Summary:

- XELA, a highly geared company has been making good progress with its deleveraging initiatives.

- The company entered the SMB market in late 2020 and its offerings there are witnessing good traction.

- Valuations are cheap and the technical picture looks encouraging.

designer491/iStock via Getty Images

Introduction

Exela Technologies Inc. (NASDAQ:XELA) is a well-known player in the global business process management solutions market which is estimated to be worth over $200bn (TAM). The company’s raison d’etre is to streamline complex and disconnected processes and accelerate the digital transformation of over 4000+ global clients. The company has solid pedigree and credentials in this space and is one of the leading global providers of digital mailroom solutions; it is also one of the largest “non-bank” processors of payments.

The company is also fairly diversified in its end market exposure- banking accounts for 27% of group revenue, healthcare accounts for 23%, insurance accounts for 10%, public sector accounts for 9%, and the rest comes from areas such as manufacturing and tech, legal, etc. XELA predominantly serves American-based clients but as these clients explore global markets, XELA too has made gradual inroads into the EMEA and Asian markets.

Deleveraging progress will weigh heavily on share price movement

Regardless of how you feel about the broad BPM market and how Exela is positioned here, there’s no getting around the fact that this is a highly geared company, quite unlike a lot of its peers. Just to put things into perspective, the company’s debt to total capital stands at 175%, the highest within Seeking Alpha’s data processing and outsourcing coverage, which includes 54 other companies! Unsurprisingly, even though XELA has an Enterprise Value of over $1.6bn, only 17% of this comes from XELA’s market-cap of equity shares.

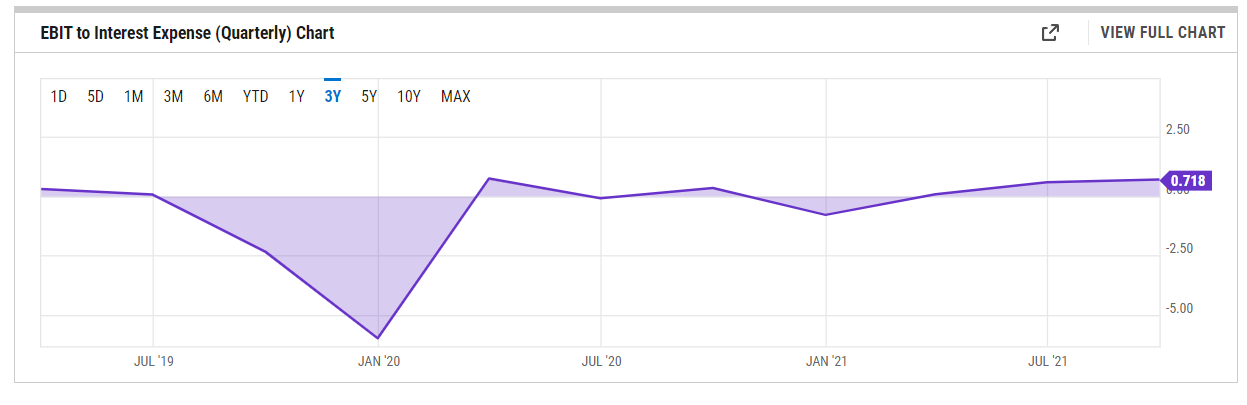

Having a sizeable debt component in your capital structure does not necessarily have to be a bad thing if you can generate ample EBIT to cover your interest expense, but that does not appear to be the case with XELA. Since 2019 the company typically generates quarterly interest expenses to the tune of $40-$50m, but the interest coverage ratio has never quite been able to exceed even 1x.

