Summary:

- IonQ secured the largest US Quantum contract for 2024 with the Air Force, highlighting significant trust and potential in its technology.

- It also achieved technological breakthroughs advancing its commercialization efforts.

- IonQ’s financial health is strong, with $72.8 million in bookings YTD and growing, despite the company’s ongoing losses.

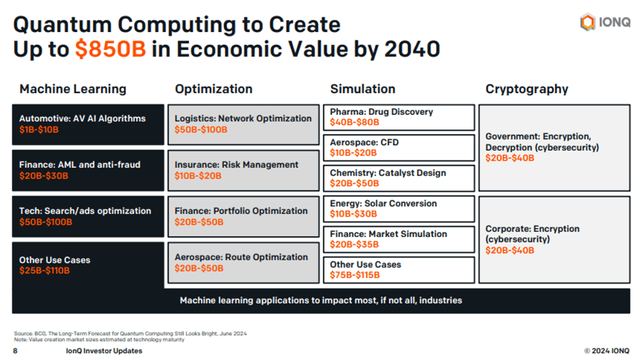

- The quantum computing market has a very large TAM at $850 billion, but the technology is not yet commercially viable, posing a key risk to its future.

sankai/E+ via Getty Images

I wrote in my article last May on how IonQ (NYSE:IONQ) is steadily pushing toward the commercialization of its Quantum product. In the few months since then, IonQ has made strides in finding more possible use cases for its quantum computing technology.

IonQ Bags Largest Quantum Contract of 2024

The big headline of the past week is how the company bagged the largest US Quantum contract for 2024 thus far. IonQ has signed a $54.5 million contract with the United States Air Force Research Lab (AFRL). This contract is for a four year time period with the focus on enabling the “scaling, networking, and deployability” of multiple quantum systems. According to the website Quantum Computing Report which has made deep dives into the contract and the technologies

Part of the company’s strategy is to scale larger quantum systems by using photonic networking and optical switching technologies to connect multiple computing modules together. […]

Specific technologies included in this research include down conversion to convert the wavelengths of light used internally inside a quantum computer to a different wavelength more compatible with standard telecommunications equipment for transmission while still preserving entanglement. Another technology that will be included in this contract is fast switching technology for routing the signals between different quantum processors. These technologies will need to be developed for environments of interest to the Air Force and will require miniaturization, modularity, availability, and ruggedization. This work will build upon previous research performed by IonQ including progress in achieving Ion-Photon entanglement which the company announced earlier this year

This isn’t the company’s first contract with the Air Force as it bagged a $25.5 million contract last year and a $13.4 million contract in 2022 for various quantum computing-related services. This new contract though demonstrates that the Air Force sees a lot of potential in the technology and trust in IonQ’s capacity to deliver. This is evidenced by the granting of new contracts at increasing sizes and project scope.

IonQ Scores Some Technological Wins

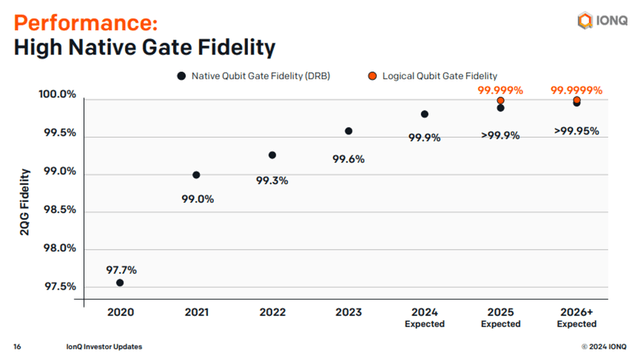

In my previous article, I discussed that IonQ’s focus is mostly on the commercialization of quantum computing using relatively mature technology. However apart from commercialization, the company has achieved important technological wins these past few months. Using its next-generation barium qubits IonQ achieved a two-qubit native gate fidelity of 99.9%.

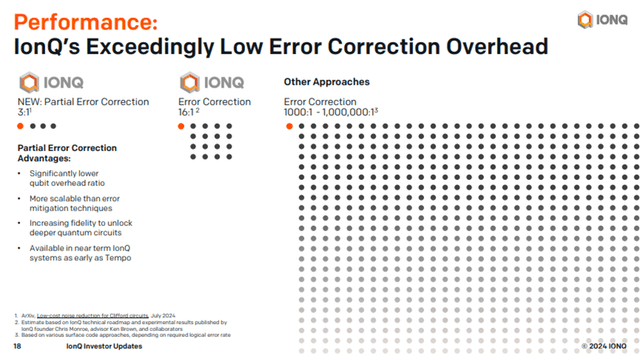

The company also invented a new industry-first partial error correction technique which will be available in its upcoming Tempo systems. This Clifford error reduction technique will allow for more accurate computations at a reduced technical cost. Typically error correction requires hundreds or even thousands of physical qubits per error-corrected qubit. IonQ’s new error correction only requires a ratio if roughly three physical qubits per one error-reduced qubit.

As described in the company’s latest earnings call ;

The technical problem that bedevils the industry is noise or fidelity in its qubits. This noise can come from the qubits themselves, the environment or any hardware like the control electronics that interact with the qubits. Key to the accuracy of a quantum computer is to increase the fidelity of its qubits and their ability to run more computational gates and larger applications.

So this is a lot of science knowledge that could be difficult for the layman to comprehend. However, the bottom line for investors is that management believes these breakthroughs will pave the way for Quantum to tackle more complex problems for IonQ’s customers. More importantly, the company is moving towards commercialization. It can begin to earn significant revenue once it actually starts running programs in a production environment.

Investor Presentation (IonQ) Investor Presentation (IonQ)

IonQ Financial Analysis

In total IonQ has announced a total of $72.8 million in contract bookings year-to-date putting it on track to meet management guidance of between $75 million to $92 million. Peter Chapman, President and CEO of IonQ, believes the company is at a major inflection point given that it is rapidly approaching $100 million in bookings and is well ahead of schedule of its technological roadmap

Looking at the company’s Q2 2024 financial statements shows that the company is still relatively healthy financially. The company grew its revenues 106% year over year from $5.5 million in 2023 to $11.4 million in Q2 2024. The company’s revenue was also roughly 24% higher than the company’s revenue guidance of $7.6 to $9.2 million for the quarter.

For Q2 2024 the company’s Net loss was $37.6 million and the Adjusted EBITDA loss was $23.7 million. This is an improvement compared to the $77 million Net loss at the same time last year. Ultimately, as I’ve said before, it should not be surprising to see IonQ book a loss for the quarter as it is still a very speculative company with largely untested technology. What is important is checking the company’s liquidity position ensuring that it has enough funds to see its vision through without having to do any highly dilutive capital raising.

Based on the latest information, the company has a cash and short-term investments total position of $402.0 million. We can calculate the company’s cash burn by annualizing the $47 million it spent on operating activities in the first half of the year. And $54 million of total non-debt liabilities. IonQ has no long-term debt. Using a back-of-the-envelope calculation gives me about 3.7 years of cash runway. This is a decent runway given the company’s growing top-line revenue.

Conclusion

I like IonQ as it is an interesting company. The total addressable market of quantum computing is $850 billion according to the company’s investor presentation. However, IonQ’s technology is currently not yet commercially viable so it’s unclear whether or not this market can ever be tapped. It should also be worth mentioning that the majority of the company’s revenue and contracts is with the US government which does not necessarily have a profit motive when making such investments. In other words, there is a risk that quantum computing will never be particularly practical or useful and that it will never leave the experimental stage.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IONQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.