Summary:

- Unlike Cisco’s overvaluation during the dot-com bubble, Nvidia is fairly valued despite potential medium-term revenue contraction. Nvidia’s recovery prospects surpass Cisco’s historical performance.

- A negative margin of safety (-34%) and a forecasted total annual return of ~5% over five years make CSCO less appealing than short-term U.S. Treasuries, which yield ~5% risk-free.

- Despite operational strengths and a 2.7% dividend yield, geopolitical risks (e.g., Taiwan conflict) and moderate returns lead to a confident Hold rating for Cisco stock.

robas

Since my last Hold rating on Cisco (NASDAQ:CSCO) in January, the stock has gained 16.8% in price, compared to 22% for the S&P 500 (SPY). This is largely due to anticipative sentiment from the market for Cisco’s growth next year.

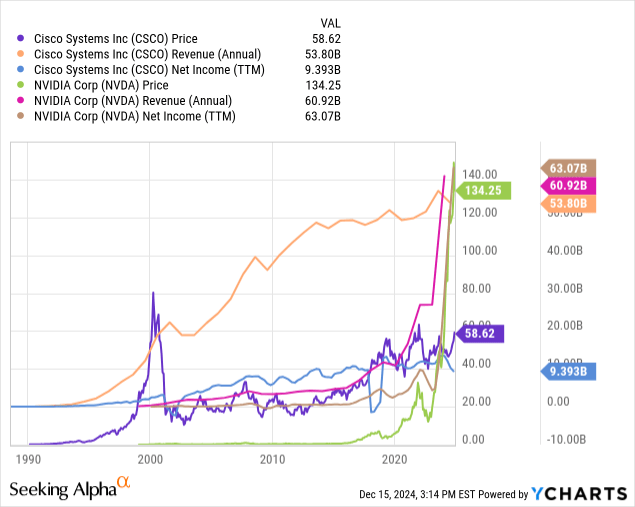

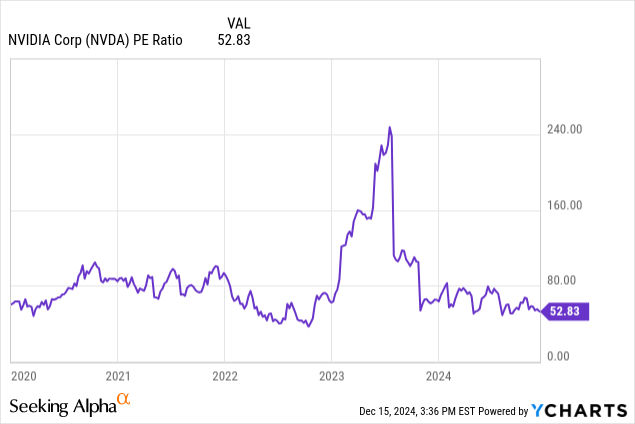

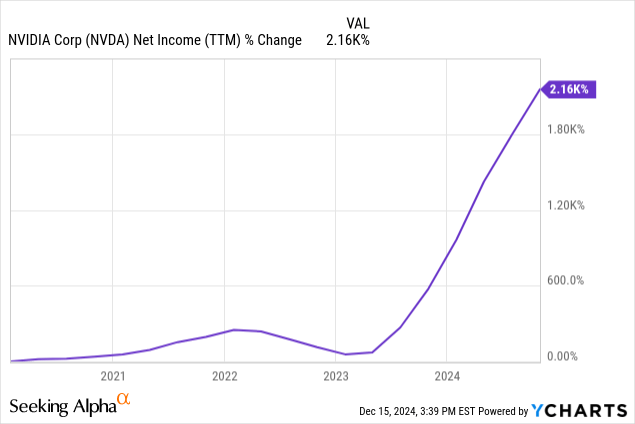

It’s tempting to compare Cisco to NVIDIA (NVDA) on the premise of rich valuation against revenue contraction, however my analysis shows that during the dot com bubble Cisco was grossly overvalued, while Nvidia is presently fairly valued, outlining a key difference in how their stock valuations will evolve, despite small similarities with an impending Nvidia valuation decline.

Looking directly as Cisco, although it has recovered quite well from the dot com crash, my valuation model shows a negative margin of safety of -34% and a likely total annual return of just over 5% over the next five years. Given the current macroeconomic and geopolitical uncertainties and that short-term U.S. Treasuries can essentially yield the equivalent with essentially no risk, my rating for Cisco stock is a confident Hold.

