Summary:

- Exxon Mobil, with a market cap of $491.5 billion, has achieved a 15.2% upside since December, though it has lagged behind the S&P 500’s 31.5%.

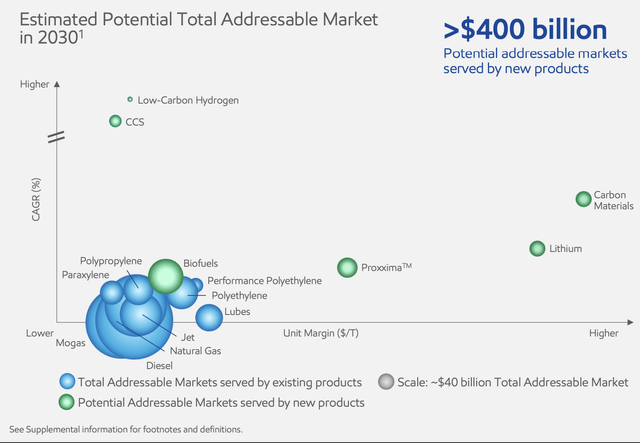

- Management’s guidance through 2030 highlights significant growth potential in both traditional and new energy sectors, with a $400 billion market opportunity for new products by 2030.

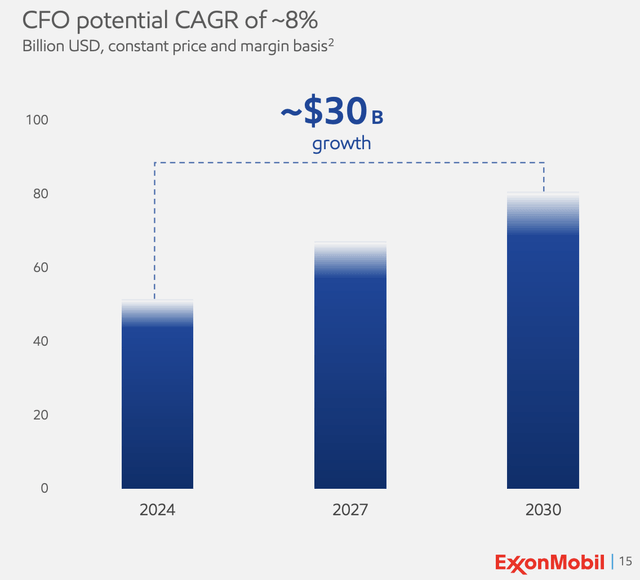

- Capital expenditures are projected to nearly triple to $140 billion from 2025-2030, aiming for a $30 billion increase in annual operating cash flow.

- Despite past performance, Exxon Mobil’s strategic investments and cost-cutting measures are expected to yield market-beating annualized returns of around 14.2% through 2030.

Lanier

With a market capitalization as of this writing of $491.5 billion, Exxon Mobil Corporation (NYSE:XOM) is a true behemoth in the fossil fuel industry. The company touches on multiple parts of the energy space, not only when it comes to traditional fuel, but also when it comes to clean energy. This is a firm that I have been bullish about for quite some time. Since I last reaffirmed it as a ‘buy’ candidate in December of last year, shares have achieved a respectable 15.2% upside. However, that does fall quite a bit short of the 31.5% achieved by the S&P 500 over the same window of time.

Despite this disappointing return disparity, the business continues to March forward with plans for the future. In fact, earlier this month, management came out with guidance covering the 2030 fiscal year. This paints a picture of a firm that will continue to grow into what is currently a very large market. It’s unlikely that the company will make you rich with this growth. However, enough upside exists to justify a soft ‘buy’ rating at this time.

A look into the future

On December 11th, the management team at Exxon Mobil released a detailed report in which they talked about what the next several years should look like for the company. This is a rather comprehensive piece, touching on multiple parts of the company. And it gives insight into where management believes the firm can go from a shareholder return perspective. For starters, I think it would be helpful to put into perspective just how large the market opportunity for the company is.