YCharts

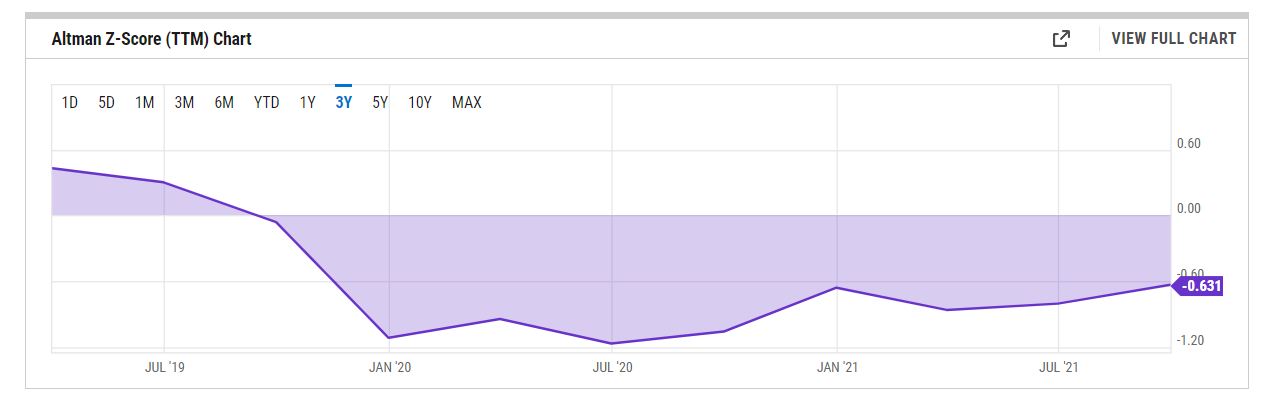

The weak EBIT dynamics coupled with an elevated debt profile has pushed XELA’s Altman Z score into a worrying zone below 0. For the uninitiated, a score of less than 1.8 points to heightened probability of bankruptcy financial distress.

YCharts

So, is this a total washout? Not quite, in fact there have been some encouraging developments to reduce the level of gearing and boost the liquidity profile.

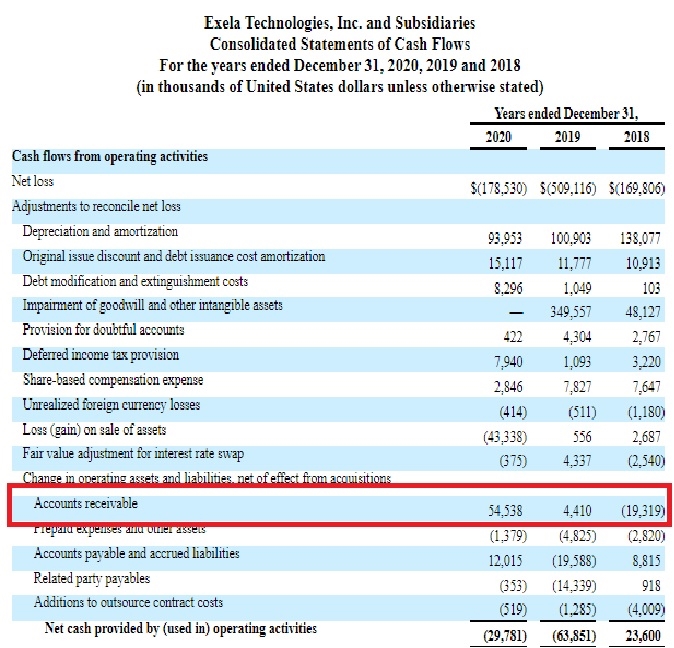

Net debt which stood at $1.56bn levels in FY19 and FY20 has come down by 12% and currently stands at $1.37bn. Through measures ranging from debt repurchases in the open market, equity issuances, and refinancing the debt, the company plans to bring the net debt down to $1bn. Over recent years, they’ve also gotten into an accounts receivable securitization program which has helped improve the liquidity position (even as of 9M-21 change in receivables contributed $14.4m of cash).

Annual Report

Now looking ahead to 2022, XELA plans to bring through additional cash inflow of $50m; 25% of this would come on account of lower lease and facility costs and the rest would come from lower interest and loan amortizations. Considering that XELA is currently incurring $40-$50m worth of interest expenses per quarter, these fresh $12.5m of savings per quarter will be very useful in improving the interest coverage ratio.

XELA has also been attempting to cash in on non-core assets. In 2020, they sold two units and currently have a number of units up for sale. For instance, one business that I think would make great sense to exit is their proprietary Human Capital Management (HCM) or Recruit-to-retire platform. Not only would this help with liquidity, it could also help galvanize the companies cost base and revenue per employee metric which is really quite relevant when comparing various data processors and outsourcers. In 2019, XELA had moved the bulk of its employee base to their HCM platform. Although not strictly comparable, note that XELA’s revenue per employee metric of ~$69k as of 2020, lags the likes of PAYS and BMTX. Thus, stake sales such as this could potentially act as a key trigger for the stock.

