Summary:

- I reiterate a “buy” rating for Amazon with a revised price target of $320, driven by projected revenue acceleration from its AWS segment with its AI product roadmap.

- AWS’s Nova foundation model on its Bedrock model layer, along with better price performance of its custom silicon are expected to accelerate enterprise AI adoption.

- Despite high capex, Amazon’s diversified revenue streams and its dominance in e-commerce and cloud computing justify these investments for its long-term growth trajectory.

- In this post, I conducted a sum-of-parts valuation, which indicates a 38% upside, with AWS contributing $266/share, North America $38/share, and International $17/share.

JHVEPhoto

Introduction & Investment Thesis

I last covered Amazon.com, Inc. (NASDAQ:AMZN) in October, where I initiated a “buy” rating with a price target of $237, which represented an upside of 25%.

As an existing investor, I needed to reassess my price target with the stock closing in on my price target.

SA: Stock performance since “buy” rating

After doing a thorough analysis (that I present below), where I evaluate the business as a “sum of parts,” I believe there is room for another 38% upside from its current levels.

This is primarily driven by my expectation for its AWS (Amazon Web Services) segment. I believe its revenue growth will continue accelerating from its current levels, as companies invest their resources towards modernizing their infrastructure from on-premise to the cloud while unlocking scalable AI use cases that require large-scale deployment of AI workloads.

Plus, during the re:Invent 2024 conference in December, Amazon set a new AI agenda. It made a commitment to innovating the core layers of its AI stack while announcing its Nova foundation models. These will play a core part in its AI strategy, unleashing a wave of enterprise AI adoption given its dominance in cloud computing and improving the economics of large-scale AI deployment.

As a result, I will remain bullish and reiterate my “buy” rating with a price target of $320.

AWS has taken a decisive turn with Nova, and it will spearhead enterprise AI adoption

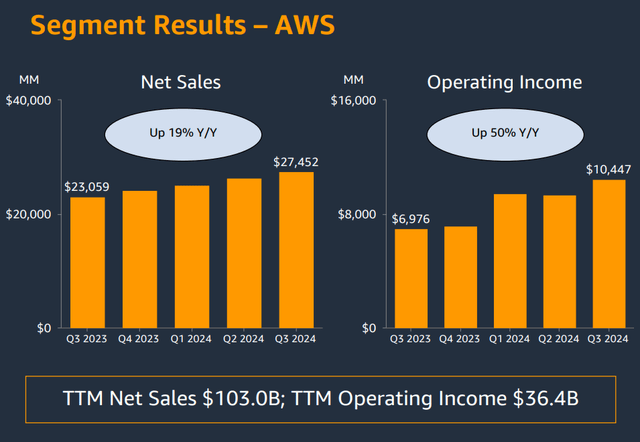

In Q3 FY24, the growth momentum of AWS continued at 19.1% YoY, albeit at a slower pace compared to the previous three quarters. While GCP (Google Cloud Partners) (GOOG) (GOOGL) grew at the fastest rate among all hyperscalers, AWS continues to maintain a superior market share of 32%, as per Synergy Research Group, with Azure (MSFT) and GCP at 20% and 13%, respectively.

Meanwhile, AWS continued to contribute a higher share to overall revenue, growing from 16% in Q3 FY23 to over 17% in Q3 FY24. Operating Income from the AWS segment expanded by close to 50% YoY, with a margin expansion of over 800 basis points to 38%.

Q3 FY24 Earnings Slides: Breakdown of Revenue and Operating Income for AWS

In my previous post, I claimed that AWS should see a continued acceleration in its revenue growth. This was because companies had completed their cost optimization efforts and were ready to invest their resources towards modernizing their infrastructure while leveraging AI at the same time.

With management’s commentary from its Q3 FY24 earnings call, along with its latest announcements at its re:Invent 2024 conference in December, I believe that Amazon has set a new AI agenda. It has made a commitment to innovating the core layers of its AI stack, where I expect it to take a lead in enabling enterprises to adopt and deploy AI at scale.

Allow me to explain why.

Thinking of Amazon’s AI offering as three macro layers, let’s start with the bottom layer, or the Infrastructure Layer, which is for model builders. While the company was the first major cloud provider to offer Nvidia H200 GPUs (NVDA) through their EC2 P5e instances, it has been innovating its customized machine learning chips such as Trainium for training. The introduction of Trainium 2 promises twice the performance of its predecessor while reducing energy consumption, and Inferentia for inference, with Inferentia 3 chips that would make AI inference more cost-effective, thus enabling enterprises to deploy AI workloads at scale.

Moving to the second layer of the AI stack is the Models Layer, also known as Bedrock, where companies leverage existing large language models such as Anthropic’s Claude Sonnet 3.5, Meta’s Llama 3.2 (META), Mistral’s Large 2 Models, and more to build high-quality GenAI applications. Furthermore, during the re:Invent 2024 conference, Amazon further expanded model choice in Amazon Bedrock with its announcement of Amazon Nova models. Andy Jassy, CEO of Amazon, described these as “state-of-the-art in performance, offering groundbreaking capabilities at 75% lower costs,” thus democratizing AI and simplifying the integration of GenAI into business workflows while ensuring a safety framework at the same time.

