Summary:

- A recent Appeals Court unanimous judgement declined to block the ban on TikTok which will be enforced on Jan 19th, 2025.

- Amazon is facing massive challenges from TikTok Shop as the gross merchandise value of this app hit $50 billion worldwide.

- TikTok could give massive discounts to customers and lower fees to sellers due to the lucrative ad business.

- Amazon is making efforts to penetrate new shopping models through ‘Haul’ and other initiatives which could improve the revenue growth and monetization of its e-commerce platform.

- Amazon’s massive EPS growth trajectory has reduced the forward PE multiple to only 30 for the fiscal year ending Dec 2026 and future EPS revisions should improve the bullish momentum for the stock.

4kodiak/iStock Unreleased via Getty Images

Amazon (NASDAQ:AMZN) has been facing significant challenges in the past few quarters from new shopping models of China-based apps like Temu and TikTok Shop. Amazon sellers have been flocking to TikTok Shop due to lower fees and a more interactive shopping model. EcommerceDB has forecasted that TikTok’s worldwide gross merchandise value or GMV would be over $50 billion in 2024. This is a massive growth spurt for a new app. Amazon’s global GMV is estimated to be $757 billion. TikTok has been able to achieve this staggering growth by giving big discounts to customers and very low fees for sellers. TikTok has been redirecting its advertising profits to grow the e-commerce business. In the prior article, it was mentioned that we could see a strong uptick in Amazon’s advertising revenue as new AI tools deliver better results.

The recent unanimous judgment by an Appeals Court has declined TikTok’s effort to block the upcoming ban on the app. A TikTok ban should help Amazon build a better moat around its e-commerce business. Amazon has launched ‘Haul’ and other initiatives to gain a foothold in the new shopping models. It is likely that Amazon will be able to retain its market share, and we could see newer shopping options from Amazon, which should improve the monetization capability of the platform.

The approach of the next White House administration towards TikTok and other China-based apps would be very important. Amazon also has the advantage of a strong Prime subscription business, which is growing at a healthy pace. We could see better sentiment towards Amazon stock if the TikTok ban continues according to schedule. Currently, Amazon stock is trading at a forward PE multiple of only 30 for the fiscal year ending Dec 2026, making it quite attractive.

TikTok saga reaches close to the finish line

TikTok has been facing numerous challenges for the past few years. However, the recent Appeals Court judgment has increased the possibility that the app will be banned soon. If the ban goes according to schedule, we could see the app being banned on Jan 19th, 2025.

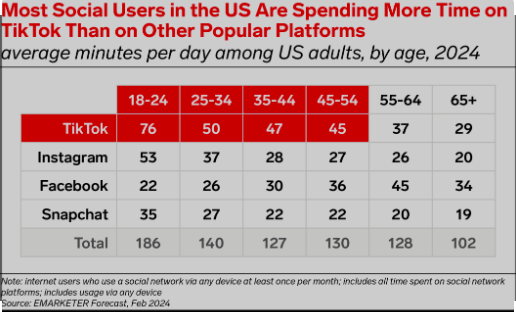

The massive engagement level of the TikTok app cannot be overstated. It has overtaken Meta’s (META) Instagram and Facebook in terms of average time spent on the app for many age groups. TikTok is estimated to earn $12.3 billion in ad sales in the U.S. in 2024. This is a high-margin business and the company was able to divert the profits to increasing the sales on TikTok Shop.

eMarketer

Figure: Average time spent on different platforms. Source: eMarketer

It is estimated that TikTok Shop would reach GMV of $50 billion globally in 2024. This is quite a big number when we compare to Amazon’s GMV of $757 billion globally and $360 billion in the U.S. according to EcommerceDB estimates. TikTok Shop has achieved this GMV in a few short years. It has been attracting sellers and tech talent from Amazon. With very low seller fees and big discounts for customers, TikTok could continue this growth momentum, which would hurt Amazon’s e-commerce business.

There is bipartisan agreement in the U.S. regarding the security threat from some of these apps. TikTok has also been facing challenges in the European Union. A TikTok ban in the U.S. could likely follow up with a ban in other important international markets. However, it is still very important to note how the next White House administration deals with TikTok and other China-based apps.

