Summary:

- I’m skeptical of IonQ, Inc.’s high valuation given its early-stage technology.

- While IonQ has made impressive technical advancements, its cash burn far exceeds its revenue generation.

- I’m concerned that stagnant bookings signal limited near-term growth despite the company’s ambitious plans.

- I believe that expectations for IonQ are too high, making it difficult for the stock to deliver meaningful returns.

adventtr/E+ via Getty Images

Investment Thesis

IonQ, Inc. (NYSE:IONQ) is a contentious stock. Proponents of this business describe quantum computing as the next big wave, and that taking a position early makes sense.

While more suspicious investors, myself included, make the case that expectations are too high.

And not only is the business’ backlog remaining stagnant, but IonQ is burning through a lot of cash in a short period of time.

Yes, IonQ is debt-free, and with more than 20% of its market cap made up of cash, this provides the business with some semblance of a margin of safety.

But as I look through, I struggle to get confident with its near-term prospects. Therefore, I remain neutral on this stock.

Rapid Recap

Back in June, I cautioned investors against backing IONQ stating,

The critical aspect to keep in mind, is that for now, this business is far from scalable. And yet, it’s being priced as if it’s undoubtedly successful

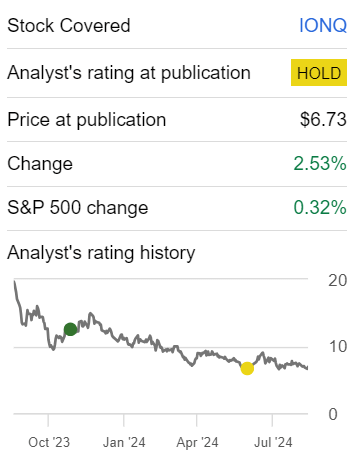

Author’s work on IONQ

Since that time, the stock has been highly volatile, but ultimately gone nowhere.

Today, as I look ahead, I believe that investors’ expectations remain high, leaving investors with too small a potential upside potential.

IonQ’s Near-Term Prospects

IonQ specializes in quantum computing, an advanced form of computing that leverages the properties of quantum mechanics to solve complex problems beyond the reach of classical computers.

IonQ is working on improving the accuracy and performance of its quantum systems by enhancing the fidelity of qubits, the basic units of quantum information.

By achieving high fidelity in its barium qubits, IonQ aims to reduce errors and move closer to commercially viable quantum applications.

Meanwhile, IonQ has shown substantial progress in commercial domains. It has exceeded revenue expectations and secured a notable contract with ARLIS, part of the U.S. national security sector.

With advancements like its new error-correction techniques and improving qubit fidelity, IonQ is optimistic about achieving further milestones in quantum computing by 2025.

The company is confident about near-term revenue growth, especially with increasing demand from government projects and its cloud partnerships, signaling an important transition toward meaningful commercial applications.

Yet, quantum computing technology is still in its early stages, and the industry as a whole has not yet reached profitability.

Furthermore, high costs, including those related to expanding manufacturing, continue to weigh on IonQ’s financials. While the company has increased its revenue guidance for 2024, it has yet to consistently turn a profit, and the development of scalable quantum computing remains a long-term goal.

Given this background, let’s now discuss its fundamentals.

Revenue Growth Rates Look Impressive

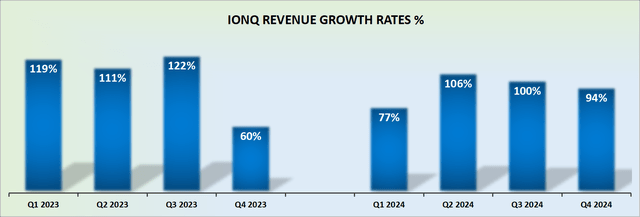

IONQ revenue growth rates — author’s work

When a business is growing its revenues at less than $200 million per year, tiny changes in how much revenue is recorded in a quarter can make a large difference to a company’s growth rates and narratives.

And when a business is still growing at substantially less than $100 million, this statement becomes all the more significant and noteworthy. For its part, this year, IonQ is expected to deliver around $50 million.

This means that extrapolating IonQ’s growth rates into 2025 is a challenge. And then, what complicates matters further for this growth business is that its bookings, a leading indicator of future revenue growth, have remained around $95 million for 2 quarters.

While this doesn’t dent the bull case to any great extent, it does add questions about how confident investors can be in extrapolating its growth rates in 2025 and beyond?

And then, what complicates matters further, is that its valuation is already starting from a very high level.

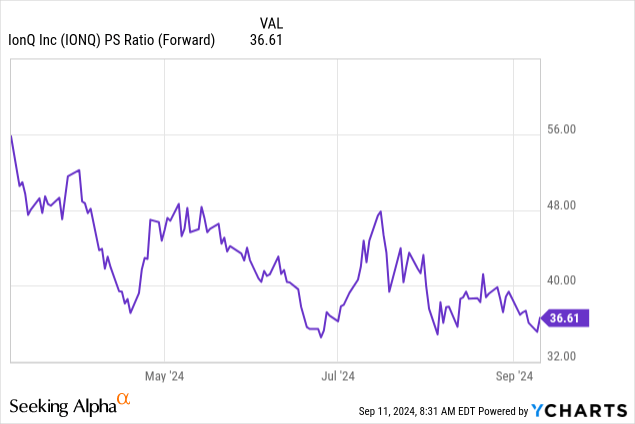

IONQ Stock Valuation — 34x Forward Sales

As an inflection investor, having an understanding of a company’s balance sheet is critical. On this note, IonQ is well positioned, with no debt and more than $360 million made up of cash and marketable securities on its balance sheet.

This means that more than 20% of its market cap is made up of net cash. This clearly leaves IonQ in a strong position. Right?

Here’s where the plot thickens. It’s straightforward to grow a business when you don’t need to be profitable. But to grow a profitable business is a different story.

Case in point, for Q2 2024, for IonQ to deliver just under $8 million of revenues, it had to burn through slightly more than $34 million of free cash flow.

Think about it from this perspective, to make $1 of revenues, IonQ must burn through $4 of free cash flow.

And let’s be clear, I recognize that the bulk of the thesis here is that IONQ is now priced at 36x forward sales, when earlier this year it was priced above 50x forward sales.

But it’s really difficult to make a return when investors’ expectations are already this high. The easiest way to make money is by investing in a stock when investors’ expectations are still relatively muted. When there’s some uncertainty over its prospects.

I believe that most rational investors would agree, that paying more than 25x forward sales means that expectations are already super high. And best avoided.

The Bottom Line

I’m skeptical of IonQ’s starting valuation of 34x forward sales because it reflects sky-high expectations for a company that is still far from profitability. Despite its technical advancements and exciting government contracts, IonQ continues to burn through cash at an alarming rate, spending $4 to generate just $1 of revenue.

While the potential of quantum computing is immense, IonQ’s stagnant bookings and unclear path to scaling raise concerns about whether it can deliver meaningful returns anytime soon.

At this IonQ, Inc. valuation, it feels like we’re putting too much faith in quantum theory without seeing practical results.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.