Summary:

- Quantum Computing Inc. stock surged 500% last month but has dropped near 50% in two days, raising questions about its long-term value.

- Despite promising technology, QUBT stock is overvalued at 3000x P/S, making it a risky investment compared to peers like IonQ.

- QUBT’s financials show revenue growth but also increased costs, with future focus on TFLN foundry for cash flow positivity.

- I recommend caution and rate QUBT a sell unless it drops to $4 support, RSI shows oversold, and market conditions improve.

D-Keine

Thesis Summary

Quantum Computing stocks have seen increased interest in the last week. Understandably, a company that is literally named Quantum Computing Inc. (NASDAQ:QUBT) is going to attract some attention.

But after rallying over 500% in the last month, this stock is now down 40% in the last two trading days.

Is the hype over? Was there ever any real reason to buy QUBIT? Is it worth holding for the long term?

Though I am interested in the future of Quantum computing, I do believe there are better companies out there.

QUBT has entered meme territory, and it is overvalued even by the lofty standards of Quantum stocks today.

The Quantum Leap

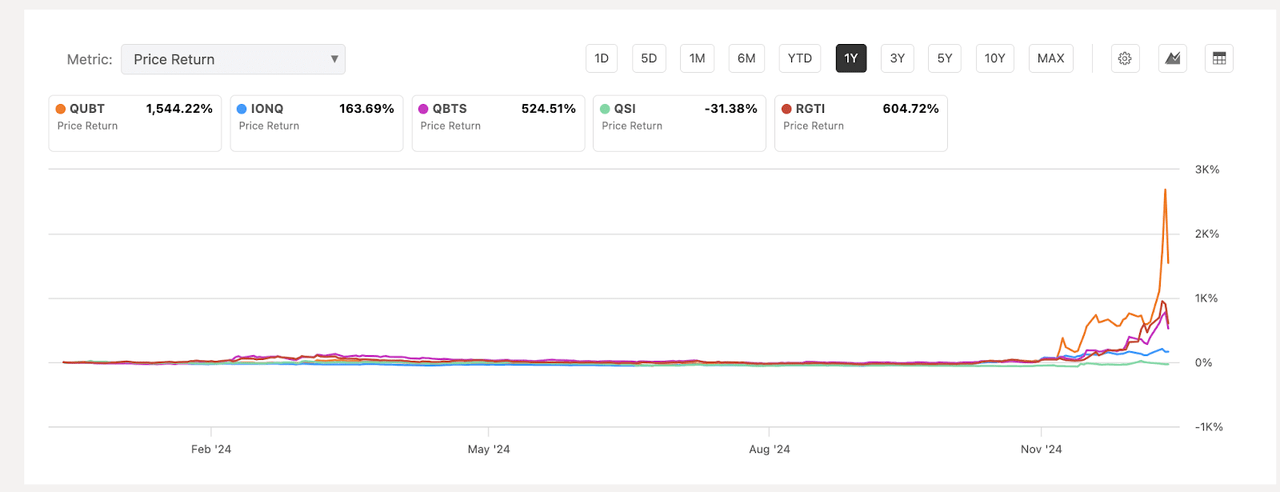

If not literally, we have at least figuratively witnessed a quantum leap in the stock price of quantum stocks.

Quantum stocks performance (SA)

A lot of these stocks have gained 10x in the last year, with most of the gains taking place in the last week.

I believe this was all sparked by Alphabet’s (GOOGL) latest breakthrough in Quantum technology, which I covered here.

But we are already seeing a lot of these stocks come back down.

Is this a dip buying opportunity?

QUBIT: What Do They Do?

QUBT stands out as the company that has benefitted the most from this rally. But what does the company actually do?

Like many of these companies, they are working on technology that has yet to gain real-world application, although QUBT already has some promising products that are in use today.

In terms of Quantum computing, QUBT’s Dirac System, promises to solve quantum computing problems using Entropy Quantum Computing. The Dirac system will, in fact, be used by NASA to support its imaging and processing demands.

QUBT also has technology specialized in remote sensing, and the uQRNG, a portable box that can generate random numbers from quantum processes.

