Summary:

- Tesla, Inc. stock continues to trade at all-time highs with increased confidence in its autonomous mobility future under the Trump administration.

- While TSLA stock’s ballooning valuation premium leaves little room to absorb for impending execution risks in FSD and robotaxi, it’d be shortsighted to completely dismiss related prospects.

- The following analysis will provide clarity on drivers of Tesla’s valuation today and gauge whether there are permitting catalysts that can take it another leg higher from here.

Sundry Photography

The Tesla, Inc. (NASDAQ:TSLA) has continued to surprise investors with a relentless rally towards new all-time highs. Interest in the company’s proprietary Full Self-Driving (“FSD”) technology and robotaxi developments have soared to record levels as well. While the 10/10 “We Robot” launch event was met with mixed feelings from markets, it had eventually benefited from a catalytic effect when complemented by a subsequent Trump U.S. presidency win.

Much of the stock’s rally is reflective of increasing confidence in Tesla’s future opportunities in autonomous mobility. The following analysis will go through a reverse engineering exercise to gauge what the stock’s ballooning valuation implies and where it’ll go from here.

Our base case view is that Tesla’s potentially overextended its rally based on substantial fundamental prospects. But a fast-tracked global rollout of Unsupervised FSD, alongside regulatory support under the incoming Trump administration, could be supportive of an upside scenario that’d underpin a further upsurge from current levels.

Why Has Tesla Been a Key “Trump Trade”?

In addition to crypto stocks, Tesla has also been a key beneficiary of the Trump trade.

Trump’s presidency victory has effectively reinforced the market’s confidence that Tesla will become a key beneficiary of improved visibility into regulatory developments for the autonomous vehicle (“AV”) industry. And this tailwind hasn’t been pervasive for the broader cohort of AV technology developers, which is evident in continued volatility observed in names such as Luminar Technologies (LAZR) and Mobileye (MBLY), to name a few.

The reason for Tesla’s sole upsurge is complemented specifically by CEO Elon Musk’s tie-up with the Trump administration through an external advisory team coined “The Department of Government Efficiency” – or “DOGE”. Musk, who will be leading DOGE alongside Vivek Ramaswamy, has vowed to become Trump’s greatest ally in “Making America Great Again”. This will include substantial spending cuts and regulatory reforms to ensure improved efficiency within the federal government. Musk’s critical role under the Trump administration also effectively adds weight to the fact that FSD is currently one of the most popular ADAS/advanced AV technologies among few global competitors today.

Most importantly, Musk’s close ties with the Trump administration will improve prospects that current regulatory hurdles facing FSD/robotaxi’s go-to-market today can be further streamlined and addressed soon. This is crucial for Tesla, given autonomous mobility has been the crux of its valuation recently.

Our Predictions for FSD and Robotaxi

Essentially, the Tesla stock’s been trading today as if FSD and robotaxi have already been greenlighted for public general availability and full monetization. While that certainly isn’t the case yet, the improved regulatory set-up does represent a positive development for Tesla. This is already evident in the incoming Trump administration’s plans to remove a current requirement for crash reports involving an engaged autonomous driving system. The Trump administration has also prioritized the development of a federal framework for autonomous mobility as its first order of business. These two developments alone would be huge helps to the emerging technology’s eventual deployment going forward.

Trump’s presidency and the regulatory tailwinds it entails would primarily be additive for two of Tesla’s prospective revenue streams – namely, FSD and robotaxis. Automotive and energy generation and storage sales, however, are unlikely to materially deviate from their current growth prospects.

FSD

FSD’s gained substantial uptake and consumer awareness since Musk’s push for free trial deployments this year. The recent rollout of “Actually Smart Summon” (“ASS”), whereby owners can “summon” their Teslas to autonomously navigate their way to them within an enclosed parking lot or driveway, has also been in itself a positive marketing tool for the governing FSD software.

The key Trump trade thesis facing FSD is that the technology will benefit from potential regulatory tailwinds that’d underpin a speedier rollout and roadmap to full monetization. Recall, Musk has promised the rollout of Unsupervised FSD for Texas and potentially California by the end of 2025. And Trump’s prioritization of a federal AV regulatory framework could underpin a faster pace of nationwide go-to-market for the technology’s unsupervised alternative.

