Summary:

- IonQ, Inc. has shown remarkable stock performance despite being labeled “risky” and “unproven,” driven by strong Q3 earnings and strategic partnerships.

- IonQ’s pioneering quantum technology, partnerships with major cloud providers, and focus on optimization, material science, AI, and cybersecurity offer significant growth potential.

- Financially, IonQ boasts substantial cash reserves and new contracts, but faces high costs and increasing losses due to heavy R&D and operational expenses.

- I rate IonQ stock a “buy” due to its strong partnerships, cash position, and potential to lead in the quantum computing industry, despite short-term volatility risks.

koto_feja

Risky Yet Rewarding Rise

IonQ, Inc. (NYSE:IONQ) has been described by analysts in terms that might make even the hardiest of investors hesitate—words like “unproven,” “risky,” and “very negative” have been tossed about with little by way of encouragement. And yet, here we are: up 12% post-Q3 earnings, 70% in the past five days, and over 100% year-to-date. Against all conventional wisdom and a fair share of raised eyebrows, it’s been quite a rally.

One particularly self-aware Seeking Alpha premium member summed it up best on the earnings call, musing, “I’m either a shrewd investor or a Kool-Aid drinker. I’m holding out for the former.”

So, for the moment, shrewd you are.

Investors can enjoy this unexpected upswing, with a collective, cautious grin and a well-deserved pat on the back—for now, anyway.

Thesis: Relying on Data Overhype

As an analyst here, my sentiment is not to chase, well, the sentiment – the emotions of the market. Rather, relying on the cold, hard facts of the data has served me well. But, more often than not, the data doesn’t always capture or find that hidden corner, that little gap where sentiment’s little seed is growing and peering out from the cracks, ready to sprout like a great oak tree. With that said, for today, I’m going to go in with a clean, fresh slate, and do what I do: examine IONQ’s latest earnings data but also keep an open mind about the momentum that’s driving this stock’s performance to incredible heights.

Pioneering Quantum Technology

To set the stage, here’s a brief overview.

IonQ is a bit of a unicorn in the tech world, as it’s the very first company dedicated purely to quantum computing to go public. Unlike the traditional computers we’re all so cozy with, IonQ’s machines operate on the strange principles of quantum mechanics. In short, these quantum computers can tackle certain kinds of problems at speeds that make classical computers look like they’re moving through molasses.

How fast, exactly? Well, way back in a 2019 test, Google’s Sycamore quantum processor blitzed through something called an RCS, or Random Circuit Sampling task, in just about 200 seconds. To give that some perspective, it would take the world’s fastest supercomputer roughly 10,000 years to accomplish the same task.

But before you toss out your laptop, a reality check: the impressive speedups offered by quantum computing are, for now, limited to a fairly narrow range of problems. When it comes to the everyday grunt work of email, spreadsheets, and internet browsing, our trusty classical computers remain not only more efficient but also, for the moment, quite indispensable. As APS Global Physics reminds us, quantum speed isn’t yet universal—it’s astonishing, but not yet practical for most of our day-to-day digital chores.

Appeal and Market Position

So, if quantum computers aren’t really for regular folks like us yet, who exactly is IonQ targeting?

To start with, IonQ’s partners with the big cloud providers—Amazon Web Services, Microsoft Azure, and Google Cloud. No longer confined to traditional research labs and high-tech facilities, quantum computing is getting a foot in the door of the broader business world. By teaming up with these well-established cloud platforms, IonQ makes it possible for companies, even those without massive budgets or in-house quantum experts, to dip their toes into quantum computing. This matters because, while quantum computing is still very much a niche field, it’s growing fast as companies start looking into how it might help solve tough, business-world problems that leave classical computers stumped.

Revenue Potential in Optimization

When it comes to revenue, just the optimization sector alone could be a big market for IonQ’s technology. And the whole quantum computing market worldwide is expected to grow a ton—projections indicate that it could reach around $16.2 billion by 2034, with a yearly growth rate of 30.9% starting in 2024. Companies in areas like logistics, finance, and urban planning are always looking for ways to be more efficient, cut costs, and simplify how they operate—tasks where quantum computing might be able to improve in a big way.

Amazon Braket on AWS, for example, now includes IonQ’s quantum tech, letting companies test out and eventually use quantum algorithms built for optimization. If IonQ’s systems can show real cost savings or efficiency gains, they could lock in long-term partnerships with big businesses, creating consistent revenue streams. For investors, that means a potential source of steady income that could keep growing as more companies jump into quantum computing.

