Summary:

- Johnson & Johnson’s diversified revenue streams, significant presence in oncology and immunotherapy, and aggressive growth investments make it a strong defensive play.

- The company’s low leverage, ample liquidity, and impressive free cash flow margin support its dividend sustainability and long-term growth.

- The stock is very attractively valued with an 18% potential upside.

Sundry Photography

My Thesis

After massive rallies delivered by the growth part of my portfolio, it became imbalanced as the share of defensive plays decreased in relative terms. Therefore, I am adding Johnson & Johnson (NYSE:JNJ) stock to my portfolio and giving it a Strong Buy rating due to several fundamental reasons.

The stock is very attractively valued with an 18% potential upside and quite a low forward Price/Cash flow ratio. The dividend yield is solid and notably above the inflation. My high confidence in JNJ’s dividend sustainability is backed not only by 60+ years of consistent payouts but also by the company’s solid growth prospects. JNJ invests aggressively in both organic and inorganic growth, which will highly likely deliver results. The current portfolio of products is well-diversified and gives exposure to large, growing markets. The company has ample liquidity to financially support its ambitious growth plans.

JNJ Stock Analysis

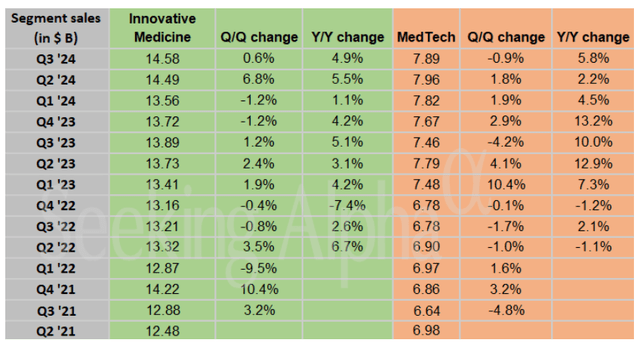

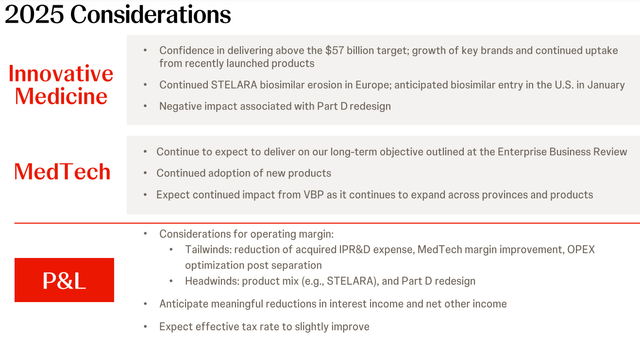

Johnson & Johnson is the world’s most valuable pharmaceutical brand, according to Web Wire. The company generates revenue through two primary segments: Innovative Medicine (formerly Pharmaceuticals) and MedTech. Innovative Medicine is the largest revenue stream that generated 65% of the total during Q3 2024. Both segments demonstrated YoY growth in the latest reportable quarter.

Seeking Alpha

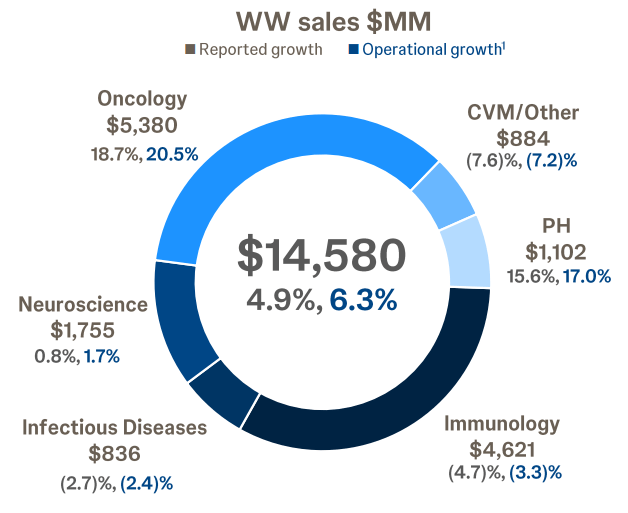

The Innovative Medicine segment has been a significant driver of growth, with standout performances from products like DARZALEX, ERLEADA, and STELARA. The revenue mix is diversified across various diseases, which is certainly JNJ’s fundamental strength that gives exposure to several niches. Oncology and immunology are the largest by-category revenue streams for JNJ, with a combined share of 44% in the company’s business mix.

IR

JNJ is one of the largest players in the oncology drugs industry, with a 10% global market share. This is a strong strategic advantage because this niche is growing notably and BCC Research expects this market to increase from $196.4 billion in 2023 to reach $401.4 billion by 2029 (12.7% CAGR).

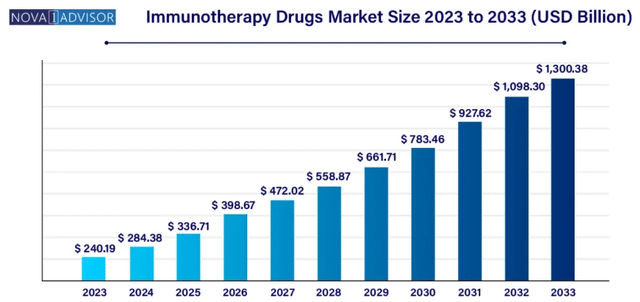

Immunotherapy is another hot industry where JNJ’s footprint is notable. According to BioSpace, the global immunotherapy drugs market size is expected to surpass one trillion USD by 2032.

