Summary:

- Tesla’s stock has surged post-2024 election, gaining $550 billion in market value, driven by Elon Musk’s close ties with Trump and potential deregulation benefits.

- Favorable regulatory changes and strong growth in China could significantly boost Tesla’s autonomous vehicle ambitions and overall market performance in 2025.

- Despite high valuation, TSLA’s forecasted 20–30% delivery growth and robust gross margins suggest continued stock momentum, supported by a pro-business Trump administration.

- Risks include potential profit-taking, competition in autonomous driving, and the impact of any regulatory setbacks, but overall, Tesla’s outlook remains positive.

jetcityimage

The stock of electric-vehicle company Tesla Inc. (NASDAQ:TSLA) has skyrocketed following Donald Trump’s win of the presidential election with Tesla gaining approximately $550 billion in market valuation since November 5, 2024.

Tesla now has a market value of $1.4 Trillion, and the electric-vehicle company is likely poised to profit from Elon Musk’s close relationship to Trump and a deregulation strategy that could unleash Tesla’s potential.

Though Tesla has soared lately, I think investors don’t have any good reason to sell the stock and, in my view, Tesla investors could be in for a very nice ride during a second Trump Administration.

My Last Rating Classification

Tesla’s stock was a ‘Hold‘ for me in my last piece on the electric-vehicle company, but Donald Trump’s second-term could be a game-changer for the EV manufacturer.

A more favorable regulatory environment in terms of autonomous vehicles (meaning the reduction of regulations) could benefit Tesla’s AV aspirations while federal agencies may also take it easier on the company in terms of investigations.

Moreover, a potential scaling back of clean energy regulations (such as the abolishment of EV-related tax credits) may actually help Tesla.

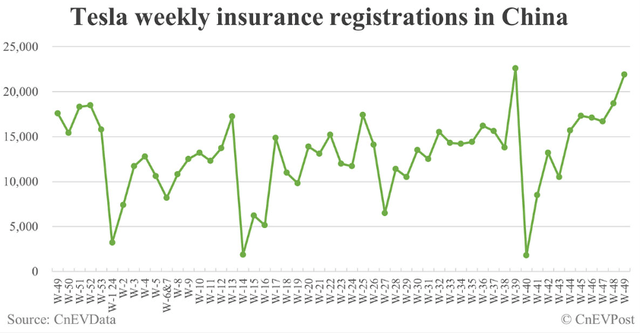

Momentum is also building in China, with Tesla seeing strong insurance registrations in the month of November.

Tesla Is The Ultimate Election Winner

Tesla’s stock crushed its previous high and is presently selling for $427.77 which gives the electric-vehicle company a $1.4 trillion market value. Clearly Tesla has been a big winner, alongside Donald Trump, in last month’s election and Elon Musk’s proximity to Trump could further propel Tesla’s market valuation higher in the months and even years ahead.

First of all, Tesla is making a strong push for its self-driving vehicles, the introduction of which the company postponed multiple times, to the chagrin of investors.

A Trump Administration is likely to take a very anti-regulation stance which could particularly help Tesla which is contending with Waymo for the crown in the self-driving car market. General Motors Company (GM), for example, just threw in the towel and shelved its Robotaxi project names Cruise.

Tesla could obviously profit, for instance, if federal regulation surrounding autonomous vehicles were to be reduced which in turn could accelerate the company’s time-line for its AVs and relief the cost burden on Tesla. A federal framework for EVs could also provide regulatory clarity for large-scale AV manufacturers like Tesla and create a clear path for the company’s autonomous vehicle introduction in 2026.

Tesla is currently being investigated by the National Highway Traffic Safety Administration for its full self-driving system, which might be linked to some accidents in the recent past.

A close working relationship between Elon Musk and Trump as well as a general deregulation drive of the new Administration could unshackle Tesla and remove any unnecessary regulatory costs.

Moreover, the abolishment of EV tax credits, which has been discussed by Republicans, would likely help Tesla as the only major EV-focused automaker. Republicans, which are going to take over the government next year, have said that they will reduce incentives to buy electric-vehicles which is likely going to benefit the biggest EV maker in the U.S.

Tesla is the only manufacturer producing EVs at real scale, and no U.S. company has as profitable EV product lineup as Tesla. Thus, the abolishment of EV tax credits might hit legacy automakers much harder than Tesla as they don’t have Tesla’s economies of scale and, relatively speaking, still very small production volumes.

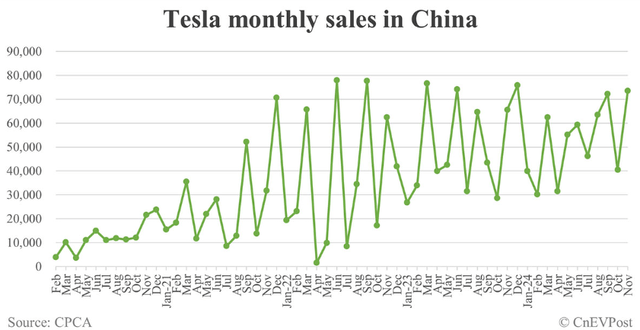

Tesla’s Insurance Registrations In China Are Surging, Indicating Accelerating Delivery Momentum

Tesla’s management forecast 20-30% delivery growth in 2025 and China is going to be an important market that could contribute a good chunk of growth for the electric-vehicle company.