Cisco Vs. Nvidia Valuation Analysis

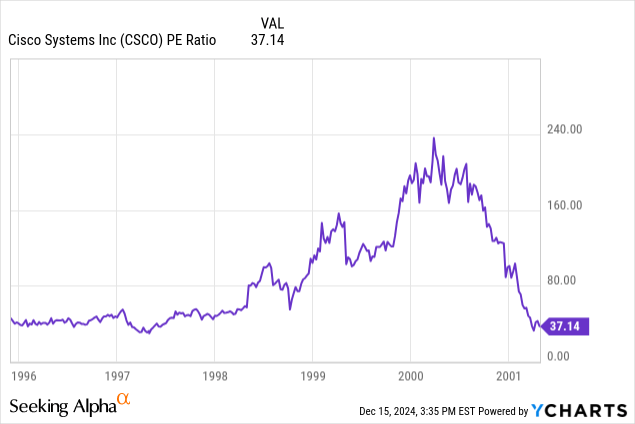

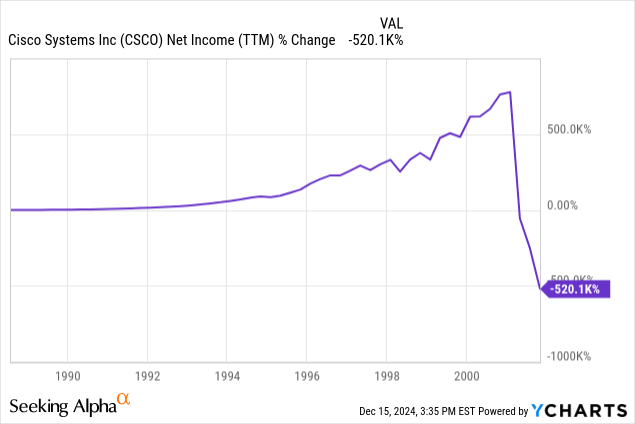

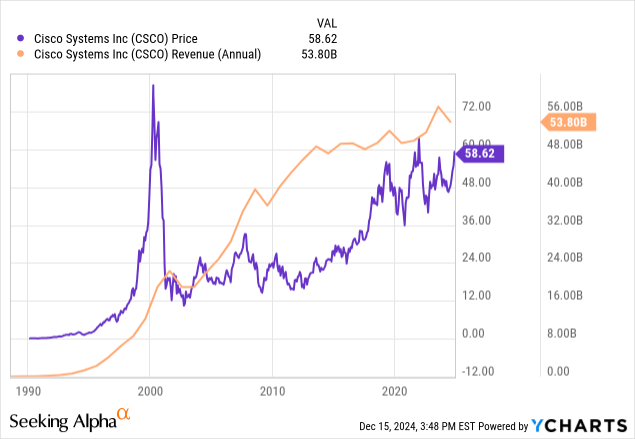

Cisco is an incredibly interesting case study of how the market can react to a company experiencing a momentary heavy revenue expansion, which then corrects, returning the stock valuation to normality a few years later. Indeed, the popular idea that Nvidia could end up mimicking Cisco’s crash in the early 2000s is potentially quite apt. Have a look at the following chart, and I will walk you through what I observe.

Cisco developed a very strong revenue growth in the 1990s related to the widespread adoption of its networking hardware as the internet became increasingly prominent. Yet, just a moderate revenue contraction saw its stock price crash. Even when the company regained previous highs in revenue and net income, the stock price failed to develop the same level of sentiment. Much of this could arguably be a result of broader irrational exuberance surrounding dot com companies at the time. We’re seeing similar irrational exuberance among some AI companies right now, like Palantir (PLTR), but Nvidia doesn’t seem to quite fit into the same category, and the overvaluations seen during the dot com bubble don’t generally apply to the broad AI market right now. Based on my analysis, Nvidia stock is fairly valued with the potential for a medium-term valuation decline, but one may expect a recovery that is stronger than Cisco’s once Nvidia’s revenue regains ground, potentially related to stronger inference of compute demand and emerging trends in robotics.

For clarity and brevity, the main difference between Cisco and Nvidia is that Cisco was heavily overvalued around the year 2000 based on speculative behavior, but Nvidia is currently fairly valued based on immense growth, with the potential for a justified valuation contraction in the next five to 10 years as market demand contracts (akin to normal semiconductor cycles).

The above charts clearly indicate Cisco’s gross overvaluation during the dot com boom, but show Nvidia is currently likely fairly valued. Therefore, I generally refute the popular observation of the similarity of Cisco and Nvidia. Albeit, the one similarity is a likely cyclical decline on the horizon when Nvidia posts a revenue contraction, but this is likely to be both less severe than Cisco’s drop, and potentially fully recoverable in five to 10 years based on new emerging chip trends related to inference and robotics, as well as continued expansion of AI factories related to new training needs at a lower intensity of demand.

Cisco Modern-Day Operations & Financials

Now to the main task at hand, ascertaining whether Cisco is still investable after its overvaluation, valuation collapse, and slow recovery over the past 20 years.