Amazon’s new shopping models

While Amazon has been a market leader in the e-commerce business, it has also shown agility in launching new shopping models for new customer preferences. It has recently launched ‘Haul’ which competes with Temu, Shein, and other apps by allowing customers to buy items for less than $20 and taking a longer time to complete delivery.

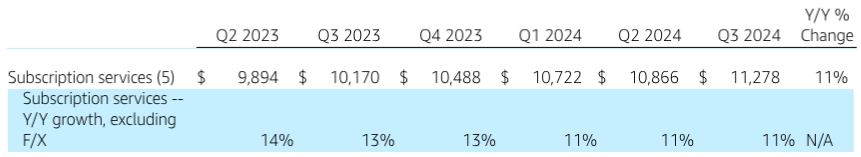

Company Filings

Figure: Amazon’s subscription business in the recent quarters. Source: Company Filings

Amazon’s subscription business provides a good moat for the company and the ability to gain customers for new shopping models. In the recent quarter, the subscription revenue was $11.2 billion, with 11% YoY growth.

Another major initiative by Amazon has been launching quick commerce operations in South Asia. This will allow Amazon to sell groceries, electronics, and other items to customers in 15 minutes or less. Amazon will be building warehouses closer to customers, which would require heavy infrastructure investment. Softbank-backed Swiggy and Zomato are the market leaders in this region, with a combined market cap of over $50 billion. Earlier this year, Walmart-backed Flipkart also started its quick commerce operations in this region. Amazon has shown an ability to quickly move to new shopping models and build a robust platform despite being a latecomer.

E-commerce market is not saturated

One of the key bearish arguments for Amazon is that its core e-commerce business has been saturated and that there is not a big runway for growth in this segment. However, the rapid growth of TikTok and other China-based apps like Temu and Shein has shown that there is still a lot of unmet customer demand for new e-commerce shopping models. Amazon has the resources and the management to enter these shopping models and gain a good market share.

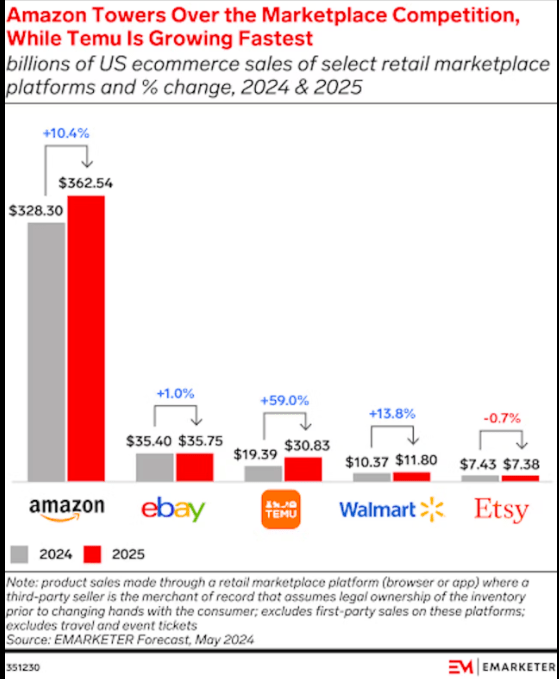

TheDrum, eMarketer

Figure: Growth in Temu’s e-commerce sales. Source: TheDrum, eMarketer

In a recent report, eMarketer estimated that Temu’s e-commerce sales could grow to $30 billion which would be close to ebay’s sales. TikTok Shop’s GMV is already predicted to reach $50 billion in 2024. While Amazon is still the market leader by a wide margin, the new shopping platforms give a clear sign of the potential growth runway within the e-commerce segment.

