Summary:

- Canoo is running out of cash, with $5.7 million in cash & short-term investments and a $43 Mln loss. I think the company will face issues in raising more funds.

- Canoo raised $383 million in net debt and $304 million through stock issuance since Q1 2022, while burning nearly $1 billion in cash.

- Despite years of capital raises, Canoo is still not disclosing production numbers or car shipments, and faces operational inefficiencies.

- Management has expressed “substantial doubt” about continuing operations in the latest 10K, with limited financing options and dwindling retail investor interest.

- Shorting Canoo or using long puts offers potential but carries high risks due to the stock’s volatility and illiquidity. I rate Canoo a STRONG SELL.

J Studios

I believe Canoo Inc. (NASDAQ:GOEV) is facing significant financial distress, which could lead to a further decline in its stock price and possibly put at risk the survival of the company. In this article, I will explore recent developments that lead me to this conclusion and examine the dire financial state of a company that has historically relied heavily on shareholder dilution and excessive debt to fund a capital intensive business which has so far failed to produce any EV at scale.

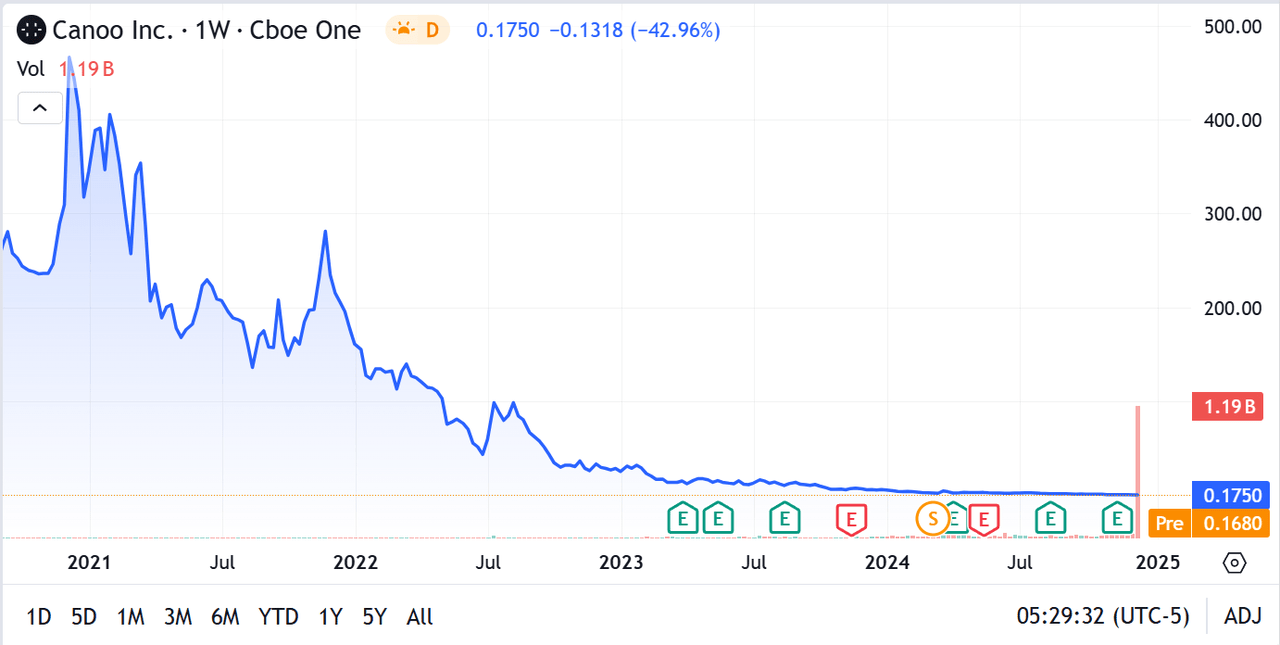

Canoo – from $ 347 to $ 0.17 (Seeking Alpha)

This article is part of Seeking Alpha’s ‘Top 2025 Long/Short Idea’ competition, as Canoo represents in my opinion an intriguing short position (or long put opportunity, as I will outline later).

I covered Canoo in June of this year, arguing how the company has an interesting product, but lacks any credibility in executing its strategy. I have also covered other EV and traditional automakers, which readers can find on my profile.

