Summary:

- Eli Lilly’s diverse product portfolio and promising pipeline, including Tirzepatide, Orforglipron, and Retatrutide, support a “buy” rating for long-term investors despite current valuation metrics.

- Zealand Pharma’s weight management candidates, Survodutide and Petrelintide, show potential but face competition and valuation concerns, leading to a “hold” rating.

- Eli Lilly’s revenue growth, driven by weight management treatments, and strategic moves like a $15 billion share buyback and dividend increase, indicate strong future prospects.

- Zealand Pharma’s market cap already reflects expected success, and any clinical trial setbacks could impact its valuation, highlighting the need for cautious investment.

John Sommer/E+ via Getty Images

Business overview

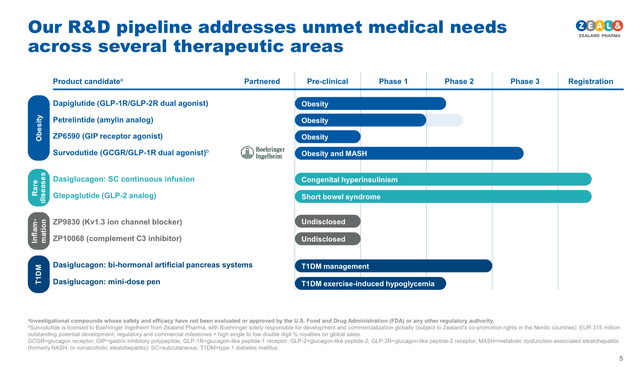

Zealand Pharma (ZLDPF) is a biotech company, based in Denmark, focused on the discovery and development of therapeutic peptides for the treatment of metabolic conditions, such as obesity, congenital hyperinsulinism, diabetes type I, chronic inflammation and short bowel syndrome. Within the obesity pipeline, Zealand has one product candidate in Phase III clinical trials, licensed by Boehringer Ingelheim, known as Survodutide. And two wholly owned product candidates, Petrelintide, just announced the first Phase II clinical trial participant was dosed last week, and Dapiglutide, which recently announced Phase I clinical trial results of the part 1 (13 weeks) of the study, and it is expecting to release results of part 2 (26 weeks) in H1 2025. Beyond the obesity pipeline, the company receives royalties from Novo Nordisk (NOVO) associated with the commercialisation of Zegalogue (for the treatment of hypoglycemia, low blood sugar, in people with diabetes) and it is expecting the FDA decision on Glepaglutide (for short bowel syndrome) by December 22nd, 2024.

Eli Lilly (NYSE:LLY) is currently the largest pharmaceutical company by market cap, which at the moment of writing this article is standing around $700 billion. Lilly has a long story on the development of treatments against diabetes, cancer, neurological conditions, endocrine and immune system alterations, among others. Overall, Lilly’s current product portfolio and pipeline exhibit diversity, while accounts with several products considered first- or best-in-class. Particularly, Lilly’s Tirzepatide (commercialised as Zepbound and Mounjaro), is one of the two weight loss “miracle drugs” that account with regulatory approvals (including the U.S., Europe, Canada, and UK). The second being Novo’s Semaglutide (brand names Wegovy, Ozempic, Rybelsus). Lilly, as well as Novo, has suffered problems at meeting demand given supply chain issues. In order to provide a solution to this problem, Lilly acquired, and it is planning to expand manufacturing facilities in the U.S. Beyond obesity, Lilly’s product portfolio and pipeline is diverse, accounting with products, such as Kisunla for the treatment of early signs of Alzheimer’s disease, which offer future blockbuster potential.

Thesis

Eli Lilly and Novo Nordisk have seen their revenues skyrocket with the success of their diabetes and weight management treatments (Tirzepatide and Semaglutide, respectively). The weight loss market is estimated to reach $200 billion by 2031. Lilly/Novo’s duopoly is poised to be disrupted by other product candidates such as Zealand Pharma’s Survodutide and Petrelintide, Viking Therapeutics’ (VKTX) VK2735, Amgen’s (AMGN) MariTide, Altimmune’s (ALT) Pemvidutide and/or Structure Therapeutics’ (GPCR) GSBR-1290 by 2026 onwards.

