Summary:

- DELL stock has underperformed recently, but with favorable market tailwinds ahead, my valuation suggests it may be undervalued by over 40%. It’s simply too cheap to ignore now.

- Dell’s strong Q3 performance, driven by a 34% increase in ISG revenue and a 14% rise in non-GAAP EPS, supports my “Strong Buy” rating.

- The AI revolution and upcoming Windows 10 refresh cycle are expected to drive Dell’s future growth, despite current market underperformance.

- Dell’s robust cash flow, strategic innovations, and shareholder returns highlight its solid financial health and long-term growth potential.

- Despite some risks, I believe Dell is undervalued today, staying a promising investment with significant upside potential.

Thinglass

Intro & Thesis Update

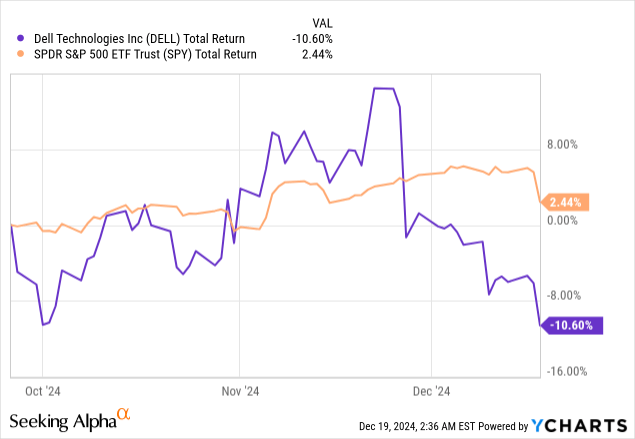

I began covering Dell Technologies Inc. (NYSE:DELL) stock on September 26, 2024, “Strong Buy,” believing that Dell’s ISG growth was going to rise due to higher revenue share leading to rapid earnings growth, so the fair value of the stock seemed way higher. To my rating’s dismay, the stock has fallen behind the S&P 500 index (SPX) quite substantially since:

Despite this underperformance, I believe DELL is still primed to capitalize on the AI revolution driving its growth in earnings. I expect an eventual sentiment shift that I believe will allow Dell to outperform the market and completely rebound from its current downturn.

Why Do I Think So?

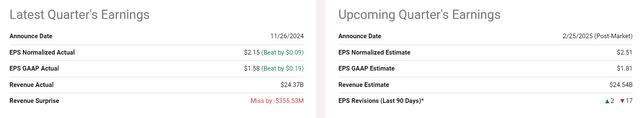

From its Q3 FY2024 results, we see that DELL continued to lead the pack in taking advantage of the rising demand for AI-based infrastructure. The company made ~$24.4 billion in revenue, a 10% YoY increase, led by a 34% increase in its Infrastructure Solutions Group (ISG), which was enough to offset the slowing Client Solutions Group’s (CSG) performance. The revenue expansion was below expectations, but on the bottom line, we see that DELL’s non-GAAP EPS rose 14% YoY to $2.15 – well above expectations, and cash flow from operations was $1.6 billion. Despite these strong numbers that showed Dell’s solid positioning in the AI and enterprise IT space, the analysts lowered their expectations for Q4 FY2024 (set to be published on February 25, 2025):

As I expected in my previous article, DELL’s ISG segment continued to drive the overall business thanks to the rising demand for AI-based servers (shipments totaled $2.9 billion in the 3rd quarter). Dell’s AI server backlog reached ~$4.5 billion as the company’s five-quarter pipeline grew more than 50% YoY. The company’s willingness to continue to innovate and offer advanced solutions, including the XE9680 and new GB200 NVL72 racks, has established it as a pioneer in the AI infrastructure market. These solutions are specifically geared toward the growing demand for high-performance computing and generative AI workloads, especially from Tier 2 cloud providers and enterprise customers.