Material Science Applications

IonQ’s dive into material science and chemical simulations—thanks in part to partnerships like Azure Quantum—puts the company in fields that are on the brink of potentially revolutionary advances. In the pharmaceutical and materials science sectors, where billions are spent on R&D, quantum-powered simulations could drastically cut the time and cost needed for new drugs or materials. Even a small slice of this market could mean a big revenue boost for IonQ. Translation: being at the cutting edge of these breakthroughs opens the door to profitable partnerships and licensing deals.

AI and Machine Learning Opportunities

The machine learning (ML) and artificial intelligence (AI) markets are also key areas for IonQ’s future growth, as ML and AI power everything from self-driving cars to personalized medicine to financial forecasting. With Google Cloud backing IonQ’s tech for quantum-enhanced ML, IonQ already has a foot in the door. That said, although quantum ML is still in its early days, any company that develops effective quantum algorithms for these applications could gain some serious market influence, so if IonQ can show real improvements in ML or AI using quantum computing, it could set itself apart from competitors.

Cryptography and Cybersecurity Demand

Finally, cryptography is yet another strategic area where IonQ’s technology lines up with future market demands. The way I see it, the bigger picture here is, first and foremost, definitely within the realms of the military complex as this could make IonQ a key player in cybersecurity—a field where both governments and, secondly, businesses are willing to spend big and where the demand shows no sign of slowing down.

IONQ’s Financial Highlights

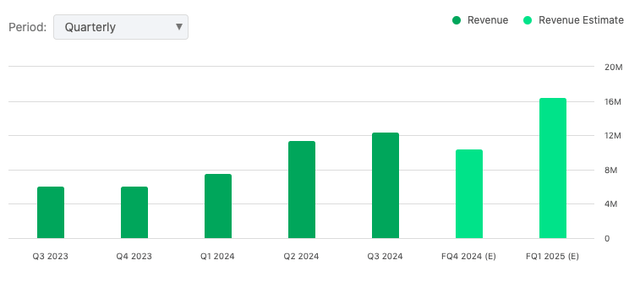

Seeking Alpha

With this basic understanding of where IonQ sits in the quantum computing world, let’s take a look at its latest financial results to see how these efforts are actually paying off. Looking at its Q3, IonQ reported $12.4 million in revenue, exceeding its own guidance range of $9 million to $12 million – a positive performance that prompted the company to raise its full-year 2024 revenue forecast to between $38.5 million and $42.5 million.

New Contracts Fuel Momentum

IonQ’s real-life momentum is clearly on display here with substantial new contracts it secured in Q3, adding up to $63.5 million – deals that include a $54.5 million contract with the U.S. Air Force Research Lab and a $9 million renewal with the University of Maryland. So far this year, IonQ has booked $72.8 million toward its annual target of $75 million to $95 million. For broader context that might help explain the recent stock surge is that this steady track record has been meeting or beating expectations in 12 out of 13 earnings reports since its IPO.

Strategic Expansion Through Acquisitions

Also, with its $22 million purchase of Qubitekk, IonQ added 118 patents to its portfolio that gives it even more of a leg up in its quantum networking capabilities and expanding its potential market reach. Partnerships with big names like AstraZeneca and Ansys also signal a shift from R&D-focused projects to real-world, production-ready applications that further pave the way for commercial quantum solutions in areas like biopharma and engineering.

Cash Reserves and Financial Health

Financially, IonQ is sitting on $382.8 million in cash as of September 30, 2024—the largest cash reserve among publicly traded, full-stack quantum companies. In practical terms, this hefty cash reserve not only backs its ongoing R&D and expansion efforts but also gives it the financial muscle to keep pushing its ambitious growth plans. Keep in mind, strategic partnerships with NKT Photonics and imec are set to bring down manufacturing costs and ramp up production. Given that lasers make up a big chunk of production expenses, these partnerships should help IonQ cut costs and improve efficiency.

Future Market Projections

Looking ahead, I believe the real core source of all the buzz around IonQ is management’s alignment with McKinsey’s much bigger projection that quantum computing could have a $2 trillion economic impact by 2035. As I mentioned, as government investments in quantum technology keep ramping up, with Elon Musk as a clear player and voice in the ear of our next administration, IonQ’s solid partnerships in the public sector put it in a great position to benefit from future national and international funding.

