Summary:

- AVGO’s robust growth prospects are driven by the growing hyperscaler demand for custom ASICs, one that is likely to be a top/ bottom-line driver through FY2027.

- If anything, the management has already hinted at an accelerated CAGR of +83.1% from the FY2024 AI accelerators/ networking revenue base from $12.2B in FY2024 to $75B in FY2027.

- Assuming that AVGO delivers on its long-term growth guidance of approximately ~30% through FY2027, we believe that the stock remains compelling for high growth oriented investors.

- Even so, given the recent outsized rally and the potential selling pressure after the ex-dividend date, we believe that there may be a near-term correction indeed.

- Opportunistic investors may take this chance to buy AVGO’s upcoming dip, with the uptrend bullish support offering interested investors with an improved margin of safety.

mikkelwilliam/E+ via Getty Images

Broadcom’s Custom Compute Chips Remain Long-Term Growth Tailwinds – Near-Term Correction Likely

We previously covered Broadcom (NASDAQ:AVGO) in September 2024, discussing its robust growth prospects through custom silicon chips and higher networking demand, which supported the excellent top-line expansion, the high-margin subscriptions/ services segment, and the strong enterprise backlog.

Despite the elevated debts from the VMware acquisition, its rich free cash flow and commitment to shareholder returns made it a compelling high-growth investment thesis, resulting in our reiterated Buy rating then.

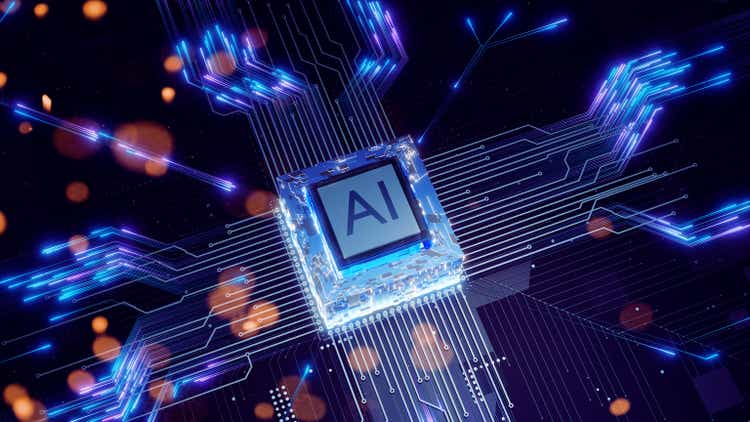

AVGO YTD Stock Price

Trading View

Since then, AVGO has mostly traded sideways, before the market rewarded the stock with an outsized rally of +38.3% after the double beat FQ4’24 earnings call.

Much of the optimism naturally arises from the durability of generative AI demand through the infrastructure and SaaS layers, with the world’s largest foundry by market share, Taiwan Semiconductor Manufacturing (TSM), reporting robust October 2024 revenues of NT$314.2B (+29.2% YoY) and November 2024 revenues of NT$276.05B (+34% YoY).

This is on top of the TSM management hinting at another outperforming year as “next year looks to be a healthy year. So it is very likely that our CapEx next year will be higher than this year,” with it lending further credibility to the “customers’ demand (which) far exceeds our ability to supply.”

This is a material development indeed, since AVGO specializes in Custom Application-Specific Integrated Circuits [ASIC] – one currently in hot demand from the global hyperscalers, as the company calls Google (GOOG), Meta (META), and ByteDance (BDNCE) as its customers.

This is on top of the rumored upcoming partnership with OpenAI and Apple (AAPL) along with “two additional hyperscalers,” with it further demonstrating AVGO’s undisputed leadership in the custom ASIC market.

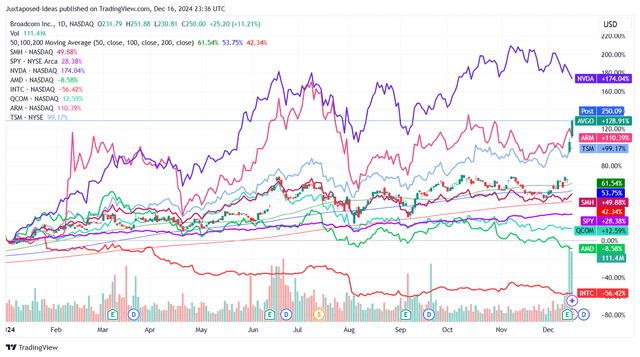

The Consensus Forward Estimates

Seeking Alpha

The same has been observed in AVGO’s robust FQ4’24 performance, with semiconductor revenues of $8.23B (+13.2% QoQ/ +12.4% YoY) and infrastructure software revenues of $5.82B (+0.5% QoQ/ +196.9% YoY).

If anything, the management’s promising FQ1’25 guidance, with revenues of $14.6B (+3.9% QoQ/ +22% YoY) and adj EBITDA margin of 66% (+1.4 points QoQ/ +6.3 YoY/ +10.7 from FY2019 levels of 55.3%) further underscoring its high growth/ profitable business operations, building upon the FY2024 numbers of $51.57B (+44% YoY) and 61.8% (-3 points YoY), respectively.

These reasons may also be why the consensus raised their forward estimates, with AVGO expected to generate an accelerated top/ bottom-line growth at a CAGR of +16%/ +22.2% through FY2027.

This is compared to the original estimates of +7.9%/ +13.2%, while accelerating from its historical growth at a CAGR of +17.9%/ +18% between FY2019 and FY2024, respectively, thanks to the renewed growth opportunity from the custom ASICs and higher networking demand.

If anything, given AVGO’s robust core portfolio revenues of $39.3B (+22.9% YoY) and the AI accelerators/ networking revenue of $12.2B (+221% YoY), we believe that the company is likely to beat the consensus FY2027 revenue estimates of $79.94B indeed.