Understanding Canoo’s runway

Canoo reported a loss of $43.1 million in Operating Income for the three months ending September 30, 2024, consistent with the negative Operating Income from the prior quarter.

The company’s cash and short-term investments currently total $5.7 million, with an additional $800,000 in accounts receivable—approximately half the amount reported in the previous quarter.

When evaluating unprofitable, capital-intensive startups like Canoo, I prefer using metrics commonly employed in the Venture Capital industry rather than those suited for profitable companies. One key metric I focus on is the “runway”—the length of time a company can sustain its operations with available cash.

A company’s runway is calculated with the following simple formula:

Runway (months) = Cash Balance / Monthly Burn Rate

Canoo has $5.7 Million in cash and short-term investments, and it is burning roughly $15 Million per month, based on its latest quarterly earnings. Based on what Canoo has on its balance sheet as of its latest earnings, the company has a runway of less than 2 weeks:

- Canoo’s Runway (Q3 balance sheet figures) = 5.7 / 15 = 0.38 months (~11 days)

Accounting for a further $12 Million credit facility that management discussed in its latest earnings (and that I will cover later), Canoo’s runway grows to 5 weeks:

- Canoo’s Runway (with announced funding) = 17.7 / 15 = 1.18 months (~5 weeks)

Accounting for a further $45 Million Convertible Stock Purchase Agreement (which again, I will cover later), Canoo’s runway grows to 18 weeks:

- Canoo’s Runway (with announced funding and stock agreement) = 62.7 / 15 = 4.18 months (~18 weeks)

To be clear – this is not the first time Canoo finds itself in a situation where it needs to raise cash, and quickly. The company might be able to find more funding than what they announced until the time of writing this article – something I will cover in the risk section. However, I do believe this time might be different as the company is running out of financing options and problems are compounding.

Was Canoo ever a viable business?

Historically, Canoo has heavily relied on raising capital to finance its operations. The company has achieved this in two ways:

-

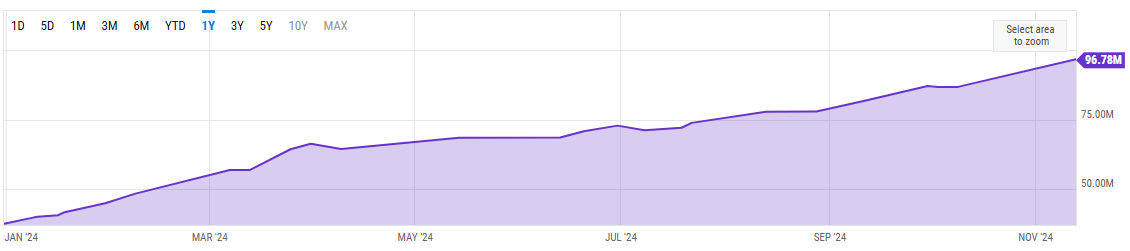

Issuing new shares. In 2024 alone, Canoo’s outstanding shares have increased 2.5 times, rising from just under 38 million to over 97 million shares, significantly diluting existing shareholders.

-

Incurring in short- and long-term debt. The company has accumulated nearly $80 million in total debt and an additional $81 million in accounts payable, reflecting its reliance on borrowed funds to finance its operations.

Shares outstanding, Canoo, 1Y (Companies Market Cap)

Based on Seeking Alpha Cash Flow data, Canoo’s debt issuance since Q1 2022 totaled roughly $436.4 million, with net proceeds of $383.5 million after debt repayments. Stock issuance during the same time period, including both common and preferred, amounted to approximately $304.4 million. During this same period of time, Canoo burned a total of $935.5 Million.

Spending almost $1 Billion in 2 years might seem a lot of money at first glance, but it is worth reminding this is an automotive company. Automotive is a very capital-intensive business. For reference, during the same time frame, Lucid Group, Inc. (LCID) has burned $10.9 Billion in cash, partially financed by issuance of new shares worth $6.4 Billion. Rivian Automotive, Inc. (RIVN), another young automaker, spent $19.7 Billion in the same time period.

This stark difference in cash burn between Canoo and other EV startups, in my view, represents a red flag that the company has never actually built a viable and scalable business. This worry is compounded by the fact that Canoo only shipped 22 vehicles in 2023, and still does not release official figures about shipments.

While Canoo avoids disclosing the number of vehicles it has shipped (or plans to ship), it frequently announces agreements with companies promising future purchases and production targets for its factories. Recent examples include deals with USPS and Kingbee.