For those who may not have a deep knowledge of Cisco, here are the main points you should remember. It is a global technology company specializing in networking hardware, software, and high-tech services. Its revenue primarily comes from switches and routers, but it is also growing its presence in cybersecurity, collaboration tools, and data analytics. In Fiscal 2024, Cisco earned $53.8 billion, with over half coming from subscription-based services as it shifts towards recurring revenue models. To meet modern business needs, Cisco is expanding into software and AI-driven solutions.

Since its dot com era valuation collapse, the company has recovered well, albeit with slow revenue and price growth.

Over the past 10 years, the company has only returned about 120% in price. In the past five years, the company has only returned about 27.5% in price. Therefore, this is not the type of investment one will be buying for large returns. My sentiment is further supported by a dividend yield of 2.7%. Using just this rudimentary data, it becomes apparent that my rating is deservedly a Hold.

However, moderate returns do not necessarily mean a stock is not worth owning. Indeed, stability is a useful substitute for growth, especially in times of macroeconomic or geopolitical uncertainty. Unfortunately, given that I anticipate a total annual return of approximately 5% for Cisco over the next five years (which I will expand upon in my valuation analysis), I can’t see a valid reason to own the stock given that short-term U.S. Treasuries yield approximately 5% a year essentially risk-free, and Cisco is one company heavily prone to a valuation collapse in the event of a Chinese invasion or blockade of Taiwan.

Valuation

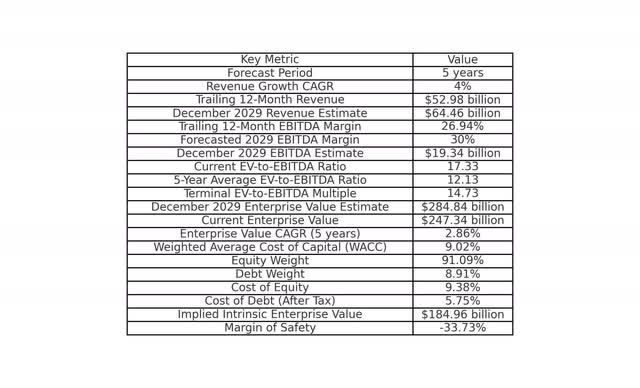

For my valuation model I will be using a period of five years because I do not see any significant reason that the stock will outperform in a time horizon longer than this, and given the geopolitical uncertainty at the moment, I prefer to keep estimate horizons shorter for purposes of forecasting agility.

Over the next five years, I estimate that Cisco will deliver a revenue growth CAGR of approximately 4%, which aligns with my style of conservative optimism. The company’s trailing 12-month revenue is $52.98 billion, leading to a December 2029 annual revenue estimate of $64.45 billion.

The company’s EBITDA margin has contracted recently—it is down from 30.8% as a five-year average to 26.94% as of the last trailing 12 months. This appears to be significantly impacted by the integration costs of Cisco’s acquisition of Splunk in March 2024. As I expect these pressures to ease in the next five years, I am forecasting an EBITDA margin of 30% by December 2029. The result is a December 2029 trailing 12-month EBITDA estimate of $19.34 billion.

I anticipate that Cisco will maintain a higher EV-to-EBITDA ratio than over the past five years due to stronger revenue growth compared to the past five years (five-year average trailing 12-month revenue growth of 1.8% compared to a 4% five-year future revenue CAGR in my model). The company’s current EV-to-EBITDA ratio is 17.33, but its five-year average is 12.13. I will be using the midpoint of these two figures, 14.73, for my terminal multiple. The result is a December 2029 enterprise value of $284.82 billion estimated for Cisco.

The company’s current enterprise value is $247.34 billion, indicating a 2.86% enterprise value CAGR over the next five years.

Cisco’s weighted average cost of capital is 9.02%, with an equity weight of 91.09% and a debt weight of 8.91%, with equity costing 9.38% and debt at 5.75% after tax. Discounting back my estimate for the company’s December 2029 enterprise value to the present day over five years renders an implied intrinsic enterprise value of $184.94 billion. Therefore, the margin of safety for investment, based on my model, is -33.73%.

Cisco Valuation (Author’s Model)

Conclusion: Hold

My thesis on Cisco shows two primary risks that are likely to deter prudent investors, namely a lack of security against present geopolitical uncertainties, and a negative -34% margin of safety for investment even in the case of no market crash. Although the company has certain operational strengths and the investment seems somewhat stable with a moderate dividend yield of 2.7% taking the likely total annual return over the next five years to just over 5%, short-term U.S. Treasuries can yield close to this with essentially no risk. Therefore, my rating for Cisco is a confident Hold.

Moreover, when comparing Cisco to Nvidia, the latter obviously has a more robust moat related to advanced AI infrastructure, but Nvidia is also much more fairly valued than Cisco was during the dot com bubble. As a result, I would not have been a buyer of Cisco in the year 2000, but I consider Nvidia a rational investment at this time given its fair valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.