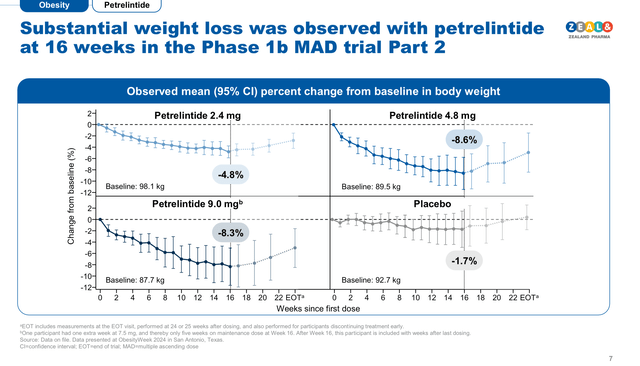

Interestingly, a large proportion of the weight loss product candidates under development, exhibit a differentiation factor that sets them apart from Tirzepatide and Semaglutide. In this sense, Zealand’s Petrelintide is an amylin analogue (i.e. a chemical similar to amylin), which is a non-incretin hormone secreted by the pancreas that promoted moderate 8.6% weight loss after 16 weeks of treatment with 4.8 mg dose vs. 1.7% in the placebo cohort in Phase I clinical trials, by inducing a long-lasting satiety sensation. Although Petrelintide’s weight loss rate is not as impressive as Zepbound’s, this type of treatment can become very valuable for people with moderate overweight, people intolerant to GLP-agonists, and people who have developed resistance to incretins. Survodutide is a glucagon and GLP-1 dual agonist, which Zealand’s development partner (Boehringer Ingelheim) announced it has started two Phase III clinical trials and received the breakthrough FDA designation for the treatment of metabolic dysfunction-associated steatohepatitis (MASH). If successful in Phase III clinical trials, Zealand/Boehringer’s would be able to file for FDA approval by H1 2026.

Eli Lilly, released study results where Tirzepatide demonstrated a higher reduction of total body weight (22.2%) than Semaglutide (13.7%) in 72 weeks of treatment. Despite the stronger efficacy of the dual GLP-1/GIP agonist, as reported in their Q3 earnings call presentation, Novo owns 65% of the GLP-1 global market. To counterattack, Lilly made Zepbound available as single dose from their Lilly direct self-pay platform at a lower price last summer, and last week announced the single dose vials will be also available through the telehealth platform Ro.

Despite the unfavourable valuation metrics exhibited by LLY, the commercial product performance and pipeline development in weight management provides a promising future outlook, which when added to the oncology, neuroscience and rest of their product portfolio is likely to support strong revenue growth in 2025 and beyond. Therefore, I consider that Lilly’s share price tumble, might be a good entry point opportunity for long-term investors pursuing a dollar-cost-average investing strategy, leading me to rate LLY as a “buy”. On the other hand, Zealand’s weight loss portfolio is very promising, exhibiting different mechanisms of action from Zepbound and Semaglutide. While Zealand’s weight management portfolio is likely to be 2-3 years away from obtaining regulatory approvals (presuming positive clinical performance), the company is expecting the FDA decision on Glepaglutide by December 22nd, 2024. Although Zealand Pharma’s future outlook looks promising, its market cap seems to already account with their weight management pipeline success, leading me to rate ZLDPF as a “hold”.

This article will provide readers with a comparative analysis of both companies, mostly focused on the weight management product portfolio and pipeline of both companies, their financials, valuation and risks.

Product Portfolios & Pipelines: Weight management

Zealand Pharma

Zealand’s weight management product candidates include Survodutide (licensed by Boehringer), Petrelintide and Dapiglutide (see image below). However, given the developmental stage of the products I will focus on the two most advanced of them, Survodutide, which has recently started two ambitious Phase III clinical trials, and Petrelintide, which just started Phase II trials.

Zealand Pharma complete pipeline (Zealand Pharma Corporate presentation November 2024)

Survodutide is a glucagon and glucagon-like peptide 1 (GCG/GLP-1) receptors dual agonist (i.e. activator). Please refer to my latest Viking Therapeutics analysis, where I explained the scientific background and GLP-1 mechanism of action. The dual activation of GCG/GLP-1 receptors facilitates weight loss and diabetes management by increasing metabolic activity, reducing blood sugar concentrations, and reducing appetite.

