Summary:

- IonQ’s recent $54.5M contract with the U.S. Air Force Research Lab doesn’t justify the $6B market cap increase; future outlook remains uncertain.

- IonQ faces significant competition from Big Tech, with Google showcasing a superior quantum system; revenue is still tiny, and losses are increasing.

- The company’s investor presentation lacks concrete details on pricing, quantities, and pre-orders, raising red flags about future revenue potential.

koto_feja/E+ via Getty Images

Thesis

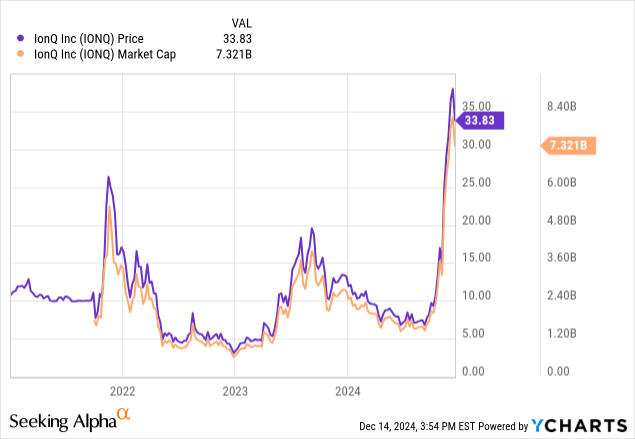

I have covered IonQ (NYSE:IONQ) several times, and it’s been over a year since the last article. Today, I look at where the company stands, the new developments, and targets. If you look at the chart below, you can see how volatile the share is trading. The sudden jump recently was probably triggered by this news: “IonQ bags $54.5M contract with U.S. Air Force Research Lab”. Does a $50M contract justify an increase in market capitalization of $6B? I don’t think so. This is not justified, especially since the future outlook is still very difficult to assess, and Google presented a seemingly better system a short time ago.

Quick recap

The first time I covered this stock was in 2022, and I gave it a sell rating due to the difficulty of seriously assessing the company, its outlook, and potentially challenging competition. I argued that it’s almost impossible to understand their product, and it was hard to even find information/experiences of customers about its quantum computing cloud offering. Overall, summarized like this:

The company is competing with companies with more financial resources necessary to pay for the best talent. The company is losing money, and that will not change soon. Constant refinancing or dilution will be required. It’s also unclear how much value IONQ has added to its customers. It is difficult to find information and even more challenging to understand the technology behind quantum computing.

Article 2022: IonQ: Enormous Valuation And The Competition Is Big-Tech

My last article about the company is just over a year old and contains further background information, e.g., under the heading “A quantum computing ‘ChatGPT moment’? The CEO says a quantum leap for quantum computers will happen very soon and surprise people just as much as ChatGPT.

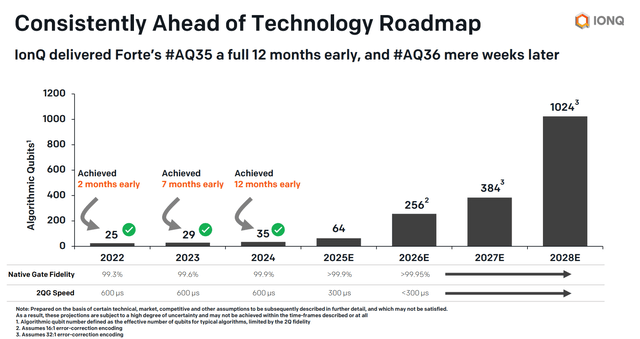

The world is starting to come to grips with the implications of ChatGPT, with most caught off guard and with some facing an existential threat to their business. Within approximately the next two years, we expect that quantum will have its own ChatGPT-like moment, with QML in 2024, and line of sight for IonQ’s broader adoption with an #AQ of 64 in 2025. My prediction is that no matter how much we say it and deliver on our technology roadmap, both investors and customers will be taken by surprise.