This is why.

For now, as more hyperscalers aim to develop more of their in-house AI chips to better suit their needs while lowering costs, it is unsurprising that the AVGO management has highlighted its massive multi-year opportunities through ASICs, with an estimated FY2027 AI Serviceable Addressable Market [SAM] size of between $60B and $90B – with it defining “a potential target market size a business can reach.”

Given the accelerated CAGR of +83.1% from its FY2024 AI accelerators/ networking revenue base from $12.2B in FY2024 to $75B at the midpoint in FY2027, we concur with the management’s promising sentiment in which they “are very well positioned to achieve a leading market share” ahead.

Combined with the AVGO’s guidance of “the industry’s historical growth rate of mid-single digits” on the broad portfolio of non-AI semiconductors with its multiple end-markets (assuming a CAGR of +5%), we believe that we may see the company generate an expanded top-line growth at over +30% instead.

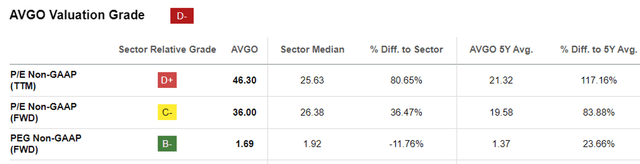

AVGO Valuations

Seeking Alpha

For now, we believe that AVGO remains attractive at FWD P/E non-GAAP valuations of 36.00x, despite the notable upgrade from its 1Y mean of 30.57x, 5Y mean of 19.58x, 10Y mean of 15.73x, and the sector median of 26.38x.

This is because AVGO’s valuations are still reasonable after comparing to the king of GPU/ AI accelerators, Nvidia (NVDA) at 45.46x, along with two other AI contenders, Advanced Micro Devices (AMD) at 38.17x and Intel (INTC) at 28.96x.

On the one hand, given AVGO’s lower consensus adj EPS growth estimates over the next few years at +22.2%, compared to its peers’ projected high double digit growth rates, including NVDA at +62.7% and AMD at +38.9%, it appears that AVGO’s FWD PEG non-GAAP ratio of 1.69x may be somewhat expensive after all, compared to NVDA at 1.19x and AMD at 0.91x.

On the other hand, assuming an acceleration of AVGO’s adj EPS growth at a CAGR of over ~30%, as discussed above, we may see the stock’s FWD PEG non-GAAP ratio moderate to 1.20x, with it signaling the stock’s improved investment thesis.

Naturally, this is assuming that AVGO is able to deliver on their long-term growth guidance of at least $75B in FY2027 AI accelerators/ networking SAM while maintaining its current profit margins, barring which, the stock’s inflated valuations/ outsized rally may offer interested investors with a minimal margin of safety.

So, Is AVGO Stock A Buy, Sell, or Hold?

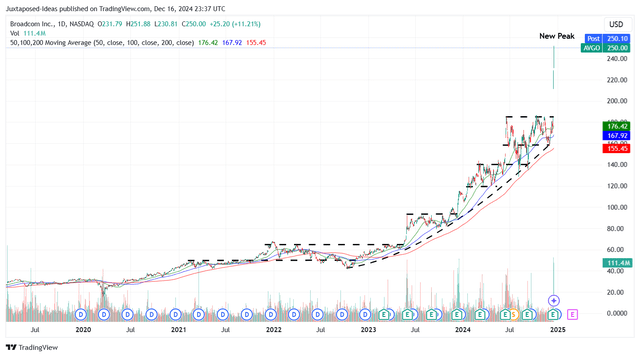

AVGO 5Y Stock Price

Trading View

For now, AVGO has already charted new heights beyond historical levels, as the stock hits $250 while running away from its 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $139.10 in our last article, based on the LTM adj EPS of $4.55 ending FQ3’24 (+9.3% sequentially) and the 1Y P/E non-GAAP valuations of 30.57x.

However, based on the FY2024 adj EPS of $4.87 (+15.1% YoY), it is apparent that AVGO ran away from our updated fair value estimates of $148.80.

Based on the consensus FY2027 adj EPS estimates of $8.74, there appears to be a minimal margin of safety to our long-term price target of $267.10 as well, with it underscoring why the recent rally may have occurred overly fast and furious indeed.

Part of the optimism may also be attributed to AVGO’s recent dividend hike by +11.3% to $0.59 per share, with it building upon the 5Y growth rate at +14.7%.

Even so, the recent outsized capital appreciation has also triggered its moderated forward dividend yields to 0.94%, compared to its 5Y average of 2.53% and the sector median of 1.43%.

As a result of the baked in upside potential and the potential selling pressure after the ex-dividend date of December 23, 2024, we believe that there is a minimal margin of safety at current levels, with AVGO likely to lose part of its recent gains in the near term.

Does this mean that we are downgrading the stock to a Hold here?

Not so fast.

We believe that AVGO is likely to continue enjoying robust bullish support ahead, as observed in the consistent uptrend line since the October 2022 bottom, with any dip likely to be well defended by the bulls.

If anything, historical trends point to $180s as the next support level and $220s as the next resistance level, with the stock likely to trade sideways over the next half of year.

Lastly, based on our bull-case 3Y top-line growth rate at a CAGR of ~30%, we may see the semiconductor company report a possible acceleration in its adj EPS growth at a similar pace, if not more, with it implying a potential FY2027 adj EPS of over ~$10 and a bull-case long-term price target of ~$300s.

As a result, we are maintaining our Buy rating for the AVGO stock, preferably upon its upcoming dip to the $180s/ $190s, with those levels also unlocking improved upside potential to our long-term bull-case price target.

Patience may be more prudent in the near term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, TSM, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.