Summary:

- Pfizer’s shares have significantly underperformed, but the current valuation and high dividend yield present a compelling value play.

- Despite revenue declines and potential regulatory risks, Pfizer remains a cash-generating machine with strong liquidity and a robust drug pipeline.

- Pfizer’s operational improvements, debt reduction, and consistent dividend growth signal a turnaround, making it an attractive investment at current depressed levels.

- I am bullish on Pfizer, expecting its share price to rise as the market recognizes its improving fundamentals and economic tailwinds.

PM Images

This has been the lost decade of shareholder value for long-term shareholders of Pfizer (NYSE:PFE). The S&P 500 has gained over 192% since 12/15/14, while shares of PFE have declined by -20.38%. Since shares peaked around the $60 mark in December of 2021, they have been on a multi-year decline, shedding more than half their value. It’s been another difficult year as shares of PFE closed at $25.58 on 12/13/24 and are now down -11.15% YTD. PFE feels like it’s the new AT&T (T), and while there are many reasons to be concerned, management just rewarded shareholders with another dividend increase today as they raised the quarterly dividend by 2.4% to $0.43. PFE certainly isn’t generating the same level of profitability as it was during the pandemic, but it’s still a cash cow that has produced $8.23 billion in free cash flow (FCF) over the trailing twelve months (TTM). The recent sell-off since October has created a scenario where the current valuation places PFE trading at less than 9 times 2024 earnings, and the dividend yield exceeds 6.5%. I have been wrong about PFE so far, but after reviewing the numbers again, I think this investment is an immense value play. I am asking myself whether I think PFE can come back from the lowest level its shares have traded for in more than a decade. I am a buyer here, and I am happy to collect a large dividend while the market negatively perceives PFE because I think shares will be higher next year than they are today.

Following up on my previous article about Pfizer

Pfizer has been one of the investment ideas I have gotten absolutely wrong this year. When shares were trading for $28.13 around this time last year, I thought it was a great time to either start or add to an existing position. Since my last article was published last December (can be read here) shares of PFE have fallen -10.01% while the S&P 500 has climbed 27.15%. Despite PFE having a large dividend, the generated income hasn’t been enough to produce a positive total return, as shares are still down -4.51% when the dividend is accounted for. In the article, I discussed why I felt the valuation made a compelling investment case and why I felt the fears of a dividend cut were overblown. I am following up with a new article to discuss why I am adding more to my position in PFE and why I believe the market is mispricing shares.

Risks to my investment thesis about Pfizer

While I am bullish on PFE and believe the current valuation presents an opportunity, there are many reasons to remain cautious about allocating capital toward this investment. Before discussing the business risks, I am going to address the elephant in the room, which is Robert Kennedy Jr (RFK). RFP chaired the Children’s Health Defense non-profit, and since 2020, it has filed close to 30 federal and state lawsuits challenging vaccines and public health mandates. RFK is listed as a lawyer in some cases, and his legal advocacy work has caused some fear throughout the pharmaceutical industry, as former President Trump has nominated him to be the next Secretary of the Department of Health and Human Services. Right now, everything is heresy, as nobody except RFK and his inner circle knows what direction he will push the agency in. This could end up being a nothing burger or a problem for big pharma, which PFE is part of. Recently, Albert Bourla, CEO of PFE, and Dave Ricks, CEO of Eli Lilly (LLY) had dinner with President-elect Donald Trump and RFK at Mar-a-lago. Only time will tell how this plays out, but for now, RFK could be a negative risk factor for not only PFE but the entire pharmaceutical industry.

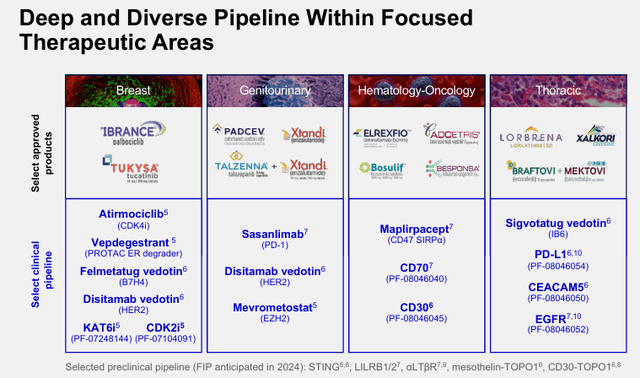

From a business perspective, there are several risk factors to consider before investing in PFE. There has been a significant decline in revenue for PFE since the pandemic, as the amount of revenue PFE produces dropped by -$40.96 billion from the 2022 fiscal year to the TTM. PFE has drugs on patent, such as breast cancer medicine Ibrance and the blood thinner Eliquis, that will eventually expire and allow generic drugmakers to replicate these compounds and take away market share. PFE is always in a race against its peers, and if breakthroughs are made outside of the PFE environment, it could mean lower utilization rates of its drugs. No matter who is in charge of the Department of Health and Human Services, there are always regulatory hurdles for pharmaceutical companies, and there is no guarantee that drugs within PFE’s pipeline will receive approval. PFE also needs to invest in R&D to advance its drug pipeline, and if it loses leading researchers to its competitors, then it could negatively alter PFE’s future profitability. Investors should consider all of these factors and conduct their own due diligence before investing in PFE.

