Summary:

- Quantum computing stocks have soared recently, driven by advancements like Amazon’s “Quantum Embark” service and Alphabet’s “Willow” quantum chip.

- Technical hurdles (e.g., scaling qubits with accuracy) and slow commercialization limit immediate potential, with most of RGTI’s revenue tied to government grants.

- Despite hype, quantum computing remains years from mainstream applications, with current uses limited to niche areas like drug discovery.

adventtr

Investment Thesis

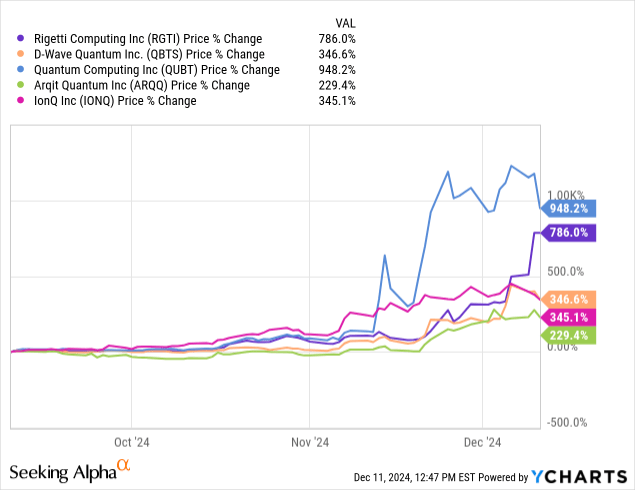

Quantum computing stocks are enjoying a surge in investors’ interest, driven by recent developments that catalyzed an industry-wide rally. In the last 90 days, Quantum Computing (QUBT) rose by 950%, Rigetti (NASDAQ:RGTI) by 790%, D-Wave Quantum (QBTS) by 346%, IonQ (IONQ) by 345%, and Arqit Quantum (ARQQ) by 230%.

Recent developments driving the recent change in sentiment include:

Public Cloud Momentum: Major cloud providers are accelerating their QC roadmaps, with Amazon (AMZN) recently announcing its new service Quantum Embark, a consulting service that aims to help large corporations prepare for the Quantum Computing ‘QC’ era. Alphabet (GOOG) unveiled its new quantum chip, called Willow, which GOOG says can compute in 5 minutes, which is what a traditional supercomputer would take sextillion years. GOOG also claims that it found a way to maintain accuracy while scaling up the number of Qubits.

Generative AI Synergy: QC companies are exploring synergies with generative AI applications. D-Wave’s partnership with Zapata AI and Rigetti’s collaboration with Israel Quantum Computing Center are examples of this trend.

Practical Applications: New practical applications are emerging, albeit on a limited scale. For example, IonQ has already started commercial shipments, extending beyond R&D and government funding, including IonQ’s partnerships with AstraZeneca (AZN) to explore ways to use QC in drug discovery research.

Still, there are significant technical and commercial hurdles facing the sector, and I believe that early investors suffer from a first-mover disadvantage, bearing the brunt of risk with minimal potential returns. The recent hype will likely subdue as monetization lags behind the technological progress.

New Paradigm

RGTI is adopting a new modular platform, after failing to achieve acceptable fidelity rates in its prior products. Trial and error are to be expected from a development-stage company such as RGTI, operating within the cutting-edge realm of QC.

The company announced encouraging speed and accuracy for its new 9-qubit chip and plans to roll out its 4-chip (36-qubit platform) next year. Scaling qubit count while maintaining accuracy is a significant challenge facing RGTI. Management is optimistic that its 36-qubit platform will achieve a 2-gate fidelity near 99.5%, a threshold where a QC system could theoretically be used for practical applications. New Quantum Error Correction ‘QEC’ will be used to control the fragile qubits sensitive to vibrations, magnetic fields, and temperature. RGTI is drawing on the expertise of Riverlane a private, UK-based quantum computing company specializing in QEC applications.

