Summary:

- AT&T outperformed the S&P 500 in 2024, despite headwinds, and remains my top pick for 2025.

- AT&T’s stable earnings, improved free cash flow, and debt reduction support future dividend growth.

- The sale of DirecTV simplifies AT&T’s business, enhancing efficiency and profitability.

- Investors can boost income through selling put or covered call options, but should be aware of associated risks.

jetcityimage

Introduction

Telecom giant AT&T (NYSE:T) has surprised many investors by outperforming the S&P 500 handily in 2024. The company faced several headwinds including an unprecedented dividend cut before shares began rallying back. Back in September, I wrote my latest bullish article on AT&T where I gave investors ways to enhance their income. Today, I still think AT&T has room to run with the stock being my favorite pick for 2025.

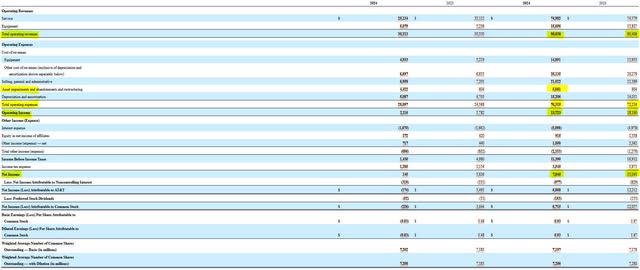

AT&T Earnings

On the surface, AT&T’s 2024 earnings aren’t that impressive. In the first nine months of 2024, AT&T’s revenue has been essentially flat compared to the same period a year ago at $90 billion. Operating expenses ticked up by $4 billion compared to a year ago, but that was entirely due to an asset impairment and restructuring charges of $5 billion that were completely noncash related.

Without the asset impairment charges, operating income would have been higher than where it was a year ago. The asset impairment charges were also the leading cause behind net income dropping from $13 billion last year to just under $7.8 billion in the first nine months of this year. AT&T’s earnings performance is stable once considering the asset impairment.

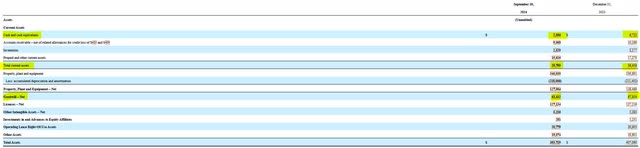

On the balance sheet side, assets dropped by $14 billion, with declines in goodwill and a more than $4 billion drop in cash. On the liability side of the balance sheet, AT&T made marked improvements in its debt situation, with short-term debt down by nearly $7 billion and long-term debt down by an additional $1 billion. Shareholder equity has decreased by more than $1 billion to $116 billion.

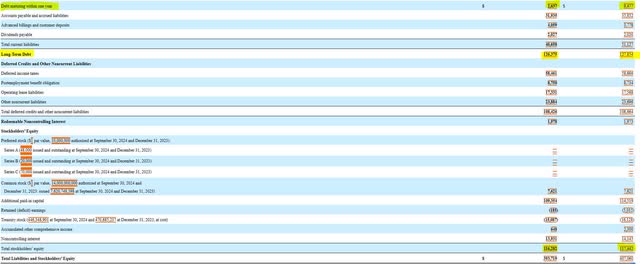

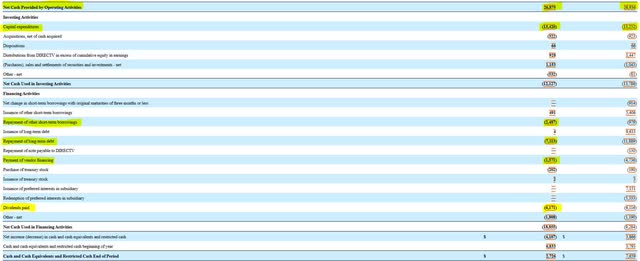

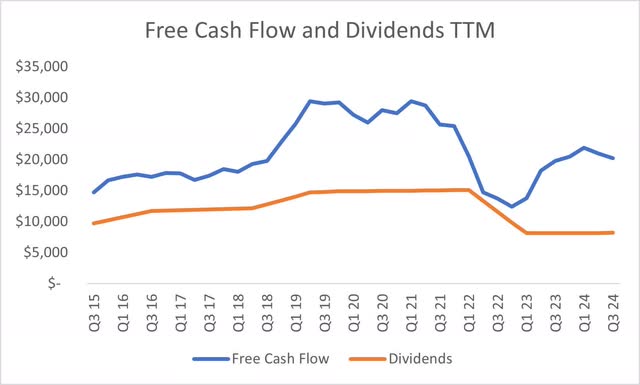

Cash Flow and Dividend Sustainability

AT&T’s ability to generate healthy cash flows is key to its ability to maintain (and possibly grow) its dividend. In the past, vendor payments have crowded out dividends after free cash flows were calculated. In the first nine months of 2024, free cash flow remained at $13 billion. This was sufficient to cover the $1.5 billion vendor financing payments and the $6.2 billion in dividend payments. Since the dividend cut in 2022, AT&T’s free cash flow has improved markedly from under $15 billion to around $20 billion on a trailing twelve-month basis. The growth in free cash flow certainly presents the case for future dividend growth.