Traditional servers also played a key role in ISG’s growth, with demand increasing for the fourth quarter in a row. The company’s 16G servers deliver more density and reduced power, which is why customers are investing more in modernizing their data centers, the management said during the earnings call. It’s part of a wider consolidation and optimization movement as enterprises upgrade their environments to support AI workloads. Storage sales at ISG increased by 4% YoY driven by double-digit growth in midrange offerings such as PowerStore and PowerFlex. Although the storage market is still behind servers, Dell’s investments in its own storage product line (such as PowerScale F710 and F910) should support long-term growth and margin growth, in my view.

Dell’s PC business and the CSG segment generated $12.1 billion in revenue, down 1% YoY. Commercial PC sales increased by 3% as enterprise customers began to replace old installs, but consumer PC revenue dropped 18%, indicating continued market challenges. I think Dell’s strategic move towards AI-powered PCs and high-end business products should boost its earnings in the medium term, while the PC refresh cycle – with the Windows 10 end-of-life and AI-based architectures becoming the new normal – should provide Dell with significant growth potential through FY2025 and beyond.

A Windows refresh cycle is about to begin as the end of support for Windows 10 in late 2025 is expected to lead to PC refreshes starting in the second half of 2024.

Source: IDC.com

Looking ahead, Dell’s leadership has affirmed its forecast for Q4 FY2024, which shows revenues in the range of $24-$25 billion (about 10% growth at midpoint). ISG should expand into the mid-20s by year-end based on the sustained strength in AI and traditional servers. The expected PC refresh cycle is expected to drive CSG growth into the low single digits. Dell expects revenue growth of 9% and non-GAAP EPS growth of 10% for the entire year, signaling its belief that it can overcome the near-term pressures.

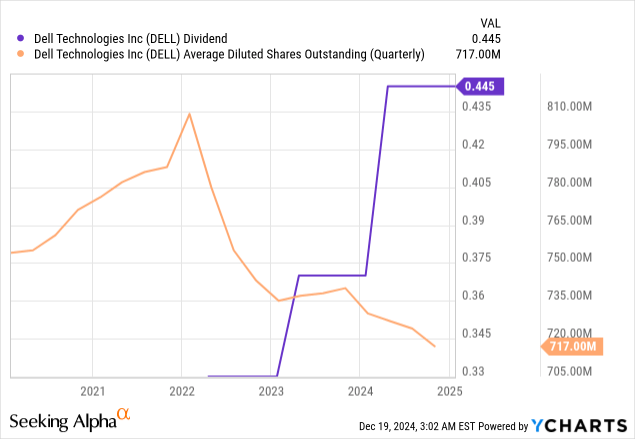

While we await the refresh cycle to kick in and the company’s server offerings to continue pushing DELL’s top-line higher due to AI demand all over the place, the company is still creating solid FCF. Powered by strong profitability and capital management, Dell generated $1.6 billion in operating cash flow in Q3 alone (the firm’s capacity to convert net income into FCF at or above 100% looks very solid to me). Also, Dell’s recent 20% dividend increase and continued share buybacks demonstrate the company’s long-term perspective and commitment to creating value for shareholders. Shareholders’ returns remained the highest priority for DELL – it repurchased ~3.7 million shares during the quarter and paid a $0.45/share dividend.

Dell has returned $9.8 billion to shareholders through buybacks and dividends since Dell launched its capital return program in FY2023. Meanwhile, DELL’s $6.6 billion of cash and investments with a debt-to-equity ratio of just 0.3 is a testament to a relatively clean balance sheet, in my view.

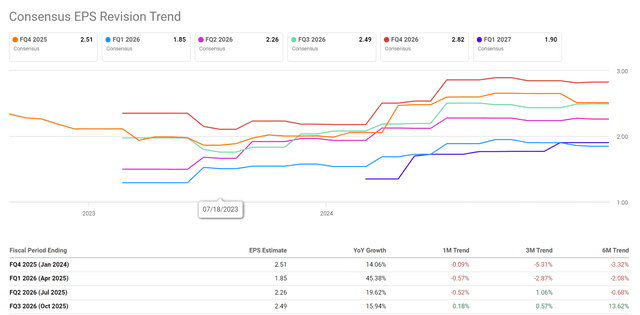

To be honest, I don’t quite understand why analysts have lowered their estimates for DELL’s EPS for Q4. More than that, they have become more skeptical about Q1/Q2 FY2025 earnings as well:

