Summary:

- PepsiCo hit a 52-week low, and while its stable dividend yield and profitability are positives, the technicals and market sentiment make it a sell.

- I see three potential outcomes for PEP: slow bleed (45% probability), fast flush (30%), or a minor dip (25%).

- PEP’s Yield At a Reasonable Price (YARP) valuation is unattractive, with a high dividend yield indicating high risk; the technical pattern suggests further downside potential.

- Despite its quality and stable dividend, PEP doesn’t fit my yield-at-a-reasonable-price methodology, making it a poor buy in the current market.

Jonathan Knowles

Oh, the irony. I was just sitting down to write about another well-known cola company stock (take a guess which one), when I saw a note from one of my Seeking Alpha editors: “how about writing about PepsiCo. (NASDAQ:PEP), which just hit a 52-week low without significant news.” The timing was perfect, not for PEP holders, who have suffered with the rest of the dividend stock crew lately. But for how this “cash cow” and perennial “boring but stable” business that is PEP is so symbolic of what I see in yield-land.

In fact, it is why my own Sungarden YARP Portfolio has gone from a high single-stock allocation for much of this year to now expressing a very different take on “what the market is rewarding” in the pursuit of “yield at a reasonable price (YARP). Specifically, I see increasing signs that classic dividend stocks like PEP are screaming “high risk” when it comes to their price appreciation potential. Not simply for the next few weeks, but probably a while longer. Or, since this is about price and not time.

I see 3 possible paths from here for PEP and its high-quality, above-average yielding peers:

1. Slow bleed

2. Fast flush

3. Only a flesh wound (quoting Monty Python): yet another dip to buy

I practice investing, not betting when it comes to markets. But since putting the odds in one’s favor, on a continuous basis, is truly what investing is (reward, risk and the tradeoff between them), I’ll assign these probabilities to those three outcomes, in the order shown just above: 45%, 30%, 25%. In other words, as with many, many yield stocks I follow, I see about a 3:1 risk:reward. Not good for a new buy, as it is too risky.

The bigger issue, which is a personal decision for each investor, is how badly one wants to hold the stock for the 3.5% dividend yield, with the potential to lose several years’ worth of dividend cash flow in price slippage. This is THE investment issue of our time for all dividend investors. Because whether or not it follows through (in slow bleed or fast flush form), the risk is there. Just because AI stocks have not crashed to this point, that doesn’t mean the risk of that was T-bill-like. That’s my whole point here. Now, to PEP in particular before I need a caffeine boost.

PepsiCo: quality and yield but missing that critical third element

When you publish a lot of research as I do, you’re always looking for where you think you have something different from offer. Ultimately, that is in the eyes of the audience. But as I see it, a company like PEP is so familiar, if one is to have a differentiated thesis, it is not likely to be based on fundamentals.

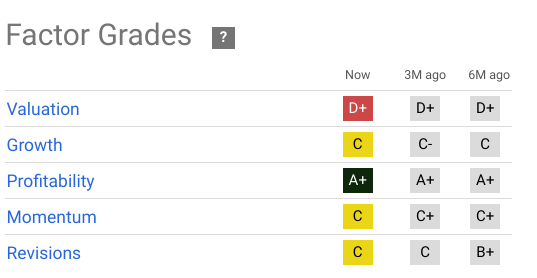

For instance, here are Seeking Alpha factor grades for the stock. A+ profitability is what I look for. Yet PEP is not on my 50-stock watchlist. When the list was 75 stocks, it was. But it did not make the cut, since I did not see a path to owning it in the near future. I maintain that view.

Seeking Alpha

Growth is a C grade, but that’s not as bad as it seems. That implies average growth for the consumer staples sector, as these grades are cast at the sector level, not versus the entire market. But that valuation grade of D+, in a sector I don’t have a high opinion on at this time, offsets whatever “goodwill” the profitability grade represents in my stock selection process.

