Summary:

- Broadcom’s stock surged 24% despite a slight revenue miss, driven by investor excitement over a massive AI growth opportunity in custom AI accelerators (XPUs).

- Management projects AI revenue SAM among three hyperscalers could reach $60-$90 billion by FY2027, significantly boosting AVGO’s AI growth trajectory.

- AI revenue remains strong in 1Q FY2025, even though total revenue guidance is slightly below consensus. However, margins are expected to see significant expansion.

- Assuming a constant market share and the midpoint of its AI revenue SAM, AVGO is projected to achieve 50% AI revenue growth from FY2025 to FY2027.

- Assuming a 55% AI revenue mix in FY2027, up from 25% in Q4 FY2024, I estimate AVGO’s FY2027 EV/sales at 12.1x, which is 28% above its current 5-year average.

Sundry Photography

Why Did the Stock Rally 24%

Broadcom’s (NASDAQ:AVGO) stock popped 24% despite a slight miss on 4Q FY2024 revenue, as investors looked beyond its near-term revenue outlook and focused on a massive AI growth opportunity in custom AI accelerators, known as XPUs. While the rally might seem a little speculative, I mean who doesn’t get excited given management’s projection that its AI revenue serviceable addressable market (SAM) among three major hyperscalers could reach $60 billion to $90 billion in FY2027, compared to AVGO’s AI-related revenue of $12.2 billion in FY2024. The three major hyperscalers likely include Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL). With these hyperscalers planning multi-generational AI XPU roadmaps over the next three years, AVGO’s AI growth trajectory is likely to gain significant momentum.

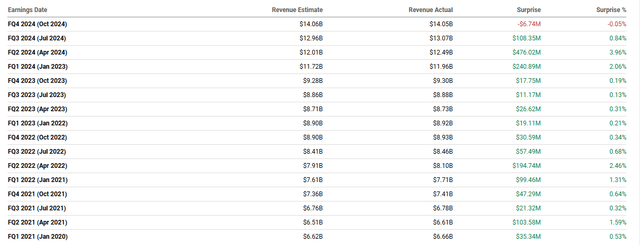

In 3Q FY2024, AVGO dropped 10% after issuing a gloomy revenue guidance for 4Q, below the previous market consensus of $14.04 billion. The company’s actual 4Q revenue came in at $14.05 billion, slightly below the current estimates. As shown in the table above, this marked AVGO’s first negative revenue surprise since FY2021. Its 1Q FY2025 revenue outlook also indicates a growth normalization, growing 22.1% YoY compared to 34.2% YoY in 1Q FY2024. Additionally, the guided $14.60 billion of 1Q revenue outlook is also slightly below the consensus of $14.63 billion according to Seeking Alpha.

In my previous analysis, I maintained a hold rating on AVGO due to my concerns about its revenue growth potential. Now the management implies a significantly higher growth trajectory driven by new AI chips opportunity. In the current AI-focused equity market, investors are positioning years ahead of an actual growth inflection point. However, I believe a 24% rally is overdone as its AI SAM is not exactly equal to its revenue outlook. Therefore, I maintain my hold rating on the stock, and I’ll explain why.

Strong AI Revenue Growth in 4Q FY2024

The company model

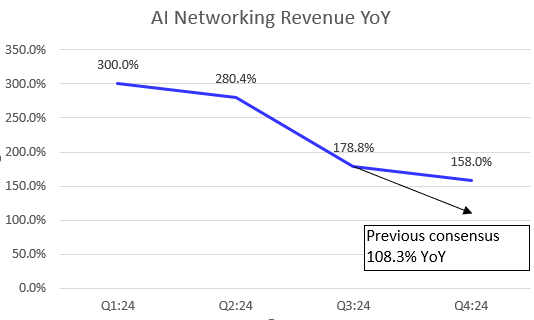

Despite muted total revenue in 4Q FY2024, AVGO demonstrated a QoQ acceleration in revenue growth to 51.2% YoY, up from 47.3% YoY in 3Q. Particularly, its AI revenue significantly exceeded market expectations. Management had previously raised the AI revenue outlook by $1 billion to $12 billion in Q3, implying approximately 108.3% YoY growth in Q4.