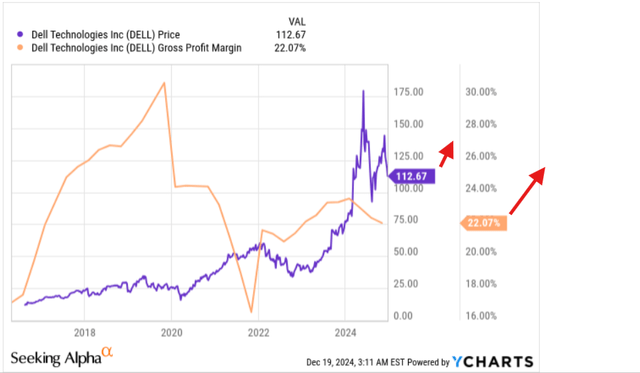

Anyway, even amid the above negative adjustments, the current consensus expects Dell’s EPS to grow with a CAGR of over 11% for the next 5 years. In reality, I expect the firm’s gross margin to start growing as the PC refresh cycle begins, and given that the AI boom will stay there.

YCharts, DELL, the author’s notes added

So because of all that I think the current expectations are set too low for Dell. Over the past 2 years, the firm missed the expectations only once, while the average beating amounted to ~2.3%. Assuming that Dell delivers the same kind of EPS surprise for FY2025 EPS consensus and expecting the stock to trade at just 20x (the sector’s median is over 30x right now), I get DELL’s price target for 2025 at $160/share, 42% above today’s price.

Given all that, I maintain my “Strong Buy” rating for DELL today.

Where Can I Be Wrong?

Of course, my bullish thesis has its pitfalls.

First, Dell’s sequential loss in AI server sales due to the slow deployment of Nvidia’s (NVDA) Blackwell chips sparked concerns about the firm’s ability to translate its expanding pipeline into sales. Maybe that was the main reason behind the EPS expectations lowering. However, management has emphasized that this is an issue that will subside as Blackwell production continues to grow and will fuel FY2025 revenues. So I hope for a better outcome.

Dell is also still being hampered by the consumer PC segment, though Dell’s market position with commercial PCs and AI-powered devices gives it a solid foothold for the coming refresh cycle. If the refresh cycle doesn’t start as I expect, the margin expansion will likely be postponed for longer.

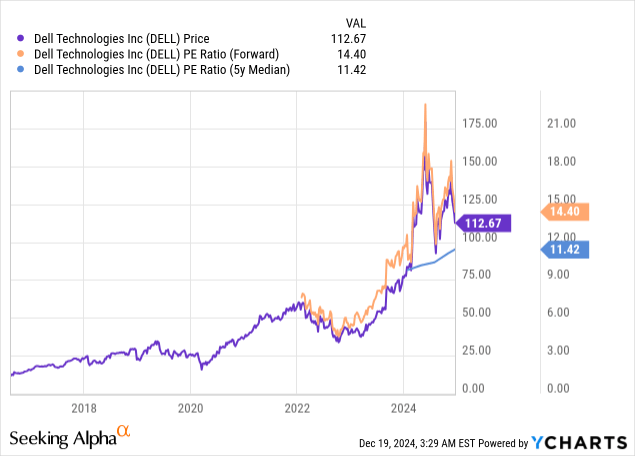

Furthermore, the stock might actually turn out to be a bit too expensive today because if we compare the FWD P/E ratio today to the 5-year median figure, we’d conclude that Dell’s valuation is already quite rich:

The Bottom Line

Despite the above risks, I still believe that Dell represents one of the most promising cases of a company trying to be flexible and adapt to new trends to become even more established in its addressable markets. Over the past few weeks or so, the stock became even cheaper than before, underperforming the broader market, while at the same time, the driving forces in its end markets are likely to turn in the firm’s favor shortly.

According to my valuation calculations, DELL stock may be undervalued by over 40%. Let that be the upside I expect to see from it next year. That’s why I decided to reiterate my “Strong Buy” rating today.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!