Summary:

- Goldman Sachs’ CFO is optimistic about the deal activity outlook in 2025 after the US presidential election due to enhanced client dialogue.

- The stock’s financials have firmly recovered due to strong Asset Management & Equity Trading, and in Q3, earnings were beaten by a substantial amount.

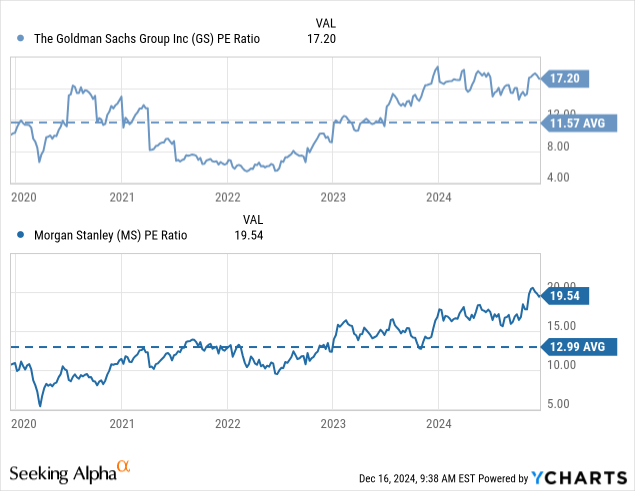

- Although the valuation remains high, it is cheaper than its closest peer, and it has remained within the same range throughout the year without expanding, while the stock has appreciated.

LeoPatrizi/E+ via Getty Images

Since my last “hold” rating on The Goldman Sachs Group (NYSE:GS) in August, the shares have increased by approximately 17.2%. Most of the gains were achieved on November 6th, the day after the US presidential election, when GS appreciated 13.1% on a single trading day.

On the analysis, I suggested that the stock was trading 64% above its historical average, limiting the potential expansion. Nonetheless, I also pointed out some tailwinds regarding the lower cost of borrowing, potentially driving deal activity and benefiting their Global Banking & Markets segment.

Goldman Sachs’s Q3 Earnings

Although the stock has recently moved due to external factors such as the elections, it is critical to draw conclusions from the latest earnings release. In Q3, the firm beat EPS substantially, obtaining $9.02 while expecting $7.31. Nonetheless, the stock experienced little price movement, modestly decreasing by -0.07% on the earnings day.

Here are the main points of Q3 earnings:

- Investment Banking fees keep recovering, with a 20% rise year-over-year.

- FICC revenues were weak, dropping by -12% vs. the third quarter of 2022.

- Equities sat 18% higher YoY, with most gains arriving from intermediation.

- Asset & Wealth Management was 16% YoY higher, primarily due to higher average assets under supervision, deposit balances, and incentive fees in Private banking.

- Platforms Solutions (a minor revenue contributor) saw a -42% drop from Q2, primarily due to lower revenues from the General Motors (GM) credit card program and a loss related to the transition to another issuer.

In addition to growing consolidated revenues by 7% year over year, the company decreased operating expenses by -8% yearly, decreasing the efficiency ratio to 64.3% vs. 74.4% in the prior year’s quarter.

Goldman Sachs 2024 U.S. Financial Services Conference

Recently, at the Goldman Sachs Financial Services Conference, CFO Denis Coleman presented the backdrop of the M&A market for 2025. Overall, he was pretty bullish. Coleman pointed out that 2024 has been a year of great momentum and that deal activity still remains below the 10-year average. Simultaneously, he referred with optimism to the outcome of the presidential election, where they have seen the intensity of client dialogue accelerating. Finally, the CFO feels that in 2025, deal activity will normalize to historical averages.

The CFO also referred to the IPO and ECM markets.

“ECM, obviously quite depressed versus just take a 10-year average, both aggregate ECM and then in particular, IPO activity is probably 50% below the average. Again, I think the building blocks are coming into play. So, we’ve all been calling for the reopening of the capital markets, writ large. And of course, across the course of 2024, we saw more and more market subsegments open, IPOs are open.