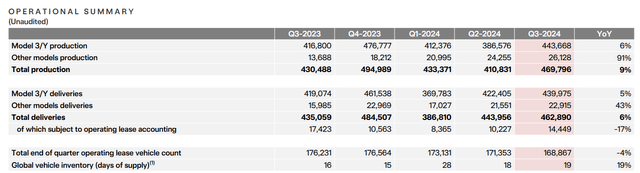

In the third quarter, Tesla produced 469,796 electric vehicles, mostly Model 3/Y, and delivered 462,890 vehicles to customers. Tesla’s total delivery volume thus increased 6.4% YoY and more momentum may await investors in the fourth quarter.

Operational Summary (Tesla Inc.)

The reason for this is that Tesla insurance registrations in China are surging: in the last week, Tesla had 21,900 insurance registrations, its second-highest number in 2024, and the trend is positive for all major electric-vehicle manufacturers, according to CnEVData which compiles Chinese insurance data.

Weekly Insurance Registrations In China (CnEVData)

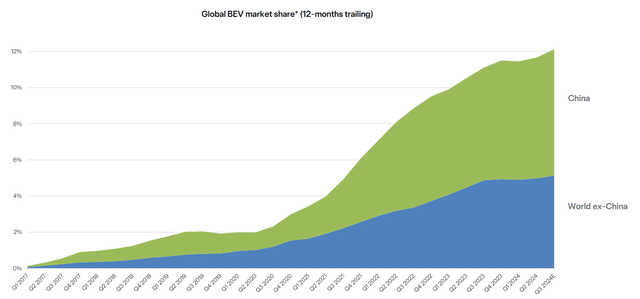

China is by far the biggest market for EV producers and Tesla has had considerable success in this particular market, despite fierce competition from companies like BYD.

As a matter of fact, Tesla has seen exceptional market share and delivery growth in the last couple of years, despite the emergence of an entirely new slate of EV startup companies.

Global BEV Market Share (Tesla Inc.)

In the month of November, according to data from the China Passenger Car Association, Tesla sold 78,856 vehicles in China in November, up 12% YoY. I think it is entirely possibly for the automaker to see a substantial sales acceleration in 2025 if the present momentum in sales, deliveries and car registrations spills over into the new year which I consider likely when taking into account that Beijing has launched substantial fiscal and monetary stimulus plans in order to promote economic growth.

Tesla is still leading U.S. auto manufacturers in terms of gross margins, which is another area for which I expect a positive trend in 2025, particularly with sales ramping up and positive delivery trends in China. In the third quarter, Tesla worked itself to a gross margin of 19.8%, reflecting a margin increase of almost 2 percentage points QoQ.

If Tesla sees stronger delivery growth in 2025, as the company has forecasted, and maintains gross margins of 20% or higher, I think that Tesla’s stock has the fundamental backing to keep soaring in 2025 as well.

Tesla Is Expensive, May Have A Lot More Upside Anyhow

Tesla is growing its sales and has forecast that it could grow its deliveries between 20-30% next year, which would be a substantial accomplishment for a company with nearly $100 billion in anticipated sales. Tesla has struggled, particularly in 2023, due to intensifying competition in China, and growing price pressure in the electric-vehicle market.

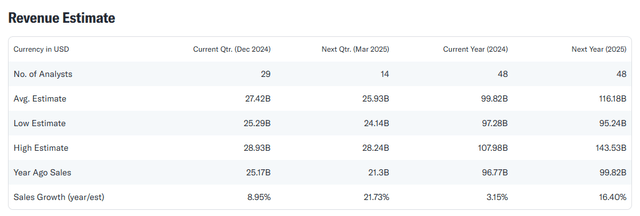

With Tesla’s stock reaching as high as $427.77 on Wednesday, the stock clearly is no bargain. Presently, based on a consensus sales estimates of $100 billion in 2024, the stock is selling at a whopping 14x sales.

Tesla is profitable and set for a boost of growth in 2024, however, which are two reasons I would cite in addition to the electric-vehicle company potentially benefiting from a more favorable regulatory landscape under a Trump Administration.

Rivian Automotive (RIVN), which anticipates to deliver about 50K electric-vehicles this year and which lowered its production guidance recently, is selling at a leading sales multiple of 3.1X and is thus considerably more affordable.

Nonetheless, as a market leader with substantial volume and growth potential, favorable regulatory tailwinds and momentum in China, I think Tesla’s valuation has room to expand.

Revenue Estimate (Yahoo Finance)

Why Tesla Remains A Risky Investment

Soaring stock prices attract speculators and risk-takers, which means that one of the biggest headwinds for Tesla actually could be profit-taking itself.

Tesla’s stock has skyrocketed 69% since November 5, 2024, so a lot of investors are sitting on a good amount of unrealized gains. Any correction could trigger a substantial consolidation for Tesla and expose investors to the risk of a contracting multiple.

Tesla’s autonomous vehicle project, known as FSD, has repeatedly disappointed and fell short of expectations, meaning it could potentially take years before Tesla actually debuts a market-viable autonomous driving solution.

Should Tesla fall back behind Waymo in terms of self-driving tech development, the EV company may lose the race to capture a big portion of the autonomous market.

My Conclusion

Tesla and Elon Musk have been the real winners of the 2024 presidential election, with Tesla adding more than half a trillion in market value.

Tesla’s stock reached an all-time high on Wednesday, and the momentum is presently clearly in favor of the electric-vehicle company.

The EV manufacturer is also poised to benefit from a closer relationship between its Chief Executive Officer and the incoming U.S. president, which could help lower pressure coming from federal agencies that are investigating Tesla.

Deregulation drives and strong growth momentum in China are two other reasons to remain hopeful that Tesla’s rally has fundamental support in 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.