Seeking Alpha

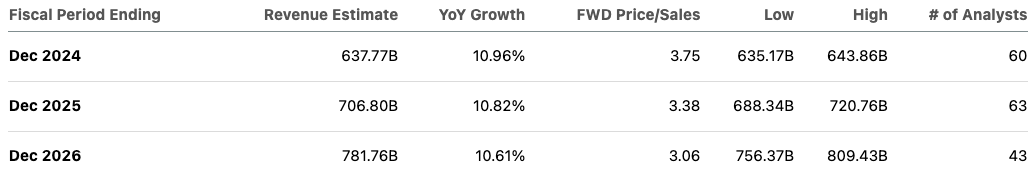

Figure: Amazon’s forward revenue growth projections. Source: Seeking Alpha

The forward revenue growth projection of Amazon shows a stable 10% growth for the next two fiscal years. However, we could see a strong improvement in growth if the new shopping models of Amazon gain momentum. A TikTok ban in U.S. would be a very big event for Amazon. TikTok Shop has already shown the success of “scroll-based purchases”.

Amazon’s other growth segments

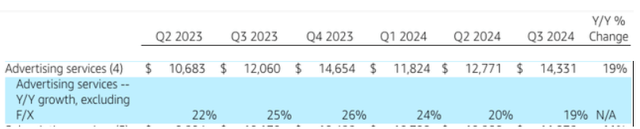

The e-commerce segment has wafer-thin margins. However, this segment drives other high-margin businesses for Amazon. One of the most important segments for Amazon currently is the advertising business. Higher customer usage of Amazon’s e-commerce platform will directly improve the advertising business. Over the last few years, Amazon has been able to break the digital advertising duopoly of Google and Meta. Amazon’s advertising YoY growth continues to be quite good and the annualized revenue base has reached over $50 billion.

Figure: Amazon’s advertising growth in the last few quarters. Source: Company Filings

In Q3 2024, the advertising revenue was $14.3 billion showing 19% YoY growth. The advertising revenue growth is much higher than that of core e-commerce growth. This shows that new advertising tools and AI services have helped in improving the growth momentum of this segment. As customers and advertisers move from TikTok to Amazon, we could see a better growth momentum in this lucrative segment.

Modest valuation multiples

Amazon’s recent EPS growth has reduced the forward PE multiple of the stock. Amazon’s EPS estimate for fiscal year ending Dec 2026 is $7.55. The difference between low and high EPS estimates for fiscal year ending Dec 2026 is small, unlike other big tech companies like Tesla (TSLA) and Nvidia (NVDA). This shows that most analysts are convinced that Amazon could deliver stable EPS growth in the near term. The stock is currently trading at 30 times the EPS estimate for fiscal year ending Dec 2026. I believe this is quite modest when we look at the moat of the company, its flywheel effect, and the ability to quickly enter new shopping segments and business segments.

Seeking Alpha

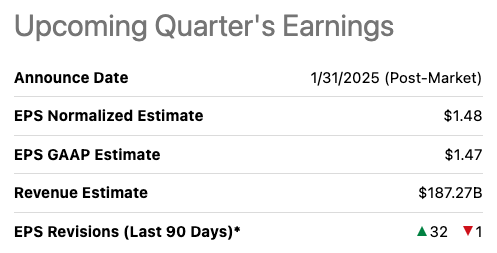

Figure: Forward EPS estimates of Amazon. Source: Seeking Alpha

It should also be noted that Amazon has received a large number of upward EPS revisions in the past 90 days. There have been 32 upward EPS revisions and only 1 downward revision for Amazon in the last 90 days.

Seeking Alpha

Figure: Upward EPS revisions of Amazon. Source: Seeking Alpha

The stock is modestly priced, and we could see good sales momentum in the core e-commerce segment through new shopping models in the near future. A TikTok ban and headwinds for other China-based apps in the next White House administration could be a strong tailwind for Amazon, improving the sentiment towards the stock.

Investor Takeaway

Amazon will gain from the upcoming TikTok ban in U.S. in early 2025. In a short period, TikTok has been able to gain a GMV of $50 billion by spending its advertising profits to give lower seller fees and bigger discounts for customers on TikTok Shop. The strong growth of TikTok also shows that there is still unmet customer demand within the e-commerce space and increases the growth runway for Amazon.

Amazon has been launching new initiatives like ‘Haul’ to enter new shopping models. This should improve the revenue trajectory of Amazon in the near term. There have been a large number of forward EPS revisions for Amazon, and we could see a continuation of this in the near term, which should boost the stock momentum. The forward PE multiple is 30 for the fiscal year ending Dec 2026, making it reasonably priced compared with some other big tech peers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.