In the image above, you can see that management has identified multiple opportunities for shareholders to benefit. This includes potential associated with existing products, as well as potential involving new products. All said and done, management believes that the potential addressable market for new products alone will be worth over $400 billion by the year 2030. Examples here include things like biofuels, lithium, carbon capture and storage opportunities, low-carbon hydrogen, and more.

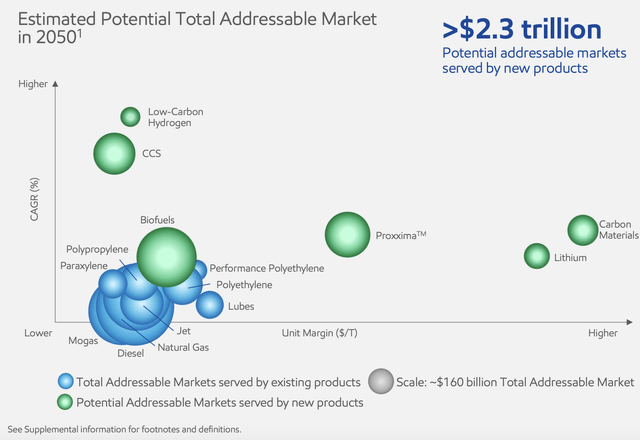

By 2050, the market opportunity for new products could be worth more than $2.3 trillion. Much of this will involve growth associated with biofuels, carbon capture and storage initiatives, and Proxxima. For those not familiar with the last of these, it refers to the firm’s Proxxima polyolefin thermoset resin systems. This technology can be used for the production of anti-corrosion coatings, as well as in the oil and gas industry to replace polypropylene and silicone that is currently used for subsea thermal insulation. In the wind turbine industry, these systems can also be used for the turbines themselves, and they can also be used for electric vehicle parts.

