Summary:

- AbbVie offers a compelling investment opportunity after a recent price drop, combining dividend income, value, and growth potential driven by a strong drug portfolio and pipeline.

- Robust growth in immunology with Skyrizi and Rinvoq, resilience in oncology and aesthetics, and expanded Botox indications support long-term prospects.

- A solid balance sheet, manageable debt, and a 3.8% yield with consistent dividend growth make AbbVie attractive for diversified pharmaceutical exposure.

Guido Mieth

It’s been quite some time since I covered AbbVie (NYSE:ABBV) in my last article, back in October 2020, highlighting its undervaluation despite robust top and bottom-line growth. I’ve largely watched the stock from the sidelines as it’s gone on to produce a stellar 142% total return for shareholders, far surpassing the 76% rise in the S&P 500 (SPY) over the same timeframe.

As such, it appears that my previous investment thesis was validated as the market was overly bearish around the loss of exclusivity around Humira while ABBV executed well on new drug development and on its acquisition of Allergan, which brought among other drugs, the household name brand, Botox.

Over the past month and a half, ABBV has fallen in price from a high of $207 to $173 at present, resulting in what appears to be a solid entry point for the stock. In this article, I revisit ABBV including recent business results, and discuss why the recent pullback in price presents another appealing investment opportunity for the stock for dividend income, value, and growth, so let’s get started!

Why ABBV?

AbbVie is a leading global biopharmaceutical company specializing in innovative medicines that address unmet needs across multiple therapeutic areas. Since its spin-off from Abbott Laboratories (ABT) in 2013, AbbVie has become a diversified pharmaceutical powerhouse. This is supported by drugs in key therapeutic areas including immunology, oncology, neuroscience, and aesthetics.

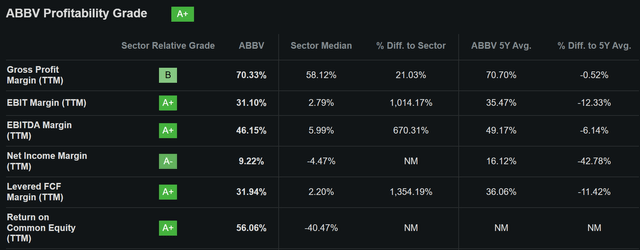

ABBV’s innovation pipeline and leading portfolio that includes blockbuster drugs Skyrizi, Rinvoq, Botox, and Vraylar contribute to strong margins. ABBV scores an A+ for Profitability, with sector-leading EBITDA and FCF margins of 46% and 32%, respectively. In addition, due to material share buybacks, ABBV carries a very high 56% return on equity, as shown below.

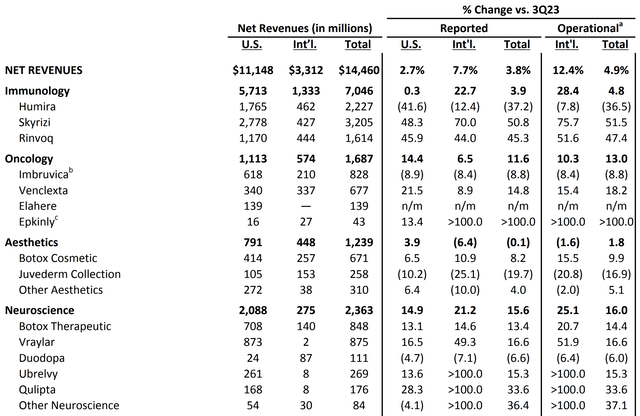

Meanwhile, ABBV continues to demonstrate respectable growth in its Q3 2024 financial results, with total revenue rising by 4.9% YoY on an FX-neutral basis. Excluding Humira, sales surged by 18% driven by immunology drugs Skyrizi and Rinvoq, which are largely seen as replacement candidates for Humira. As we can see below, Skyrizi and Rinvoq achieved FX-neutral sales growth of 52% and 47% YoY respectively to hit a combined $4.8 billion in total sales during Q3, which is more than double Humira’s sales of $2.2 billion.

Beyond Immunology, ABBV’s other therapeutic areas showed resilience with Venclexta (oncology) showing 18% YoY revenue growth to $677 million while Imbruvica (also for oncology) held up well amidst competitive pressures with just a 9% YoY revenue decline, coming in at $828 million in sales.