In summary, Canoo is a company that has historically relied on heavily indebting and diluting shareholders to finance its capital-intensive operations. Despite this, the company has also fundamentally failed to prove it can actually create a viable mobility business, in my opinion.

Why this time might be different

I believe Canoo’s strategy of raising capital from shareholders to finance its capital-intensive operations is nearing its end. This belief is based on several developments that have surfaced in recent months, which I will outline in the following paragraphs.

Reason #1: retail interest has almost dried up

Historically, Canoo has relied on issuing new shares as one of the prime ways to finance itself. This, however, might no longer be the case very soon. Readers don’t need to take my word for it, but simply refer to one of Canoo’s recent press releases, where management states:

At this time, there are not present, by remote communication or by proxy, a sufficient number of shares of the Company’s common stock to constitute a quorum.

Canoo’s management has recently adjourned its last annual meeting to give more time to shareholders to vote on its proposals. This indicates, in my view, that such a heavily diluted and discouraged retail shareholders’ base is so disengaged with the company that it does not even bother to vote on its quarterly resolutions.

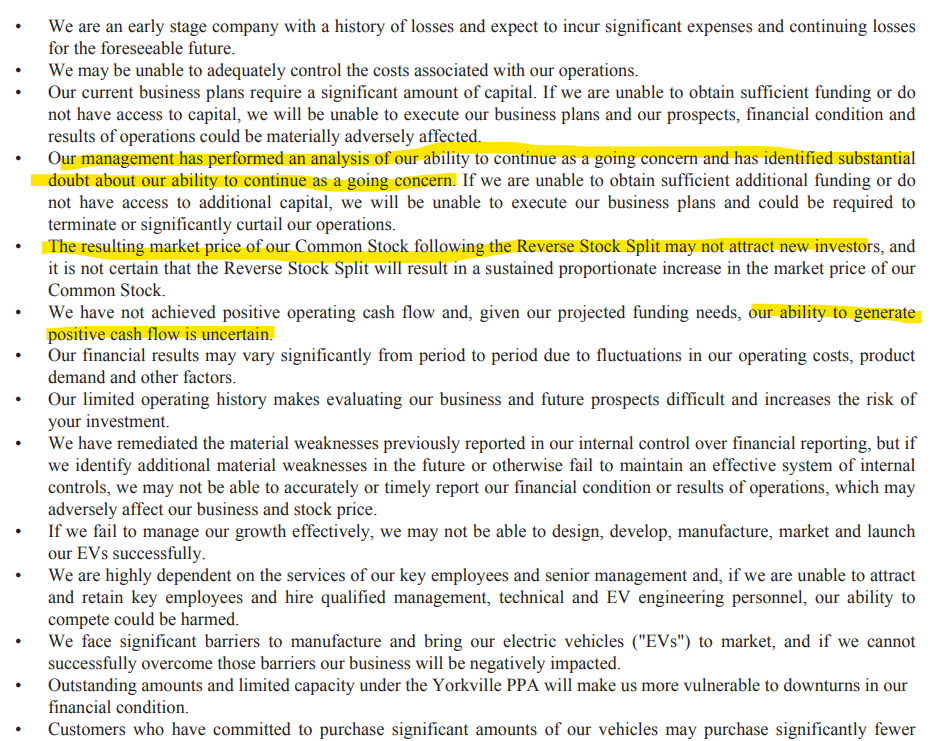

Readers who are not convinced yet of the fact Canoo will hardly find new investors to buy more of its stock can also refer to the company’s latest 10K, where management states:

The resulting market price of our Common Stock following the Reverse Stock Split may not attract new investors, and it is not certain that the Reverse Stock Split will result in a sustained proportionate increase in the market price of our Common Stock.

In other words, management is well aware that they will have a hard time finding retail investors buying stock in their company. I think the reason is fairly simple: everyone is catching up with the fact that Canoo’s business does not seem to be viable long term.

Reason #2: No specifics about future debt financing

The other way Canoo has historically financed itself—besides issuing new shares—is through various forms of debt.

In the latest earnings call, Kunal Bhalla, Canoo’s new CFO, stated that the company secured a $12 million credit facility during the past quarter. However, management did not specify whether this has already been fully utilized or not.