Why I am very bullish on Pfizer and think it could be a strong value play

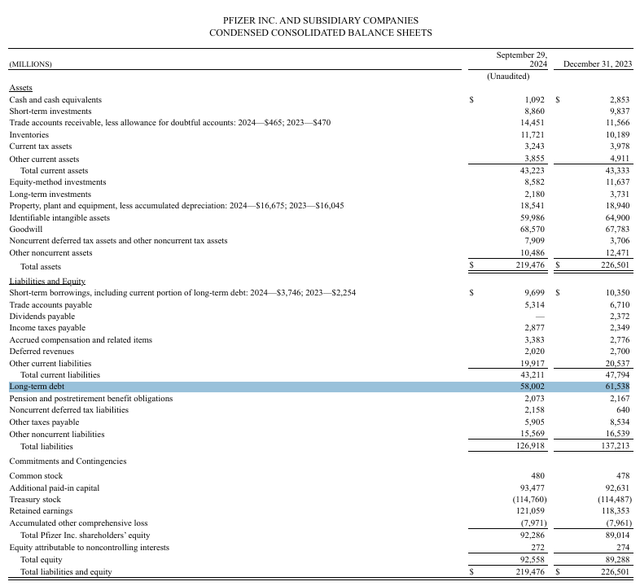

When some investors look at PFE, they see a company that has too many potential problems, from the loss of revenue to potential headwinds with the incoming administration, but when I look at PFE, I see a company that is an FCF machine with economic tailwinds on the horizon. In 2023, PFE added almost $30 billion in long-term debt to the balance sheet to acquire Seagen. As of PFE’s Q3 10-Q filing, there was still $58 billion in long-term debt on the balance sheet. Since the close of their 2023 fiscal year, PFE has eliminated -6.1% of their long-term debt, and they have reduced their long-term debt by -$3.54 billion. In Q3, PFE paid $783 million in interest expenses, and over the TTM, the cost of servicing their debt amounted to $3.04 billion. PFE is sitting on $9.95 billion in cash and short-term investments, with another $10.83 billion in long-term investments on the balance sheet. They have more than enough liquidity to eliminate the $3.77 billion of debt due over the next 12 months. The next FOMC meeting will occur this week, and CME Group is projecting that there is a 95.3% chance the Fed will cut rates by another 25 bps. The Fed dot plot remains unchanged, with rates expected to be around 3.5% by the end of 2025 and 3% at the end of 2026. PFE should be in a position to refinance higher-yielding debt at lower rates and reduce a portion of their current interest expenses that exceed $3 billion on a 12-month run rate. This could provide a boost to profitability and help drive additional earnings to the bottom line.

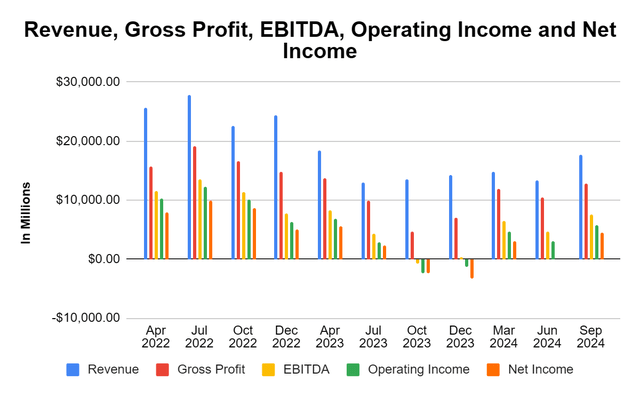

When I conduct a multi-quarter lookback on PFE’s income statement, it looks like the bleeding has stopped. On a quarterly basis, PFE’s revenue peaked in Q2 2022 at $27.74 billion and declined by -53.11% to $13.01 billion over the next year. During Q3 and Q4 of 2023, PFE generated negative operating and net income as PFE struggled to turn a profit. In Q3 2023, PFE generated $13.49 billion of revenue, which was a -40.40% (-$9.15 billion) decline, and YoY and PFE lost more than -$2 billion over those 3 months. Q3 2024 was a much different story as PFE has strung together 3 strong quarters, which signals to me that the bleeding has stopped. In Q3 2024, PFE generated $17.7 billion in revenue, which was an increase of 31.2% ($4.21 billion) YoY while growing its gross profit by 179.70% ($8.24 billion) to $12.83 billion. In Q3 2024, PFE operated at a 72.48% gross profit margin while turning over $4.47 billion in net income for a bottom-line profit margin of 25.22%. There is a clear trend of revenue and profitability increasing on a quarterly basis, which makes me look at PFE differently than others. Over the TTM, PFE has generated $59.38 billion in revenue, $18.37 billion in EBITDA, and $4.25 billion in net income, which includes Q4 of 2023 when PFE lost -$3.37 billion. Once Q4 2024 results come in, the TTM numbers will look much different as the -$3.37 billion rolls off and stays on the books for 2023.