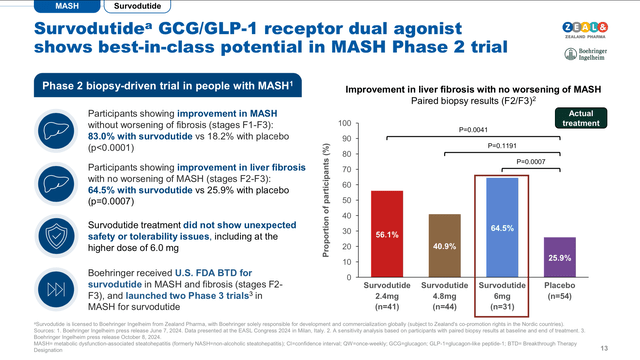

The phase II clinical trial, associated with Survodutide in obesity, revealed a 19% total body weight loss in trial participants who completed the study on 4.8 mg dose. While, 40% of trial participants treated with the 3.6 and 4.8 mg doses of Survodutide achieved 20% body weight reduction in 46 weeks, in contrast with 0% in the placebo cohort. In addition, Survodutide’s Phase II clinical trial focused on metabolic dysfunction associated steatohepatitis (MASH), demonstrated Survodutide’s capacity to improve MASH, i.e. improve the metabolic function of the liver, in 83% of trial participants vs. 18.2% in the placebo cohort. Building on this data, the analysis of the secondary end-point in the study highlighted that 52.3% of individuals with liver fibrosis in stages F1, F2 and F3, also observed significant reductions in liver scarring (fibrosis) after 48 weeks of treatment versus 25.8% in the placebo group. Those results were also correlated with a 30% reduction of fat in the liver, which was observed in 87% of trial participants treated with Survodutide.

Survodutide’s Phase II trials, also highlighted that 24.6% of treatment discontinuations were caused by treatment-related adverse events, vs. 3.9% in the placebo cohort. The serious adverse events, reported, were mainly expected gastrointestinal problems associated with GLP-1 agonists (vomiting and nausea). Interestingly, the Survodutide group reported 4.2% serious adverse events, in contrast with 6.5% in the placebo group. Overall, Survodutide’s Phase II results supported the advancement of the treatment into Phase III clinical trials, and the FDA breakthrough designation in MASH (see image below).

Survodutide’s summary updates (Zealand Pharma’s Corporate presentation November 2024)

To date, the companies have not released data about lean mass protection, so, I wonder if Survodutide may be able to match the results of another GCG/GLP-1 agonist. Altimmune’s Pemvidutide has reported a 21.9% lean mass loss after 48 weeks of treatment, which indicates greater lean mass protection than the competitors. However, it is important to note that Survodutide’s formulation (8:1) is slightly different from Pemvidutide (1:1), in terms of CGC/GLP-1 agonism ratio. Thus, explaining differences, if any, in the lean mass protection capacity. Given that Pemvidutide is Survodutide’s closest competitor in MASH and obesity, it will be very relevant for investors to keep an eye on Altimmune’s Phase II results in MASH, which are expected by Q2 2025.

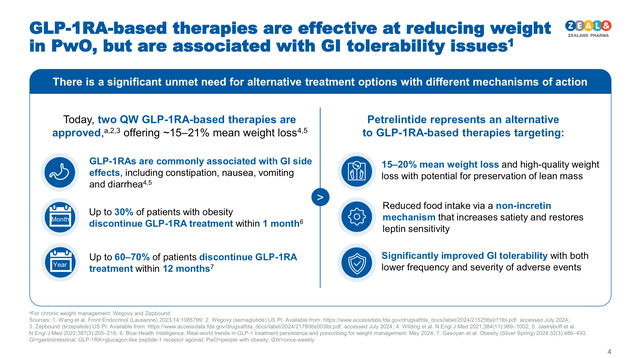

Petrelintide is Zealand’s most advanced wholly owned product candidate in the obesity treatment pipeline. This product candidate is an amylin agonist, which is a non-incretin hormone produced in the pancreas. Petrelintide aims to generate a long-lasting satiety sensation while increasing metabolic activity, in order to induce weight loss while reducing the occurrence of severe side effects associated with GLP-1 receptor agonists (see image below).