This is significant for Tesla because related regulatory progress would likely improve consumer acceptance of the nascent technology and bolster uptake. Tesla’s sold millions of its vehicles to date, with the U.S. being its primary market, contributing about 50% of the sale mix. Yet FSD uptake rates have comparatively been nominal still, with substantial headroom for penetration, depending on the pace of regulatory developments which remain key gatekeepers of adoption today.

Improved regulatory clarity for AV developments would also bolster Tesla’s ambitions to becoming the distribution leader of FSD licenses to third-party OEMs in the longer-term. This would be key to scaling deployment and enabling substantial margin expansion for FSD, given the margin cost of rolling out the software is practically near zero.

On a lesser extent, the broader approval of Unsupervised FSD would also allow Tesla to release deferred revenues on fixed license sales during earlier years of the technology’s rollout into PnL. Admittedly, fixed FSD license uptake has been overshadowed by increased consumer preference for monthly subscriptions instead recently. But deferred revenues related to FSD license sales have likely approached $3 billion based on Tesla’s latest financial disclosures, which can be a beneficial one-time boost to growth in the near-term.

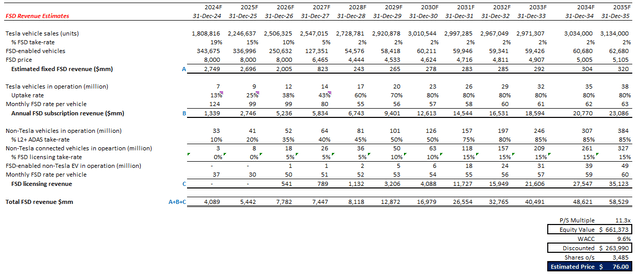

Given these considerations, we expect total FSD revenue to expand at a 27% 10-year CAGR to $58.5 billion by 2035. This would consist of revenues generated from the sale of fixed FSD licenses to individual car owners, monthly FSD subscriptions, and fixed FSD licenses to third-party OEMs.

By applying an 11.3x multiple on projected 2035 FSD revenues, discounted back at a WACC of 9.6%, the business yields an estimated intrinsic value of about $264 billion. The valuation assumptions applied are consistent with the average multiple observed across comparable high-growth, high margin software names, and considers Tesla’s capital structure and risk profile. This would put the business at about $76 per share based on Tesla’s outstanding diluted share count of about 3.5 million.

Robotaxis

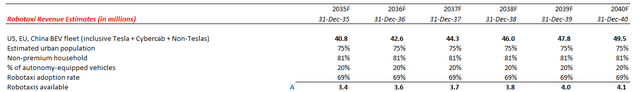

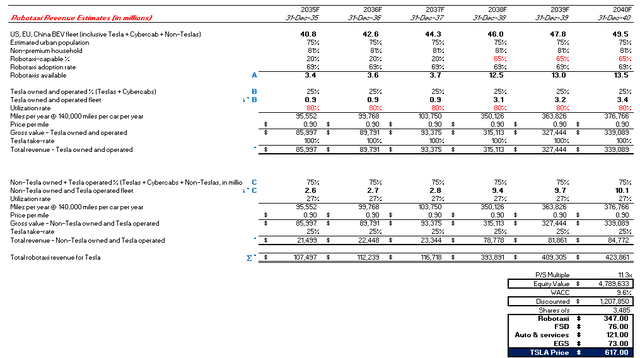

Greenlighting FSD would inadvertently mean robotaxi monetization will closely follow. Robotaxis can be meaningfully monetized by Tesla in two ways – i) a Tesla owned and operated fleet, and ii) a non-Tesla-owned, but Tesla operated fleet. Key industry assumptions for the prospective robotaxi business today includes an average utilization rate of about 70%, travelled distance of about 140,000 miles per car per year, and revenue of about $0.90 per mile travelled.

We predict the total number of robotaxis available over the forecast period by considering key factors such as:

- The estimated urban population in key operating regions (U.S.; EU; China): This is consistent with expectations that only the urban population would be receptive of connected vehicles and in need of autonomous transportation

- The percentage of non-premium households: This considers that only non-premium households would consider putting their privately owned vehicles up for robotaxi services. It’s likely that more affluent individuals would want to keep their autonomous vehicles for private use. This is similar to the thinking behind private car ownership and participation in offering ride-hailing services today.

