Summary:

- The Walt Disney Company’s stock is comfortably above $100 due to strong Q4 2024 performance, but 2025 structural changes in streaming could disrupt this.

- “Moana II” succeeds without DEI virtue signaling; however, the 2025-2027 film slate is heavy on sequels, lacking new creative IP.

- Since the 2021 stock drop, Disney faced streaming losses, flop movies, and poor succession plans, questioning the aging IP and over-reliance on sequels.

- The failed succession plan for Robert Iger and the return of Iger highlight ongoing leadership challenges, with changes still uncertain.

hocus-focus

Above: Slimmed down, Disney remains a brand leader in streaming as it approaches a sustained profit in the years ahead without ESPN and AB.

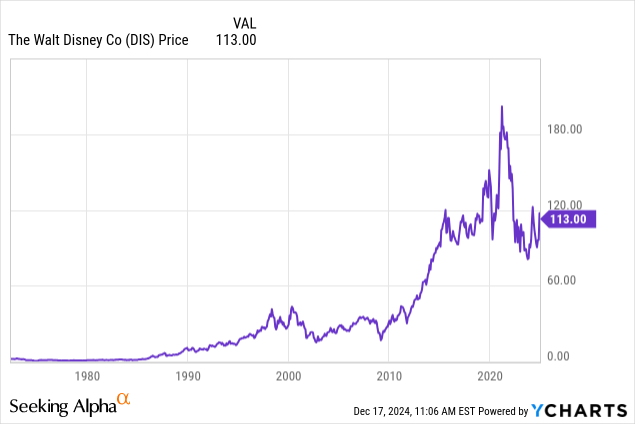

- The Walt Disney Company (NYSE:DIS) comfortably has risen above $100 ($112) based on strong 4Q24 performance in streaming and filmed entertainment. $100+ is low-hanging fruit, the true test will be in 2025 when possible structural changes in the streaming sector disrupt with sharper price deals.

- Moana 2 embraces the best of DIS tight-focus films without a DEI virtue signal.

- 2025 to 2027 film slate overloaded with sequels—understood, but still tests lack creative new IP tent poles.

Since the swoon in Walt Disney Co. stock from its lofty perch at $201 in March 2021, I have kept digging to find a coherent case for a recovery anywhere near that price. Shareholders encountered one negative after another, such as streaming losses, flop movies, bungled succession plans for CEO Robert Iger, a clueless board. The IP legacy richness of DIS is the rescue source. DIS has fallen as low as $85 last August, so on the heels of a robust 4Q24 and annual performance across the board has triggered a price gain to $122.

Above: Can the 4Q24 spike be sustained or even approach an all-time high?

The long trek to sustained $100+ valuation this year has brought out the DIS bull scenario cheering squad, who do see a rosy five years ahead. That is justified by many projections of a steady rise in DTC revenues and total subs clocking a hefty 15% increase in the segment in 4Q. Also supporting the price jump is a widening bull case for its entertainment sector, with a 21% YOY bump. Its latest hit, of course, is Moana 2, already grossing $717m at writing, heading for $1b.

The healthy growth in DTC, which is the core rationale for the lifted bullish outlook, is admittedly sprung from price increases as well as new subs drawn from various deals. That’s contradictory in a way. But the hard truth for all streamers is that their business has become a souk right off the streets of Morocco. They are all merchants hustling bargain prices at passing crowds selling the same trinkets amid the din of hot promotional bellowing.

So when a leader like DIS+ rises in total sub, it clearly is at the expense of another merchant. So we are never certain what the churn rate will be for subs built after price rises, and contrarily deal or bundle buyers. While this is clearly vindication for DIS loyalists, one must be constrained to assume the party will go on deep into the next five years. It might, then again, it might encounter unseen events to slow down the happy highway ahead.

Likewise, the surprise hit Moana 2 headed for $1b in grosses is a testament to the dice-rolling nature of the movie business, which has been with us for over 100 years. DIS has a full plate of releases ahead. Overloaded with sequels, they can easily result in either 20-megaton bomb status for some eagerly anticipated films or sudden monster hits hiding behind low expectations. Best yet, leave all the crystal balls at home. Assume a slate will be a mix of the usual blend: Flops, so-so films eking out a small profit after a time, and one or two mega hits Mr. Market, per usual, will overact and trigger a buying spree.

(Note: Some Moana 2 DEI finger pointers may cite its success as evidence that DEI doesn’t matter. The DEI lapdogs who occupy key DIS creative precincts will have a tough time convincing anyone that Polynesian people qualify as “people of color” with a U.S. population a bit shy of one million, among 335m, mostly living in a Hawaiian tropical paradise).