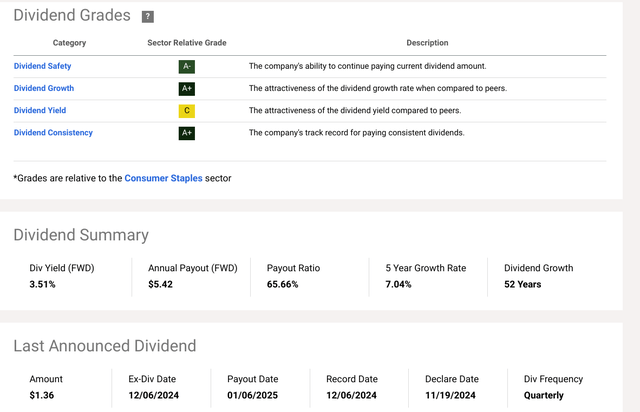

The dividend is rock-solid as the A- grade indicates. Growth is just as solid and stable, at a 7% sustained growth rate, growth that has continued since way back during the Nixon Administration. So no issues here, either.

Seeking Alpha

So, what’s not to like about PEP?

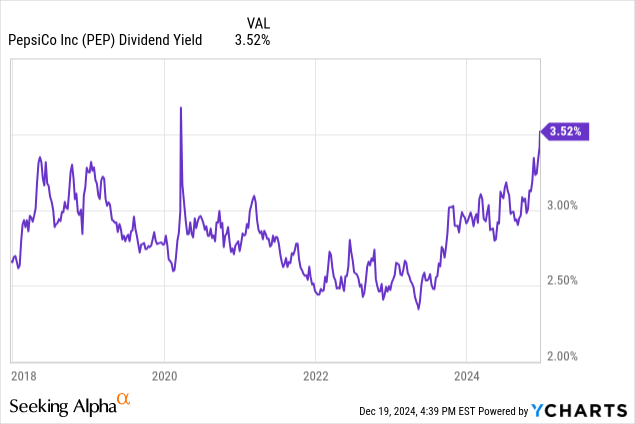

As an operating business, not much. If I had a 20-year investment time horizon and commensurate risk tolerance, I’d like this stock. But I don’t And in my yield at a reasonable price methodology, this is a picture of the historical dividend yield that tells me clearly that PEP is in what I call “the white zone.” That is, its yield is at the very top of that 7-year range. Translation: high risk, maybe high reward potential. I don’t like that combination.

And finally, here is the “must-have” for me on any position I take in the Sungarden YARP Portfolio, or any of my other portfolios. Even the trading accounts. The technical pattern has to be what I consider to be favorable. The more so, the better. Technicals do not replace the rest of the process. However, the way I’ve rolled for decades has the same 1-2 punch:

1. Create a watchlist of stocks and ETFs I’d be willing to own.

2. Use technicals to let the market tell me when reward/risk tradeoff is in my favor.

In the case of PEP, it would be very much in my favor… if I were planning to short it or buy put options. But this is about analyzing it to buy, beyond a short-term time frame. And this stock just does not have that strong tilt toward higher reward/lower risk I insist on. Frankly, very few stocks do right now. And I’ll be just fine if that persists. I’m no gambler.