Recent pivot towards the SMB market is paying off

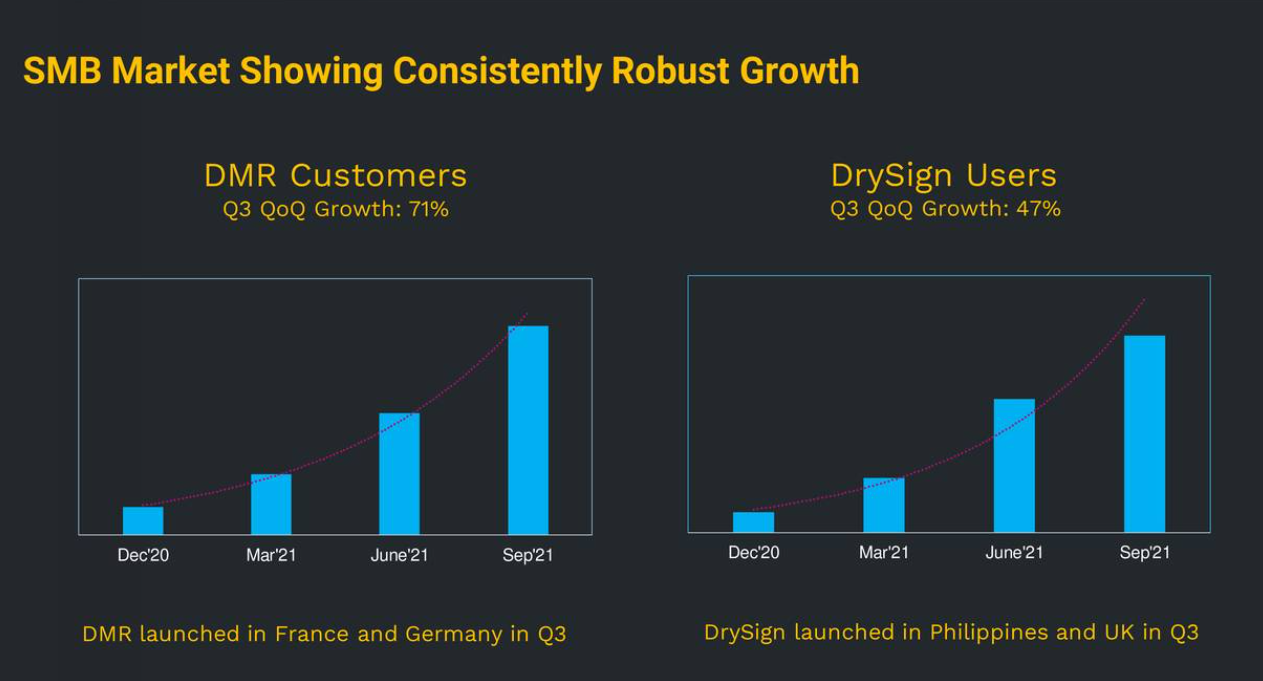

I also want to highlight the company’s recent pivot towards the SMB (Small and medium businesses) space which is something of an underappreciated element in the overall XELA story. Until late 2020, XELA’s value proposition was previously largely oriented towards large companies that were looking for BPM experts to help accelerate digital transformation. Over the last 12-18 months, we’ve seen significant traction within SMB clients who have signed up for XELA’s digital mailroom (DMR) offering. In Q3, SMB clients signing up for DMR was up 71%. XELA’s DMR offering was recently launched in the German and French markets and they now intend to bring through a cloud-based online notarization platform which should help bring through greater conversion of SMB clients.

Q3-21 earnings presentation

Also note that a higher utilization of SMB related offerings such as DMR and DrySign will likely boost the overall gross margin picture of XELA as they come under the high margin Digital Assets Group (DAG). Separately also consider that despite revenue attrition of $106m as of 9M-21, XELA’s gross profit is up by $9m and the 9M GMs are up by over 360bps!