Petrelintide’s opportunity in the weight management market (Zealand Pharma corporate presentation November 2024)

Petrelintide’s Phase I clinical trial results demonstrated that the long-lasting amylin was able to induce up to 8.6% body weight reduction after 16 weeks of treatment with a 4.8 mg dose vs 1.7% in the placebo (see image below). In terms of tolerability, the 4.8 mg dose seems to provide the best ratio of efficacy and tolerability, as this cohort only reported mild events of nausea, but no diarrhea or vomiting were reported.

Petrelintide’s tolerability results in phase I clinical trials (Zealand Pharma corporate presentation November 2024)

The favourable efficacy and tolerability performance supported the initiation of Phase II clinical trials in people with overweight or obesity. The company announced that the first participant was dosed last week, and it is expecting to complete enrollment by H1 2025. Zealand is also planning to initiate by H1 2025 an expansion of this Phase II clinical trial, where they will assess Petrelintide’s efficacy and tolerability in patients with diabetes type II and obesity or overweight. Given that amylin does not directly induce insulin production, I wonder about the efficiency of Petrelintide on blood sugar management. Considering the experimental design of the Phase II clinical trial, I would expect top-line results by H2 2025, and potential Phase III studies initiation in 2026. Hence, pending good clinical trial performance, this amylin-based product candidate might become commercially available in the U.S. by 2027-2028.

Eli Lilly

Lilly’s highest revenue driver is Tirzepatide, commercialised as Mounjaro and Zepbound in the U.S., and Mounjaro in ex-U.S. markets. Tirzepatide is a dual GLP-1 and Glucose-dependent insulinotropic polypeptide (GIP) receptor agonist. The dual activation of GIP and GLP-1 receptors has demonstrated to be the most efficient commercial treatment in terms of promoting weight loss. Tirzepatide has also proven to be beneficial for the treatment of certain obesity comorbidities including sleep apnea, on which the company already obtained a label expansion for Mounjaro in the EU, and it is awaiting the FDA decision in the U.S. In addition, the company released positive Phase III clinical trial results demonstrating the efficacy of Tirzepatide on reducing the risk of heart failure in patients with obesity, and announced the initiation of global regulatory filings for Tirzepatide in this indication. Tirzepatide is also under clinical trials assessment for the treatment of chronic kidney disease (CKD) with or without diabetes type II in patients with overweight or obesity. In terms of age group, the company is also seeking to obtain label expansions for Tirzepatide in pediatric and adolescent people with obesity and diabetes type II. Hence, Mounjaro/Zepbound has the potential to significantly increase their sales-growth in the U.S. and globally.

Taking into account the mechanism of action, the closest Tirzepatide’s competitor is Viking’s VK2735, which is being developed as a subcutaneous once a week injection and daily oral pill. However, VK2735 is expected to be commercially available by H2 2026 or H1 2027, providing a good commercial advantage to Tirzepatide for the next 2-3 years.

On the other hand, Eli Lilly is working on the next generation of weight management treatments. The most advanced product candidates in this sector are Orforglipron (GLP-1 oral pill), and Retatrutide (Glucagon/GIP/GLP-1 triple receptor agonist subcutaneous injection).

Lilly obtained the worldwide development and commercialisation rights of Orforglipron from Chugai Pharmaceutical Co., Ltd. (OTCPK:CHGCF). In June 2023, Lilly announced positive phase II results associated with the GLP-1 oral pill. Briefly, after 36 weeks of treatment, 45 mg Orforglipron was able to induce a 14.7% total body weight reduction. Orforglipron also demonstrated to be more efficient than Dulaglutide on the management of glucose in blood (A1C) in patients with diabetes type II, achieving a 2.1% decrease in A1C from baseline versus a 1.1% reduction induced by Dulaglutide, after 26 weeks of treatment. Based on those results, the company initiated various Phase III clinical trials seeking to evaluate the role of Orforglipron in diabetes, obesity and comorbidities. According to updates reported in the latest business updates presentation, the company expects to complete the first of those studies (ACHIEVE-1) in April 2025, while the ACHIEVE-5, ACHIEVE-J, ACHIEVE-3 and ACHIEVE-4 have completion dates in late Q2 and Q3 2025. Thus, investors should keep an eye on Orforglipron’s updates in the coming year.