My 2023 article: IONQ CEO Peter Chapman

The past: Financial Progress & Trends

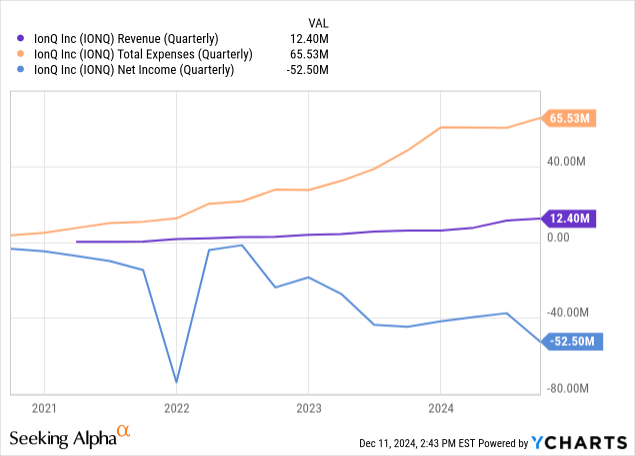

First, I want to provide an overview of revenues and net income over a longer timeframe. This helps to give a clearer picture of the company’s direction. IONQ doesn’t have a long history, and what can be seen here shows that revenue still barely exists, and the loss keeps getting bigger.

Normally, I would also look at the margins at this point, but it doesn’t make sense in this case.

The present: Valuation & current developments

The company is currently valued at an enterprise value of $6.97B, its market cap is $7.32B, and it has about $365M cash left (according to the data on Seeking Alpha). The current cash burn rate of about $92.9M in the trailing twelve months (according to the cash flow statement) should still suffice for more than three more years. So, financially, the company seems to be in a stable position.

Besides these facts, it’s hard to even write about the valuation. Ultimately, whether one considers the current valuation justified is also somewhat subjective. If one believes that quantum computing has a glorious future ahead of it and that IONQ will be one of the pioneers in this business, the share could be deservedly expensive.

However, it is likely very often with speculative stocks without high revenues. It is virtually impossible to make an objective assessment as it is not possible to give a P/E. Also, the P/S ratio is not helpful, and there is no comparison with competitors possible. I also ignore huge total addressable market numbers. I don’t think these offer any value. But what does the latest investor presentation say? Does the company state long-term (financial) targets?

The future: Outlook

Overall, the investor presentation of IONQ doesn’t contain a lot of information. It’s only 34 pages, and several are just describing the potential market without giving any specific numbers or expectations for IONQ. 7 or 8 pages are just filled with little text announcing partnerships. Several pages contain technical details, but below, I want to show the three pages that, in my opinion, contain the most interesting info. One of them shows the achieved and roadmap of algorithmic Qubits where they are ahead of schedule.

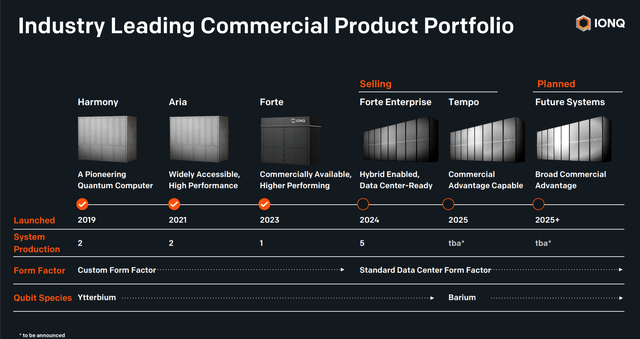

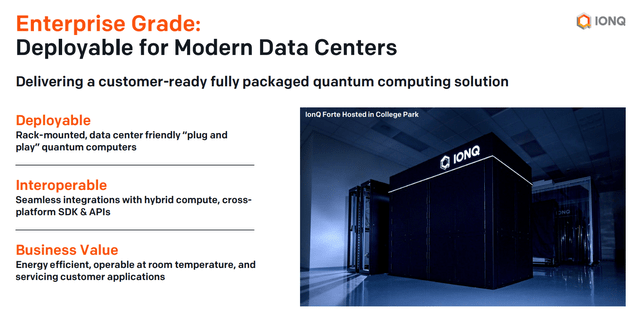

Another page shows the planned product portfolio where, according to the company, “Deployable for Modern Data Centers” systems will be manufactured and sold soon. Note that the Forte Enterprise system is set to launch in 2024 But is not yet marked as completed (this presentation is from November 2024).

In addition, these systems should be compatible with existing computers, be easy to install, and be operable at room temperature.

What is definitely missing, however, is concrete information. If systems are to be delivered to data centers by next year at the latest, why is there no more precise information on the prices of those systems, quantities, and pre-orders? In the latest third-quarter results, they mention as a highlight, “Secures $63.5 Million in Third Quarter Bookings“, but it is not clear if that means bookings on their existing offering via cloud or bookings for those machines designed to be sold to data centers? It is very vague and unclear; it leaves too much room for interpretation. If they plan to deliver finished systems to data centers next year, I would like more information about the details. After all, shareholders are co-owners of the company after their purchase. I don’t like this lack of concrete information and consider this a red flag.

