Summary:

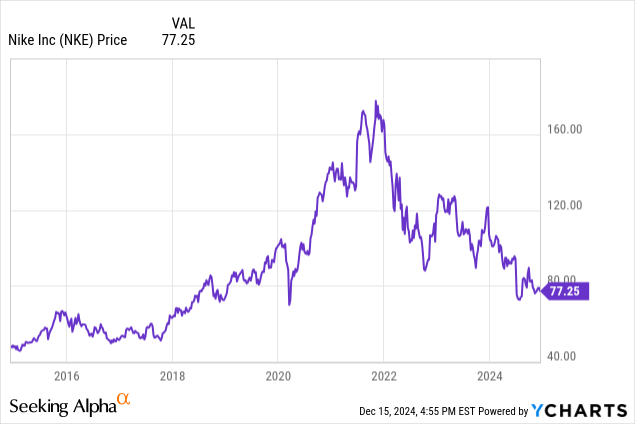

- Nike’s stock has declined significantly, trading below pre-Covid levels, making it a poor investment for many who saw it as a safe-haven.

- Recent data shows lackluster Black Friday sales for Nike, with Academy Sports reporting a 2% decrease in footwear sales, including Nike products.

- In this article, I explain why I believe Nike’s upcoming results could be worse than anticipated.

dnaveh/iStock Editorial via Getty Images

Earnings season is winding down while the holiday shopping season is reaching its peak. At the crossroads between these two seasons, we find Nike (NYSE:NKE), a stock we all remember as one of the pandemic winners now trading at less than half the share price of the late-2021 peak. Nike is actually trading below its pre-COVID levels and has turned into a detrimental investment for many who thought they had taken hold of a safe haven, a strong franchise, and a company with an endurable moat.

I myself have held Nike in the past. I bought it in December 2022, at a share price of around $100. It was an initial buy that I planned to increase. I thought I was buying a true compounder that would soon have seen a turnaround. I thought 2022 was a bad year for Nike more because of a pullforward effect seen in 2021, rather than structural issues. Well, as my research and understanding of the company deepened, I understood the stock was a real battleground for bulls and bears. Bears, in particular, pointed out how Nike was struggling to grow its sales because of poor sales in China and rising competition from nimbler rivals. So, even though Nike keeps being the most valuable brand in foot apparel and sportswear, I kept gathering data that made me more and more cautious about Nike’s prospects. In particular, in March 2024 I realized Nike would have faced at least two more years of slow growth. This was particularly enhanced by Nike’s strategy to bet mainly on direct sales that freed up the shelf space of many sporting goods retailers that was quickly filled by Nike’s rivals.

Once the company announced it would change its CEO, the stock popped and I seized the opportunity to exit my position at a price of around $87. I took a small hit, but I wasn’t confident anymore in the company’s operations and outlook. Moreover, Nike’s valuation continued to be rather optimistic for a company expected to have flat to negative sales for at least two more fiscal years.

This doesn’t mean I stopped watching and monitoring it. After all, many things have developed so unfavorably for Nike that the turnaround is almost inevitable. Bill Ackman thinks so, and we know he piled into Nike during Q3.

As we prepare for Nike’s Q2 FY25 earnings, there are a few things we should keep in mind.

Let’s start with some data that were recently released.

Adobe, Mastercard, and Salesforce released Black Friday shopping data and we know that in the footwear and apparel category, Hoka and On were top sellers while lackluster activity was seen for Nike.

Recently, we listened to Academy Sports and Outdoor’s (ASO) earnings call. Although we know the retailer is facing some struggles concerning growth, what its management disclosed about Nike can be useful to our purpose of forecasting what Nike’s earnings report may look like. In fact, we heard Academy state that: “Footwear was our second best performing category, down 2%, driven by strength in key brands, such as Nike, Brooks, Sketchers, and Crocs”. So, even though this was a good result for Academy, we are still talking about a 2% decrease in sales and this doesn’t bode well for Nike.

On the other hand, it seems Nike is reversing its sales strategy and returning to occupying shelf space. In fact, in Q1 2025, Academy will have a big launch of an expanded offering of Nike’s product line in more than 140 stores.

After all, Nike admitted in its last earnings call that “retail sales underperformed our plan, including our wholesale partners, with slightly elevating marketplace inventories requiring higher levels of promotional activity in Q1 to drive conversion”. To address this issue, Nike gave some information about what we should expect from actions aiming to rebalance the business away from depending too much on classic footwear franchises:

So we are actively rebalancing product allocations to our highest traffic channel in order to maximize franchise health and full-price realization.

In the near-term, this will have implications for certain dimensions of our business. Our men’s and women’s lifestyle business was planned down double-digits in Q1, and we expect these declines to continue through the year. The Jordan brand was planned down double-digits this quarter, and we expect Jordan to be down at the same rate for fiscal ’25. And we expect NIKE Digital to decline double-digits in fiscal ’25 versus the prior year. All taken together, these trends drove a mid-single digit headwind on Q1 revenue.