If you do read the great Q4 and annual numbers, you are clearly pivoted to a speed highway driven by the expectation of more of the same ahead

But before such giddiness overcomes common sense, we urge caution because so many structural issues ahead face DIS management as party poopers on a large scale. For one, is adapting the business to the realities of a new world in the entertainment business that has suggested the age of the media conglomerate born in the 1980s is dying. Where once the concept of blitzing customers with every form of diversion from a single corporate source was the base marketing strategy, that no longer exists.

Media consumers today are brand blind. They buy what they want, from whoever has it, and move on to the next. Among peers, DIS does have what is left of brand value, but even that is an automatic, knee-jerk response to DIS products, continually wrapped and repackaged over decades.

But valid questions arose about such issues as the aging out of some IP for young audiences, overdependence on third- and fourth-try sequels, and the extent to which DIS virtue signaling polices led to confrontational disputes with government agencies hidden behind a double down on DEI. That’s why DIS has postponed its Snow White revamp forays into attempts to teach its audiences cheap social justice mantras rather than rebooting a beloved movie from 1938. It would be hoped DIS is beginning to get it on DEI, as have dozens of U.S. companies that are abandoning DEI at a record pace.

The succession plan for Robert Iger is another lingering issue. It produced a temporary successor to Robert Chapek who was doomed by insider gossip from day one and paving the way for a triumphant Iger return. He now sits on his throne until 2026. He appears to be someone who will need a derrick to remove him from his chair. Fans will cite this strong price recovery as evidence of Iger’s “genius.” Do not be surprised if you begin to hear rumbling gossip about retaining him coming from a toothless board?

What is the point in my view is that the fine Q4 and annual performance was built off existing segments. DIS has yet to confront the core issues it faces. Certainly, having Iger at the helm worked on several levels—that’s not the point. He deserves the gold watch, the cash-out, and the gala dinner for keeping his finger in the dyke as the cascading flood of bad news inundated the company. There are two unresolved mega issues we see that have bypassed the priority list of DIS management to date, despite the great 4Q24. That’s among the reasons why DIS requires new, creative leadership focused on both stability and pivotal decisions on holding assets out of corporate pride. What else can be the motivation for DIS to have not shown the moxie of Comcast, who recently announced the spinoff of its melting ice cube in linear TV.

Long-term debt still looms at $38.9b

DIS has been diligent in paying down its massive debt. Just the last two years, with a total of 14.4% repaid. Assuming this pace can continue with improving FCF, DIS can envision a forward shaving of as much as another $10b. At its highly manageable 4.22% it still costs near $2b annually to service. From our viewpoint, DIS solvency at any level is not an issue. However, what is one is the debt service taking $1.7 to $2b each year from its cash which otherwise can be used to invest in any number of new projects to build IP.

ESPN: The madness of crowds and sports programming

The DIS sports segment (mostly ESPN) is on a long path of revenue decline associated with linear TV. But it remains profitable. Yet production costs are soaring, salaries of excessive personalities stuffed into panel and game hosts, rights costs out of control relative to their trending lower. The irony here is that ESPN is among the networks which madly chased NBA rights as ratings of regular season games have sharply declined. The love affair with sports programming is costly and will get pricier.

To date, regarding ESPN Bet, it’s too little too late answer to getting into sports betting has thus far underperformed. ESPN is not the cash cow it once was for DIS. It has lost over 20% of its audience since 2018. It shows an operating loss of ($78m). With cord cutting still a major factor, we can expect at best a stabilized segment, if not one that will accumulate intolerable losses for DIS.

Our sources in the sports media have told us that they believe DIS has let out the word occasionally of their possible interest in unloading ESPN. But that has been idle talk for 8 years.

ESPN now may be a pothole that can be driven around, but it won’t continue with programming costs, rights deals and overstuffed staffs moving up the cost parameters. We see the Comcast model for linear best. A spinoff of ESPN by our calculation of around $23.2b. A savvy investment banker could cook a tasty dish for ESPN as a pure play in sports. Of course, you lose profit, but you gain cost savings. A new management can produce cost savings that will more than compensate for profit losses. DIS exits clean.

ABC Networks

DIS has had offers of $8 to $10b for the ABC TV network. Both offers are borderline ridiculous. The business has been valued for as much s $90—also pure fantasy. That is why we see it, like ESPN, as a spinoff as well, since qualified buyers at this point will be bargain hunters.

Conclusion

These two issues need resolving before their value equation continues to fall. As pure plays they free themselves from plenty of costs, open up new vistas connected with the base and at least can reverse the downward spiral. For DIS, the streaming business, film studio and Parks businesses can cohere into a profit powerhouse unencumbered by segments acquired now past.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.