- The percentage of autonomy-equipped vehicles: Industry currently predicts a 1:5 ratio of autonomous vs. traditional passenger vehicles on the roads when the nascent technology reaches general availability. Tesla’s robotaxi business would only be able to monetize on autonomy-equipped vehicles in the future.

- Robotaxi adoption rate: This reflects the percentage of autonomous vehicle owners that’d actually be willing to put their cars up for robotaxi services to the public.

i. Tesla Owned and Operated Fleet.

The Tesla owned and operated robotaxi fleet would boast superior economics to the non-Tesla-owned, but Tesla operated fleet, despite it potentially being on the inferior side of global market share. The Tesla owned and operated fleet would consist fully of Tesla-owned vehicles deployed directly through its Robotaxi platform. The take-rate would be 100%, given the eliminated requirement to share revenues with car owners. This implies a 67% margin, considering industry’s expectations for robotaxi revenue to average $0.90 per mile and Musk’s predictions for Cybercab operations to cost $0.30 per mile at scale.

We forecast Tesla’s owned and operated fleet to account for 25% of the global robotaxi population. This is consistent with expectations that the majority of global passenger vehicle in operations will continue to be privately owned by individuals, even in a future where autonomous mobility and robotaxis exist. The prediction would equate to about 1 million Tesla owned and operated robotaxis, generating more than $91 billion in revenue by 2040.

ii. Non-Tesla-Owned but Tesla Operated Fleet

This cohort will represent the remainder of 75% of non-Tesla-owned robotaxis that’ll be operating on Tesla’s Robotaxi platform. These can either be Tesla branded or non-Tesla branded vehicles fitted with autonomous mobility technology, potentially FSD, given assumptions that the company will eventually license the technology to third-party OEMs.

We expect a utilization rate of 23% on the non-Tesla-owned, but Tesla operated robotaxi fleet. This represents 1/3 of the average 70% utilization rate expected by industry forecasts. The assumption considers expectations that the fleet’s run-time will be split simultaneously between multiple future robotaxi platforms, apart from Tesla’s when in operation. This is consistent with observations today that ride-hailing drivers are typically operating simultaneously on both Uber (UBER) and Lyft (LYFT) when engaged. The prediction would equate to about 3.1 million non-Tesla-owned, but Tesla operated robotaxis, generating about $23 billion in revenue by 2040.

Under these assumptions, Tesla’s Robotaxi platform is expected to grow into a $100+ billion business by 2040. By applying an 11.3x multiple to total projected 2040 robotaxi revenues, discounted at a WACC of 9.6%, the business yields an estimated intrinsic value of $325 billion, or $93 per share.

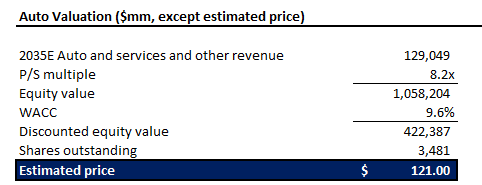

Automotive and Energy Generation and Storage

Automotive sales are expected to moderate going forward. Although we expect Tesla to benefit from an uplift in deliveries following the anticipated launch of a more affordable model in 2025, the related impact on revenues will be offset by a lower average selling price (“ASP”). We forecast auto and services revenue growth at a 2% 10-year CAGR to $129.0 billion by 2035.

By applying a 8x multiple on projected 2035 sales and discounted at a 9.6% WACC, the business yields an estimated intrinsic value of about $422.4 billion, or $121 per share. The valuation assumption applied on Tesla’s automotive business is consistent with the average observed across its comparable megacap peers’. This includes consideration of Apple’s (AAPL) current valuation as proxy, given it also boasts a single-digit long-term growth trajectory alongside a premium multiple due to its industry moat.

Author

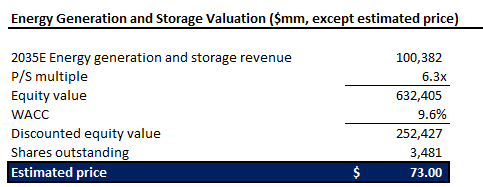

Meanwhile, Tesla’s energy generation and storage business is expected to be a key near-term growth driver. We forecast energy generation and storage revenue growth at a 20% 10-year CAGR to $100.4 billion by 2035. By applying a 6x multiple to projected 2035 sales and discounted, the business yields an estimated intrinsic value of about $252.4 billion, or $73 per share.