Now, I believe this take implies noteworthy consequences. First of all, Nike wants to diversify from footwear. Some investors may cheer, but this means Nike is not as confident as before about its franchise in this category, which has traditionally been viewed as Nike’s stronghold. Secondly, we should not expect Nike’s turnaround to be happening anytime soon. We have at least two to three quarters of slower sales and decreasing revenues while Nike rebalances its product portfolio and its sales channels.

After all, Nike’s Q2 guidance was clear: sales should be down 8% to 10% YoY, with gross margins down by 150 bps because of higher promotions and channel mix headwinds. Moreover, Nike didn’t provide FY guidance, meaning it is quite careful about how this fiscal year could turn out. In fact, Matthew Friends, Nike’s CFO, did admit that the company’s revenue expectations have moderated. Surely, if during this upcoming earnings call, which reports Nike’s first six months, we don’t hear anything about the full-year guidance, we should start worrying.

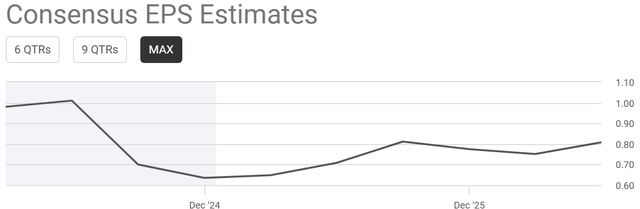

By looking at Nike’s consensus EPS estimates since last February, it is immediately evident that analysts have significantly revised their earnings estimates downward.

Seeking Alpha

But let’s start from the top line and see what Nike should be reporting in a few days.

First of all, a year ago Nike reported revenues of $13.4B. This was already a disappointing quarter because it reported a sales increase of just 0.5%. Well, this year we are expecting a 9% decrease so sales could come in around $12.2B.

A year ago, Nike reported a gross profit of $5.97B, a 44.6% gross profit margin. Nike said we should see a 150 bps deterioration, so we should expect Nike’s gross profit margin to be 43.1% or $5.25B.

Considering a 10% net income margin, Nike’s quarterly net income would be $1.34B. Divided by the 1.49B shares outstanding, we have an EPS estimate of $0.90. Now, given the data I have recalled coming from the ongoing shopping season, I believe Nike’s results will be worse than that. In particular, while I think Nike’s sales can be reasonably expected to be 10% lower YoY, I think a 150bps margin hit is too optimistic. The reason is simple: Nike is rebalancing its sales channel mix and its product mix, therefore we might see its sales mix as less favorable than anticipated in terms of margins. Moreover, I think Nike’s net income margin will also be below 10%.

So, this leads me to make a forecast that is below what we can infer from Nike’s guidance.

A 10% decrease in sales would have Nike report $12.05B in revenues and the gross profit margin I expect is more towards 42% than towards 43%. This means Nike’s gross profit should be $5.06B. With a net income margin of 8.5%, we would have the company’s net income to be around $1.03B. This makes me expect Nike’s EPS to be $0.69. The current consensus is $0.63 and this tells us how negatively Nike’s earnings are viewed.

Moreover, if Nike confirms what it has already disclosed about its FY25 and the hard path towards pushing sales up once again, we have many reasons to believe that at the end of its FY25 Nike’s EPS will be in the range between $2.65 and $2.80. This means the stock is trading at a fwd PE above 28.5 if we take the middle of the range as its expected earnings. No wonder, Seeking Alpha valuation grade is still a D-, suggesting the stock is still expensive.

Now, this is an expensive multiple for a stock that not only is seeing sluggish growth, but is also seeing a margin compression.

Of course, I am not saying Nike will go bankrupt. Its balance sheet is rock solid, with over $10.3B in cash and ST investments and an LT debt of $8B. It is also a highly profitable company that usually generates $2B in quarterly FCF. However part of Nike’s premium valuation comes from the pricing strength that it has usually shown. In the past quarter, because of its inventory clearing actions, Nike reported only $400M in operating cash and $120M in capex, meaning the company generated only $280M in FCF. If this trend goes on, Nike’s investors will have to expect very different FCF numbers from the past.

Moreover, Nike got investors used to gross margins above 44%. If the market starts thinking that Nike needs to further compress its margins to fight off competition, a rerating of the stock is probably due.

All in all, I would avoid buying the stock before earnings. I would also suggest dumping it before such a dangerous earnings call. As you know, I am no short-seller and I don’t short stocks. But I do sell them when they don’t meet my investing parameters anymore. Currently, though I love Nike’s products, I don’t see a favorable setup for the stock and I believe this earnings report will show a company that is still bleeding. Even in case you are thinking about a recovery play, as far as I see it there will be plenty of opportunity for at least a year to buy the stock at decent valuations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.