BioSpace

As most giant pharmaceutical companies do, JNJ is not focused solely only on organic growth. For instance, recent developments include the completion of the Shockwave Medical acquisition, which strengthens JNJ’s position in cardiovascular intervention. This strategic move expands the company’s portfolio in one of the largest and highest-growth Medtech markets, complementing its existing strengths in heart recovery and electrophysiology. Overall, in the first half of 2024, JNJ invested approximately $17 billion in strategic, value-creating inorganic growth opportunities. Focus on organic growth is also substantial, with a $16.4 billion TTM R&D spending. This big bet has already produced major clinical and regulatory successes, including approvals for TREMFYA and RYBREVANT.

IR

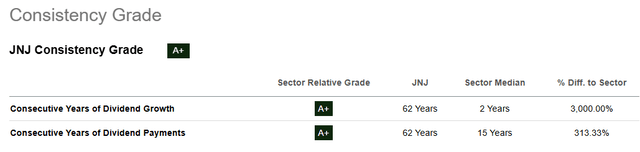

JNJ has a healthy financial position which allows it to be financially able to take on aggressive growth projects. The total debt of $35 billion represents around 10% of the company’s market cap, indicating quite low leverage. JNJ also had an ample liquidity position as of the last reporting date, with more than $20 billion in cash and cash equivalents. JNJ’s levered TTM FCF margin is impressive at 22.72%. With a profitability like that, it does not just keep the balance sheet strong, but it also helps make JNJ one of the biggest dividend powerhouses in the U.S. stock market. JNJ not only boasts a rich history of dividend payouts but also delivered solid dividend growth with the last decade’s CAGR of 5.93%.

Seeking Alpha

Wall Street analysts are positive about the company’s long-term growth prospects. I think that this optimism is fair, as it is backed by a solid exposure to a wide array of growing industries within the giant global pharmaceutical market. According to consensus, JNJ is expected to deliver a steady revenue and EPS growth that will outpace long-term inflation averages. This makes JNJ a good defensive investment opportunity.

Intrinsic Value Calculation

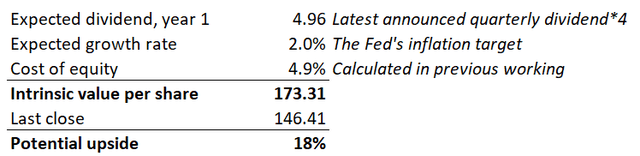

For a dividend legend like JNJ, the most suitable approach to calculate the stock’s intrinsic value is the dividend discount model (DDM).

DT Invest

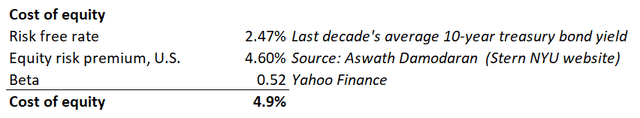

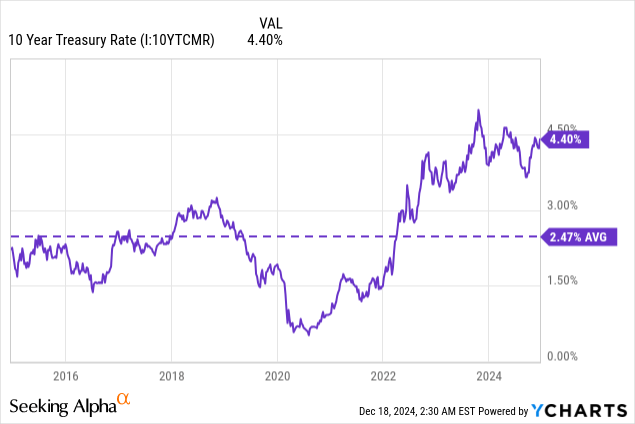

As one of the prominent players in the defensive healthcare industry, JNJ demonstrates a quite low 0.52 beta. The relatively low beta explains JNJ’s quite investor-friendly 4.9% cost of equity. I use the last decade’s average risk-free rate because pivots in monetary policy were quite sharp in the last few years. Moreover, taking the current treasuries yield as a discount rate might be unfair as we are at the beginning of the interest rate cuts cycle.

I multiply the latest declared dividend by four to get the year 1 dividend amount assumption, which will be $4.96. The dividend growth rate is conservative and aligns with the Fed’s inflation target rate.

JNJ’s intrinsic value per share is slightly above $173. This looks quite good compared to the last close, indicating an 18% potential upside.

DT Invest

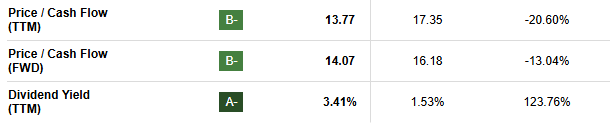

Since any company’s dividend reliability substantially depends on its cash flow, we can also look at valuation ratios related to the FCF. The forward Price/Cash flow ratio of JNJ is notably lower than the peer group average at 14.07.

Seeking Alpha

What can go wrong with my thesis?

JNJ operates in a highly regulated industry, subject to scrutiny from agencies like the FDA and EMA. Changes in healthcare policies or non-compliance with regulations could lead to fines, product recalls, or reputational damage.

The company has faced numerous lawsuits in its history. Some were about product safety, including talc-based products and surgical mesh. A new lawsuit can lead to big losses and reputational harm.

Being a global business, JNJ also has to contend with economic shifts that affect healthcare expenditures. Due to the downturn, consumers may stop purchasing non-essential health items or defer care procedures, affecting sales across various segments. JNJ’s global supply chain could potentially be disrupted by geopolitical instability, natural, or other unanticipated circumstances. These interruptions can have an impact on the availability of products and performance.

Summary

So, I certainly will be adding JNJ to my portfolio and continue to have a higher portion of safe play quality in my portfolio. There is a great strategic positioning here, and aggressive investments in growth drivers in the future will very likely bring new opportunities to grow JNJ’s potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.