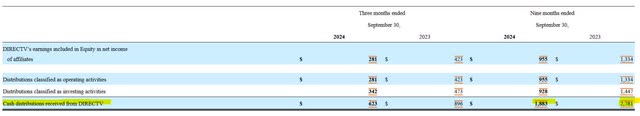

The Sale of DirecTV is Good for AT&T’s Future

In terms of the future, my optimism in AT&T’s future success lies in management’s commitment to focusing on the wireless and fiber portions of the business. In September, AT&T reached an agreement to sell its remaining 70% stake in DirecTV to TPG Capital for $7.6 billion. It is past time for AT&T to part ways with DirecTV, as the TV provider’s performance has been lagging. In the first nine months of 2024, AT&T received just under $1.9 billion in distributions from DirecTV, down from the nearly $2.8 billion received during the same period a year ago.

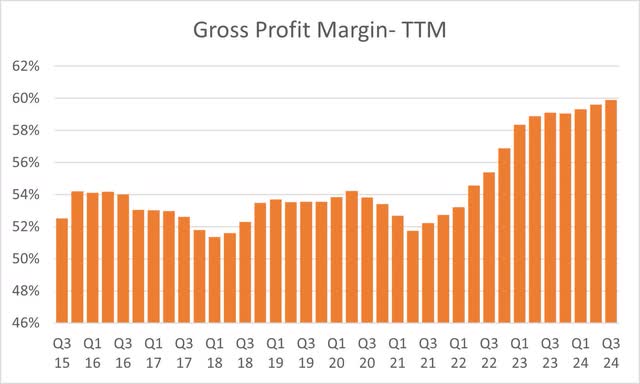

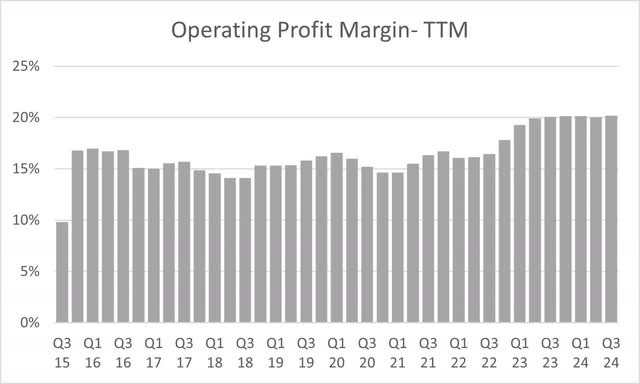

The sale of DirecTV will further simplify AT&T’s business and help it deliver on ever-improving efficiencies. Over the last few years, AT&T has achieved noticeable improvements in gross profit margin, going from under 52% in 2021 to nearly 60% in the third quarter. Operating profit margins have grown from under 15% in 2021 to 20% this year.

Barchart for Excel Barchart for Excel

Enhanced Income Through Options Trading

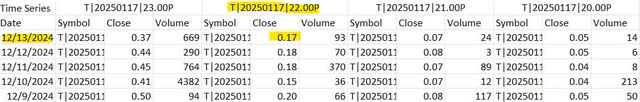

Holders of AT&T shares will receive income in the form of dividends, which is currently set at $1.11 per share per year, or a yield of 4.7%. Income investors can enhance their income through the sale of put options or the sale of call options. Investors can sell $22 strike puts that expire on January 17th for 17 cents per share. This strategy more than doubles the dividend income if this strategy is carried out over the year, but investors need to be mindful that they will need to buy 100 shares at $22 per share if they are assigned (which would happen if shares drop below $22).

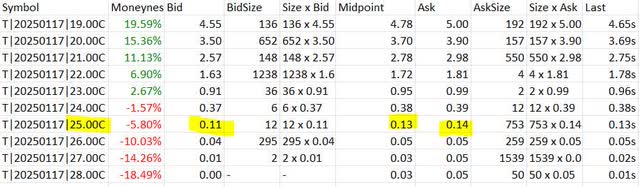

With respect to call options, investors can sell covered call options to generate additional income, but not as much as selling put options. Currently, $25 strike call options expiring on January 17th are selling for 11 cents per share, which would double the dividend income if covered over the year. Investors should be mindful that if share prices exceed the strike price of the options, they will be forced to surrender (sell) their shares when the options expire.

Risks to AT&T

AT&T is transitioning its traditional wireline service over to fiber. This transition requires the declines in the wireline to be moderated. Should the company see declines in wireline faster than it can build fiber, it will affect revenues and profitability. Additionally, AT&T is competing with T-Mobile and Verizon for customers in the wireless business. If AT&T were to lose market share, it would also negatively affect earnings.

Conclusion

AT&T’s turnaround rewarded shareholders in 2024. The telecom giant is poised to continue to deliver free cash flow that will cover dividends and reduce long-term debt, which in turn will help grow earnings. Investors can supplement their income by either selling put options or covered call options. With a simpler business model going forward, AT&T can further optimize its business and improve profitability, creating further returns for investors.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.