Additionally, CEO Tony Aquila mentioned ongoing discussions with Tier 1 banks about purchase order financing (borrowing against confirmed customer purchase orders). However, once again, no specific timelines or amounts were disclosed.

Overall, I find it concerning that management provided no clear details about future debt financing plans, instead focusing on past achievements. In my view, this may reflect limited financing options available in the upcoming months.

The only other financing option I found from Canoo is a $45 million convertible preferred stock purchase agreement announced in late October. While this could provide significant funding and could help Canoo survive another quarter, it is not debt-related but rather a dilutive measure for existing shareholders. The agreement allows an undisclosed “foreign institutional investor” to purchase up to $45 million in preferred stock.

What I find particularly concerning is that management made no mention of this deal during their earnings call, despite its size.

Reason #3: Management is disclosing concerns about their ability to continue running the business

Canoo’s latest 10K report offers other insights on what management sees as key risks of running this company. I am particularly worried by the following statements:

Our management has performed an analysis of our ability to continue as a going concern and has identified substantial doubt about our ability to continue as a going concern.

[…]

We have not achieved positive operating cash flow and, given our projected funding needs, our ability to generate positive cash flow is uncertain.

When management tells investors they have “substantial doubt” and the company’s ability to generate a positive cash flow is “uncertain”, I choose to believe them.

Extract from Canoo’s last 10K (Canoo’s 10K)

There are several more interesting statements in Canoo’s latest 10K, indicating in my view how management acknowledges the risks the company is facing. The picture above provides a snapshot of some of these statements.

Reason #4: No turnaround plan in sight and founders abandoning ship

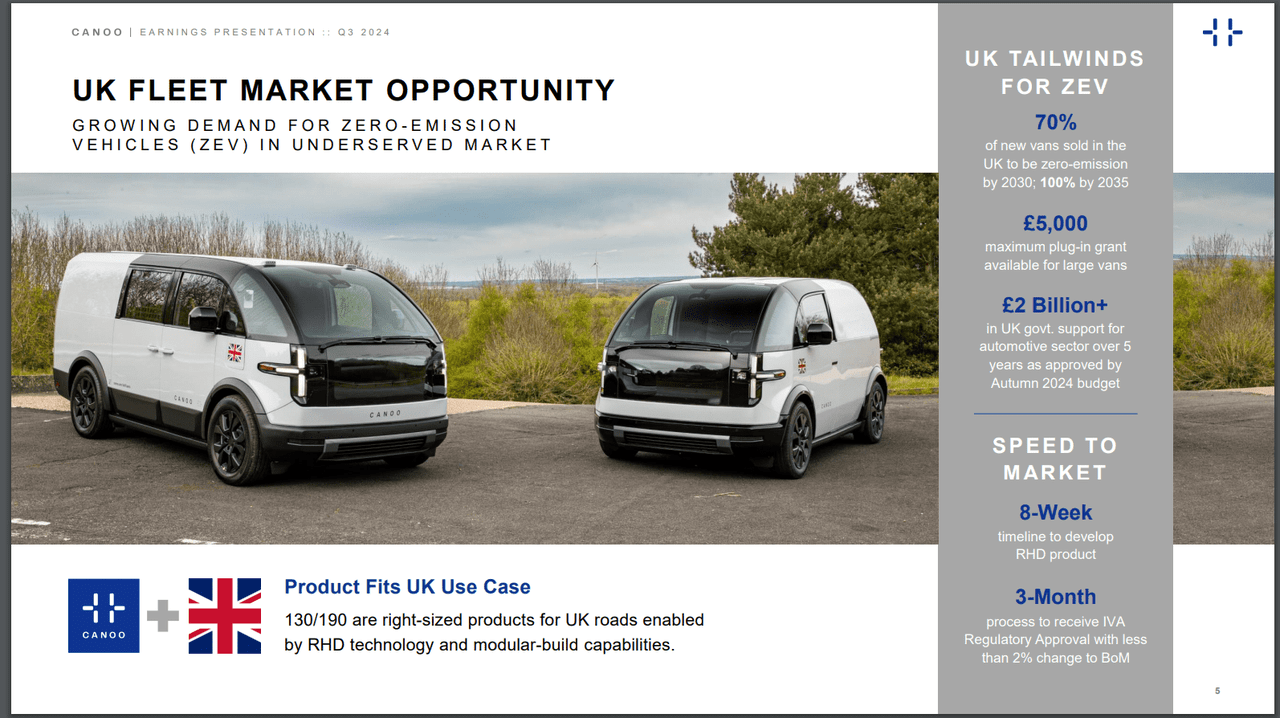

Canoo’s latest shareholders’ presentation struck me for how short and generic it felt. The deck is only 10 pages long, with only 3 slides dedicated to strategy. These three pages are focused on Canoo’s supposed international expansion to the UK, with fairly generic information about the growing demand for EV trucks in the country, and the opportunity that this represents for Canoo.