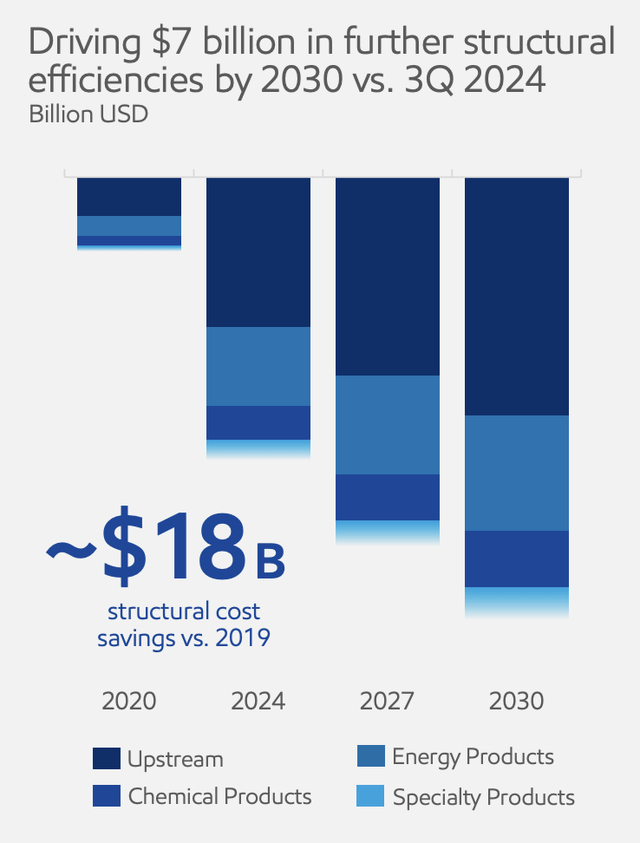

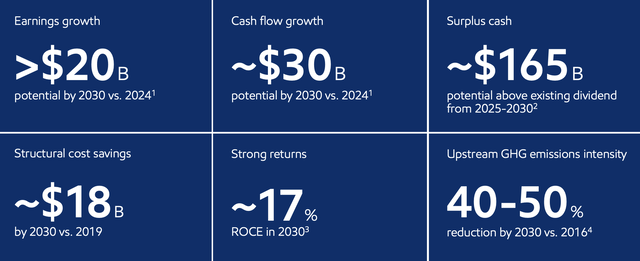

Of course, this does not come cheap. From 2019 through 2024, management spent $51 billion on capital expenditures for major projects. From 2025 through 2030, management expects this to be nearly triple that at $140 billion. A lot of this spending will be used on some traditional sides of the business. For instance, management intends to grow upstream energy production by 25.6% over this window of time in a bid to push upstream earnings up at a rate of around 7% per annum. That should grow upstream earnings by roughly $9 billion over that window of time. Management has said that it will continue working on cost-cutting, which should help with these improvements. From 2019 through 2030, management is targeting $18 billion in cost reductions. $7 billion of that will be realized between the end of the third quarter of this year and the end of the decade. The end result of these changes should be an operating cash flow that is $30 billion, annually, greater than what it should be this year.

When it comes to the newer opportunities, management believes that certain product solutions, such as Proxxima, will help the company capture around $6 billion or more in annual earnings potential by the year 2040. By 2030, this market alone is estimated to be worth around $100 billion. By 2030, management also believes that it can grow its low-carbon solutions earnings to $2 billion on an annualized basis. These low-carbon solutions include its carbon capture and storage initiatives, as well as its low-carbon hydrogen. This, combined with Proxxima, advanced recycling, carbon materials production, lower emissions fuels, the company’s own version of lithium, and more, should result in annual earnings of around $3 billion by the end of this decade. And by 2040, they think that number could balloon to $13 billion.

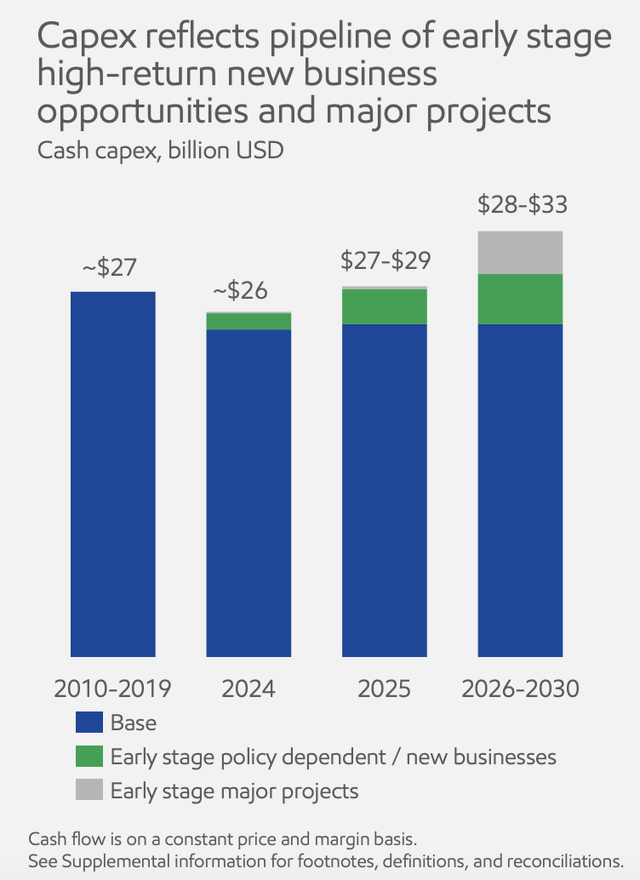

To capture all of these opportunities, management intends to spend around $27 billion to $29 billion on capital projects next year. In 2026 through 2030, they expect annual capital expenditures to be between $28 billion and $33 billion. About $30 billion, in the aggregate, of this spending will involve lower emissions opportunities. Obviously, with these kinds of investments, one would be right to wonder if the company will continue to be able to reward shareholders appropriately. To put this in perspective, during the first nine months of the 2024 fiscal year, Exxon Mobil repurchased $13.8 billion worth of shares. At the same time, they also paid out dividends to shareholders amounting to $12.3 billion.

