Summary:

- NIO has continued to report improving gross profit margins and healthy balance sheet, while guiding FY2026 break even.

- The management’s FQ4’24 delivery guidance also underscores the country’s healthy consumer demand, thanks to the government subsidies/ tax breaks for EV purchases.

- NIO entry to the Middle East market, ongoing ONVO launch, and H1’25 Firefly launch are likely to boost its top-lines in the near-term.

- At the same time, readers must note that the automaker has finally reported positive Free Cash Flow in FQ3’24 (sum unspecified), with the management expecting to continue doing so moving forward.

- Even so, as a result of the ongoing cash burn and geopolitical headwinds, NIO is only suitable for those with a long investing trajectory and moderate risk appetite.

mikkelwilliam

NIO’s High Growth Cadence Remains Promising – Near-Term Reversal Unlikely

We previously covered NIO Inc. (NYSE:NYSE:NIO) in October 2024, discussing its robust intermediate term prospects, thanks to the timely mass market model launches and the introduction of government subsidies/ tax breaks for EV purchases.

Combined with the improving profit margins, healthy balance sheet, and potential moderation in cash burn, we had believed that its reversal was likely to come sooner than later, resulting our reiterated Buy rating upon a pullback to the $5s.

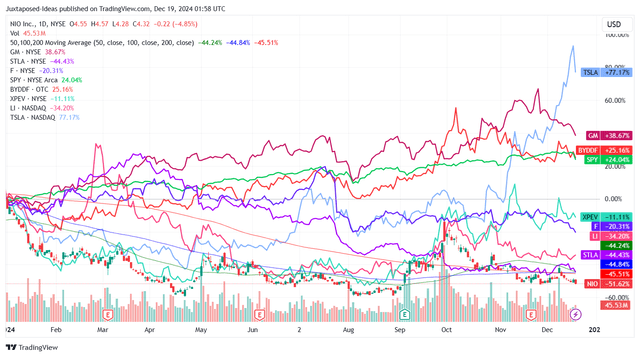

NIO YTD Stock Price

Trading View

Since then, our reiterated Buy point for NIO has materialized as expected, after the exuberant market sentiments surrounding Chinese ADRs moderate, as similarly observed in the other Chinese automotive stocks.

Part of the headwinds are naturally attributed to the slowdown in China’s consumer spending, with it pointing to the “persisting deflation and dwindling confidence.”

While some analysts may have hypothesized about the recovery of consumer sentiments and spending sometime in 2025, it is uncertain when and how the bend may occur indeed.

This is especially NIO has reported a sequentially flat delivery of 20.57K vehicles in November 2024 (-1.9% MoM/ +28.9% YoY), despite the growing demand for its mass-market model, ONVO, to 5.08K vehicles (+17.8% MoM).

Given the pessimistic consumer sentiments, it is also uncertain if the management may be able to achieve their ambitious March 2025 delivery target of 20K ONVO monthly deliveries along with the doubled FY2025 sales target on a YoY basis.

On the one hand, assuming that demand remains robust, we may see NIO achieve an improved manufacturing scale as the management commences production at its third factory in H2’25.

This may potentially expand upon the promising progress observed in the FQ3’24 gross margins of 10.7% (+1 points QoQ/ +2.7 YoY), as the automaker enters volume production.

On the other hand, we may also see NIO’s cash burn worsen from the FQ3’24 adj net loss margins of -23.6% (+2.3 points QoQ/ -2.9 YoY), as the management ramps up their ONVO production and increase their sales/ marketing activities, especially since Firefly (mass market model) is set to be delivered in H1’25.

Assuming that consumer demand remains sluggish in FY2025, we may also see the automaker having had to engage on painful price wars arising from the upcoming supply glut, as other Chinese automakers also look to expand their production outputs, including XPeng (XPEV), BYD Company (OTCPK:BYDDF), and Li Auto (LI).

For now, the first silver lining in NIO’s investment thesis will be the management’s promising FQ4’24 delivery guidance of 73.5K vehicles at the midpoint (+18.8% QoQ/ +46.8% YoY), with it underscoring the country’s still healthy consumer demand.

The second silver lining will be the stable cash position of $6B on its balance sheet (+5.2% QoQ/ -3.2% YoY), with it exemplifying its ability to fund the upcoming capex and yet profitable operations in the intermediate term, as the management continues to guide FY2026 break-even in the latest earnings call.

