Summary:

- Quantum Computing has seen a significant stock surge, driven by its Q3 2024 financial report and Amazon Web Services’ Quantum Embark program announcement.

- The firm’s TFLN foundry in Arizona, set to start production in early 2025, is expected to drive significant revenue growth through pre-sales and off-take contracts.

- The global quantum computing market is projected to grow significantly, providing substantial growth potential for QUBT’s revenue in the coming years.

- The entire QC market should be worth $12-13 billion by FY2032; QUBT’s market cap today is already 6-7% of that amount. QUBT’s stock is extremely overheated despite clear fundamental tailwinds.

- I think it’s safest to wait for the current stock price decline of 20-30%, if not more. I therefore rate QUBT as a “Hold” today.

da-kuk/E+ via Getty Images

Intro & Thesis

According to Seeking Alpha description, Quantum Computing Inc. (NASDAQ:QUBT) is a young (founded in 2018) $768 million market cap company specializing in integrated photonics that offers low-cost, easy-to-use quantum computing systems. Their products include the Dirac systems, portable, low-power, room-temperature qubit, and qudit entropy quantum computers (EQC). They also provide reservoir computing, remote sensing, and single-photon imaging technologies. In addition, the firm offers a Quantum Random Number Generator (uQRNG), a mobile quantum random number generator device, and quantum authentication that makes quantum cyber secure by utilizing entanglement quantum cyber solutions that are embedded in existing telecom and communication infrastructure.

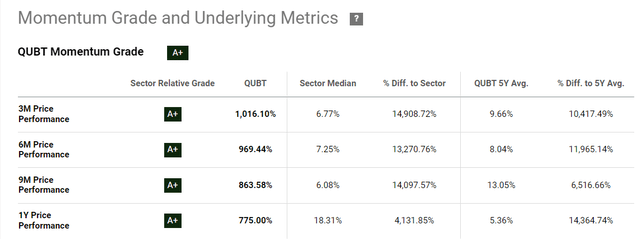

Over the past few months, the QUBT stock has shown phenomenal momentum – in the last 3 months alone, it has increased by over 10 times:

Seeking Alpha, QUBT’s Momentum

Most of the stock’s movement took place in November, as this phenomenal rally was initially triggered by the QUBT report for Q3 2024, which was published on November 6, 2024. At the end of the month, the rally that had begun was spurred by news that Amazon Web Services (AMZN) announced the Quantum Embark program, “created to help customers prepare for the era of quantum computing, an emerging field that harnesses the powers of quantum mechanics,” Seeking Alpha reported.

So we see that QUBT had a fundamental justification for its rapid rise, but it’s unclear at this point how much of the FOMO we are seeing in the stock’s price action today is justified. I think the massive move up may be exhausted, and speculators and medium-term investors should look to buy the stock at a lower price, but not at its current $6-7/sh levels.

Why Do I Think So?

Since QUBT’s Q3 2024 financial report was the first trigger for its growth, I suggest starting with its analysis.

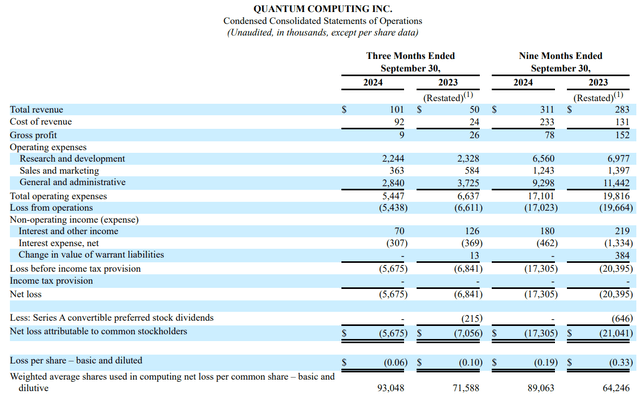

Quantum Computing generated revenues of $101 thousand this quarter, compared to ~$50K last year. This growth largely came from contractual revenue, such as a deal with Johns Hopkins University to develop an underwater quantum LiDAR prototype. However, QUBT’s gross margins fell from 52% to 9%, largely because the Johns Hopkins work is high on the direct component and labor side, as opposed to higher-margin NASA LiDAR work. On the other hand, QUBT’s operating expenses in Q3 2024 totaled $5.4 million compared to $6.6 million last year (a cut of 18% YoY) as the management tried to trim SG&A expenses, such as employees, consultants, and legal costs. The company maintained its R&D spend at $2.2 million as a demonstration of its dedication to innovation and future growth, especially in high-performance computing infrastructures. As a result of all that the bottom line (i.e. EPS) was still negative at $0.06/sh, but it’s way better than last year’s net loss per share of -$0.10 (and it was a surprise to Wall Street’s consensus of -$0.08/sh).

But the above financials wouldn’t be enough to trigger the rally we saw in November.