Steven Fiorillo, Seeking Alpha

It also feels like the investment community isn’t taking into consideration what PFE is accomplishing and how it’s impacting their numbers. When I look at PFE on an operational basis, its revenue has increased by 1.5% YoY in the TTM, while its cost of revenue has declined by -$6.05 billion or -25.2%. PFE is becoming more efficient, and they’re on track to deliver on their cost realignment plan. PFE also increased their guidance for 2024 as they are now projecting that revenue will come in at $61 to $64 billion, while their diluted EPS will range from $2.75 to $2.95. While shares of PFE are trading at depressed levels, this is still a company that has generated $41.43 billion in gross profit and, after all of its business expenses, had the ability to allocate $10.6 billion toward R&D over the TTM while still producing over $4 billion in profitability. PFE has a robust pipeline that spans different sectors and has a large focus on oncology. It’s expected that there will be 2 million new cancer cases in the U.S. in 2024, while the new cases of cancer in 2022 reached 20 million worldwide, while cancer caused 10 million globally. As an investor, I always want to make a profit, and I look for companies that are undervalued by the market quite often. However, the fact that PFE is a leader in oncology is another reason why I want to invest in PFE.

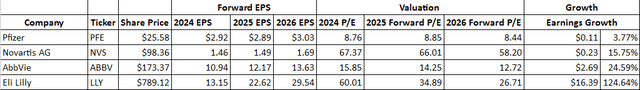

When I compare PFE to other large-scale pharmaceutical companies such as Novartis AG (NVS), AbbVie (ABBV), and Eli Lilly (LLY), PFE may not have the same growth trajectory, but their valuation is certainly attractive. PFE is trading at 8.76 times 2024 earnings and 8.44 times 2026 earnings. The analyst community is only pricing in 3.77% of earnings growth over the next 2 years, but they are producing enough EPS to increase dividends consistently and pay down debt. PFE is trading at such a low valuation, and the market may not be pricing in PFE’s ability to reduce its interest expenses by refinancing and eliminating debt on the balance sheet. Overall, I think that PFE trading in the single digits is too low of a valuation, and I am bullish.

Steven Fiorillo, Seeking Alpha

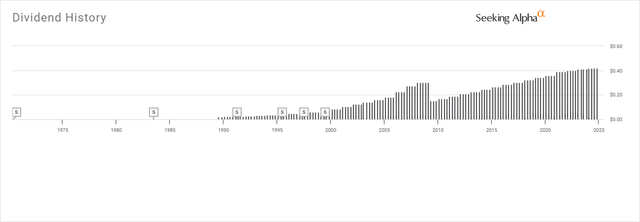

The strongest dividend is the one that was just raised, and Pfizer continues to provide dividend growth

Despite the deteriorating share price, PFE has been able to deliver 15 years of dividend growth and another 2.4% raise today. PFE is now paying a dividend of $1.72 per share, which is a 6.72% yield. PFE is expected to generate $2.92 of EPS in 2024, which will place its dividend payout ratio at 58.90%. PFE has 5.67 billion shares outstanding and is expected to pay $9.75 billion in dividends, which leaves $6.8 billion of retained earnings to pay down debt and reinvest in the business. I remember that throughout the year, there was speculation that PFE would need to cut the dividend, but this increase and the progress PFE has made operationally send a different message. From an income perspective, PFE is a solid pick that can continue its dividend growth in the future.

Conclusion

I’m looking for value heading into 2025, specifically companies that have fallen and can benefit from lower rates. There are several uncertainties for PFE, especially what RFK plans to do, but I don’t make investment decisions based on speculation. Based on the numbers, PFE is turning the business around, and the share price doesn’t reflect the progress being made. PFE is growing its revenue and profitability while increasing its 2024 guidance. We just saw their financial stability as billions in debt were paid down in 2024 while providing shareholders with a 2.4% dividend increase. The investment case may take several more quarters to materialize, but I think PFE is a golden opportunity, as it has traded at its lowest level in more than a decade.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I had a position in FTNT but my shares got called away due to options that expired. I may start another position. Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.