The company reported that AI networking revenue grew 158% YoY in 4Q, far surpassing the projected growth rate shown in the chart. Additionally, AI networking revenue as a percentage of AVGO’s total revenue increased to 25.1%, up from 18.1% on a YoY basis. During the 4Q FY2024 earnings call, CEO Hock Tan attributed the strong AI revenue result to a 100% increase in AI XPU shipments to their three major hyperscale customers and a 400% growth in AI connectivity revenue.

AI Momentum Extending into 1Q FY2025

AVGO expects strong AI revenue growth in 1Q FY2025, offset by a sequential decline in non-AI revenue, including seasonal weakness in wireless revenue. While the 1Q total revenue guidance is slightly below consensus, the company is on track to begin volume shipments of 3nm XPUs in 2H FY2025. Its AI revenue is expected to normalize, growing 65% YoY, down from 158% YoY in 4Q FY2024.

It’s encouraging to see that the company forecasts a 100-bps increase in non-GAAP gross margins in 1Q, potentially lifting its non-GAAP EBITDA margin to a record high of 66%. Strong margin expansion would help drive the bottom line, contributing to sequential growth acceleration in non-GAAP EPS in 1Q.

AI Revenue Growth Outlook: Over 50% CAGR from FY2025 to FY2027

During the earnings call, the management announced partnerships with two additional hyperscalers that are developing their own AI XPUs, which could boost its SAM going forward. An analyst Vijay Rakesh mentioned a $17.5 billion SAM for AVGO’s AI custom silicon opportunity, implying nearly 70% market share based on $12.2 billion in AI revenue for FY2024. For modeling purposes, assuming a constant market share over the next three years, the midpoint of a $65 billion SAM among these three hyperscalers suggests that AVGO could capture around $45.5 billion in AI revenue by FY2027. This implied a 55% CAGR of AI revenue for AVGO, which is significantly above the previous consensus.

Is the FY2027 Revenue Outlook Reflected in the Valuation?

Now, let’s analyze whether this growth opportunity is priced into the rally. AVGO is currently trading at an expensive EV/sales fwd of 18.1x (91% above its 5-year average), and the recent 24% rally has pushed the company’s enterprise value (EV) to $1 trillion.

Assuming AI revenue as a percentage of total revenue increases by 10% annually (up from 25.1% in Q4 FY2024), and as management expects AI to outpace its non-AI segment (with a faster 10% increase compared to the 7% annual increase in 4Q FY2024), I estimate AVGO’s AI revenue mix will reach 55.1% by FY2027. Based on the projected $45.5 billion of AI revenue in FY2027, we can approximately estimate that AVGO’s total revenue to be $82.6 billion. The EV/sales FY2027 multiple is expected to decrease to 12.1x, which is 28% above its 5-year average.

Assuming a more bullish scenario where AVGO gains 10% more market share, bringing its share to 80% by the end of FY2027, with all else remaining constant, this would imply total revenue of $94.4 billion in FY2027. In this case, its EV/sales FY2027 would decrease to 10.6x, still 12.2% higher than its 5-year average. However, I believe AVGO should be trading at a higher multiple to reflect its above-trend growth outlook driven by GenAI growth opportunities. In addition, its non-GAAP P/E fwd is 36x, which is higher than the Nasdaq 100 index of 28x. Therefore, I think the stock’s risks and rewards don’t justify buying at this level.

Conclusion

I’m not surprised to see a strong rally in the current sentiment-driven market, fueled by the strong AI SAM outlook. However, SAM does not equal revenue. AVGO must capture the SAM of the three hyperscalers by maintaining its current market share. While I believe AVGO is well-positioned to significantly accelerate its AI growth momentum, I prefer to stay on the sidelines for now. With AVGO trading at an EV/sales TTM of 21.5x and the recent 24% rally pushing its EV to $1 trillion, the stock may already be pricing in much of this potential. My calculations suggest that even with a 50% CAGR in AI revenue growth, its FY2027 multiples still trade at a premium. As such, buying at this level is premature, and I maintain a hold rating on AVGO.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.