Although Rybelsus is not indicated for weight loss, Novo’s GLP-1 oral pill has been reported to promote up to 4% body weight loss after a six-month treatment with 14 mg Rybelsus. However, Novo presented new results at Obesity Week 2024, demonstrating that 25 mg oral Semaglutide induced 13.6% body weight reduction from the baseline vs 2.2% in the placebo group at 64 weeks of treatment. Orforglipron’s clinical results, to date, exhibit better efficacy in weight loss than oral Semaglutide. Another potential future competitor for Orforglipron is HS-10535, which is a GLP-1 oral pill in preclinical stage that Merck & Co., Inc. (MRK) just announced acquiring worldwide development, manufacture and commercialisation rights from Hansoh Pharma. Nonetheless, this product candidate is not an immediate threat to Lilly’s Orforglipron given that it hasn’t started clinical trials yet.

Retatrutide, Lilly’s triple agonist, is considered the next generation Tirzepatide. Last year, the company published Phase II clinical trial results, demonstrating Retatrutide’s capacity to induce up to 17.5% mean body weight reduction from the baseline after 24 weeks of treatment and up to 24.2% mean body weight reduction at 48 weeks. Based on the positive Phase II results, the company is currently carrying out a series of clinical trials where it is assessing the efficacy of Retatrutide in the treatment of obesity, diabetes and their comorbidities, which are estimated to yield results from February 2026 onwards. Hence, Lilly’s next generation subcutaneous obesity treatment seems to be future proofing the company’s weight management franchise.

Financials

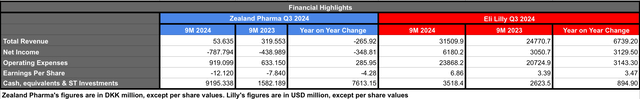

In the following table, you will find the year to date financial highlights comparing Zealand Pharma vs. Eli Lilly. Please note, Zealand’s figures are in DKK, while Lilly’s are in USD.

Zealand’s and Lilly’s Financial Highlights 9M 2024 (Data collected by the author from Zealand’s and Lilly’s Q3 2024 financial results)

In terms of revenue, Zealand reported an 83% decrease in 9M 2024 when compared against the same period of 2023. The difference is attributed to $30 million milestone payment from Boehringer Ingelheim associated with survodutide and $10 million milestone payment from Sanofi associated with lixisenatide, in 2023. While year-to-date 2024 revenues include DKK 54 million royalty payments from Novo associated with Zepalogue. In contrast, Eli Lilly reported a 27% year-to-date revenue growth in 2024 when compared against 2023. The revenue increase is mostly attributed to the sales-growth performance of Mounjaro & Zepbound, which combined represented $11.028 billion or 35% of Lilly’s total product revenue in the 9M 2024. Considering Tirzepatide’s recent clinical performance demonstrating its superiority against Semaglutide and potential to obtain label expansions associated with obesity comorbidities, together with the manufacture facility acquisitions and expansions, I would expect Tirzepatide to continue driving strong revenue growth in 2025.

Both companies reported increased YTD 2024 operating expenses when compared against 2023, which were mostly attributed to their research & development activities. The 45% increase in Zealand’s operating expenses translated into a 79% YTD 2024 net loss increase vs. YTD 2023. On the other hand, Lilly’s 15% operating expenses increase was completely off-set by their revenues, equating to a 102% net income increase YTD 2024 vs YTD 2023.

Zealand raised capital early this year, in January (DKK 1.45 billion) and June (DKK 7 billion), in consequence its cash position improved by 481% when compared against the figures reported in September 2023. Considering this cash position and the 9M 2024 operating expenses, Zealand’s estimated cash runway is approximately seven years, which is likely to secure the financial stability of the company beyond the potential commercialisation of their most advanced obesity treatments. Furthermore, the company is expecting an FDA decision about Glepaglutide by December 22nd, 2024. If approved, the company will be able to commercialise their short bowel syndrome treatment in H1 2025, and likely increase their revenues in 2025.

Eli Lilly’s cash position has also seen a 34% increase in September 2024 vs the figures in September 2023. This improved cash position is mainly associated with their operating profits. However, Lilly has been increasing its long-term debt, which is standing at $29.8 billion vs. $18 billion reported in September 2023. The short-term debt was reported to be $1.295 billion in September 2024 vs $6.198 billion in December 2023. More importantly, Lilly has rewarded investors with the announcement of $15 billion share repurchase, which follows the previous $5 billion share repurchase program that the company completed this quarter. In the same press release, Lilly announced that from Q1 2025 their dividend will be $1.5/share per quarter, a 15% increase from previous.

