Summary:

- Tesla, Inc. continues to show strong financial results. The company’s Q4 2022 revenue increased by 37% and EBITDA was up by 41%.

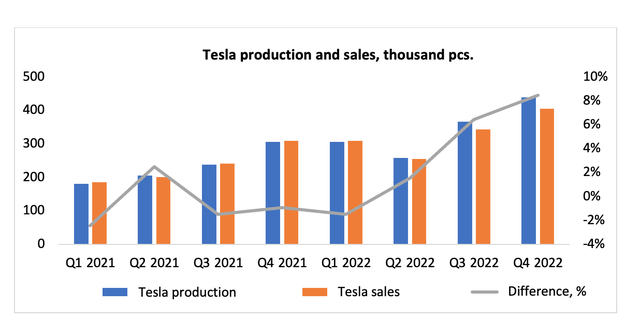

- Lower real income is negatively affecting demand for EVs. In Q4, the company produced 8% more EVs than it managed to sell.

- As a result, Tesla has entered a price war with other automakers, slashing 6%-20% off its prices in different markets.

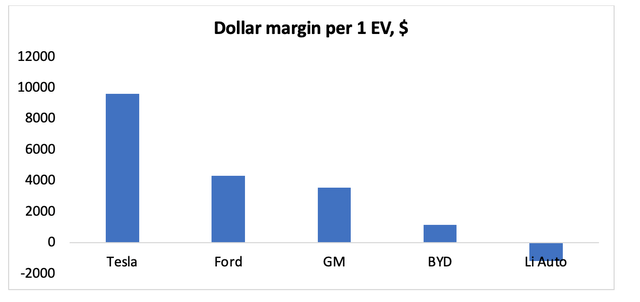

- Tesla can afford it because it has the highest dollar margin per EV compared to its competitors.

- Despite the short-term headwinds, Tesla, Inc.’s outlook remains positive and Tesla’s financial position is strong. We see a good entry point for long-term investors right now and give a BUY rating to Tesla, Inc. stock.

jetcityimage

Investment thesis

Tesla, Inc. (NASDAQ:TSLA) is a growth company. It is actively harnessing the power of its brand and shifting increased costs to the consumer. In 2022, Tesla was on its way to active expansion through increased electric vehicle (“EV”) production. However, 2023 likely will be a tough year for Tesla. The company is entering a price war with other EV manufacturers amid a sharp drop in demand for electric cars. Tesla has an opportunity here, as the company has the highest dollar margin on EVs in the sector.

We maintain a BUY rating for the company.

Tesla and the demand issue

With falling real income and rising interest rates on loans, Tesla is facing problems with demand. In Q4 2022, Tesla manufactured 439 700 and sold only 405 300 EVs. So, the difference between production and sales reached 7.8%, accelerating compared to Q3 2022 (6%).

As a result, Tesla faced a choice: to cut production and abandon plans to grow by 50% YoY in sales, or to try to make their own EVs more affordable and take some of the competition’s market.

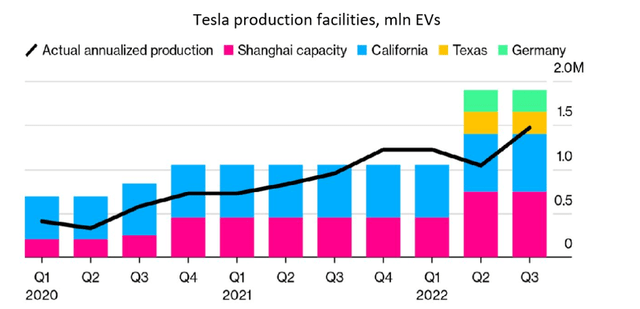

Tesla has adopted the second path and is not giving up on its plan to achieve a 50% YoY increase in sales. Especially since Tesla has almost doubled its production capacity in 2022 and is ready to produce up to 1.9 million EVs per year.

Tesla is looking to solve the demand problem by introducing 6%-20% discounts in China and the U.S. market. On the one hand, the decision looks risky, but it is already bearing the first fruits. During the last press conference, Elon Musk announced, that after the price cuts, orders for EVs are coming in at a rate twice as high as the company’s production capacity in the U.S.

In China, consumers have also responded positively to Tesla’s lower EV prices. Wedbush surveyed consumers in China who intend to buy an EV in 2023. The poll found that people in China are more eager to buy an EV from Tesla after the price drop, with ~73% of those interviewed preferring Tesla. The second and the third place are taken by China’s BYD Company Limited (OTCPK:BYDDF) and NIO Inc. (NIO).