What is also interesting to note is that until now, Amazon would provide its clients access to third-party foundation models through its AWS cloud platform. With the announcement of Nova models, it marks a shift in Amazon’s AI strategy, where it will now compete directly with Microsoft with its exclusive access to OpenAI’s GPT series models and Google’s Gemini models. With Amazon positioning Nova as a cost-effective and efficient alternative, combined with its robust customization options, I believe that it can assert significant competitive pressure on existing players. On one hand, AWS’s dominance in the cloud computing industry gives it a strategic edge. On the other hand, the positioning of Nova may unleash a wave of enterprise AI adoption, especially for those that are struggling with the economics of large-scale AI deployment.

Finally, moving on to the third and final layer on the top of the AI stack is the Application Layer. This is where the company continues to see strong adoption of Amazon Q, which is their GenAI-powered assistant for software development, integrated across AWS services with the highest reported code acceptance rates in the industry. I expect to see the adoption of Amazon Q continue to accelerate, especially as the economics to deploy AI workloads improve, leading to higher productivity gains and superior business outcomes.

Gold rush from AI capex may strain short-term profitability

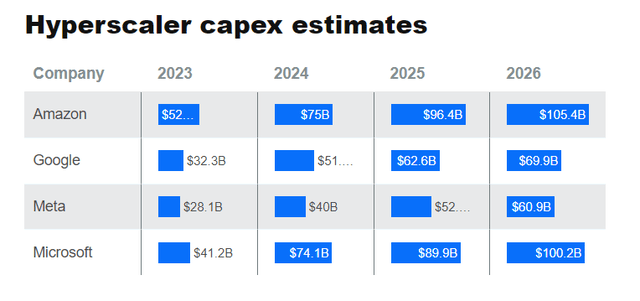

One of the areas that often attracts mixed investor sentiment is the level of capex (capital expenditure) spending associated with AI-related investments. Year-to-date, Amazon has spent $51.9B in capital investments, and the number is expected to grow to $75B for FY24.

This is the highest capital investment amount, compared to all other hyperscalers, as can be seen below.

Business Insider: Breakdown of capex spend and forecast by large hyperscalers

What is also interesting is that these companies will continue to expand their capex in FY25 and beyond, while the pace will likely slow down from FY26 onwards.

However, I will point out that Amazon is far larger compared to Google and Microsoft, given its diversified revenue streams of e-commerce, advertising, and more. During the earnings call, the management discussed that while the bulk of their capex is related to AWS to support demand for their AI services, they are also investing in their technology infrastructure and fulfillment and transportation network. This is to support their North America and International business segments to improve delivery speeds, especially with the ongoing holiday season shopping.

Plus, Amazon’s capex as a share of projected FY24 revenue is 11%, much lower compared to Google’s at 14.5% and Microsoft’s at 26.6%.

However, it is important to remember that companies such as Amazon are investing based on-demand signals and the potential of AI applications. While it is possible that they may see a short-term shrinkage in margins, should enterprise AI adoption not take place at the pace that they are expecting, I believe it is too big an opportunity to miss out on. This is especially given their massive revenue run rate and product innovation roadmap with better price performance of its custom silicon and Amazon Nova.

A sum of parts valuation points to a 40% upside from here

Moving forward, I will conduct Amazon’s valuation based on my underlying assumption for each of its business segments. I believe a “sum of parts” valuation method like the one I am about to show you will allow me more control over my assumptions.

So, let’s begin.

Amazon’s North America and International segments are valued at $38/share and $16/share, respectively

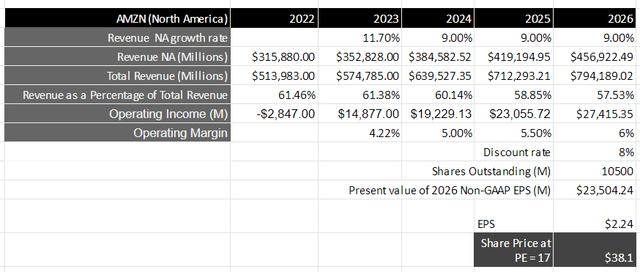

America’s North America business segment contributed roughly 61% to Total Revenue, growing at 11.7% YoY, with a little over 4% in operating margin in FY23. Meanwhile, its International segment grew at a similar rate to its North America segment, contributing 22% of Total Revenue, with a margin of -2.2%.

Note that this segment consists of revenue from its Online Stores, Physical Stores, Third-party seller services, Advertising Services and Subscription Services in North America and its International markets.

In the coming years, I expect Amazon to continue to maintain its leadership as the largest e-commerce platform, as customers worldwide buy more frequently with larger order values. This is given its commitment to broaden its selection of products at low prices and improve delivery speeds through fulfillment center optimization and investment in robotics, reducing overall cost to serve.