Valuation Beyond Traditional Metrics

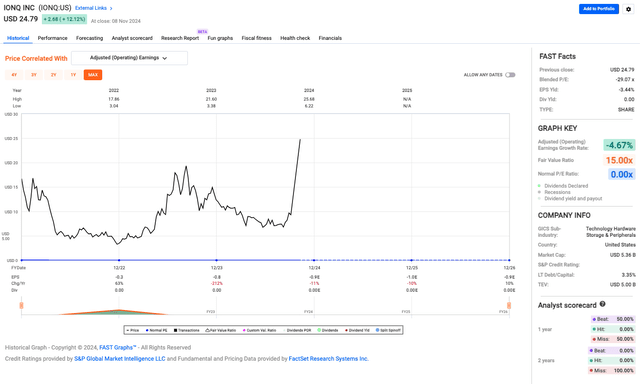

Fast Graphs

Explaining IonQ’s valuation in simple terms, we’re looking at one of those unique situations in tech that doesn’t follow the usual financial rules. Normally, investors look at things like the price-to-earnings (P/E) ratio to figure out a company’s value. But with IonQ, the P/E ratio is zero—it’s not making any profit yet, which actually isn’t strange in the quantum computing world. Since this field is so new, companies are still pouring tons of money into research and development, so profits aren’t really expected anytime soon.

IonQ technically falls under the hardware sector, but I really think that comparing it to the usual profitable hardware companies would be like comparing apples to oranges. So traditional metrics just don’t capture the whole story here; that is, IonQ’s value isn’t based on reliable earnings but on its potential to shake up entire industries with quantum technology.

Overall, it doesn’t seem like investors in IonQ are concerned too much with what it’s earning today—the stock price is clearly telling us that they’re placing their bets on the future. So, typical metrics like the P/E ratio or earnings per share don’t tell us much here; instead, investors are focused on how fast its technology is advancing, the strength, and frequency, of its partnerships, and its ability to scale.

Now, about that negative P/E ratio of -29.07x – while it might look bad in a typical analysis, here it just highlights IonQ’s high costs and the huge investments it’s making in quantum technology. In other words, the market is telling us that investors are currently pricing this as a high-value company, worth the long haul wait with the high-risk motive that these quantum tech breakthroughs will eventually pay off big.

High Costs and Financial Strain

Back to reality.

Speaking of expenses, IonQ’s ambitious growth strategy certainly comes at a cost: in Q3, its operating expenses climbed to $65.5 million, up from $48.3 million the year before, mainly due to ramped-up investments in research, development, and sales. Specifically, R&D costs jumped 35% year-over-year to $33.2 million, and sales and marketing costs rose by 31% to $6.6 million, underscoring the hefty financial demands of scaling in a new industry. On top of that, the recent acquisition of Qubitekk, funded from cash reserves, adds a bit of pressure on IonQ’s liquidity if it needs to make any more cash-heavy investments, tightening up its operational finances a bit.

Rising Challenges to Profitability

Spending at IonQ has been increasing, which is sapping away at any potential momentum in profits: the company lost $52.5 million in Q3, that’s up from $44.8 million last quarter. And their adjusted losses (if you subtract some expenses) also increased, reaching $23.7 million from $22.4 million in the prior year. In part, these losses stem from the increasing expense of stock-based compensation, which grew from $17 million to $24.6 million last year. Besides, the time it takes to build quantum tech isn’t helping either. The deals they’re working on with Hyundai and others are definitely exciting, but it’s going to take time, and patience, to get to the point where they’re generating revenue.

Final Takeaway

I’m giving IonQ a “buy” rating, mainly because of its partnerships, and healthy cash cushion—all of which put it in a rather enviable position in the uncharted territory of quantum computing. Now, I didn’t go with the usual “hold” rating here, which is, let’s be honest, often the default for analysts, like myself, trying to hedge a high risk call, especially with companies as speculative as this. “Hold” is better suited for those more predictable stalwarts with lower risk. So, I skipped right past that option, leaving me with two choices: “buy” or “sell.”

A “sell” just doesn’t sit right when we’re looking at a company with real potential to lead the charge in an industry that may shape the future.

Of course, I could be entirely wrong—especially in the short run. IonQ’s stock has enjoyed quite a rally, and it wouldn’t be surprising if some investors start cashing in, especially if this post-election “Trump euphoria” buzz fizzles out. If that happens, IonQ, like so many other high-growth tech stocks, could face a bit of a wobble, with its price dipping in response to the shifting winds of the broader market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in IONQ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.