Extract from Canoo’s latest shareholders deck (Canoo’s website)

I view this deck as yet another major red flag. Canoo should not be discussing international expansion when it has yet to successfully produce and sell EVs at scale in the US market. Instead, I would have preferred to see management provide clear timelines for fulfilling existing orders from clients like USPS and Kingbee.

I believe it is also worth noting that Canoo’s last founder left in late September, together with the company’s CFO and top lawyer.

No free lunch: how a Long Put trade with Canoo might look like

Canoo’s shares saw a 35% spike on December 12th, 2024. The reasons for this surge are up to anyone’s interpretation, as no significant news about the company emerged on that day to justify the move. It is also worth noting that with a market cap of just $14 million, the stock is highly susceptible to sharp fluctuations when even a small amount of capital flows into it.

Readers may wonder how they could capitalize on Canoo’s current stock rally, and considering the company’s financial woes. In the following paragraphs, I will outline how long puts could be utilized for this trade. While this is not the only possible approach—shorting the stock is another option—I will use long puts as an example. As noted in the risk section, I strongly advise that only investors experienced with options consider this strategy.

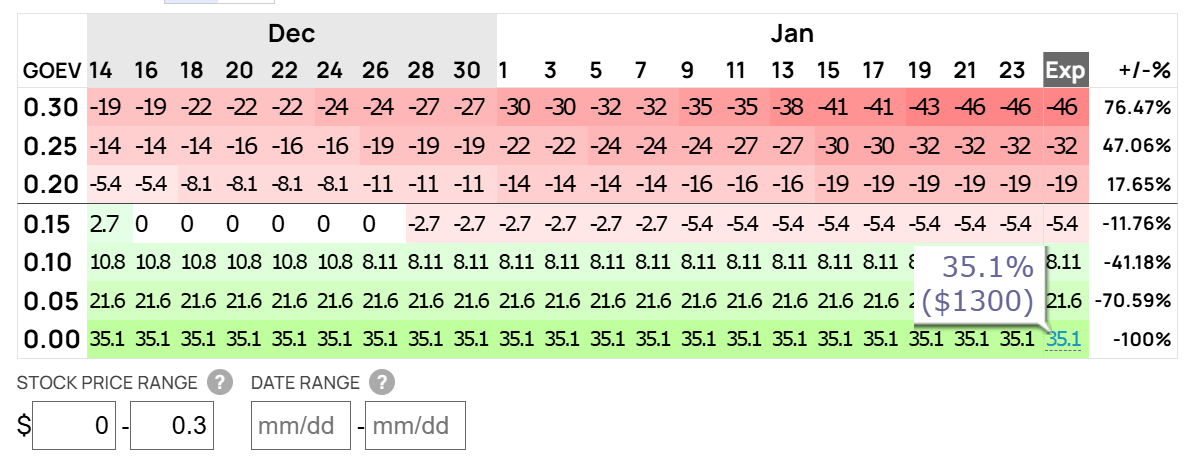

Canoo’s stock options are relatively illiquid, and the market is already pricing in the likelihood of the company facing significant shareholder dilution in the coming months. After reviewing the available long put options for GOEV, I see only two viable strategies to approach this trade.

Long Puts on Canoo – Option 1 (Options profit calculator)

The first one is to buy Long Puts with expiration dates in January 2025. For example, 24th Jan 2025 with a $0.50 strike price, as shown in the image above. This trade has a potential upside of around 30%, should the stock drop from its current price to $0.01. Given the fact Canoo has performed a reverse stock split in the past, I don’t think this is an unlikely scenario.

This is the riskier of the two strategies, as Canoo could secure new financing before January, potentially causing another spike in the stock price, similar to the one seen in early December, which could lead to significant losses.