At the same time, NIO has finally embarked on its Middle East ambitions, as they open the first NIO house in Abu Dhabi, with it likely to boost its exports from the 1.08K vehicles reported on a YTD basis (up to September 2024).

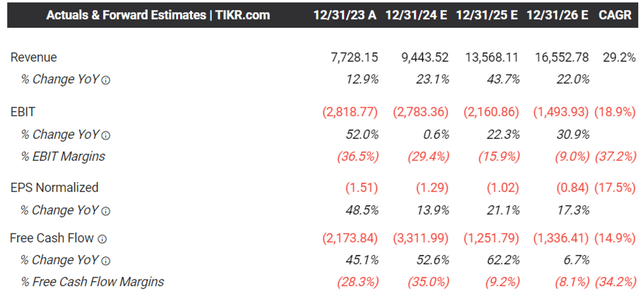

The Consensus Forward Estimates

Tikr Terminal

Given the management’s optimistic FY2025 guidance, it is unsurprising that the consensus forward estimates remain promising, with NIO still expected to generate robust top-line growth at a CAGR of +29.2% through FY2026, while building upon the 5Y historical growth at +62.2%.

At the same time, readers must note that the automaker has finally reported positive Free Cash Flow in FQ3’24 (sum unspecified), with the management expecting to continue doing so moving forward – with it signaling a new stage of operating scale ahead.

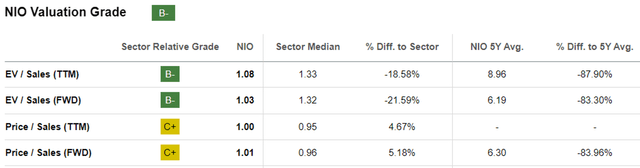

NIO Valuations

Seeking Alpha

This is also why we believe that NIO remains attractive at FWD EV/ Sales valuations of 1.03x, compared to its 5Y average of 6.19x and the sector median of 1.32x.

The same may be observed when comparing to its Chinese automotive peers, including XPEV at FWD EV/ Sales valuations of 1.84x and BYDDF at 1.01x, aside from LI at 0.47x.

Based on NIO’s Enterprise Value of $9.29B at the time of writing and the consensus raised FY2026 revenue estimates to $16.55B, the automaker’s high growth investment thesis is undeniably compelling at FY2026 EV/ Sales valuations of 0.56x indeed.

So, Is NIO Stock A Buy, Sell, or Hold?

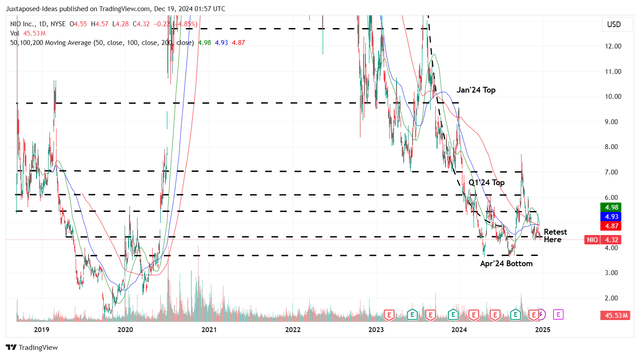

NIO 6Y Stock Price

Trading View

For now, NIO has returned most of its recent gains, albeit remaining well supported at its recent bottom of $4s. Part of the stock’s inability to sustain its upward momentum may also be attributed to the still elevated short interest of 9.31%, with any gains likely to be moderated by aggressive short sellers.

While the management may have guided FY2026 break even, the ongoing cash burn over the next two years remain a concern indeed, especially since it is uncertain if further capital raises may be necessary prior to its profitability some time in FY2027.

While NIO does not export to the US and is unlikely to be affected by the higher EV import tariffs, it goes without saying that a heightened tension between China and the US is likely to trigger further pessimism and volatility in Chinese ADRs, pending a reversal in market and investor sentiments.

As a result of the ongoing cash burn and geopolitical headwinds, we believe that those whom add the stock here must also be very patient, since its capital appreciation prospects are likely to be mixed over the next few years.

Therefore, while we are reiterating our Buy rating for NIO, it comes with the caveat that the stock is likely to be a swing trade potential in the near-term, prior to its eventual capital appreciation in the second half of the decade.

This is also why the stock is only suitable for those with a long investing trajectory and moderate risk appetite.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.