Summary:

- Energy Transfer is a potentially low-risk investment with a 2-5 year price target of $25/share, offering an estimated 12% annual return potential and a 7% dividend yield.

- The company boasts a strong financial position with $8 billion in DCF and $15.4 billion in adjusted EBITDA, prioritizing unit buybacks and dividends.

- Energy Transfer’s extensive asset footprint includes 130k+ miles of pipelines and significant natural gas and crude oil capacities, supporting future growth and new deals.

- Despite concerns over debt from acquisitions, Energy Transfer’s robust cash flow and bolt-on projects make it a valuable long-term investment.

sankai

Energy Transfer (NYSE:ET) is a large midstream company, with a market cap of just over $65 billion. The company has an almost 7% dividend yield and numerous bolt-on acquisitions from its assets, which will enable the company to continue its strong growth. That makes the company a valuable additional to any portfolio despite its recent strength.

Energy Transfer Developments

Enbridge has continued to perform well, with the company releasing its latest investor update just under 2 weeks ago.

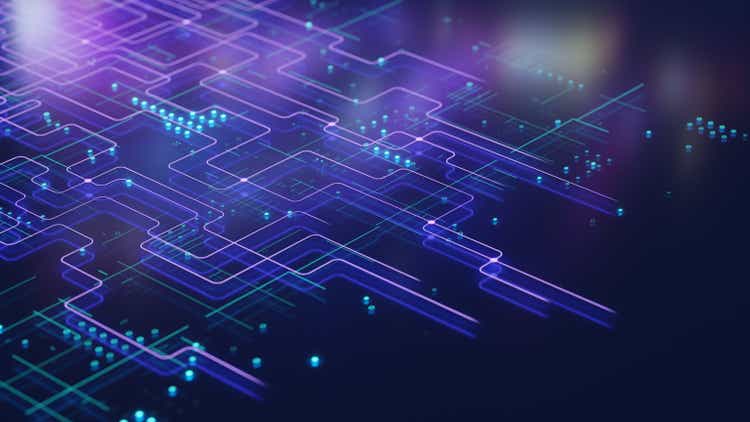

Energy Transfer Investor Presentation

The company earned almost $1.2 billion in net income, with volumes continuing to grow and set records. The company’s adjusted EBITDA was almost $4 billion. The company’s adjusted EBITDA guidance at the midpoint is $15.4 billion ($3.85 billion / quarter), up 12% YoY, and the company is lining itself well for 2025.

The company is continuing to generate almost $8 billion in DCF, with almost $1.1 billion in total capital expenditures, while funding a strong dividend. We expect the company to continue investing in its business and its future growth.

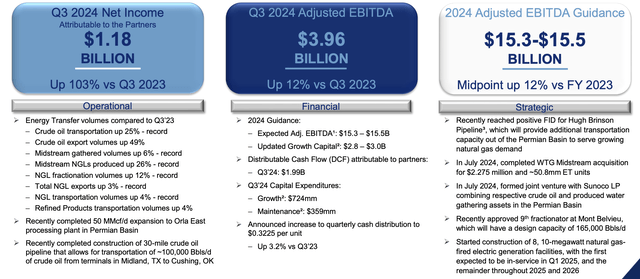

Energy Transfer Investor Presentation

The company has a strong debt rating and expects to prioritize unit buybacks over debt pay down once it hits its leverage target. Given its 6.5% dividend yield, the financial benefit of that is very prudent, and we would like to see the company accelerate share repurchases as much as it can. Its primarily fee-based contracts will enable reliable and predictable cash flow.

The company’s overall financial picture is quite strong.

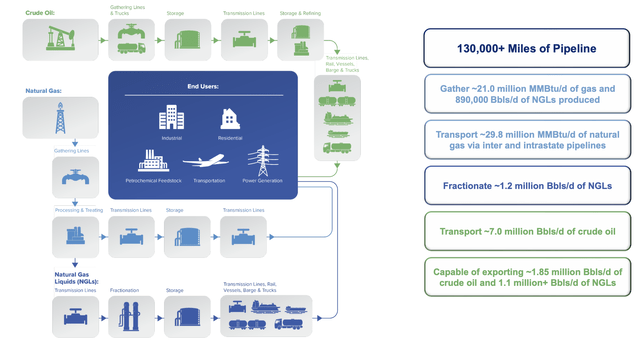

Energy Transfer Footprint

Overall, the company has an incredibly strong footprint of assets.

Energy Transfer Investor Presentation

It touches almost every point of the midstream market with 130+k miles of pipelines. The company gathers a massive 21 million MMBtu/d of natural gas and almost 900k barrels / day of NGLs throughout its portfolio. The company transfers this through a variety of pipelines, and it also has more than ~1 million Bbls/day of NGLs.

The company also moves a massive ~7 million Bbl/d of crude oil, and it’s capable of exporting more than 1 million Bbl/d of NGLs and crude oil.