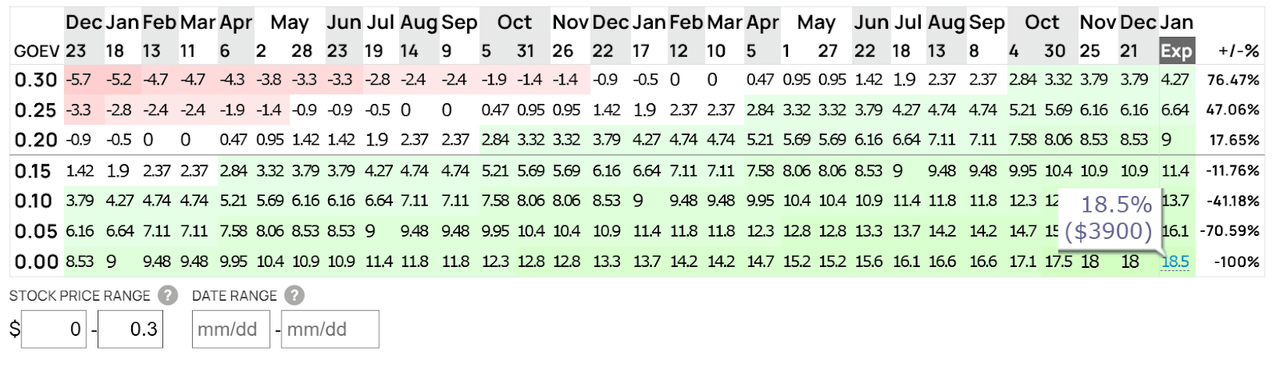

Long Puts on Canoo – Option 2 (Options profit calculator)

The other option is to buy LEAPS. For example, buying Long Put Options with expiration in Jan 2027. This trade has an upside of up to 18.5% at the time of writing, and it is relatively less risky as today it seems unlikely the company will be able to survive for another two years.

In both cases, the upside is relatively limited because the market is discounting Canoo’s dire financial situation and pricing for Long Put options takes that into account. Yet, I, personally, found long puts preferable to shorting the stock, due to the more limited risk exposure.

Risks to my thesis

Trading long put options or shorting a stock, particularly one like Canoo, carries significant risks. As a highly volatile micro-cap stock with a market cap of only $14 million, GOEV is prone to large, unpredictable price swings that can quickly erode the value of put options or lead to substantial losses in a short position.

Additionally, the illiquidity of GOEV’s options market can result in wider bid-ask spreads, making it costly to enter or exit trades. Shorting the stock outright is even riskier, as potential losses are theoretically unlimited if the stock price surges, driven by speculative activity or unexpected positive news, such as securing new financing.

These factors make trading in GOEV particularly hazardous, requiring careful risk management and a willingness to accept significant downside risks.

I believe that only investors who are highly experienced and confident in shorting stocks should consider this trade. Personally, I will not enter a short position on Canoo, as it goes against my investment principles. Avoiding such a position also ensures that there is no perception of a conflict of interest in writing this article.

An additional risk of holding a long put option is if Canoo ceases operations and its stock becomes delisted. In such cases, while the stock price may drop to near-zero, the illiquidity of the market can make it difficult to close the position, as there might be no buyers for the option. This could prevent investors from fully capitalizing on the expected decline in value. Furthermore, the process of liquidation following ceasing operations can be unpredictable, and the timing of settlements may not align with the expiration of the option, potentially leaving the trade worthless despite the anticipated outcome.

Finally, while this article focuses on buying long puts as an example of how to benefit from the current situation, there may be alternative approaches that I have not covered. Some of these strategies could potentially be more efficient or better suited to individual risk profiles and market conditions.

Conclusion

In this article, I have focused on the key facts and financial metrics surrounding Canoo. Based on these, I do not believe the company can survive much longer. Despite years of raising capital and engaging in questionable investments, Canoo has fundamentally failed to bring its EVs to market at scale or shown a realistic path to becoming a functioning, profitable mobility company.

While shorting the stock should only be considered by experienced investors who have thoroughly researched the company, I assign Canoo a STRONG SELL rating.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is for informational purposes only and does not constitute financial advice. Shorting stocks carries significant risks and can lead to losses exceeding the capital invested. While I believe Canoo is in significant financial distress, a single positive catalyst—such as securing new financing—could temporarily boost the stock and result in substantial losses for short sellers. I strongly recommend that only experienced investors consider any trade on Canoo at these levels.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.