QUBIT: Latest Quarter

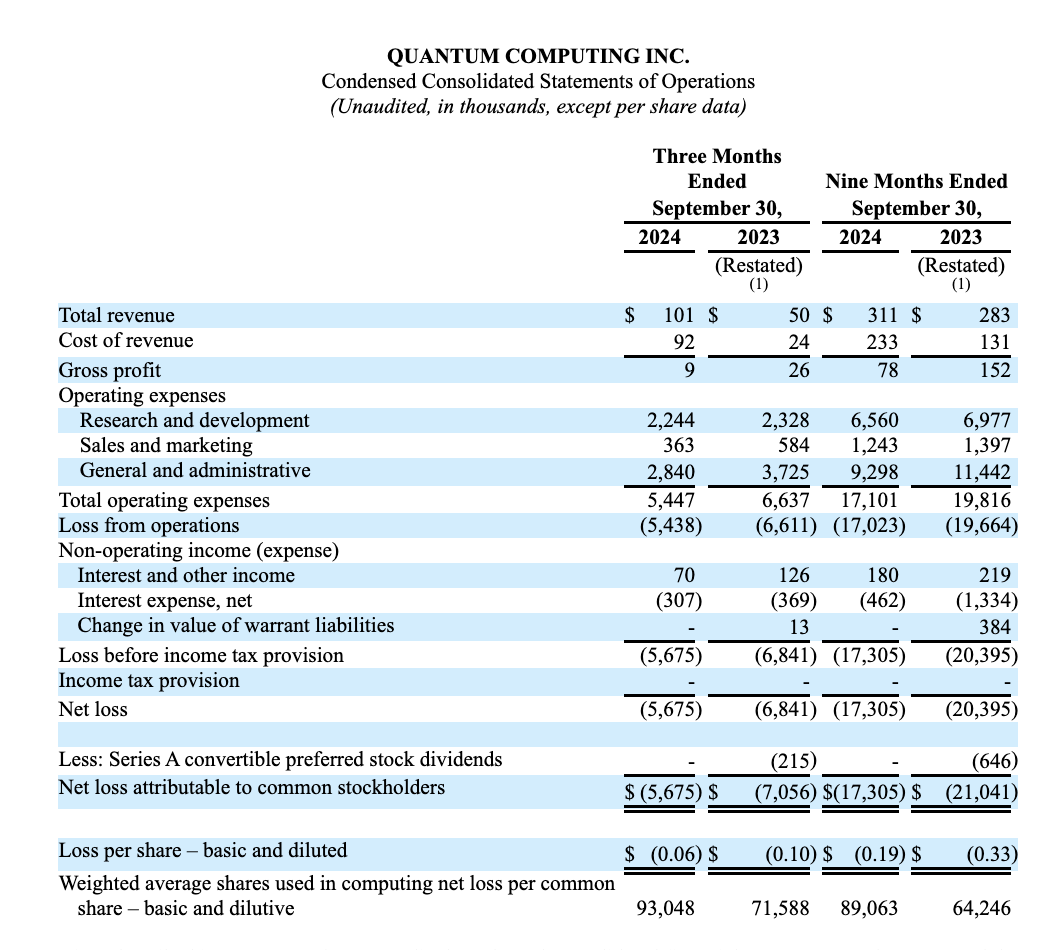

Although this technology sounds impressive, we have yet to see this reflected meaningfully in the company’s financials.

QUBT income statement (10Q)

We have seen some progress in the company’s revenues, which doubled YoY, However, the cost of revenues more than tripled over this period.

The company did make up for this with lower SG&A costs, and overall EPS loss came down from negative $0.01 to negative $0.06.

