Summary:

- Pfizer’s stock has become appealing due to irrational vaccine fears.

- Market fears about RFK Jr.’s potential anti-vaccine stance are likely overblown, as neither he nor Trump have indicated plans to block vaccines.

- Pfizer’s strong growth in oncology and specialty care, along with cost-cutting measures, suggest the stock is undervalued at below 10x EPS guidance.

- Investors should capitalize on the current weakness to own the stock, with a strong 6.8% dividend yield.

Massimo Giachetti

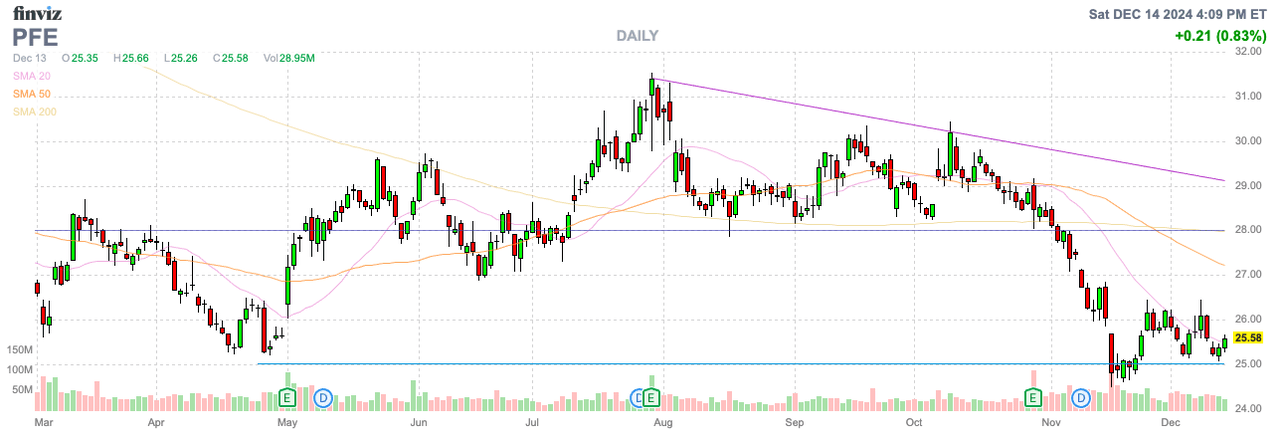

Pfizer, Inc. (NYSE:PFE) was recently added to the portfolio with the stock becoming too appealing, falling due to likely irrational vaccine fears. The market fears RFK Jr. will eliminate vaccines and the opportunity to buy the biopharma stock for the 6.8% dividend yield was far too appealing. My investment thesis remains Bullish on the stock, especially after the dip down to support around $25.

Source: Finviz

Irrational Fears

The somewhat surprise of Donald Trump winning the U.S. Presidential election has sent vaccine stocks lower. Trump has picked RFK Jr. as the nominee to run the Department of Health and Human Services, which oversees the Centers for Disease Control and Prevention that approves vaccines.

RFK Jr. is clearly against unnecessary vaccines and opposed the Covid vaccines that Pfizer benefitted greatly from quickly bringing to market back in 2020. The big question is whether the HHS pick would issue any blanket mandate against vaccines.

The statements from RFK Jr. and Trump don’t appear to support this as the case. On a quick CNBC interview with Jim Cramer, the HHS pick denied plans to block vaccine use.

In a recent interview, President Trump has this to say about RFK Jr. and vaccines in general:

We’re going to have a big discussion. The autism rate is at a level that nobody ever believed possible. If you look at things that are happening, there’s something causing it. It could if I think it’s dangerous, if I think they are not beneficial, but I don’t think it’s going to be very controversial in the end.

I want to see the numbers. At the end of the studies that we’re doing, and we’re going all out, we’re going to know what’s good and what’s not good.

He (Kennedy) does not disagree with vaccinations, all vaccinations. He disagrees probably with some.

In essence, Trump, along with RFK Jr., want to explore what is causing higher autism rates and question the norm that more childhood vaccines are needed. If the data backs up the use of a vaccine like for polio or measles, neither Trump nor RFK Jr. have shown any sign of questioning the ongoing use of the vaccine.

Clearly, biopharma companies with vaccines on the market that don’t work should be worried, but all of these companies can use data to support the continued use of any existing safe vaccine. Even with the Covid vaccine, RFK Jr. has seemed more focused on the forced use of the vaccine versus voluntary doses.

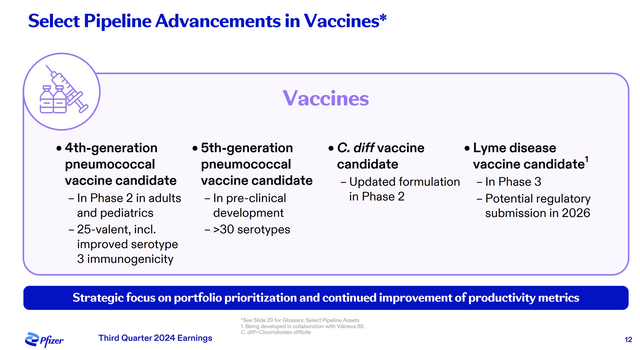

Pfizer is clearly focused on vaccines with the pneumococcal, Covid and a Lyme disease candidate in Phase 3. Paxlovid, Prevnar and Comirnaty accounted for $6 billion of the Q3’24 sales of nearly $18 billion.

Source: Pfizer Q3’24 presentation

Excluding the Covid drugs, Pfizer is growing the business at a 14% clip in the September quarter. The biopharma is seeing strong growth in the oncology segment and specialty care to move away from vaccine-centric focus, yet the overall business is very much tied to vaccine sales.

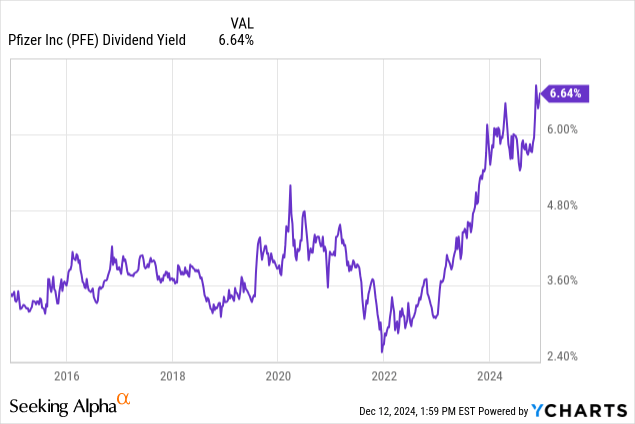

Booming Yield

Pfizer already had a strong dividend yield when the stock was at $30. The recent dip to $25 had pushed the yield to a record high over 6.6% and the company just hiked the quarterly dividend payout by 2.4% to $0.43. In more normal times of the last decade, the stock only had a dividend yield in the 3.6% range.

The company has the Analyst and Investor call on December 17 to review full-year 2025 financial guidance. Pfizer recently guided up the 2024 numbers to revenues between $61 to $64 billion, with an adjusted EPS of $2.75 to $2.95.

The stock trading below 10x the current EPS guidance further hints at the cheap stock valuation. The consensus analyst estimates forecast 2025 numbers mostly flat with 2024, with revenues at $63 billion and an EPS of $2.89.

Pfizer is currently undergoing major cost-cutting plans, so any flat EPS on similar revenues doesn’t appear accurate. The initial $4 billion plan won’t fully flow to the bottom line until 2025 and the new $1.5 billion plan for manufacturing optimization will lower costs through 2027

The company has ~5.7 billion shares outstanding, so just $500+ million in savings in any year would boost EPS by nearly $0.10. Though, Pfizer did discuss several 2024 non-recurring items that boosted EPS by $0.30.

Pfizer is on a path to a $3 EPS, while the company currently pays a $1.68 annual dividend. The annual dividend payout is a massive $9.6 billion, so a key focus with the 2025 guidance will be the go forward cash flows.

The company has a $68 billion debt load with cash of nearly $10 billion. Investors will want to see how Pfizer can continue to paying the dividend while easily repaying the debt.

The biggest risk to the investment story would be a cash flow squeeze that pressures the dividend. The market letting the yield reach nearly 7% is an indication of the fear levels on any anti-vaccine mandate by the next leader of the HHS.

Takeaway

The key investor takeaway is that investors appear far too fearful on any anti-vaccine mandate of RFK Jr., a person not even confirmed to the HHS post yet. Investors should use the ongoing weakness to own Pfizer and enjoy the large dividend yield while waiting for the stock to rebound.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start December, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.