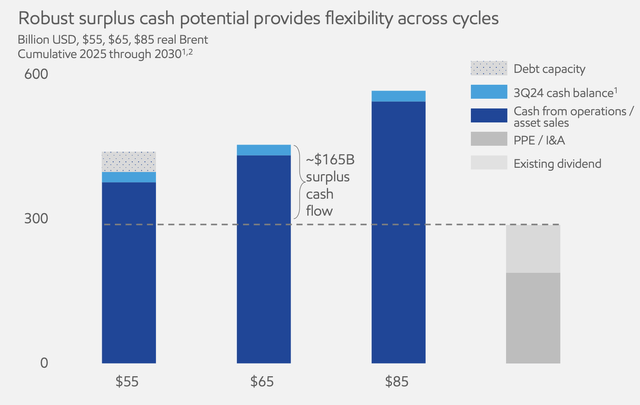

If we look at the midpoint of capital expenditure guidance for the 2025 through 2030 fiscal years, we are looking at spending of about $180.5 billion. Management has said that their goal is to allocate 45% of operating cash flow during this window of time toward those kinds of projects. They believe that this payout ratio is achievable so long as oil prices average $65 per barrel during this timeframe. When we do the math, this would imply a total operating cash flow during this time of about $401.1 billion.

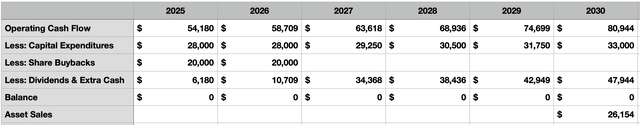

Once we strip out the capital expenditures, we end up with $220.6 billion leftover. Management stated that they expect to continue paying out the dividend as they have. They do intend to buy back about $20 billion worth of stock in each of the next two fiscal years. In my analysis of the company, I assumed that this is done subject to the same price to operating cash flow multiple that shares are currently trading at. That’s about 9.7 based on guidance and my own estimates. If we assume that management intends to keep the total dollar amount of dividends being paid out the same, and not the amount per share, that would give us about $103.7 billion worth of dividends over this span of time.

Management assessment assumes that there will be excess cash flow after capital expenditures and dividends of about $165 billion. But even this needs some adjusting. This does factor in the roughly $27 billion in cash that the company has on hand right now, minus $5 billion in minimum cash balances that it has to maintain. This means that about $143 billion in excess cash flow should be generated by the company from 2025 through 2030. Based on my own calculations, operating cash flow in the aggregate should be around $116.9 billion during this time. To bridge that gap, we have to assume about $26.2 billion worth of non-core asset sales. Management did not quantify what asset sales would look like. However, they did state multiple times that this would be part of the cash flow equation.

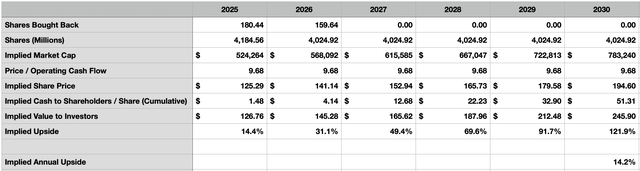

It really doesn’t make a difference when these asset sales occur for the purpose of this analysis. So for simplicity’s sake, I just put them at the tail end of this timeframe. The end result is the table above, which shows the annual operating cash flow, capital expenditures, the combination of dividends and other excess cash that the company has, and the asset sales in question. In the table below, you can see certain assumptions that I relied on in this analysis. The bottom line of this is that, if the firm continues to trade at the same price to operating cash flow multiple that it is currently trading at, this would mean an annualized upside of about 14.2%. Seeing as how the broader market usually gets around 11% to 12% per annum, this is certainly worthy of a bullish assessment.

Takeaway

Based on the data provided, I do believe that while Exxon Mobil has fallen short of my own expectations relative to the broader market, that has more to do with the irregular strength of the market than it does with the health of the enterprise. Moving forward, we probably will see years when the picture is not as attractive as it is now. But so long as the management team at Exxon Mobil achieves what it is setting out to achieve, the end result should be market-beating upside on an annualized basis between now and the end of 2030.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!