Future Outlook

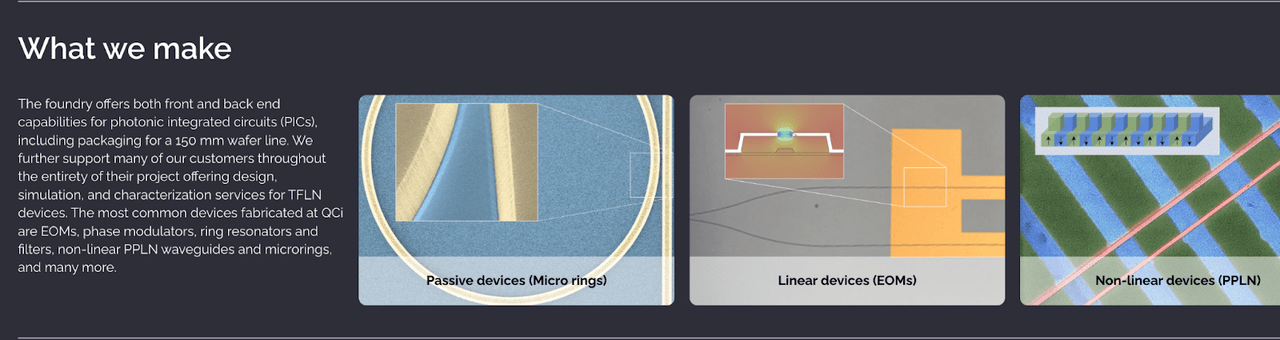

In terms of what comes next for QUBT, the company is focusing on its TFLN foundry, which aims to achieve medium-term cash flow positivity.

Looking ahead, our strategy centers on driving revenue and ultimately achieving intermediate-term cash flow from our Arizona TFLN foundry facility. We believe that over time the TFLN facility can serve as a source of stable non-dilutive cash flow while market demand for quantum computing catches up to our Quantum Computing manufacturing capabilities.

Source: Earnings Call.

TFLN stands for Thin film lithium niobate, which has implications for both quantum and photonics technology.

The company actually placed its first order for the Foundry back in November.

Comparative Valuation

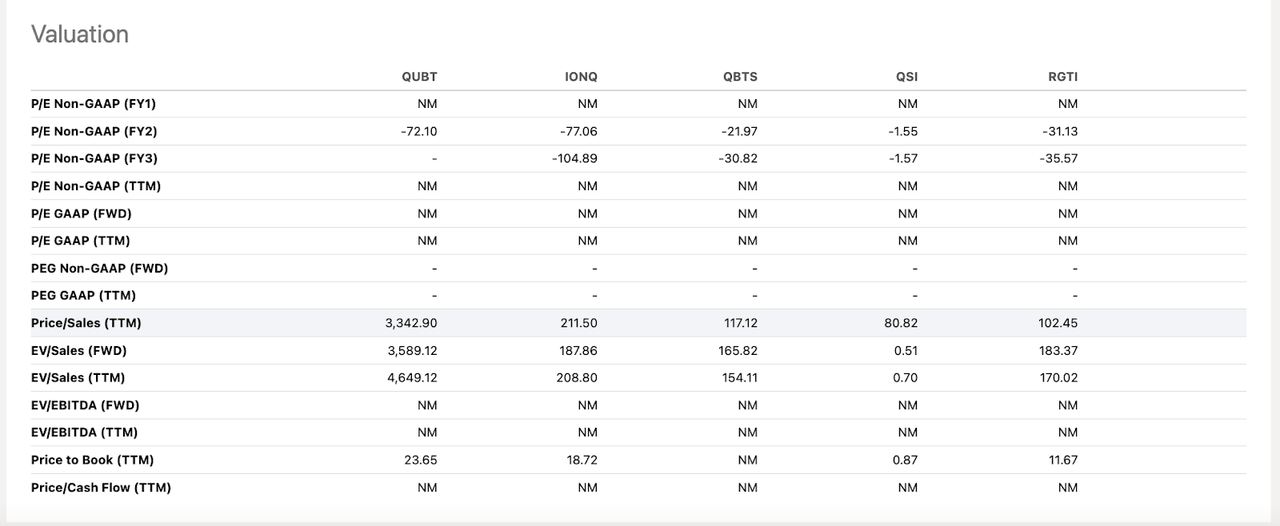

Valuing companies in the Quantum space is difficult to do, but what is simpler is to compare the valuations of the quantum stocks today.

Quantum computing sector valuations (SA)

Following the recent rally, QUBT is way overvalued compared to its peers. The stock trade sat over 3000x P/S and EV/Sales.

The next most expensive company in terms of P/S would be IonQ, Inc. (IONQ), and this trades at a ratio of 187.

With that said, the company looks a little better if we look at P/B. With over $70 million in assets and around $10 million in liabilities, it is true that at least QUBT has a decently strong financial position.

