Summary:

- The modem war between Apple and Qualcomm is heating up.

- Apple aims to replace Qualcomm by 2027.

- Qualcomm will come out strong regardless of Apple’s success.

- Apple remains committed to an ambitious vertical integration plan, which I remain skeptical about.

G0d4ather

The battle between Apple Inc. (NASDAQ:AAPL) and QUALCOMM Incorporated (NASDAQ:QCOM) has reignited once again as the former seems poised to remove its reliance finally on the latter’s modem technology. This moment has been a long time in the making and comes after years and years of research, development, delays, and throwing lots of money at the problem. However, I remain skeptical of Apple’s ability to match Qualcomm’s performance and its ability to adhere to the reported timeline.

Strap in folks, this is a long one.

The Great Modem War: How Did We Get Here?

Apple and Qualcomm have been at odds for some time (I’m putting it mildly) mostly regarding disputes over smartphone patents and the licensing fees for using intellectual property. These two companies sued and countersued each other over so many patents in so many different countries, that they probably could have kept entire law firms afloat. To put this history briefly: Qualcomm initially sued Apple in 2017 for infringing on its patents, Apple countersued claiming the patents were invalid, and the companies settled in 2019 with Apple paying billions of dollars for a license to use thousands of Qualcomm’s patents.

However, the agreement allowed the patent dispute to proceed, which led to a court upholding the patents and ruling against Apple in 2020, upon appeal in 2021, and then upon further appeal in 2022. Amidst this back and forth, Apple had already begun working in 2018 to develop an in-house modem to cut Qualcomm out of the equation and become as self-reliant and as vertically integrated as possible. Phasing out Intel Corporation (INTC) processors in favor of Apple silicon in 2020 for its Mac laptops is a prime example of such efforts. And yet, while Apple’s development of in-house processors has been wildly successful, the endeavor to challenge Qualcomm’s modem dominance hasn’t seen nearly the same success.

After purchasing Intel’s modem business for $1 billion in 2019 and hiring additional engineering muscle, the original plan was to launch an iPhone model with an Apple-designed modem by somewhere around 2024. However, the initiative ran into delays as attempts to add new features to Intel’s apparently subpar modem software ground progress to a halt, necessitating a full re-work of the codebase. A quote from the original Bloomberg report sums it up nicely:

Why we thought we could take a failed project from Intel and somehow succeed is a mystery.

There was speculation that even 2025 might be too ambitious a target for an Apple-branded modem release after the company extended its supplier agreement with Qualcomm to March 2027. However, it appears that the moment of truth is finally on the horizon and that Apple will reveal its modem in the spring of 2025. Which brings us to the present day.

Will Apple end up triumphant or does Qualcomm have some more cards left to play? Let’s get to the analysis!

Can’t Get Rid Of Me That Easily

Now, some readers might be surprised by the difficulties Apple has faced in producing even a serviceable modem after so many years. The company was able to master processors in an impressively short timeframe, why not modems?

The answer to this is multi-faceted and much of the details aren’t publicly available, but we can make some educated guesses.

First, while processors are technically more complex, modems are complex in a different way. They need to work in all different types of conditions, connect with hundreds of cellular operators around the world, work with multiple different global standards (5G, 4G, etc.) and be fast, small, and energy-efficient enough to fit in a device as small as your hand. Building processors isn’t easy of course, but building a cutting-edge modem that can satisfy all of these requirements is perhaps a more specialized task. One that Apple seems to have underestimated. Qualcomm has a decades-long advantage in real-world testing and iterating on its modem design that Apple simply doesn’t have, and replicating that has proven more difficult than expected.

Second, it seems there has almost certainly been an element of Intel’s acquired modem division poisoning the well for Apple’s engineering efforts. Instead of building from a clean foundation to create a modem that could support all the various features a cutting-edge product would offer, Apple went for a more Frankenstein-esque approach of attaching new software limbs onto a fragile body of a codebase that wasn’t designed for it. There’s a reason that, around the time when Intel sold this division to Apple, Qualcomm modems were about 30% faster! Apple wasted valuable time trying to make a better version of Intel’s modem when, perhaps in hindsight, it should simply have used Intel’s IP and engineers to start fresh.

Lastly, Qualcomm isn’t just better at making modems, it holds many of the patents that are necessary to create the chips. Apple has a license that covers much of this IP, but the company still has to be careful to avoid infringing on patents wherever possible since Qualcomm has proven itself to be prodigiously litigious, and it’d probably like nothing more than to derail Apple’s modem plans.

And yet, despite all these speed bumps, Apple is poised to finally release its first modem with Apple inside. The new expected roadmap comes from another recent Bloomberg report, which provides some interesting details on the roll-out.