It remains to be seen whether this new platform will reignite interest and sales. Revenue in Q3 2024 stood at $2.4 million, down 23% YoY, missing expectations. Most of the revenue is tied to government research grants that are often lumpy, impacting both revenue and gross margins.

To diversify its customer base, RGTI is investing in its Sales and Marketing teams, expanding its collaborations and partnerships, including the United Kingdom’s National Quantum Computing Center ‘NQCC,’ a low-margined research funding contract that will add to revenue, but not profitability.

In the US, the company is increasing its investment in lobbying to secure more funding for the sector. Some aspects of the US National Quantum Initiative ‘NQI’, which allocated $1.2 billion to QC, expired last year, and reauthorization has been postponed awaiting the administration change. The NQI Act was first signed into law in 2018, and politicians have recently pushed for a renewed program with a $2.7 billion funding budget covering 5 years. Such political developments have a significant impact on RGTI, which derives nearly all of its revenue from government research grants.

Number of Qubits

There is a dire need for more computational power to support the increasing functionality of generative AI applications. But I also believe that news headlines touting the speed of quantum computers currently under development are misleading. Quantum computing isn’t designed to replace CPUs and GPUs, simply because they’re not designed to perform logic functions. For example, a quantum computer would struggle to do matrix multiplications used in generative AI training and inference.

However, in certain applications, they do outperform traditional computing, and these applications are used in testing the speed of quantum computing.

Adding to my skepticism is Rigetti’s struggle to scale its platform beyond 9 qubits while maintaining accuracy. Last year, they rolled out a platform with 84 qubits, called ANKAA-2, with a 2-gate fidelity between 98%, far below the threshold for practical applications.

Technology Roadmap

RGTI is behind the competition in terms of accuracy. The company chose the Superconducting Qubit platform to advance its QC technology roadmap. Superconducting Qubit, which is the same technology used by Alphabet, lacks the coherence time found in other technologies such as Trapping Ion (used by IonQ) and Photonic Qubit, used by PsiQuantum and Xanadu. It also lacks the accuracy of Ion Trapping technology.

The reason RGTI is utilizing Superconducting Qubits is because of their ease of control, which theoretically means easier integration with traditional computing.

Finally, superconducting qubits require insanely cold rooms to operate, unlike other quantum technologies that can function in room temperatures.

Cash Runway

RGTI’s market cap stands at roughly $1.7 billion, weighed against roughly $200 million in Cash and Cash Equivalents, including a recent $100 million raised last month. I think raising additional equity would be a prudent move, capitalizing on the recent stock price momentum. Raising equity capital at these price points would be accretive to current shareholders in my view, assuaging concerns over its financials for years to come. RGTI burns between $60-100 million in cash annually. At current prices, a 20% dilution brings in $340 million in liquidity, extending its cash runway at least three years into the future. For context, between 2022 and 2024, RGTI diluted shareholder equity by more than 60%, raising merely $80 million in cash.

Final Thoughts and How I Might Be Wrong

RGTI is miles away from a commercial product. Despite the hype around Willow, Alphabet is also many years away from using QC in logic applications. The industry is nascent, in its early stages of development. The Willow system contains 105 qubits, which isn’t enough to match the speed of an average AI data center. The computation speeds mentioned in news headlines refer to standardized QC tests tailored for QC, where traditional computing is destined to underperform. QC isn’t replacing CPUs and GPUs anytime soon. QC’s use will, for the foreseeable future, be limited to applications that are inherently quantum, such as drug discovery, where QC excels in mimicking atoms in the quantum setting. For this reason, I believe that the recent surge in RGTI’s shares is temporary, and the hype will subdue facing commercial realities, underpinning our Sell rating.

A rating upgrade is conditional on RGTI’s success in commercializing its product, at least for research applications. The company offers a cloud service, increasing accessibility to its complex platform. According to management, the QC total addressable market ‘TAM’ stands at roughly $7.5 billion annually, allowing for a meaningful market penetration runway for the fledgling QC pioneer whose annual revenue stands at roughly $13 million annually.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.