Semiconductor sales in October reached their highest-ever monthly total, posting a sales figure of $56.9B. This was an increase of 22.1% over the same period last year and 2.8% over September 2024.

“Total annual sales are now projected to increase by nearly 20% in 2024—higher than earlier forecasts—and then continue to grow by double-digits in 2025,” said John Neuffer, Semiconductor Industry Association president and CEO.

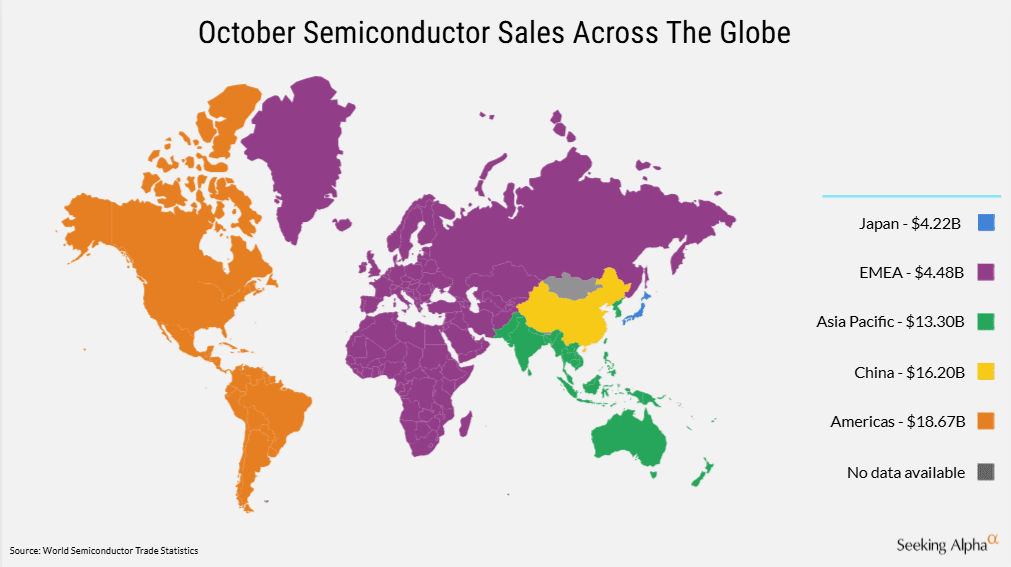

Taking the biggest chunk of semiconductor sales, the Americas further increased its monthly tally, recording sales of about $18.7B in October, a sequential increase of 8%, the highest among all regions.

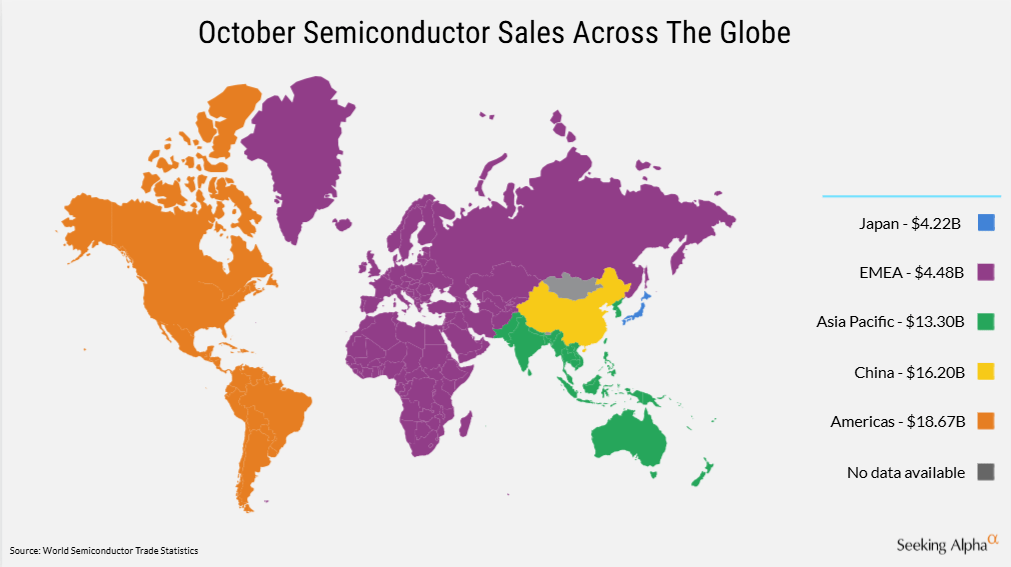

Starting below China at $12.6B in semiconductor sales in January, the Americas has upped its monthly intake since April, overtaking China by June and comfortably sitting at a $2.5B lead over China in October.

Part of this has been due to the governmental support to chipmakers under the CHIPS and Science Act. Recently, the U.S. Department of Commerce is said to have finalized a $6.165B award to Micron Technology (MU) to support the construction of two fabs in Clay, New York, and one fab in Boise, Idaho. Before this, the CHIPS Act also granted Intel (NASDAQ:INTC) up to $7.86B in direct funding.

Regions EMEA, Japan, Japan, and China saw their tallies inch higher by about 1% over September. On the other hand, the Asia Pacific region saw a minor sequential dip in monthly sales at $13.30B.

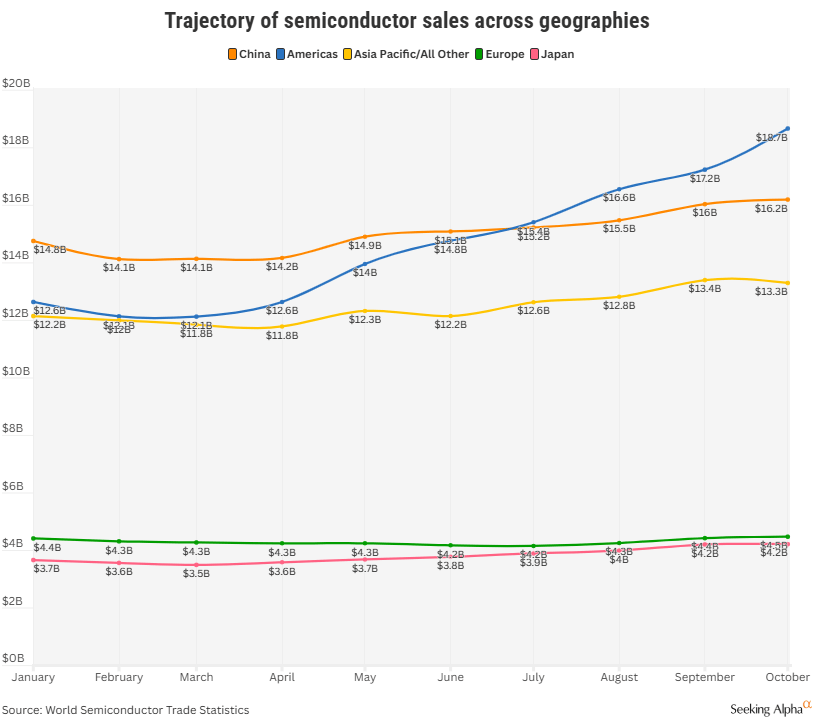

Since the start of the year, Americas has secured about $146.2B in semiconductor sales, an increase of about 37.7% over last year. In October alone, the Americas recorded a 54% year-on-year jump in semiconductor sales.

On the other hand, China has recorded about $150.2B in the 10 months of 2024, however, compared to last year, sales have increased about 22.8%.

Sales in Asia-Pacific too have seen a 14.1% year-on-year increase to $124.4B. While semiconductor sales in Japan have remained somewhat stable, the figure came down for EMEA, recording sales of $43.03B, down 7.6%.