Moreover, the Neuroscience portfolio grew sales by 16% over the prior year period, and Botox Cosmetic saw continued growth due to limited competition with 10% YoY revenue growth. Botox Therapeutic saw a robust 14% revenue growth and when combined with Botox Cosmetic, it would be the #4 best-selling drug for ABBV, sitting behind only Rinvoq.

Management recently raised its full-year revenue guidance by $500 million to $56 billion, driven by outperformance in its immunology and oncology franchises so far this year. Also encouraging, adjusted EPS guidance was raised to a midpoint of $10.90 to $10.94. ABBV’s forward outlook is driven by continued leadership in immunology from Skyrizi and Rinvoq with expansion into new therapeutic areas such as ulcerative colitis, furthering their growth trajectories.

Botox is expected to remain a vital part of ABBV’s forward outlook with expanded indications, and ABBV has a robust pipeline with pivotal readouts expected for emraclidine in schizophrenia and novel neuroscience therapies such as tavapadon for Parkinson’s diseases. ABBV’s neuroscience capabilities are bolstered by its recent acquisition of Aliada, which adds a potential best-in-class Alzheimer’s treatment to its pipeline, and by the acquisition of Cerevel Therapeutics, which enhances AbbVie’s neuroscience capabilities, as noted during the recent earnings call:

During the quarter, we successfully completed the acquisition of Cerevel Therapeutics, strengthening our neuroscience pipeline. Cerevel enhances our ability to help patients suffering from devastating conditions such as Parkinson’s and schizophrenia. The integration has been seamless and we are excited to have the talented Cerevel team join our organization. Within the Cerevel pipeline, we are very pleased with the positive Phase 3 results and emerging profile of tavapadon in Parkinson’s. And, we remain on track to read out both pivotal studies for emraclidine in schizophrenia in the fourth quarter.

ABBV carries a strong balance sheet with an A- credit rating and stable outlook from S&P. This is supported by $7.3 billion in cash and equivalents on hand and a reasonably safe 2.5x net debt to TTM EBITDA ratio, sitting below the 3.0x level generally considered safe.

It’s worth noting that the aforementioned leverage ratio is higher than 1.8x from the end of 2023, and that’s due to elevated debt that was used to pay for this year’s acquisitions. Management expects to pay down roughly $7 billion worth of debt maturities this year and achieve a net debt-to-EBITDA ratio of 2x by the end of 2026.

Importantly for income investors, ABBV currently yields a respectable 3.8%. The dividend is well-protected by a 58% payout ratio and comes with 11 years of consecutive growth, including a recent 5.8% raise to a quarterly rate of $1.64 for the Q1 2025 dividend payout.

Lastly, I find ABBV to be appealing after the recent drop to $173 with a forward PE of 15.9. While ABBV isn’t considered cheap, I believe it’s attractively valued relative to its growth prospects, with analysts estimating 10% to 12% annual EPS growth over the next 3 years. I believe these are reasonable estimates considering ABBV’s promising pipeline and stable of growing blockbuster drugs with strong brand recognition.

Risks to the thesis include the potential for increased competition in the neuroscience space, as competitors like Bristol Myers Squibb (BMY) are developing drugs of their own to treat schizophrenia and Alzheimer’s disease. Moreover, recent acquisitions by ABBV include execution risks, as they relate to new drug development, which are subject to FDA approval processes. Also, ABBV’s commitment to pay down debt over the next 2 years means that dividend raises could remain in the mid-single-digit range in the near term.

Investor Takeaway

AbbVie presents an appealing investment opportunity following its recent price pullback, offering a solid blend of dividend income, value, and growth potential. The company continues to execute well, with strong growth in its immunology portfolio driven by blockbuster drugs Skyrizi and Rinvoq, alongside resilience in oncology and aesthetics. ABBV’s robust innovation pipeline, including promising neuroscience therapies and expanded indications for Botox, supports long-term growth prospects.

While near-term risks include competition and execution challenges with recent acquisitions, ABBV’s solid balance sheet, manageable debt, and attractive 3.8% yield with consistent dividend growth make it an appealing choice for investors seeking exposure to a diversified pharmaceutical leader with proven operational strength and a promising future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Read The Full Report on iREIT+HOYA

iREIT+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.