As expected, Apple is targeting the iPhone SE line of smartphones as the first devices to include an in-house modem. The iPhone SE 4 is slated for release in early 2025, which matches up with the modem release timeline. The logic here is fairly straightforward: the iPhone SE is Apple’s budget option and buyers won’t expect bleeding-edge performance or features on such devices, which makes it a good sandbox to test drive the modem and put it through more involved, real-world testing. The assumption goes: if the phone drops a call here or there, or it gets worse battery life than it would with a Qualcomm modem, users will get annoyed, but it won’t be the end of the world — if they even notice at all.

While this is likely the optimal strategy, it’s still not without risk. Of components in a smartphone that are absolutely essential and likely to cause issues a user will notice, the modem is near the top of the list. Modem issues plagued the first iterations of Alphabet Inc.’s (GOOG), (GOOGL) Pixel line of smartphones, and can be a frustrating enough issue to incense users to switch.

The Apple modem will also likely lack features that a Qualcomm modem provides, which are a bit technical for the scope of this article, but suffice it to say Apple has a lot of work to do to reach its other goals. Namely, to release a second-generation modem for a mid-tier line of iPhones in 2026 and then a third generation in 2027 that will match or surpass Qualcomm and be included in the company’s flagship smartphones. Here’s where my skepticism comes in.

Assuming the iPhone SE 4 launches with an Apple modem in 2025, it will have taken the company around seven years from starting the initiative to create an in-house modem to launching an option that’s good enough for its budget offering. Yet somehow it now expects to catch or surpass Qualcomm, which has been the undisputed king of modems nearly forever, in just two years? I don’t see it. Building a good enough modem isn’t really all that difficult, relatively speaking. MediaTek, Samsung, Huawei, and others have done it, but Qualcomm is consistently ahead of the pack and the sole resident of the top tier.

All this to say, it could take quite a while for Apple to create a modem that offers the level of performance expected from its high-end iPhone. As an example, Samsung has made its own modems for a while and includes them in many of its smartphone offerings, but still uses Qualcomm’s Snapdragon system-on-a-chip (“SoC”), which includes other processors along with the modem, for the premium Galaxy S series in its all-important home market of South Korea (and in the US for patent reasons). Outside this market, Samsung mostly sells its Galaxy S smartphones with its in-house Exynos SoC, but the company is likely switching to Snapdragon in all of its flagship smartphones starting with the S25.

Qualcomm

When top performance is a must, which it is for a device like the high-end iPhone, Qualcomm is the best game in town. Catching up to that level of expertise will be substantially more difficult than creating this first-generation Apple modem. Which, again, took seven years.

There’s a quote I’ve heard referenced a couple of times during my career as a software engineer that illustrates this concept well, in my opinion:

The first 90 percent of the code accounts for the first 90 percent of the development time. The remaining 10 percent of the code accounts for the other 90 percent of the development time.

— Tom Cargill, Bell Labs

Getting from a good modem to a great modem to a best-in-class modem will be an unimaginably difficult task, one that I cannot see Apple accomplishing by 2027. However, there is a scenario where Apple takes the leap for its flagship iPhone regardless of inferior modem performance.

The current models use an Apple processor and a separate Qualcomm modem, which takes up space and requires external interconnects between components because Qualcomm doesn’t allow customers to include its modems on SoCs. This gives Snapdragon devices a bit of a boost in technical comparisons to the iPhone. Apple’s ultimate goal is to create an iPhone with an SoC that includes its processor and modem on a single substrate, which saves space, provides a boost to energy efficiency, and opens up other feature possibilities. So even if Apple’s high-end modem isn’t as good as Qualcomm’s for a long while, the company might still decide that the benefits of having a completely Apple-built SoC that combines its processor and modem outweigh the potential downsides of dropping Qualcomm and the resulting downgrade in modem performance.

QCOM

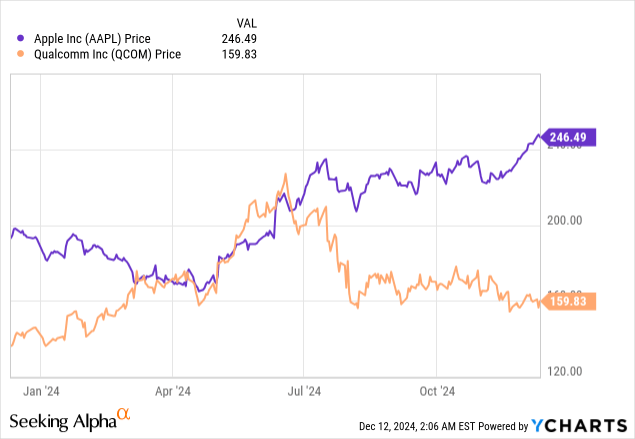

Well, we’ve finally gotten to the point where we discuss investment implications — after all, none of this matters if it doesn’t affect the almighty stock price. Let’s start with Qualcomm.

