Summary:

- Merck’s shares have declined, making its dividend yield climb and valuation compress, presenting an attractive investment opportunity at current prices.

- Keytruda, the company’s largest drug, continues to show strong revenue growth and potential for further approvals and market expansion.

- MRK’s diverse drug portfolio, including Gardasil and Winrevair, and its robust pipeline with numerous phase II and III programs support future growth.

- Merck is trading at a significant discount compared to its historical valuation, offering a solid dividend yield and potential for attractive total returns.

Sundry Photography

Article Thesis

Merck & Co., Inc. (NYSE:MRK) is a leading pharma company with an attractive drug portfolio that has seen its shares decline significantly in the recent past. This has made Merck’s dividend yield climb, while its valuation has

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

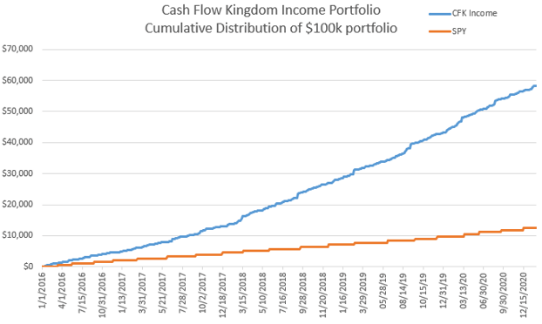

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7—10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!