Meanwhile, I also expect its Ads business to grow at an increasing pace. This will be driven by sponsored ads and Prime Video, as it can direct higher advertiser spend in the coming years given its purchase data and high-intent audience, while simultaneously investing in its content catalog on Prime Video.

This should translate to Amazon’s North America segment growing in the high single digits, while its International revenue segment grows in the low teens until FY26 to generate $456.92B and $184.3B, respectively. Note, during this period of time, the contribution to overall revenue from North America will have decreased from 61.38% in FY23 to 57.5%, driven primarily by outperformance on its AWS segment (that I discuss below), while its International segment’s contribution increases by 100 basis points.

From a profitability standpoint, I expect operating margin from its North America segment to expand by at least 50 basis points every year to 6% by FY26. This is driven by optimization in its fulfillment centers and innovation in robotics leading to low cost to serve, along with Advertising Revenue growing as a higher share of Total Revenue. Similarly, I also believe that its International segment will turn profitable with a margin of 4% during this period of time.

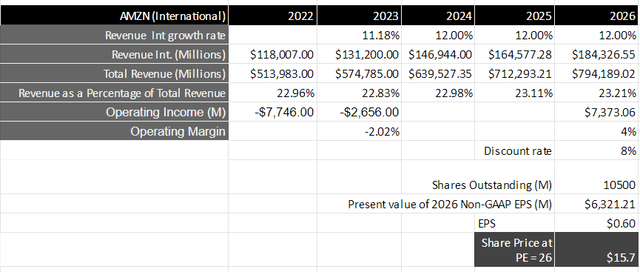

Assigning a price-to-earnings multiple of 17 and 26 to its North America and International segments, respectively, we arrive at a price target of $38 and $17 per share, respectively, for these two segments.

Note that for benchmark purposes, the average multiple of the S&P 500 (SP500) is between 15 and 18, with its companies growing their earnings on average by 8% over a 10-year period.

Author’s Valuation Model: North America Segment Author’s Valuation Model: International Segment

Amazon’s AWS valued at $266/share

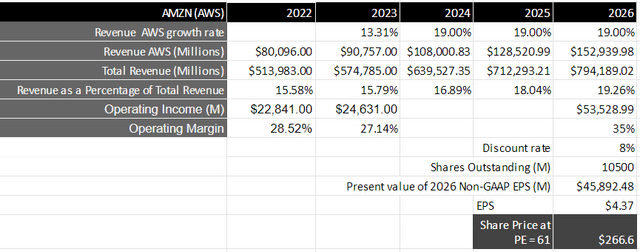

Shifting our focus to Amazon’s AWS segment, I believe that it will be able to sustain its revenue growth in the high teens range over the next 2 years beyond FY24 to generate $152.939B by FY26. Especially as companies invest their resources towards modernizing their infrastructure from on-premise to the cloud while unlocking scalable AI use cases that require large-scale deployment of AI workloads, I believe that Amazon is well positioned to deliver enterprise-ready solutions with its product innovation roadmap across the Infrastructure, Model (Bedrock) and Application layer by putting Nova at the cornerstone of its AI strategy. Note, that during the contribution of AWS to overall revenue, it will have expanded from 15.79% in FY23 to above 19% in FY26.

From a profitability standpoint, while Amazon has a year-to-date operating margin of 37% on its AWS segment, I will take a more conservative estimate for operating margin in FY26, given its capex and the associated depreciation costs. Therefore, assuming that operating margin shrinks from its year-to-date levels to 35% by FY26, Amazon’s AWS segment will have generated $53.5B in operating income, which will be equivalent to a present value of $45.89B when discounted at 8%.

Assigning it a price-to-earnings multiple that is 3.5 times higher than the average S&P 500 multiple, given the growth rate of its earnings during this period of time, we arrive at a price target of $266.

Author’s Valuation Model: AWS Segment

Adding the price targets from its North America, International, and AWS amounts to $320 per share; that represents an upside of 38% from its current levels.

My final verdict and conclusions

In my previous post, I had initiated a “buy” rating on Amazon with a price target of $237, which represented an upside of 25% from the price at publication.

As an existing investor, I needed to reassess my price target as the stock is up over 22% during this period of time, closing in on my previous price target.

In my analysis, we saw that there is room for margin expansion in its North America and International business segments, especially as costs to serve decline from optimizing fulfillment center designs and investing in automation to improve efficiency gains. Meanwhile, I also believe that a growing Ads business will help shield both the top and bottom lines of its North America and International business segments should there be a macroeconomic slowdown.

However, it is the AWS business segment that is doing most of the heavy lifting when it comes to determining the price target. With Amazon’s product innovation roadmap across its three macro layers of its AI stack, while positioning Nova as the cornerstone of its AI strategy, I believe it will unleash a wave of enterprise AI adoption. This is given its dominance in cloud computing and the improving economics of large-scale AI deployment.

As a result, I do not expect a slowdown in its AWS segment and remain bullish on Amazon, by reiterating my “buy” rating with a price target of $320.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.