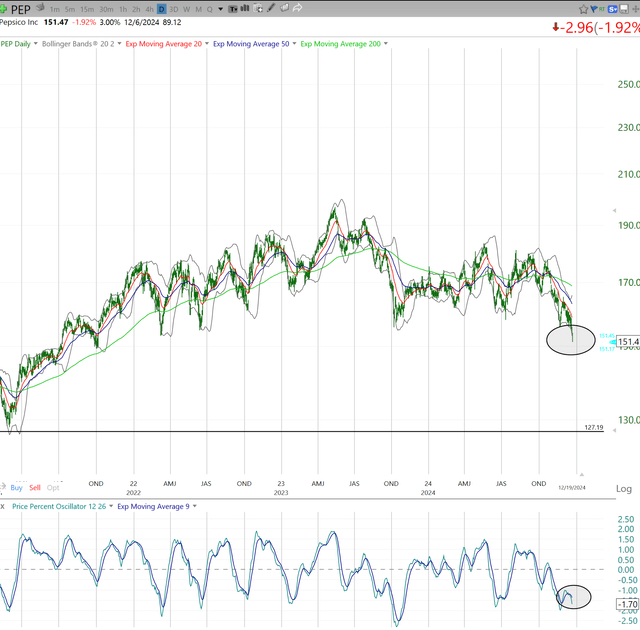

This is the daily chart. Support recently broken, and the momentum indicator at the bottom of the chart shows that recent attempts to rally have been knocked down.

TC2000

Some would argue that the stock is “cheap” because it is down. No such thing in my book. As noted above, the YARP Ratio is right around 100, which is a fancy way of saying that PEP’s dividend yield, at 3.5%, is near a 7-year-high. That’s “cheap” but at risk of getting much cheaper. Along with the vast majority of stocks I scout.

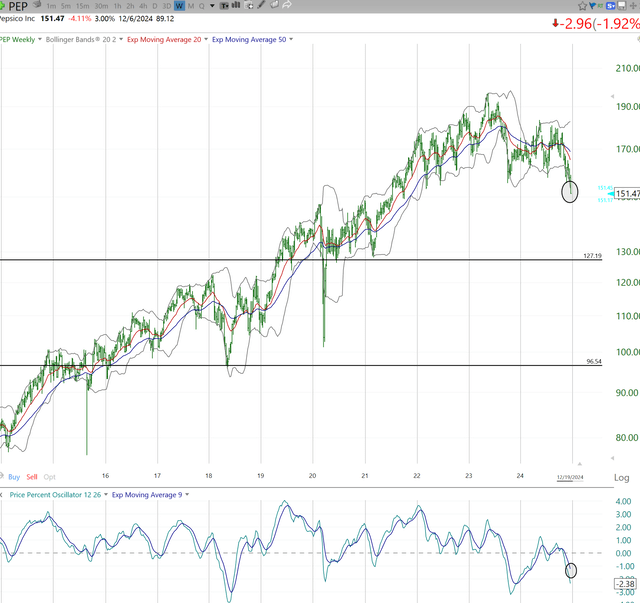

The weekly chart only makes things worse. Same type of picture as the daily, but weeklies turn more slowly. And are more trustworthy over time. The daily chart pointed to risk down to $127, which is more than 30% off the 2023 high for this stock. This weekly points to much lower, $96. That’s more than 35% off of the current price.

TC2000

Before anyone decides that these are “predictions,” they are not. They are assessments of risk based on a process that got me this far since the early 1990s. PEP is a 30% up move from equaling that all-time high price. There’s a chance that market mood changes, but as noted earlier, I give that about a 1 in 4 chance. Because NOTHING in investing is certain, despite the volume of definitive comments I see across the site.

PEP: classic stock, classic example of what’s wrong with dividend stocks right now

To me, PEP is not an isolated example. I see different varieties of the same thing. And so I’m not a buyer, and at this point, just a casual follower. Now, grab me a Coke and let’s go back to work (I own Coca-Cola stock in small size).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was about PEP, but I briefly mentioned KO, so disclosing my position.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

By Rob Isbitts and Sungarden Investment Publishing

A community dedicated to navigating modern markets with consistency, discipline and humility

Full Access $1,500/year

Legacy pricing of $975 for first 35 subscribers, a savings of 35%

-

Direct access to Rob and his live YARP portfolio, featuring a trademarked stock selection process he developed as a private portfolio and fund manager, and his decades of technical analysis experience.

-

24/7 access to Sungarden’s investment research deck

-

Bottom-line analysis of stocks, ETFs, and option strategies

-

Trade alerts and rationale, delivered in real-time

-

Proprietary educational content

-

You won’t get: sales pitches, outlandish claims, greed-driven speculation