mstahlphoto

U.S. healthcare expenditure expanded 7.5% in 2023 to reach $4.9T, up from 4.6% a year ago, mainly driven by non-price factors, according to a new report from the Centers for Medicare & Medicaid Services (CMS).

Issuing its annual health expenditure data on Wednesday, the CMS said that the figure, reflecting public and private expenditure on healthcare-related activities such as health insurance, accounted for 17.6% of the economy last year.

U.S. health expenditure, adjusted for healthcare price inflation, expanded 4.4% that year, compared to 2023 real GDP growth of 2.9% and 2022 real healthcare spending growth of 1.4%.

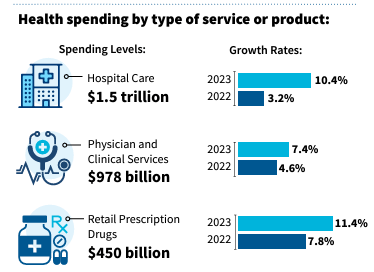

Source: The Centers for Medicare & Medicaid Services (CMS)

Despite a pandemic-era acceleration in 2021, spending on hospital care grew 10.4% from 3.2% a year ago to account for $1.5T, marking its fastest growth since 1990, driven by non-price factors.

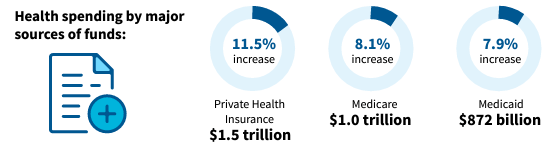

Source: The Centers for Medicare & Medicaid Services (CMS)

As for funding sources, expenditures from private health insurance and Medicare accelerated, while growth in Medicaid spending slowed as the federal-state-backed healthcare program shrank following the resumption of eligibility reviews last year.

Notably, retail prescription drug spending increased 11.4% to $449.7B from 7.8% in 2022, mainly due to a sharp uptick in spending on diabetes and weight loss therapies such as GLP-1 agonists from Eli Lilly (NYSE:LLY) and Novo Nordisk (NVO).

The CMS said that faster growth in both public and private health insurance spending contributed to the overall drug spending growth.

Major publicly listed health insurers include UnitedHealth (NYSE:UNH), Humana (HUM), CVS Health (NYSE:CVS), Elevance Health (ELV), Cigna (CI), Centene (CNC), Molina Healthcare (MOH).

Hospital stocks: HCA Healthcare (HCA), Community Health Systems (CYH), Surgery Partners (SGRY), Tenet Healthcare (THC), Universal Health Services (UHS), Select Medical Holdings (SEM), Acadia Healthcare (ACHC).