Tesla is entering a price war with other major manufacturers and is willing to sacrifice some of its margins to capture the market share and continue expansion.

Tesla has one of the most stable positions in this sector due to its high dollar margin per EV.

As before, given the severe downturn in demand amid falling real incomes, we do not expect Tesla to sell 50% more EVs in 2023 according to its plan, but expect sales closer to 1.8 million EVs (+30% YoY). However, we believe that once the U.S. economy recession is over, Tesla will manage to reach the +50% YoY sales growth target in 2024 and 2025.

Financial results of Tesla

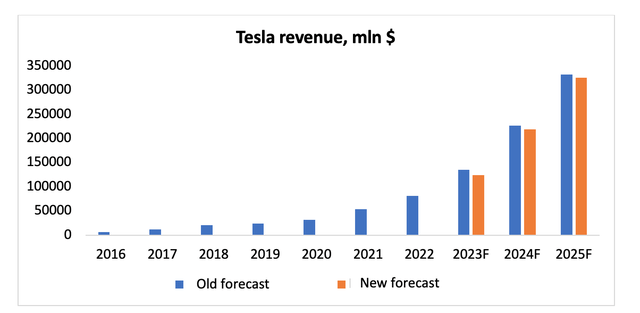

We have revised our 2023 Tesla revenue forecast downwards from $134.8 bn (+65% YoY) to 123.8 bn (+52% YoY) due to introduction of EV discounts (6%-20%) and a greater-than-expected shift in demand towards the Model Y.

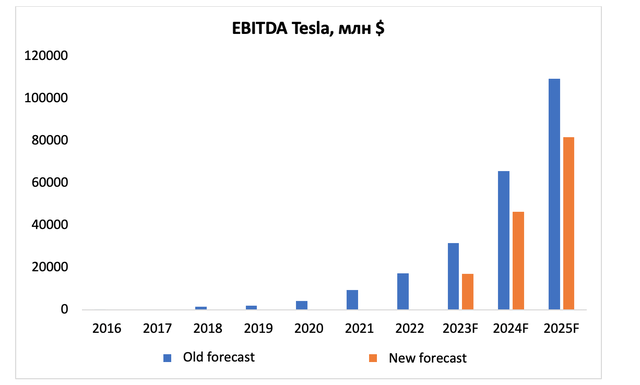

We have also revised downwards our 2023 Tesla EBITDA forecast from $31.5 bn (+81% YoY) to $17.1 bn (-2% YoY) due to lower revenue projections and downward revision of 2023 gross margin forecast from 28% to 17% because of margin discounting pressure on the company. We have revised our 2025 EBITDA forecast downwards from $109.3 bn to $81.8 bn due to greater shift in demand towards the Model Y, which is less profitable.

Valuation

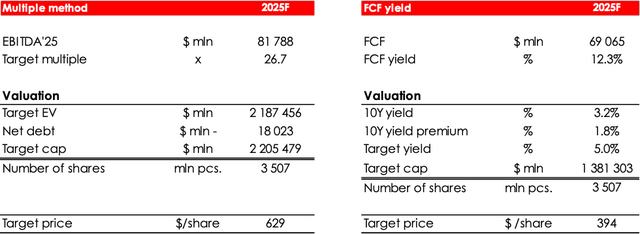

We are evaluating Tesla’s fair value price based on 2025 EV/EBITDA multiples and free cash flow (“FCF”) Yield methods, and think the fair value price for the stock is $400 (average discounted prices). We are evaluating the fair value price of Tesla stock by discounting projected prices in 2025 at the rate of 13%. Fair value prices in the tables depicted below are without discounting at the rate of 13%. We are assigning a BUY rating to the shares. The potential upside is 140%.

Conclusion

Amid a drop in real income worldwide, Tesla, Inc. faced a major decline in demand for EVs. In addition, Tesla’s sales were negatively affected by the stronger dollar and rising component costs due to high inflation.

However, we believe that the company will manage to cope with these short-term negative factors by strengthening the vertical integration of production and effective pricing strategy.

A possible recession in the U.S. market is a potential risk for Tesla, Inc. in 2023, which could reduce demand for EVs due to falling real incomes, high credit loads, and the elevated cost of the vehicles.

Against the backdrop of the company’s long-term prospects and recent surge in share prices, we believe that Tesla, Inc.’s stock position is better to purchase in portions spread over time. Moreover, its total share in the portfolio should not exceed 5% for risk-tolerant investors and 3% for conservative investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.