Apple dependency has been a fear for investors regarding QCOM for quite a while, as estimates put annual iPhone-derived revenue at around 20% of Qualcomm’s total. But while Apple’s move will have an undeniable negative effect on Qualcomm’s top line results, the latter has made great strides in recent years to diversify its revenue streams and prepare for the inevitable breakup.

Non-handset revenue was a record percentage of total revenue in FY2024, led by a 55% increase YoY in automotive revenue as the company has positioned itself as a market leader in vehicle automation. This is a fast-growing opportunity that is estimated to already have a $35 billion total addressable market. Revenue from IoT sources saw a YoY decline in FY2024 due to some oversupply issues, but still came in at $5.4 billion, or 16% of the total, and management expects this to improve in FY2025 as inventory clears.

Even in a worst-case scenario where Apple phases out Qualcomm modems by 2027, I think this diversification positions the stock well for outperformance. Even more important is, Qualcomm’s ace in the hole: the company holds the necessary patents to build a 5G-enabled modem so the license agreement between Apple and Qualcomm that allows the former to build its own modems still benefits the latter to the tune of billions of dollars. That licensing deal expires in 2027, and it’ll be interesting to see if another dispute arises, but either way, Qualcomm wins.

From a valuation standpoint, QCOM is one of the few tech stocks not trading at a lofty premium:

Part of this is likely due to the Apple boogeyman — the one thing the market hates most is uncertainty. I view this as an opportunity for savvy investors to jump on a great company at a great price. It will likely take years for Apple to truly phase Qualcomm modems out of its devices, and, when that day comes, the licensing revenue will generate plenty of dollar bills with which QCOM shareholders can wipe their tears. Samsung switching to Snapdragon for all of its Galaxy S smartphones, will soften the blow as well.

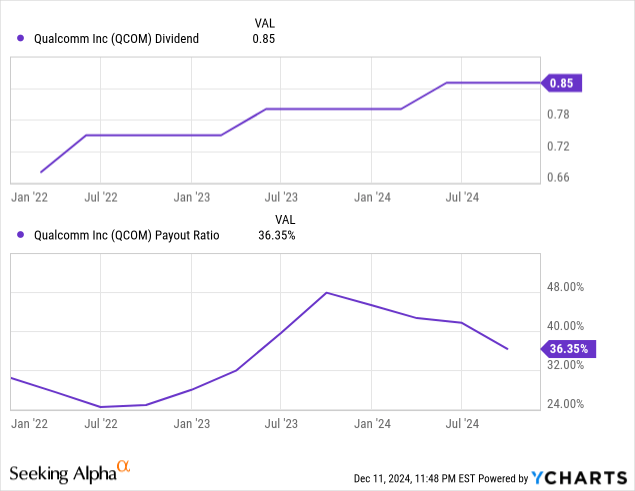

In addition to solid growth potential, the dividend is fairly high for a name in this space and the payout ratio indicates that it’s as safe as can be with plenty of room to expand going forward:

For further reading on my QCOM bull case, you can read my previous article on the stock here.

Let’s move on to Apple!

AAPL

So I think it’s apparent that Apple is investing heavily in a strategy that will, in theory, allow them to manufacture all or most of the semiconductor content in its devices. Qualcomm’s modem is in its sights, of course, but Apple also wants to replace Broadcom Inc.’s (AVGO) Wi-Fi + Bluetooth chip, and eventually radiofrequency components provided by Broadcom, Skyworks Solutions, Inc. (SWKS), and Qorvo, Inc. (QRVO).

This provides potential benefits, which I touched on earlier, in the form of cost savings, power efficiencies, enabling new features, shrinking the space that chips occupy, and just an increase in general control over the manufacturing of the device. However, it also introduces potential downsides.

If this strategy is executed perfectly, I agree that it could be a sound move from a profit-making perspective. But things go wrong in semi manufacturing all the time, and the more vertically integrated a company becomes, the more reliant it is on all of its interconnected functions to achieve a standard of excellence at the same time. The way it’s shaping up, Apple has to retain teams of engineers that will create the most cutting-edge CPU, modem, RF filters, Wi-Fi + Bluetooth chips, and whatever else the company decides to make internally, in relative perpetuity. If any of these components fail to achieve the technological leap that each successive generation typically requires, Apple will be stuck with a device that perhaps doesn’t perform as well as competitors. Over time, this could impact brand image and hurt sales.