Negative aspects

It’s crucial to be aware of the risks and negative aspects. I differentiate between risks, weaknesses, and errors in my analysis or assumptions:

Risks: potential future threats

A significant risk I have already mentioned is the fact that you naturally have tough competition in this area, namely Big Tech, which has considerably more financial resources and, therefore, talent. Just a few days ago, Google made a remarkable announcement. Their system even uses 105 qubits, significantly more than the 35 currently used by IONQ. Furthermore, with a very low error rate, it seems Google is far ahead technologically. The above-mentioned ChatGPT moment for quantum computers, mentioned by the CEO of IONQ, could, of course, take place, but it is not sure which company will trigger it.

Today in Nature, we published results showing that the more qubits we use in Willow, the more we reduce errors, and the more quantum the system becomes. (…)With 105 qubits, Willow now has best-in-class performance across the two system benchmarks discussed above: quantum error correction and random circuit sampling.

Meet Willow, our state-of-the-art quantum chip

Another potential risk for the future is that it is generally impossible to estimate how practical quantum computers will be or, in other words, how high the demand will be. From what I’ve read, the current state of quantum computing is probably best suited to very complex research areas. Although the company mentions a total addressable market of $65B by 2030, this can only be a rough estimate, as this technology is not yet fully ready for the market, making it even more difficult to project developments into the future.

Potential errors in my assessment

Of course, every reader must remember that I could also be wrong. Quantum computers are hard to understand for private investors who are not experts in this field. I look more at pure facts and figures and less at the technological background because I am not an expert. So maybe I’m wrong, and Google’s system might not be better or works fundamentally differently, or maybe I’m missing other essential facts.

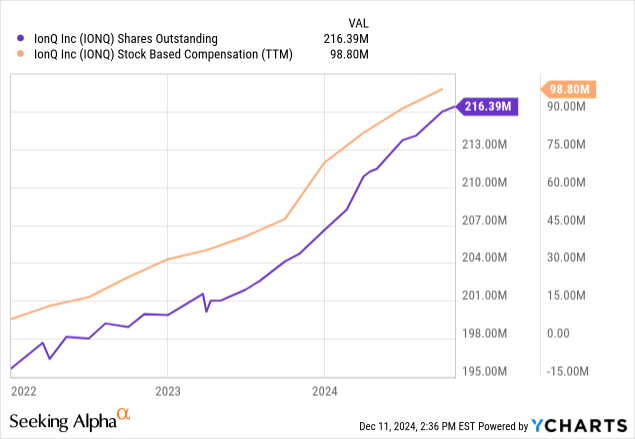

Share dilution, insider trades & SBCs

I check these aspects in each article: Excessive share dilution and stock-based compensation (‘SBC’) can be detrimental to shareholders, and insider trading sometimes contains valuable information about management confidence. The outstanding shares have increased by about 5% in the last 12 months alone, and $98M SBCs with only about 324 employees seem pretty high to me.

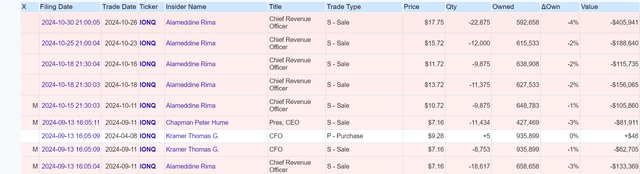

These are all insider trades of the last 6 months.

What else to know

Before I come to the end of the article, a few pieces of information that have not yet been mentioned. Firstly, the current short-selling interest in the share is very high, around 17%. Although this may indicate an unjustifiably high valuation, it could also lead to potential short squeezes, i.e., short sellers would have to realize their losses and buy the share, which could lead to a sudden sharp rise in the share price.

Another reason for a sudden rise could be a takeover bid. If the company owns valuable patents, it might be an attractive takeover candidate for larger tech companies.

Those two things should be kept in mind in case you decide to short the stock, as I have done from time to time. You should definitely set a stop (although even this can’t always protect you completely when the price fluctuates heavily).

Conclusion

Overall, there are too many negative aspects and too few tangible reasons to justify the market cap of $7.32B. If they want to deliver to data centers very soon, why is there so little precise information in the investor presentation? One of my biggest criticisms is that future revenue potential is pure speculation, given the current state of knowledge. I don’t see indications that allow a profound analysis, and the company also doesn’t predict much about its future.

The stock is far too speculative for my taste. On the positive side, however, the company has the potential to become a pioneer in new technology. Still, I prefer to act cautiously, as very few companies survive and succeed long-term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.