Summary:

- Tech stocks, including Cisco, are poised for a strong 2024, with Cisco showing robust growth in Cloud/AI and Security segments.

- Cisco’s Q1 results beat expectations with strong EPS and revenue, and product orders rising 20% year-on-year.

- I maintain a buy rating on CSCO stock, raising the price target to $68 due to improved earnings outlook and undervaluation compared to the tech sector.

- Key risks include weaker corporate spending, higher interest rates, and potential M&A slip-ups, but technical indicators suggest a generally healthy stock situation.

raisbeckfoto

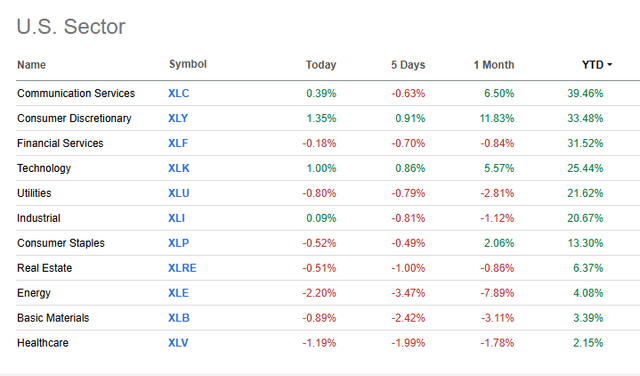

Year-end is in sight, and tech and tech-related stocks are primed to put in a second-consecutive banner year. The Information Technology sector ETF (XLK) is up more than 31% in 2024 – only Consumer Discretionary (XLY) and Communication Services (XLC) have outperformed. And the real story has been strength in the Megacap-8, with shares of Broadcom (AVGO) soaring by 38% in the two sessions following its quarterly report released last week.

Before it is curtains on 2024, I’m revisiting Cisco Systems (NASDAQ:CSCO), an often-overlooked large-cap tech name and a ‘Dog of the Dow.’ After a 24% return since my buy rating in July, and hitting the $60 mark just recently, I am raising my price target on this blue chip. I maintain a buy rating and will offer a refreshed view of the technical situation.

Tech Stocks Poised For A Big 2025

Back in November, Cisco reported a solid set of quarterly results. Q1 non-GAAP EPS of $0.91 beat the Wall Street consensus estimate of $0.87 while revenue of $13.8 billion, down about 6% from the same period a year earlier, was a modest $70 million beat. The firm reported a GAAP gross margin of 65.9% and a non-GAAP gross margin of 69.3%, above guidance levels previously given by the management team.

Cisco tallied product orders rising 20% on a year-on-year basis, though the increase was just 9% ex-Splunk. I pointed out in the summer that its Splunk asset would be a key growth driver.

As for the outlook, the management team saw Q2 revenue of $13.75-$13.95 billion, which was ahead of the consensus midpoint. As for the bottom line, GAAP EPS was seen in the $0.51-$0.56 range, with non-GAAP per-share earnings expected to be in the $0.89-$0.91 range for the quarter to be reported early next year. Its full-year 2025 top-line guide was slightly below expectations, however, while operating EPS was forecasted about Wall Street forecasts.

Shares fell just 2% after the report, and there’s just a 4.3% implied stock price change after the next earnings report, per data from Option Research & Technology Services (ORATS).

Big picture, there was growth acceleration in its FY Q1 update, and improved growth is expected in the back half this fiscal year thanks to robust performance from its Cloud/AI and Security segments. Overall Cloud orders more than doubled in its first quarter with AI orders soaring above $300 million; FY 2025 could see more than $1 billion of AI order demand, though its overall AI outlook was unchanged. Splunk grew about 15% in the recent quarter with a noted growing customer base.