Valuation

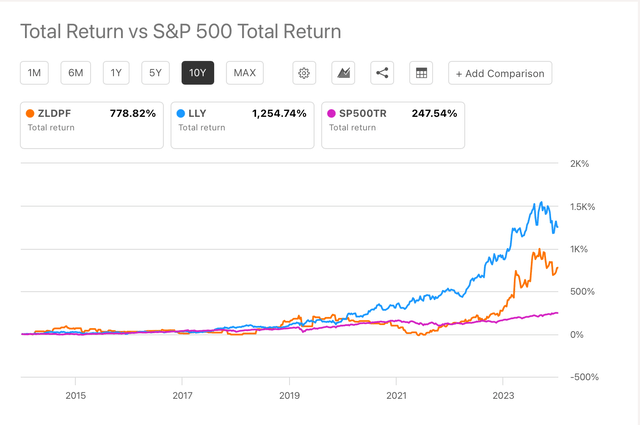

ZLDPF shares are trading at $114 and a $7.98 billion market cap, accounting for a 116% YTD growth, and a 20% decrease from their all-time-high ($141.74) achieved in August 2024. On the other hand, LLY is trading at $773 and a $734 billion market cap, accounting for a 30.7% YTD growth and a 24% decrease from its 52-week high ($972.53). Lilly’s 1254% 10-year total returns outperform Zealand’s (778%) and the SP500’s (247%) total returns in the same period of time (see image below).

ZLDPF vs LLY vs SP500 10-y Total returns (Seeking Alpha)

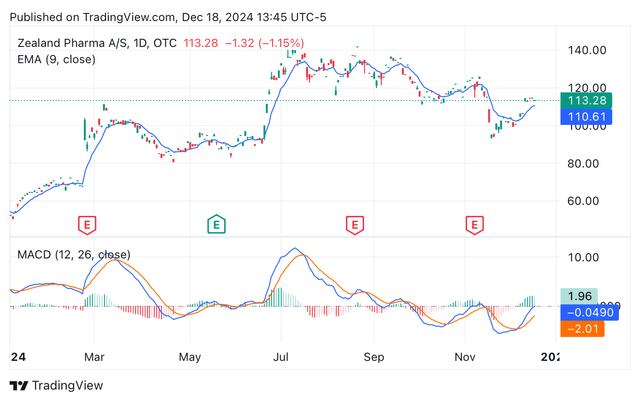

Zealand’s Price/sales TTM is 619, the Price/sales FWD is estimated at 169; both ratios far higher than the sector’s median 3.66 and 3.62, respectively. Likewise, the EV/sales TTM and FWD are far higher than the sector’s median figures. The analyst consensus estimates Zealand’s 2025 P/E will be around 135X, suggesting that the stock is already trading at a premium. Despite the bad valuation metrics, the shares have been experiencing the pressures of a bullish market, perhaps associated with the expectation of Glepaglutide’s potential FDA approval (see image below). Indeed, the expectation of Glepaglutide’s commercial launch is also fueling a 172% estimated revenue growth FWD.

ZLDPF year-to-date share price depicting EMA and MACD (Seeking Alpha/TradingView)

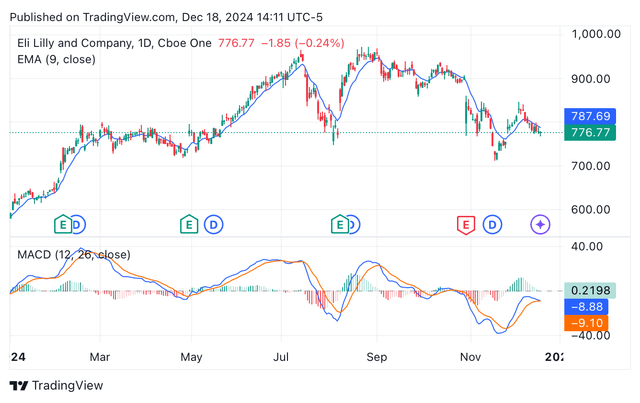

Despite the current share price tumble, Eli Lilly’s price/sales TTM (17.16) and FWD (15.37) are still far higher than the sector’s median 3.66 and 3.62, respectively. Lilly’s P/E forward is standing at 59, while the estimated 2025 P/E is estimated to be around 34. Since the Q3 earnings call, where the management reduced the top end of their revenue guidance, LLY’s shares have been exposed to the pressures of a bear market, which have been a little more accentuated with the U.S. administration changes that are expected to negatively impact the pharmaceutical sector. Indeed, the EMA and MACD are signalling for sell ratings (see image below), while the relative strength index is now nearing oversold territory (40s).