I think with where the equity markets are, some of the risk appetite we see on the investing side, and then certainly, the backlog of clients that would like to access the equity markets, I think you will see more elevated levels of IPO activity generally and then for sponsor specifically as you head into 2025.” Denis Coleman.

Valuation of Goldman Sachs

From the elevated multiple of Goldman Sachs’ stock at 17.2x earnings, I can identify a positive aspect of this scenario. In 2024, the stock PE multiple has ranged within the same levels throughout the year despite the stock being up approximately 52% YTD. This inherently means that although the stock price is rising, the denominator of trailing EPS is doing it at a rate that both the numerator and denominator balance.

Fundamentally, the best scenario is when earnings rise faster than the stock price. Although this is still not the case for GS, the multiple trajectory has been attractive in 2024, especially with its strong price appreciation performance. With that in mind, a stock trading at 17.2x earnings while having an average of 11.6x, which makes the current multiple sit 48% above the historical level, remains overvalued. Nonetheless, this level is similar to Goldman Sachs’ closest peer, Morgan Stanley (MS), which has a PE multiple that is slightly higher at 19.5x.

| Morgan Stanley | Overweight | maintained | 736 | 9-Dec-24 |

| JPMorgan | Overweight | maintained | 550 | 6-Dec-24 |

| Keefe, Bruyette & Woods | Outperform | maintained | 686 | 3-Dec-24 |

| HSBC Securities | Hold | downgraded | 608 | 26-Nov-24 |

| Oppenheimer | Outperform | maintained | 677 | 20-Nov-24 |

| Wells Fargo | Overweight | maintained | 680 | 15-Nov-24 |

| Jefferies | Buy | maintained | 609 | 16-Oct-24 |

| Evercore ISI | Outperform | maintained | 575 | 16-Oct-24 |

| Barclays | Overweight | maintained | 588 | 16-Oct-24 |

| CFRA | Strong Buy | maintained | 585 | 15-Oct-24 |

Source: Briefing| StreetInsider | Interactive Brokers

Simultaneously, based on the information I have available, seven banks have updated their ratings after Q3 earnings. All of them concluded with a bullish rating, except Saul Martinez from HSBC, who downgraded the stock rating to a hold. On average, the target price of sell-side analysts is $629, representing a minor upside potential of 7.4%.

Risks for Goldman Sachs in 2025

Although the outlook for Investment Banking is bright based on the CFO commentary, mainly due to a market that expects a soft landing and deal activity that remains below average, in my opinion, this is not exactly the case for every business line. For example, fees from asset management, which are mainly asset-level dependent, have limited room to grow next year within equities after 2023 and 2024 of strong performance. Despite fixed income being the asset class with the largest assets under administration, the fees obtained by equity products are 3.2x higher, making it the primary driver of asset management fees.

Furthermore, in the trading business, it is hard to provide an outlook for both FICC and Equities since these revenue streams are too diversified and unpredictable. Nonetheless, market volatility could be a driver for trading volume, and in 2025, there won’t be many evident market-moving events that demand leverage or hedging like the ones exhibited in 2024, such as the US and Mexican presidential elections and European Parliament elections. Yet, this could be partly countered by policy changes in a new presidential administration.

Stock Rating and Conclusion

My previous “hold” rating was primarily based on valuation rather than a poor outlook on the stock. Currently, things remain the same with the difference that the multiple has been within a similar level over the past year and it makes things more attractive although the valuation remains high to its history.

In 2025, I could easily see the stock of Goldman Sachs normalizing its multiple valuation with the stock rising at a lower rate than the effect that earnings per share could cause on the denominator due to the optimistic outlook on the Investment Banking business. Therefore, I will update my previous “hold” rating to a “buy” in Goldman Sachs’ stock. This new bullish rating aligns with Seeking Alpha’s and Wall Street analysts and differs from SA’s Quant rating as it has a “hold.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.