Energy Transfer Investor Presentation

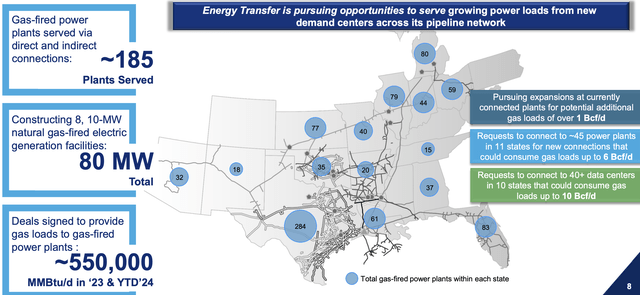

Given the expected massive natural gas demand growth from datacenters and power generation, as markets shift away from coal, the company is continuing to pursue opportunities. The company serves ~185 plants with 80 MW natural gas-fired electric generation facilities. The company has continued to sign new deals to provide natural gas.

The company is seeing requests to connect to numerous data centers and power plants, which could consume gas loads of 16 Bcf / d. Versus the company’s existing portfolio, that’s a massive potential expansion portfolio for the company.

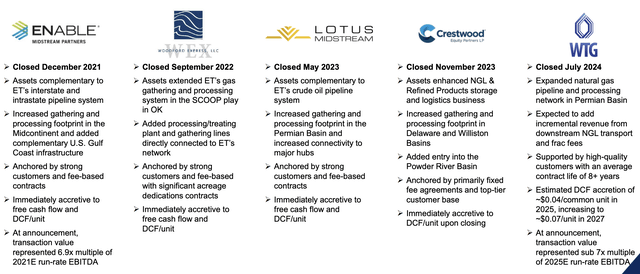

Energy Transfer Consolidation

Energy Transfer is unique in the midstream markets in that the company has continued investing in large acquisitions.

Energy Transfer Investor Presentation

The company closed 2 transactions in 2023 totaling almost $9 billion. The company closed another transaction in mid-2024 totaling more than $3 billion for WTG midstream. These transactions have been accretive to the company’s portfolio, and it’s continued to gain access to assets that fit well with its existing portfolio.

However, the continued nature of these acquisitions means that the company is regularly expanding its debt load. That could put it at risk, or put its dividend at risk, if a major long-term decline hurts the value of its assets.

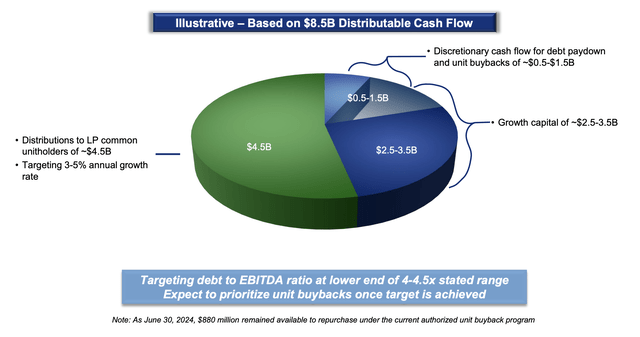

Energy Transfer Capital Allocation

Still, at the end of the day, the company earns a massive amount of DCF, roughly $8.5 billion, that it continues to provide to shareholders.

Energy Transfer Investor Presentation

The company will earn ~$8.5 billion of DCF in 2025, and spend roughly $3 billion in growth capital versus $2.9 billion estimated in 2024. The company plans to spend ~$4.5 billion on dividends, its largest expense and an almost 7% yield, and it continues to target a 4% annual growth rate. That’s a strong yield that’s continuing to grow above inflation rates.

The company will then have roughly $1 billion in discretionary cash flow that it can use for debt pay down or unit buybacks. We’d like to see it buyback stock to save on dividend expenditures, but whatever the company does, we expect it to be quite profitable for the company. The company’s roughly 13% DCF yield will be the core that enables strong returns.

Energy Transfer Investor Presentation

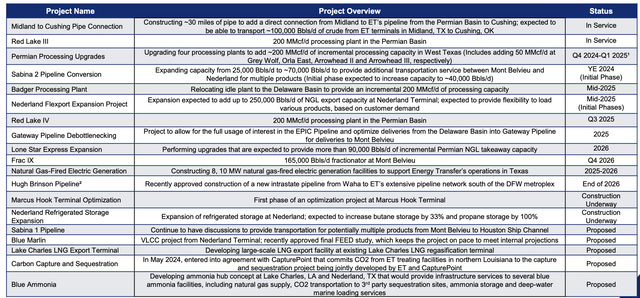

The company’s size also enables it to have numerous bolt-on projects that can incrementally add capacity to its existing asset portfolio. For example, the company’s Lone star Express Expansion provides 90k barrels / day of incremental NGL takeaway capacity on existing assets. Frac 9 provides 165 barrel / day of fractionator capacity at the company’s existing massive site, Mont Belvieu.

The company’s massive existing asset portfolio gives it the opportunity to continue growing and adding on bolt-ons.

Thesis Risk

The largest risk to our thesis is Energy Transfer’s growing valuation. The company has a $65 billion market cap and an enterprise value past $100 billion. The company has dropped to a low double-digit yield on market cap, which will potentially hurt its ability to continue providing its strong shareholder returns.

Conclusion

Energy Transfer has seen its share price and therefore its valuation both expand. However, the company has an impressive portfolio of assets, generating billions in fee-based cash flow. For 2025, the company can generate more than $8 billion in DCF, enabling it to continue chasing bolt-on growth opportunities, while providing shareholder returns.

The company’s commitment to continue its growth, sometimes using debt, can be concerning, but the company’s current financial position is quite strong. Given its dividend yields, we’d like to see the company utilize share buybacks, but overall, the company is a valuable long-term investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.