Summary:

- Rigetti Computing stock surged over 600% over the past year, driven by recent speculative fervor and advancements in quantum computing technology.

- Rigetti faces significant execution risks and competition from deep-pocketed rivals like IBM, Amazon, and Google.

- RGTI’s stock surge is fueled by speculative fervor, as the sustainability of its business model has not been validated.

- RGTI’s forward revenue multiple of more than 170x suggests the market seems ignorant of significant execution risks.

- I argue why investors sitting on significant speculative gains should consider taking profits and bailing out.

adventtr

Rigetti Computing, Inc. (NASDAQ:RGTI) has experienced a phenomenal surge in buying momentum as the stock of the quantum computing company took off over the past 12 weeks. RGTI’s more than 600% in total return over the past year was notched in the past three months as it formed its September 2024 lows. It has benefited from incredible buying momentum as investors were enamored with the boost in sentiments on quantum computing stocks. Speculative fervor in quantum computing stocks received a timely boost from Google (GOOGL) (GOOG) as the Mountain View-headquartered company unveiled its Willow quantum computing chip. Google’s technological advances in the QC era also lifted buying sentiments in the stock. GOOGL surged to a new high last week, corroborating the recent rotation to quantum computing stocks.

Notwithstanding Google’s breathtaking achievements with its Willow chip, the company highlighted it must still execute a “useful, beyond-classical computation,” actualizing the potential of quantum computing. While Google is confident of achieving that feat with the Willow generation, practical applications are still nascent and unlikely to materialize in a commercially meaningful manner in the near term. However, Google’s focus on a superconducting quantum computing system is aligned with Rigetti’s focus. However, Google has also invested in neutral atom qubits through QuEra Computing, underscoring the need to diversify risks.

Hence, investing in Rigetti encompasses a bet on its superconducting quantum technologies as the company seeks to scale more effectively. Notably, Rigetti has achieved 99+% fidelity and rapid gate speeds on its systems. It has targeted mid-99% fidelity to demonstrate its platform scalability, harnessing its full-stack and modular multi-chip technological approach. Accordingly, the company has provided a clear roadmap to launching its 36-qubit system in mid-2025, with the potential of scaling up to a 100+ qubit system subsequently.

I assess that Rigetti’s hybrid approach of working in conjunction with classical computing underscores the focus on seeking practical use cases that a solo approach may not be able to solve. The approach has support from Nvidia (NVDA), as seen with Rigetti’s QPUs integration with Nvidia’s Grace Hopper Superchip. Given the potential AI improvements afforded by Google’s Willow chip advances, it could bolster near-term use cases in AI/machine learning workloads.

Rigetti management also indicated the AI opportunities at its recent November 2024 earnings conference, highlighting the possibilities in reinforcement learning projects. Hence, I urge investors to pay close attention to the increasingly bullish AI opportunity, as Google’s advances have strengthened the robustness of scaling quantum computing while achieving “exponential error correction.” However, deep-pocketed rivals in the superconducting space, such as IBM (IBM), Amazon (AMZN), and Google, are expected to be formidable challengers as they seek to entrench their leadership in the nascent QC market.

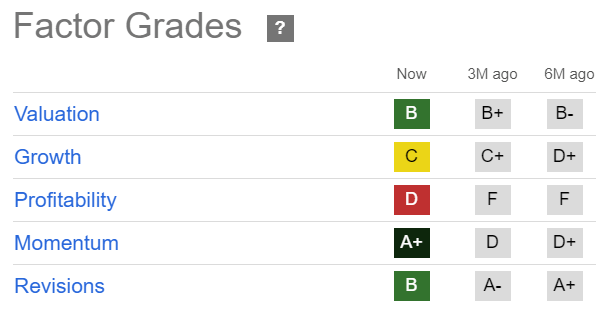

RGTI Quant Grades (Seeking Alpha)

RGTI’s momentum has improved significantly over the past six months (upgraded from “D+” to “A+”). Hence, investors seem to have ignored its current unprofitability (“D” profitability grade) as they seek to partake in the early stages of quantum computing advances. Notwithstanding Rigetti’s recent $100M equity offering in November 2024, it has failed to dampen the stock’s spectacular surge after a brief respite. Moreover, the re-authorization of the $2.7B National Quantum Initiative has underpinned the near-term growth prospects of Rigetti’s on-premise opportunities, removing the uncertainties that bedeviled the stock previously. However, the question of whether the surge has taken RGTI’s optimism too far while considering its unprofitable business model is a valid one.

RGTI’s forward revenue multiple of 176x corroborates my belief of the speculative fervor baked into the stock. The market seems to have downplayed the competitive risks against deep-pocketed big tech companies, while elevating its near-term growth prospects attributed to the recent developments enunciated above. Analysts don’t expect Rigetti to post free cash flow profitability through the FY2026 forecast period, behooving caution. In other words, I assess that significant execution risks on RGTI have been ignored as investors recently jumped on the bandwagon of chasing the super-hot quantum computing stocks.

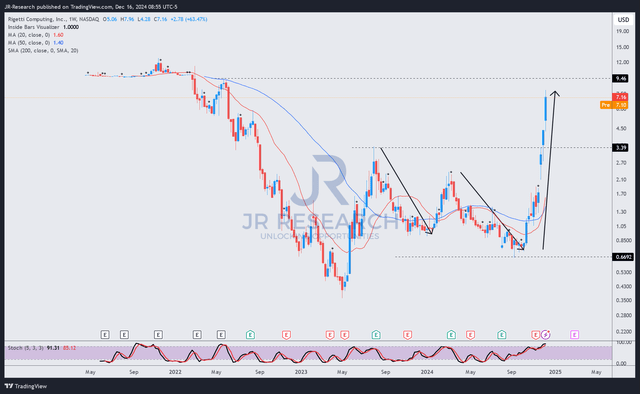

RGTI price chart (weekly, medium-term) (TradingView)

The RGTI rocketship took off since it bottomed out in September 2024, with the stock surging over the $9.5 level as it broke above its May 2022 highs. My observation is corroborated by the significant upgrade in its momentum grade, as highlighted earlier.

However, investors must be cautious in chasing RGTI’s vertical spike, given its business model variability and inherent volatility. Previous instances of sharp momentum spikes experienced subsequent significant downside volatility (see the downward pointed arrows). Given the magnitude of the current surge from its September lows, I assess that investors could be late if they attempt to join the party now. Moreover, its business model still needs validation, but its forward revenue metrics suggest the market has downplayed these risks markedly.

Given the speculative fervor driving RGTI over the past three months, the stock seems well-poised for a significant digestion phase before consolidating. As a result, I urge investors to consider taking profits and cash in on the substantial gains before they possibly dissipate.

Rating: Initiate Sell.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!