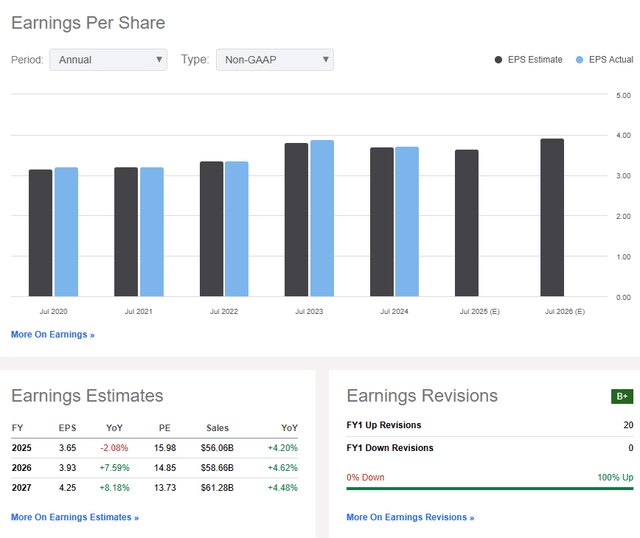

With a solid Q1 in the books, the earnings outlook has improved from earlier in the year. FY 2025 operating EPS is now seen at $3.65 with growth flipping positive in the out year, and then accelerating through FY 2027. Revenue growth is expected to be steadier, in the 4-5% range.

With bottom-line beats continuing this year, there have been a high 20 sellside EPS upgrades in the past 90 days compared with zero downgrades; high share-price momentum is buttressed by strong profitability trends. What’s more, free cash flow per share is now $2.84, which is almost a 5% FCF yield.

Cisco: Revenue & Earnings Forecasts, EPS Revision Trends

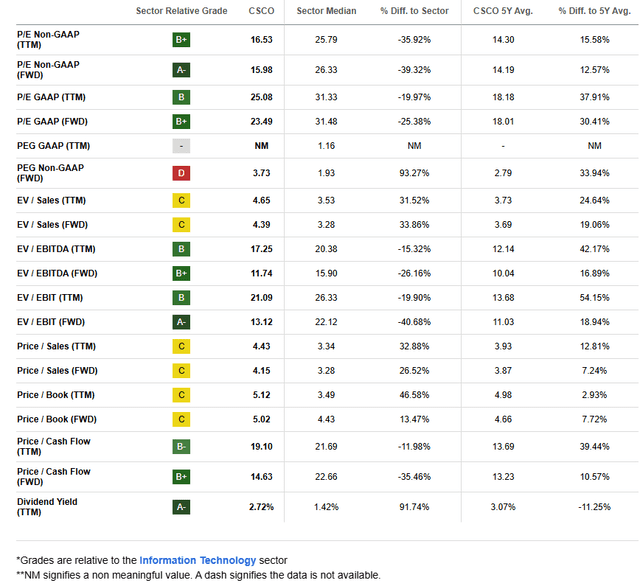

On valuation, with an improved earnings outlook, I am raising my fair value target. If we assume $3.75 of non-GAAP EPS over the next 12 months and apply an 18 multiple, then shares should trade near $68. I took my P/E multiple up two handles as the firm continues to demonstrate growth in its cloud area and AI.

Also keep in mind that an 18 P/E is still a nearly 5-handle discount to the broader market and an even larger discount to the Information Sector. Furthermore, investors are paid with a 2.7% dividend yield.

CSCO: Shares Remain Much Cheaper Than the Tech Sector & SPX

Key risks for Cisco include weaker-than-expected corporate enterprise spending trends in 2025, perhaps driven by a broader macroeconomic slowdown or higher interest rates. Reduced federal spending (all eyes on DOGE), weaker gross margins should competition increase, and any M&A slip-ups could lead to weaker company performance.