Encouraging technical picture backed by insider purchases

Relative to other micro-cap stocks the XELA stock appears to offer an interesting risk-reward picture. Over the last two years, XELA’s performance relative to IWC (an ETF that covers micro-cap stocks) has tended to fluctuate between the 0.008-0.03 levels; currently, the stock trades below this range and offers some intriguing possibilities for bargain-hunters.

Stockcharts

In addition to this, you also have strong bullish momentum that has recently visited the XELA share counter; over the last two weeks, we’ve seen two relatively strong green-bodied candles that have seen the stock break out of its descending triangle pattern. Interestingly this is also backed by exceptionally strong volumes which have been well over the long-term weekly average.

Trading View

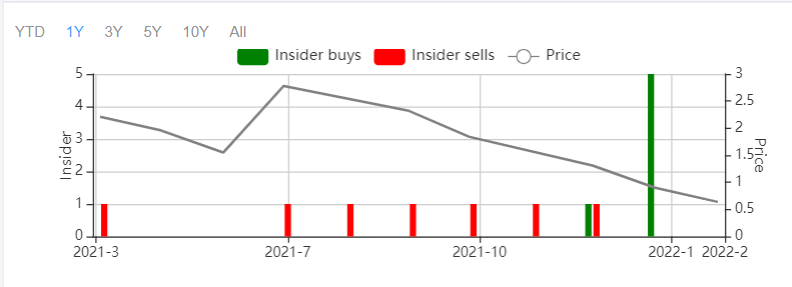

It’s also worth noting that after months of selling, notable insiders began purchasing shares a couple of months ago; this doesn’t necessarily have to connote anything of significance but it’s encouraging to see them put their money where their mouths are.

Guru Focus

Fairly ambivalent about the recently announced buyback program

Separately, also note that the company has recently initiated a buyback program whereby they propose to retire 30% of the share count, in exchange for tradable $25 notes (at 6% interest) that are due to expire in 2029. I’m not overly excited about something like this as I would like companies to get their operations in line before venturing towards buybacks (as per YCharts estimates, XELA is still expected to post losses for the next two years).

Also, the notes exchanged will first be traded on an OTC market for a brief period and there’s no guarantee about the liquidity on offer here. There are also question marks over the overall appetite for a program like this; I say this because when they first announced the program on 26th Jan, the price on offer was $1; ostensibly the interest for this program has been below par, and this has prompted them to boost the offer price even further to $1.25 a couple of days back.

XELA has history of resorting to unconventional measures to boost the share price; a year ago they had resorted to a 1 for 3 reverse stock split program to reduce Nasdaq delisting risks.

XELA’s Valuations are cheap, given underlying revenue dynamics ahead

XELA’s Q3 revenue of less than $280m (down 8.5% YoY) was the weakest it’s been in years and investors can be forgiven for feeling wary on account of this, but I’d like to believe that the Q3 performance may prove to be a bottom.

There were also some mitigating factors to consider; firstly, there’s around $30m of sales attrition linked to the disposal of non-core businesses (Physical records storage and logistics business + SourceHOV Tax) in 2020. Then seasonality-related issues tied to the EMEA region and their healthcare business too played their part, as did weak onsite utilizations which came through on account of COVID restrictions (COVID impact on revenue is closer to $90m). Finally, you also had some uncertainties and delays tied to the Federal government budgeting process. Most of these factors are expected to normalize within the next 12-18 months.

Also consider that some of the other underlying metrics are still reflecting relatively strong demand for XELA’s services; for instance, in Q3, the expansion of existing contracts was up 21% YoY and 17% QoQ, whilst the sales pipeline was up 10.5% YoY or 4.6% QoQ. This will likely translate to impressive revenue figures going forward. Also note that the company has been rapidly transitioning its customer base towards cloud-hosted digital platforms, and benefits of this will be seen this year (almost all of XELA’s customers will be on cloud this year, up from 30% levels at the end of last year).