LLY’s year-to-date share price depicting EMA and MACD (Seeking Alpha/TradingView)

Although this article is focused on the weight management pipeline, it is important to consider that Lilly owns a long list of diversified commercial products and an even longer pipeline. The company has been releasing positive news on their oncology, immunology, and neurosciences products. Taking into account Lilly’s product portfolio, the clinical and commercial performance of their weight management portfolio, the $15 billion share repurchase program, and the 15% dividend increase, I believe the current share price tumble could be a good entry point for new investors in LLY. Hence, I rate LLY as a “Buy” for long-term new investors with a dollar-cost-average investment strategy. On the other hand, given the unfavourable valuation, and limited growth expectations, I rate ZLDPF as a “Hold”.

Should investors decide to open new positions in LLY, they should also consider the risks associated with such investment, and mitigate them by diversifying their portfolio.

Risks

Zealand and Lilly are exhibiting poor valuation metrics, suggesting the share price is already accounting with the commercial success of their weight management products and product candidates. Thus, investors considering starting positions in either company must be prepared to observe some volatility in the share price. In my opinion, if Lilly’s share price continues to fall below $700, presuming that the fundamentals and thesis remain, investors should consider lowering their average cost by increasing their positions in LLY.

In the case of Zealand, one of the largest risks to investors would be a poor performance in Petrelintide’s or Survodutide’s Phase III clinical trials, as the current share price is partially justified by the expectation of success of both product candidates.

Another important point to take into account is that the obesity treatment market is getting very crowded. However, Lilly is well positioned for securing the largest portion of the estimated 2030 obesity total addressable market ($200 billion). On the other hand, if successful in clinical trials, Zealand will have the opportunity to tap into this market at a smaller scale than Lilly. Petrelintide might benefit from lower competition if it focused its commercial efforts on GLP-1 intolerant/resistant patients, or for patients on weight maintenance programs. On the other hand, Survodutide will likely see its revenue potential limited by the potential competition with Pemvidutide (Altimmune).

Conclusions

Zealand’s weight management product candidates have the potential to become commercially available within the next 2-3 years. Petrelintide’s mechanism of action (amylin analogue) would allow the company to target patients intolerant or resistant to incretin-based treatments. On the other hand, Survodutide advanced clinical stage might allow Zealand/Boehringer to reach regulatory approval in obesity & MASH, pending positive clinical trials performance, before Altimmune’s Pemvidutide does. However, Zealand’s valuation metrics suggest that the company’s shares and market cap are already accounting with Zealand’s success in regulatory approvals and commercialisation of their weight management products, despite the great competition and lack of profitability. Thus, leading me to rate the company as a “Hold”.

Eli Lilly’s share price has been tumbling since the release of Q3 earnings, as a result of the management lowering the top end of their 2024 revenue guidance. However, the revenue growth of the company, mostly fuelled by their weight management franchise, is estimated to be around 27% when compared against 2023. In terms of clinical performance, Tirzepatide continues to outperform the competition as well as to demonstrate positive effects in obesity comorbidities, allowing Lilly to obtain further label expansions for the drug. The future outlook of Lilly’s weight management franchise is looking bright with two product candidates in Phase III clinical trials (Orforglipron and Retatrutide) that may be hitting the market by 2026-2027, and many other early-stage product candidates. Despite the poor valuation metrics, Lilly’s financial performance, product portfolio diversity, a promising and diverse pipeline, the announcement of a $15 billion share buyback program and 15% dividend increase, support my “buy” rating for long-term new investors with a dollar-cost-average investment strategy. Should investors consider opening new positions in LLY, they should also be prepared to potentially observe some volatility and consider averaging down if the fundamentals and investment thesis remains, and the share price falls below $700.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LLY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.