Author

Taken together, all of Tesla’s key arms of business are expected to boast a total worth of at least $1.3 trillion, or $363 per share under our base case assumptions. This represents downside of 24% compared to Tesla’s last traded price of $479.86 on December 17 close.

So How Do We Make Sense of Tesla’s All-Time-High?

In addition to the Trump trade, we believe General Motors’ (GM) shutdown of its Cruise autonomous mobility operations earlier this month is an additive tailwind for Tesla’s robotaxi business prospects. This has likely contributed to the Tesla stock’s upsurge to its current all-time high, given further reinforcement to increased confidence in its robotaxi ambitions.

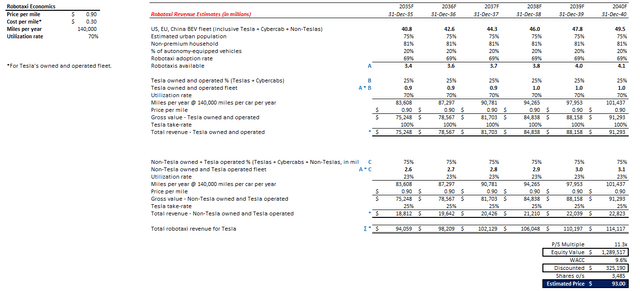

And while our base case predicts a 1:5 ratio of robotaxi-equipped vehicles vs. traditional cars by 2038, Tesla’s current stock price implies an about 1:3 ratio when combined with an increased utilization rate of 80% to reflect excess Cruise-related demand. These assumptions would yield robotaxi revenue growth to $257.3 billion by 2040, and boost our base case price from $363 to current market levels of about $480.

Can Tesla Go Higher From Here?

While these reverse-engineered assumptions aren’t reasonably substantial in our opinion, given potential room for competition in the future and other execution risks, it’d be shortsighted to fully dismiss them. Specifically, some industry surveys have shown as high as a 65% adoption rate for AVs vs. traditional cars over the next ten years. Many prospective buyers have cited regulatory approval and certified safety as the basis to their acceptance and adoption of the technology. These intentions would represent a whopping 2:3 ratio of robotaxi-equipped cars vs. traditional cars. When paired with an 80% utilization rate in our model assumptions, the combination could yield a robotaxi valuation of $1.2 trillion alone and take Tesla’s consolidated value to $617 per share.

Conclusion

It’s admittedly risky to chase Tesla at current eye-watering levels, nonetheless. Tesla’s robotaxi and FSD monetization prospects have indeed improved on the surface since Trump’s presidential victory. This is consistent with his advocated policies and intentions communicated to date from his administration that’d be beneficial and supportive of developments in autonomous mobility.

But Tesla’s nascent technology still faces a complex and challenging road to achieving mass market rollout and general availability. Moreover, the Trump tailwinds only address the U.S. market, which is only a sliver of the global opportunity currently priced into Tesla’s upsurge. These risks are accordingly reflected in our base case model assumptions. The estimated valuation attributable to Tesla’s robotaxi ambitions are generated based on further out prospects in 2040, reflecting the extended timeline of when the technology’s expected to gain public acceptance and general availability. Our base case assumptions also include comparatively modest assumptions relative to what the market’s been pricing in today.

That doesn’t mean the upside scenario’s completely out of the picture, though. Many consumers are still open to adopting the technology within the next ten years, as long it’s deemed safe and affordable. While the first part’s still undergoing a long trajectory of ongoing enhancements and fine-tuning, the latter part on affordability’s largely addressed. FSD prices are already on the way down, and will likely be lower in the future, given the nominal marginal cost of scaled rollout. Mass market adoption will also play a key role in driving FSD subscription prices down further – potentially to levels similar to utilities like internet subscriptions.

This would essentially represent a natural growth flywheel for Tesla – the lower the price, the greater the adoption, which then further improves the price to jumpstart additional uptake. While our base case price target suggests a wait-and-see approach on Tesla, Inc. stock today, the stock’s longer-term prospects still shouldn’t be completely dismissed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.