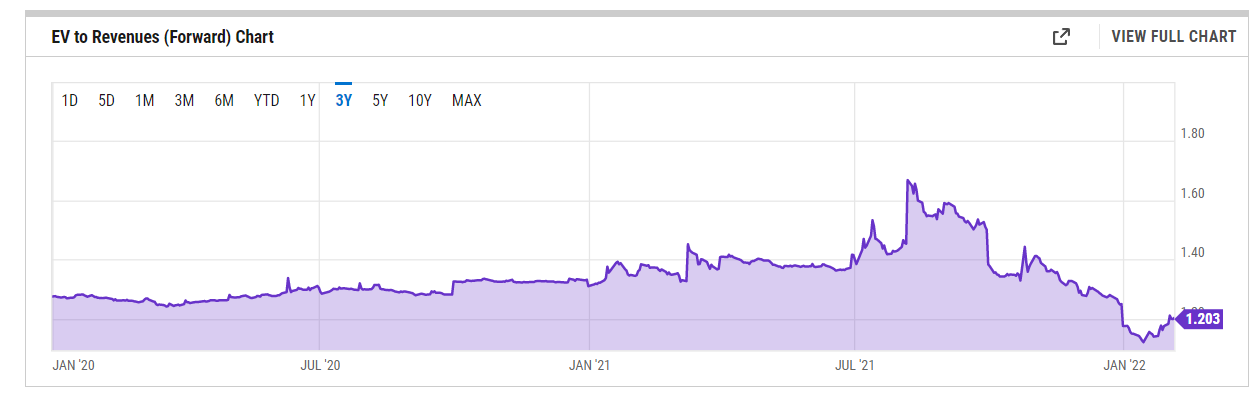

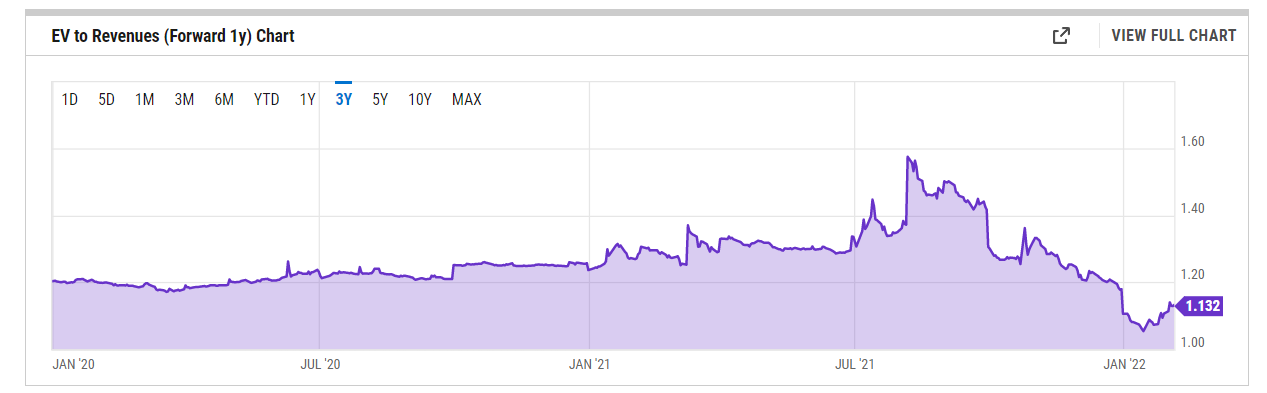

Thus, if you look at YCharts revenue estimates over the next two years, you’re looking at a company that will first deliver 3% annual growth in 2022, followed by over 6% growth in 2023. Sure, single-digit rates of this sort may not be pulling up any trees, but the forward EV/sales multiples over the next two years appear to be far too cheap to ignore. Against the 2022 estimated revenue number, the stock only trades at an EV multiple of 1.2x, lower than the long-term average of 1.34x; similarly, against the 2023 estimated revenue number you’re looking at a multiple of only 1.13x, lower than the long-term average of 1.26x.

YCharts

YCharts

Even in relation to other data processors and outsourcers, the XELA stock appears to be cheap; on a trailing EV/sales basis, the stock only trades at 1.4x, well below the sector average of 4.8x.

Closing thoughts- Is Exela Technologies A Buy, Sell, Or Hold?

Given the significant gearing risks and risks tied to potential delisting, I would recommend XELA only for investors who have the propensity for aggressive risk. The company’s deleveraging plan is progressing well and the operational backdrop also looks more promising after a difficult few quarters. Valuations are cheap and the technical picture looks encouraging as well. XELA is a Buy for investors with aggressive risk appetite.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.