ArtistGNDphotography

Broadcom’s (NASDAQ:AVGO) quick, nearly 40% price rally is among recent moves underscoring the “momentum fest” investors are locked into as the 2024 trading year winds down, according to Interactive Brokers (IBKR).

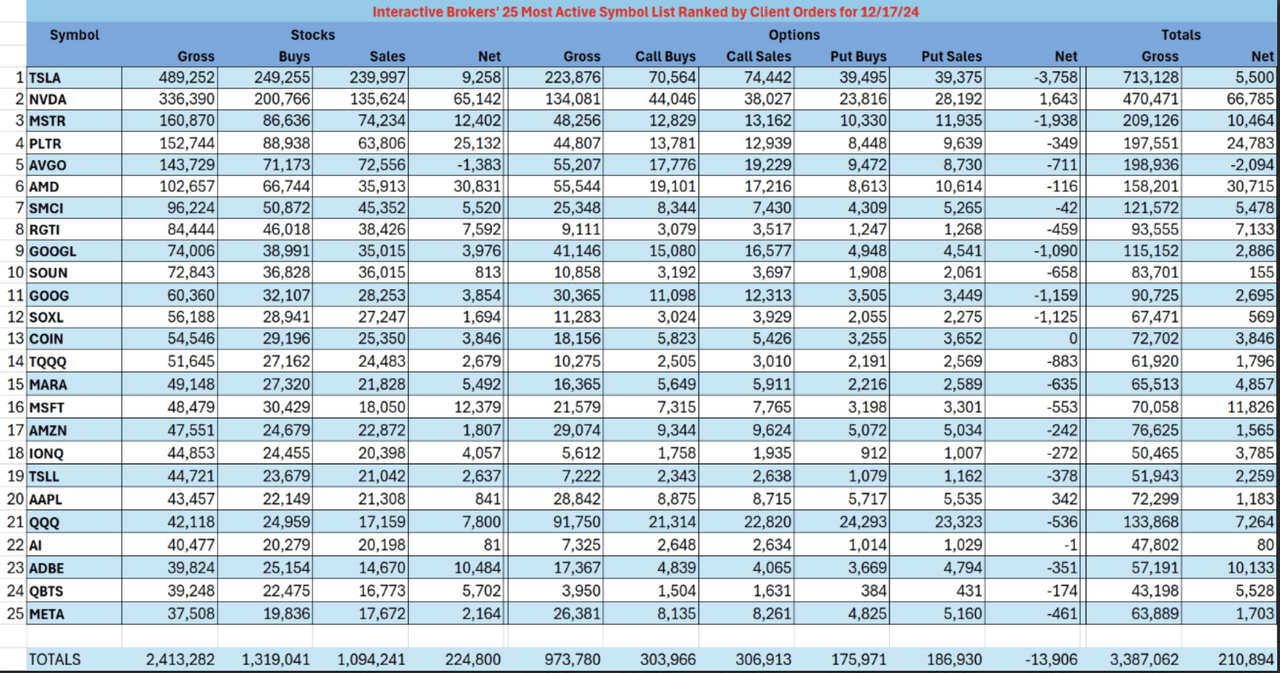

The chipmaker (AVGO) pushed into the trading platform’s weekly list of its top 25 most-active symbols, and Tesla (NASDAQ:TSLA) held to pole position during a multi-day jump. Nvidia (NASDAQ:NVDA), MicroStrategy (NASDAQ:MSTR), and Palantir (NASDAQ:PLTR) took the second through fourth spots in the list published Tuesday, tracking a five-day moving average of order flow in stocks and options.

“In case you harbor any doubt that the current market environment is a thoroughly tech-focused, story-driven, momentum fest, this week’s most actives list should puncture them,” IBKR Chief Strategist Steve Sosnick said.

“It’s pretty much all megacap tech, crypto, semiconductors, AI, and quantum computing,” he said. “Of course, there is no shortage of overlap among those themes,” he said.

Tesla (TSLA) climbed +18% in four of the past five sessions through Monday, partially on potentially stronger-than-expected EV demand in China, and CEO Elon Musk’s ties with President-elect Donald Trump will benefit the company. Bitcoin (BTC-USD) buyer MicroStrategy (MSTR) and Palantir (PLTR) are heading to the Nasdaq-100 Index (NDX) next week. Nvidia’s stock (NVDA), meanwhile, has slumped into correction territory.

Broadcom (AVGO) newly minted status as a $1T company came as its shares soared +38% over two sessions through Monday. Investors cheered revenue guidance of up to $90B from custom artificial intelligence chips by 2027. The shares were lower during Tuesday’s session.

“Interestingly, while the general movement of AVGO vs. NVDA implies that there is a movement out of the latter and into the former, that is not reflected by our customer activity,” Sosnick said. “AVGO is literally the only name with net selling activity, while the bias in NVDA is quite heavily towards the buy side,” he said.

“Our trading-oriented customers, who run the gamut from small retail to large institutions, seem to be taking the other side of large fundamental flows,” the strategist said.

See below for the full data on the IBKR 25 most-active list: