Summary:

- This article downgrades my rating on PG stock to HOLD from my previous BUY rating.

- A mix of new catalysts have developed since my last rating, and I do not see a clear bias in PG’s return/risk curve anymore.

- My top concern is the mixed results reported in its FY 2025 Q1 earnings, especially the inventory data reported.

- I am also seeing heightened valuation risks, judging by its current P/E ratio and/or dividend yield.

THEPALMER

PG Stock: Previous Thesis and 2025 FYQ1 Recap

I last analyzed Procter & Gamble stock (NYSE:PG) back in October 2024. More specifically, I published an article on 10-5-2024 under the title of “Procter & Gamble: Buy The Dip” on Seeking Alpha. As you can already guess from the title, I argued for a buy rating on the following considerations:

The current condition surrounding Procter & Gamble stock reminds me of the wisdom of buying wonderful businesses at fair prices rather than fair businesses at wonderful prices. The recent stock price pullback offers this wonderful business at a fair price. Besides fair valuation, other positives include consistent EPS growth potential, the effectiveness of the ongoing restructuring plan, and margin expansion potential.

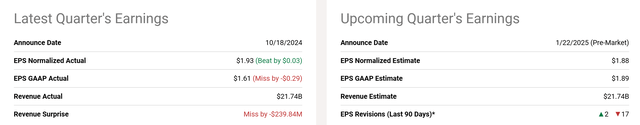

Since then, there have been a few new catalysts surrounding PG stock. In the remainder of this article, I will explain why these new developments have led me to downgrade the stock to a HOLD rating from my earlier buy rating. The top 2 catalysts on my list are its 2025 FYQ1 earnings report (released shortly after my last article on October 18, 2024, as seen in the next chart below) and also the uncertainties with its commodity costs and operating expenses.

Let me start with its FYQ1 earnings. The numbers are overall mixed in my view. As seen, its normalized EPS of $1.93 beat estimates narrowly by $0.03. However, the GAAP EPS of $1.61 missed estimates by a sizable margin of $0.29. Revenue for the quarter reached $21.74 billion, also falling short of estimates by $239.84 million. Looking ahead to the next quarter (with an announcement date scheduled for January 22, 2025), the market consensus is quite gloomy. The EPS revisions were dominated by downward revisions (a total of 17 vs. only 2 upward revisions). The market expects a normalized EPS of $1.88, or about a 2.5% decline sequentially, and a flat revenue.

Next, I will explain why I see good reasons for such a gloomy outlook.

Seeking Alpha

PG Stock: Inventory in Focus

Among the many headwinds (more on them later), the top concern in my mind is its inventory. Inventory is an area most investors do not pay much attention to, but I really urge you to follow these insights from Peter Lynch:

To start, unlike many other financial data that are more open to interpretation, inventory is one of the less ambiguous financial data. Lynch also explained why inventory levels can be a telltale sign of business cycles. Inventory buildup is a warning sign, which indicates the company (or sector) might be overproducing while the demand is already softening. Conversely, depleting inventory could be an early sign of a recovery.

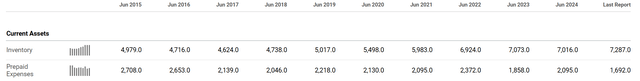

Under this background, you can see why Procter & Gamble’s inventory levels are concerning. The next chart shows its last reported balance sheet. As seen, over the years, there has been a general upward trend in its inventory. In 2015, inventory stood at $4,979 million and has gradually risen to the last reported figure of $7,287 million, a record level in at least the past decade.

Seeking Alpha

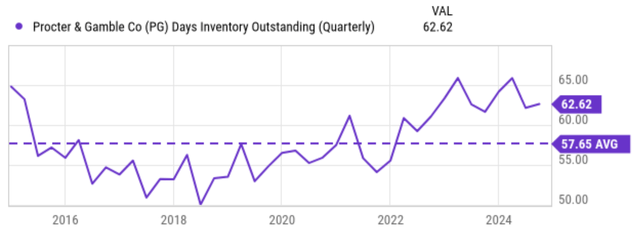

It is totally normal – or even desirable – for a business’ inventory to grow, as long as it is in tandem with its sales. Unfortunately, this is not the case here for PG, judging by its days inventory outstanding (DIO) data shown below. For readers new to the concept, DIO is a measure of how long it takes the company to sell its inventory. As seen, PG’s average DIO is about 57.65 in the long term. From approximately 2021 onward, its DIO began to trend upwards and stayed above this average. As of its latest earnings report, its DIO hovers around 62.62, not only considerably above its long-term average but also among the highest levels in the past decade.

Seeking Alpha

PG Stock is Fully Valued

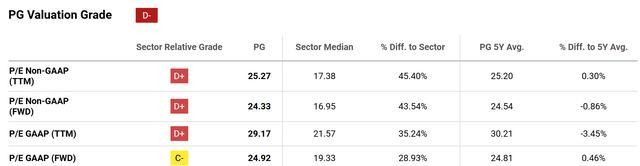

Despite mixed earnings and concerning inventory, PG’s shares appear fully valued in my assessment. As a reflection, its overall valuation grade is D- as you can see from the following chart. To wit, its P/E (on TTM and non-GAAP basis) is 25.27, a substantial 45.40% above the sector median of 17.38, which is of course justifiable to a large extent given the leading position of the stock in the sector and its superior financial strength. However, note that the current P/E multiple is also well in line with its own past average, indicating fair valuation.

Seeking Alpha

When measured in dividend yields, the valuation risks are heightened. Given PG’s status as a poster boy for dividend growth stocks, dividend payouts are a good measure of its true economic earnings, and thus dividend yield is an important valuation parameter. As seen in the next chart, its dividend yield has fluctuated between roughly 2% and 3.6% over the past, most of the time. The average dividend yield during the past 10 years is about 2.75%. The current dividend yield of 2.33% is not only below the long-term average but also among the lowest levels in at least 10 years, indicating heightened valuation risks.

Seeking Alpha

Other Risks and Final Thoughts

Besides the issues mentioned above, I am also seeing some uncertainties regarding its commodity costs and operating expenses in recent quarters. These uncertainties are especially acute in its Argentina and Nigeria operations, where the macroeconomy faced (and is still facing in my view) challenges such as high inflation. As a response, PG liquidated most of its Argentine holdings in early 2024 and has largely overhauled its operations in these two regions. Along the line of its overseas operations, I also expect foreign currency exchange rates to persist as a headwind in the coming quarters.

On the positive side, P&G is adjusting its positioning based on the updates described in its FYQ1 earnings report. Some specific changes are especially noteworthy to me. For example, the company is pursuing an integrated growth strategy that encompasses product pipeline, packaging, branding, and retail execution. These efforts are promising, and I expect them to help PG keep (or even gain) market share, bolster productivity, and grow its volume. These efforts, when combined with the pricing initiatives the company is undertaking, should help to offset the issues of commodity costs and operating expenses I just mentioned.

Overall, my assessment is that these positives are largely canceled out by the negatives, and I do not see a clear alpha in its return/risk profile under current conditions. As such, this follow-up article downgrades my rating to a HOLD from the earlier buy rating. To recap, among my concerns, the top issues are A) the mixed results reported in its FYQ1 earnings (and the inventory data is especially concerning to me), and B) the valuation risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.