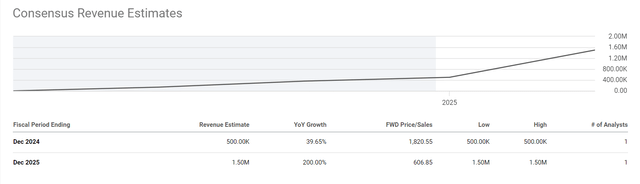

From an operational standpoint, the firm has done a great deal of work with its TFLN foundry in Tempe, Arizona. This plant is currently in the final stages of commissioning and will start production in early 2025. The foundry plays an integral role in scaling production and market penetration. Quantum Computing has already begun executing offtake contracts and pre-sales orders with prospective new customers and strategic partners, confirming the tremendous demand for TFLN devices. I think this move should yield early significant revenues, which will be reinvested into the company’s quantum computing machine platform. According to current data from Seeking Alpha Premium, today’s consensus revenue for FY2025 assumes a 200% annualized increase, which, I believe, is an understatement as the actual demand for QUBT products looks much more significant today given the recent news from AWS and universities (the new orders from University of Texas should ship in the first quarter of FY2025).

According to Grand View Research, the global quantum computing market size was estimated at just $1.21 billion in 2023, and it’s expected to grow at a CAGR of ~20.1% up to 2030. Another third-party research agency says this market should reach over $12.6 billion in size by 2032, so the growth potential of QUBT’s revenue seems to be there indeed.

The strategy that QUBT takes to use its base technology to achieve multiple revenue streams is apparent in its product roadmap. The Dirac-3 (room temperature) and the 25 watts of power it uses puts it at the head of the pack in size, weight, power, and cost (SWAP-C). It brings the company’s quantum products to market at a reasonable cost in line with its business strategy. So the advantage of QUBT’s offerings seems to help the firm pick up more contracts. According to the earnings call, during Q3, QUBT signed its 5th NASA contract to develop quantum technology for spaceborne LiDAR sensors. This contract would slash the cost of spaceborne LiDAR from billions to millions of dollars while improving climate monitoring and data collection.

For Q4 and FY2025, management anticipates recurring strong revenue growth due to the TFLN foundry and strategic partnerships. The Tempe foundry will open in the first quarter of 2025 and will host a grand opening to demonstrate its capabilities. I think the expectation of something “game-changing” from the upcoming foundry opening is driving FOMO among market players today. I’ve also read in some comments that some bulls believe that QUBT’s solutions (and quantum computing technologies in general) will become an alternative to Nvidia’s (NVDA) processors, so buying QUBT at a market capitalization of over $700 million today is a reasonable thing to do. But I’d like to urge skepticism when making such an investment decision.

The thing is that NVDA and QUBT are playing in different niches. Quantum Computing Inc. focuses on quantum computing hardware utilizing embedded photonics and novel materials such as thin-film lithium niobate – their devices (the Dirac systems, for example) are designed for high-performance computing, AI, machine learning, and remote sensing that stand out because they require relatively little power and operate at room temperature, making them well suited for niche applications that require quantum computing power. Nvidia, on the other hand, dominates the graphics processing units (GPU) market and has already expanded its offerings into AI, machine learning, and data center solutions. We know that Nvidia GPUs are essential for high-performance computing such as training AI models or doing deep simulations. Although Nvidia has been interested in quantum computing via collaboration and research, its core focus remains traditional computing. So the two firms might grow more competitive in the long run, however, if quantum computing technologies mature to support a larger number of applications not currently served by traditional computing appliances such as Nvidia’s GPUs. But since quantum computing is still in its infancy, Nvidia’s established market share and continuing investment in AI/ML give it a solid competitive advantage over the short- to medium-term.

I would also like to draw your attention to the size of QUBT’s market capitalization today – it seems to me that the rally has gone too far. I don’t want to show the price-to-sales ratio of >600x by the end of FY2025 because the estimated revenue of $1.5 million next year could actually be many times higher, as I mentioned earlier. Just look at the projections for the growth of the quantum computing market – the boldest predictions are that the entire global market will be worth $12 billion to $13 billion by 2032. When I say “the entire market”, I am primarily referring to annual revenues here. That is, the market assumes that the company’s current market cap will translate into 6-7% of the entire quantum computing market share by FY2032, assuming a price-to-sales ratio of 1x. QUBT’s offering is great, but there are already other players in the market that have much bigger “wallets” and can invest billions in quantum tech if they see a need for it. I’m talking primarily about Google’s (GOOGL) Quantum AI, Microsoft’s (MSFT) Azure Quantum platform, and IBM’s (IBM) Quantum Experience (and Qiskit), to name a few. While the products these companies sell are not comparable to QUBT’s, the mere threat of a very small company being “crushed” by a large company should give investors pause for thought. QUBT is certainly not like the early Nvidia in this respect, in my understanding.

The Bottom Line

It often happens that outstanding companies with excellent growth potential appear too early on the radar of a large number of investors, which leads to rapid growth, but in most cases also results in an inevitable pullback. The expectations priced into QUBT today after the 10x rise in the last 3 months point to serious overheating. In general, I like the development that the company has shown over the last few quarters. Moreover, one can’t ignore the many positive news from AWS, colleges, new contracts with NASA, and the upcoming opening of the company’s foundry early next year. For a medium-term buy, however, I think it is safest to wait for the current stock price decline of 20-30%, if not more. I therefore rate QUBT as a “Hold” today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!