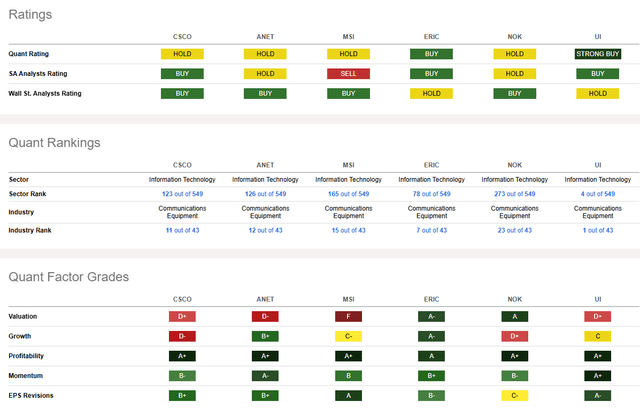

Competitor Analysis

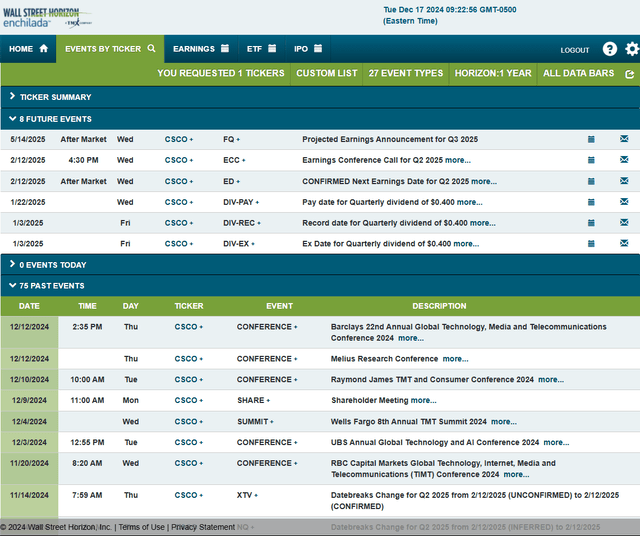

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2025 earnings date of Wednesday, February 12 AMC with a conference call immediately after the numbers cross the wires. Shares trade ex a $0.40 dividend on Friday, January 3.

Corporate Event Risk Calendar

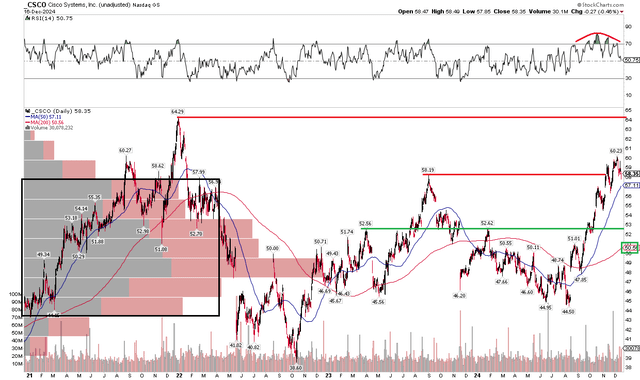

The Technical Take

With the stock still undervalued and EPS growth ahead, CSCO’s technical situation is generally healthy, but there are some areas of potential concern. Notice in the chart below that the stock rallied sharply from an August low near $45 (a key support spot I highlighted in July) to $60 in recent days – a 33% rally. Today, the long-term 200-day moving average is now positively sloped, suggesting that the bulls control the primary trend. The move could be extended, however, considering that the price is now more than 15% above the 200dma.

Also take a look at the RSI momentum oscillator at the top of the graph – it appears to be putting in a bearish rounded top pattern, which could be a leading indicator of a price reversal. If we do wee CSCO retreat, then keep your eye on the 38.2% Fibonacci retracement of the August-December rally, which would be about $54. I also see support just below $53 – the rebound high from Q1.

The good news is that there’s a high amount of volume by price from the mid-$50s down to the mid-$40s, so if we do see a broader fall, there should be cushion to the downside. Resistance is seen at the late-2021 high of $64.

CSCO: Shares Steadying After A Big August-December Rally

The Bottom Line

I have a buy rating on CSCO. There’s optimism on FY 2025 growth, with the Communications Equipment company likely to print healthy AI-related orders and revenue. The stock remains at a significant discount to the broader market, while its technical situation is generally encouraging.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.