Playing With Fire

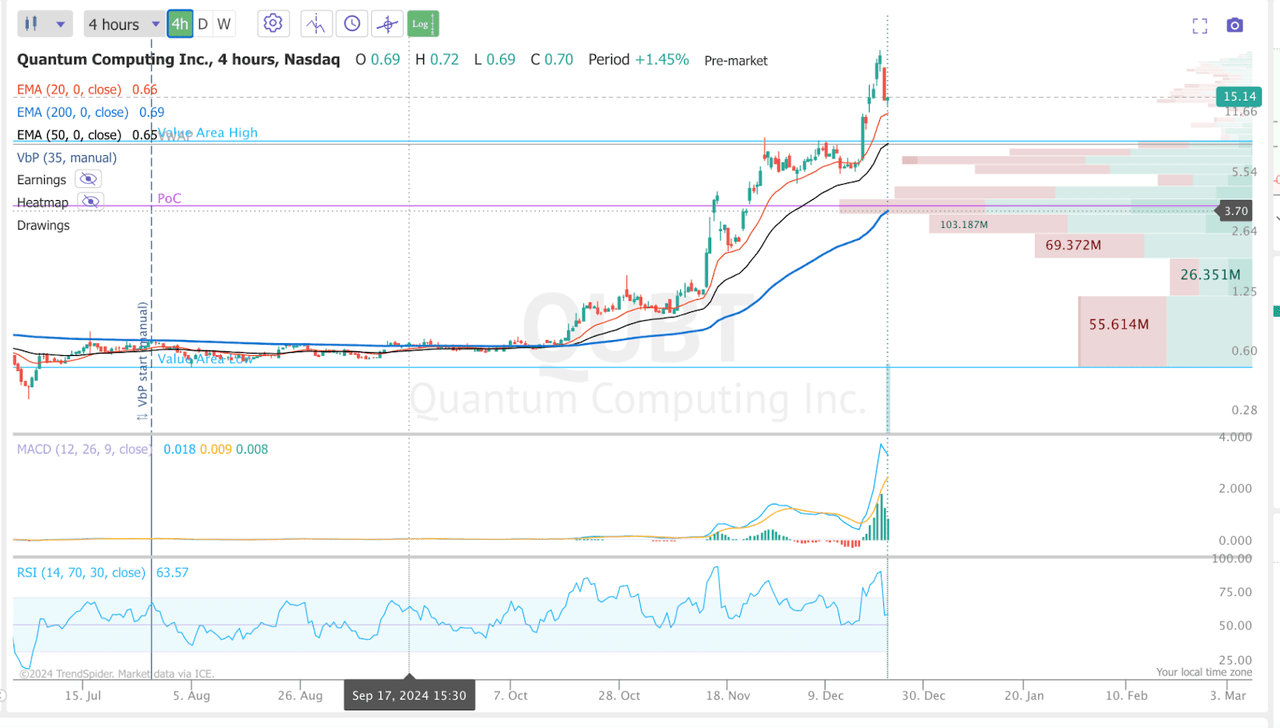

On Thursday, Quantum Computing fell over 40%. As I write this, the stock is down pre-market.

Investors and traders trying to get into the Quantum rally today are playing with fire. QUBT in particular has benefitted from recent catalysts, a NASA deal, and the fact that it is literally called Quantum Computing, which, I believe, has attracted retail investors.

From an investing perspective, it’s difficult to justify the stock as it trades at over 3000 P/S.

Now, if you did want to catch the dip, we have some meaningful support at around $7, and below that, we could look towards the $4 area, where the 200 EMA on the 4h chart comes in.

Personally, I would not buy this stock unless I saw the following;

-

Price test $4 support and hold.

-

RSI enters oversold conditions.

-

General market and risk-on investment regain its momentum.

Final Thoughts

QUBT has had a massive rally, but the higher they go, the harder they fall.

Investors trying to get into this stock now should be very, very careful. Despite some promising technology and catalysts, I don’t think QUBT is the best choice for a quantum stock at this price.

This might change if the price fell towards the $4 area, which would make it a lot more reasonably priced, at least in comparison to its peers.

For now, I advise caution and rate the stock a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video