In fact, this situation has shades of what happened and is currently happening at Intel. Intel has a design division that comes up with the specs for a given processor, and it has a foundry that manufactures that processor. This system works great as long as both the design and foundry continue to perform to the same standard, but can implode if either struggle. As many of you are likely aware, Intel’s foundry has fallen behind in recent years while Taiwan Semiconductor Manufacturing Company Limited (TSM) has leapfrogged ahead, which has allowed the likes of Advanced Micro Devices, Inc. (AMD) to manufacture chips at TSMC that outperform Intel’s. One problem becomes two.

Now hold on, before anyone jumps down my throat, I’m aware that these situations are not completely analogous. But I do think it’s an illustration of how quickly vertical integration can go from a blessing to a curse. For Apple, the more integrated its components become, the more difficult it becomes to go to outside suppliers if an internally designed component isn’t up to snuff for whatever reason. It’d be a tall order, and perhaps borderline impossible, to unravel a SoC and add an outside component to it, so Apple would be in a tough spot.

I think Apple has realized that the smartphone business, while insanely profitable, will not sustain growth. This move to bring all device components under the Apple umbrella is likely a play to increase revenue and profitability in an attempt to stave off effects from a stagnation in unit sales, which could work in the short-term but, as I discussed, could leave the company exposed in the long term.

Due to this and due to the stock’s fairly lofty valuation, I don’t think AAPL represents any screaming value worthy of investor dollars at the moment:

For a company with so much cash on hand and that generates more than $100 billion in free cash flow every year, it’s odd it doesn’t return this capital to shareholders more directly. The company has embarked on massive share buybacks, which I’ve never really been a fan of, instead of simply raising the dividend more. While share repurchase programs can have their benefits, in Apple’s case, it appears to mostly be financial engineering to continue increasing EPS even as net income growth has stalled.

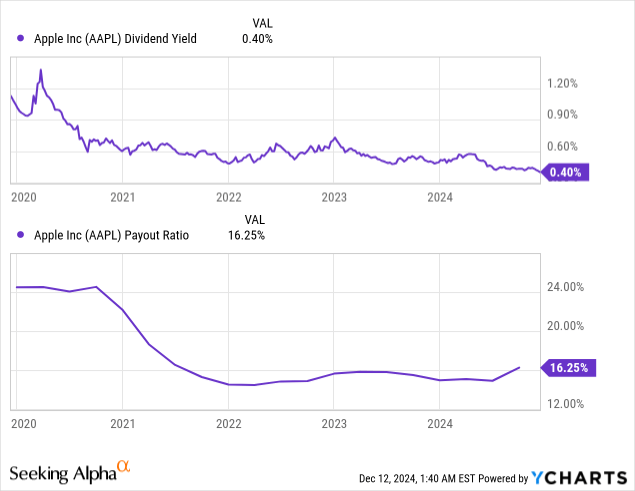

The dividend yield and payout ratio demonstrate there is plenty of room to go this route, should management decide to take that path:

Or maybe even spend it on some significant acquisition that could boost results or bolster existing product lines. Anything would be more useful than share buybacks, in my opinion, and until the company shows a willingness to change course I have a hard time seeing the stock as a Buy, especially with its current valuation.

Investor Takeaway

Apple and Qualcomm’s war over modems in the iPhone seems to be ramping up and perhaps heading towards a conclusion. I think Apple has a lot more work to do before it can claim parity with Qualcomm’s premium modem offering, which could leave the two attached for a while longer. Apple could even speed up its timeline and bite the bullet on worse modem performance in order to make an all-in-one SoC that includes the processor and modem (and Wi-Fi + Bluetooth chip if that one is finished in time), which is the company’s ultimate goal.

I remain skeptical of Apple’s ability to make a high-performing modem by 2027 and also of the company’s general strategy of making all these components internally. In addition, operating results and unit sales are stagnating, the capital return to shareholders remains lacking, and the stock’s valuation remains elevated. In light of these factors, I am rating AAPL a Hold.

While Qualcomm might soon lose Apple’s modem revenue, it will continue to earn licensing revenue from these components and has completed sufficient diversification to allay any Apple dependency issues, in my opinion. In fact, I think a de-coupling from Apple will reduce market uncertainty and could lead to valuation multiple expansion. Qualcomm has a significant foothold in the automotive space that will contribute to growth and the company continues to rake in cash and raise its dividend. I am re-iterating a Buy on QCOM.

You made it to the end! If you made it this far without skipping or skimming, you have my thanks. And if you did skim or skip, you still have my thanks, just a little less of it.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.