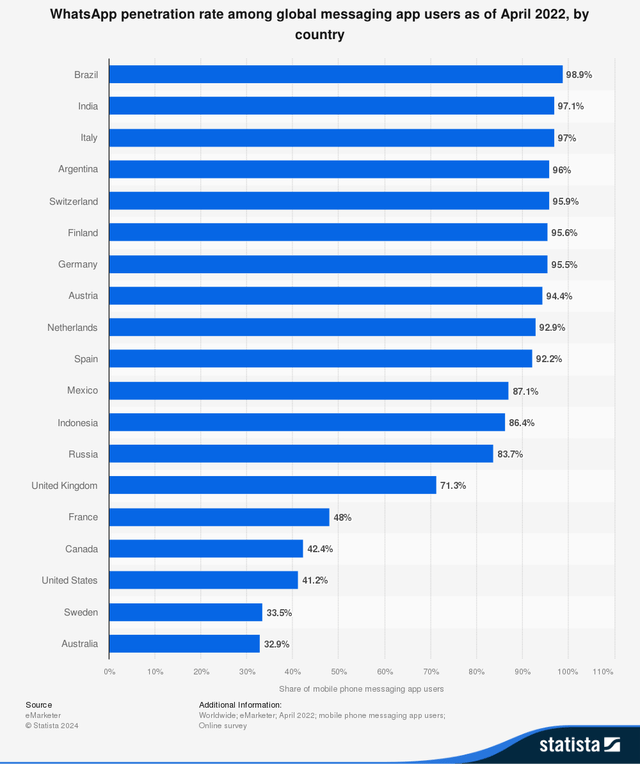

WhatsApp also offers a lot of room for growth considering that in the very important US market, the service is currently only at a penetration rate of ~41%. They however recently managed to grow to 100 million users in the US.

WhatsApp penetration rate among global messaging app users as of April 2022, by country (statista.com)

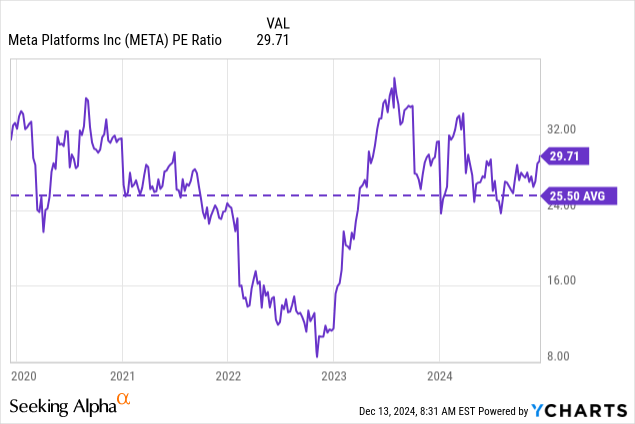

With the exaggeration to the downside in 2022 and 2023 and the potential exaggeration to the upside at current levels the reversion to the mean would suggest, that Meta’s fair value should lay somewhere between 2022 and today’s levels. In the following paragraph, we will have a further look at the valuation.

Valuation

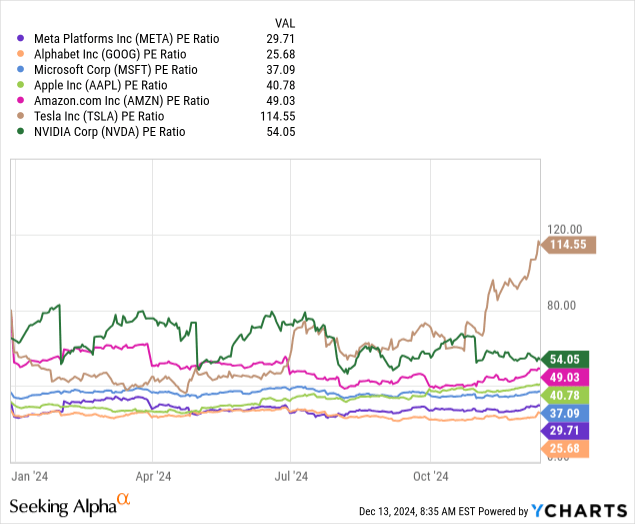

The company is currently trading at a PE Ratio of almost 30, indicating that the company could be overvalued right now compared to the 5 years average of 25.5.

Comparing the PE Ratios of the Magnificent 7 the company however seems to be the most attractively valued company right now, apart from Google which I believe is currently a good investment opportunity.

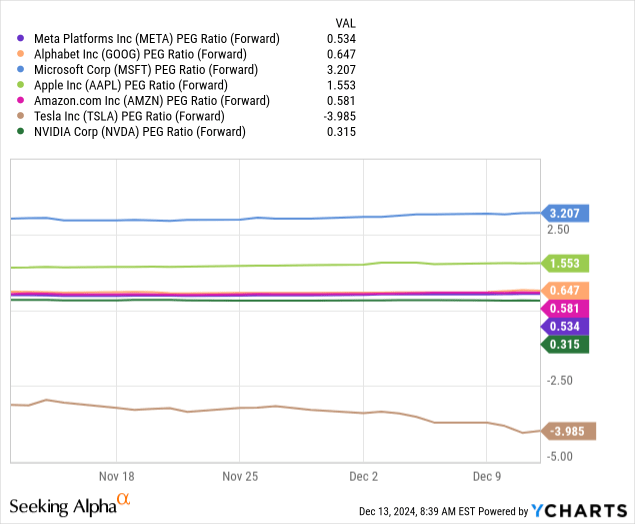

Same can be seen when we look at the current PEG Ratio of the company.

To evaluate the company independently from other stock, we will conduct a Discounted Cash Flow Analysis that factors in the growth and profitability projections of Meta.

Growth And Profitability Prospects

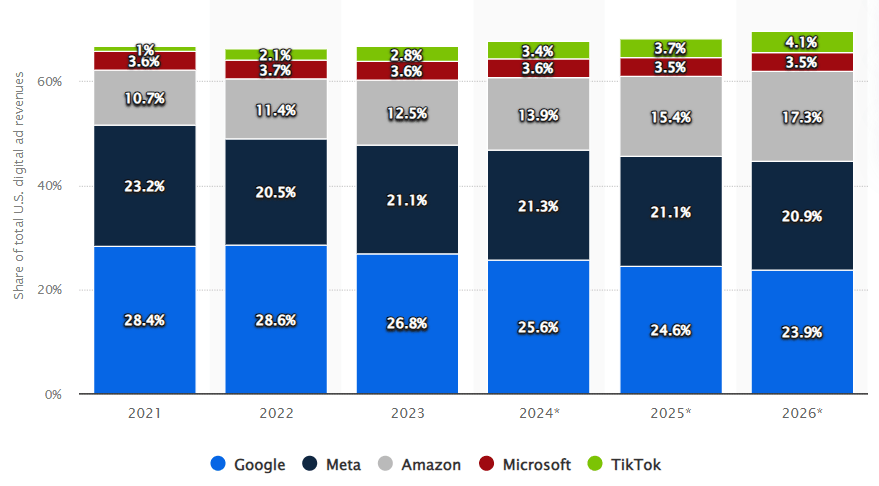

The global digital advertising market is expected to grow at a CAGR of 15.5% until 2030. When we take a look at the past market share in this competitive market, Meta was able and is predicted to pretty much hold their market share in the following years.

Market Share of Different Companies in Digital Advertising (statista.com)

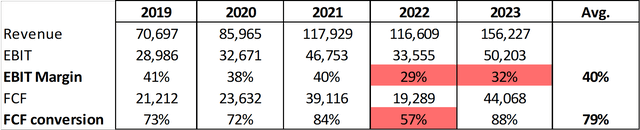

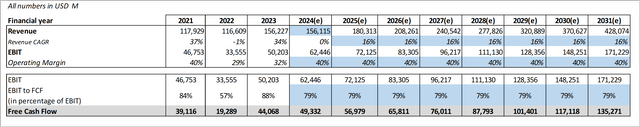

If we take a look at the EBIT margin and the Free Cash Flow conversion of the last few years, these averages seem fitting. The red cells seem like outliers and weren’t considered in calculating the averages.

Meta’s Profitability 2019 – 2023 (seekingalpha.com)

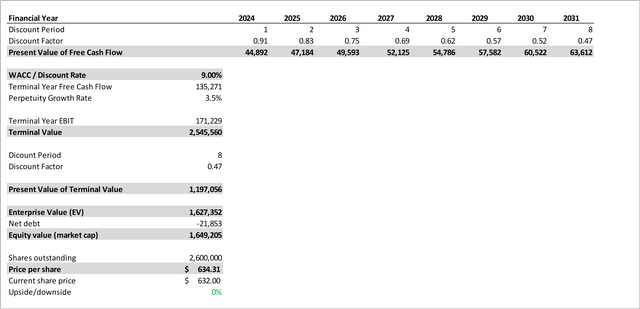

With these assumptions and assuming a WACC of 9% – right around the company’s current rate – and a perpetuity growth rate of 3.5%, we get the following DCF for Meta.

Meta Discounted Cash Flow Analysis (I) (own assumptions)

Meta Discounted Cash Flow Analysis (II) (own assumptions)

Given these assumptions the company seems to be fairly valued right now, with a fair value share price of $634.

Risks To Consider

When investing in Meta there are also plenty of risks that potential investors need to keep in mind.

Further Metaverse Investments: The management of Meta could come to the conclusion that further investments in the Metaverse are justified and needed for the company to grow. Profitability of these investments seems very uncertain, in my perspective.

Dependency: The company is currently heavily reliant on the device manufacturers like Apple to keep their privacy regulations constant.

Innovation Risk: The company is also investing heavily into AI tools to further boost output, improve profitability and weaken Apple’s grip on Meta. This new initiative combined with the mentioned Metaverse project and the WhatsApp monetization bring a big risk as relying on these for future growth could backfire if the expected growth won’t come to fruition.

Public Sentiment: As the biggest social media provider, the company is heavily dependent on the daily users. Negative sentiment around the company, through privacy concerns for example – could therefore heavily impact their business negatively.

Conclusion

Our valuation gave us a fair value share price of $634 indicating that the company is currently trading at fair value. Our DCF however didn’t consider any profitability improvements through AI or a significant growth apart from their digital advertisement – from example trough the reasonable developments in the Metaverse.

Considering this the company definitely is no screaming buy right now, I nevertheless believe that investors that are looking for exposure in this stock can use current prices to initiate a position, which is why I currently rate the stock a Buy.

What’s Your Perspective? Let’s Discuss!

Thank you for reading my analysis! I’d love to hear your ideas and points of view — whether you agree, disagree, or have your unique take on the stock. Let’s start a discussion in the comments! I welcome any helpful arguments and ideas that can help us better comprehend this topic. Thanks!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.