Summary:

- NIO stock has slumped by 50% in 2024 and close to 90% since hitting the peak in 2021, but the stock is showing some silver linings.

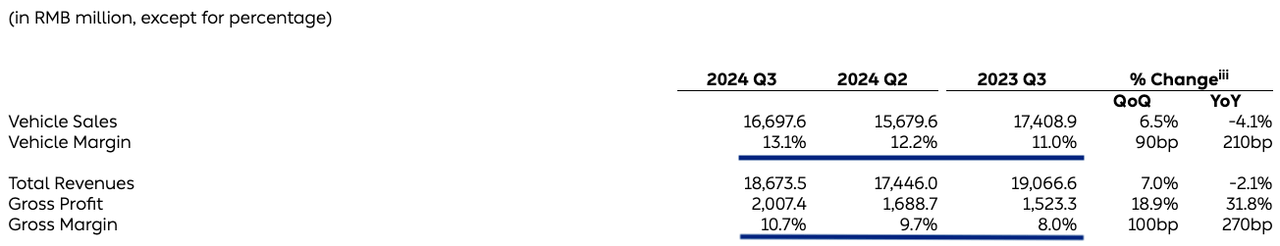

- Despite the intense price war in China, NIO has been able to increase its gross margin from 8.0% in the year-ago quarter to 10.7% in the recent quarter.

- The forward revenue growth projection for the fiscal year ending Dec 2025 is 44% which shows a strong consumer demand for its vehicles.

- Ultra-hawkish foreign policy by Trump administration could also be a tailwind for NIO and other Chinese stocks, similar to what we saw during the first term.

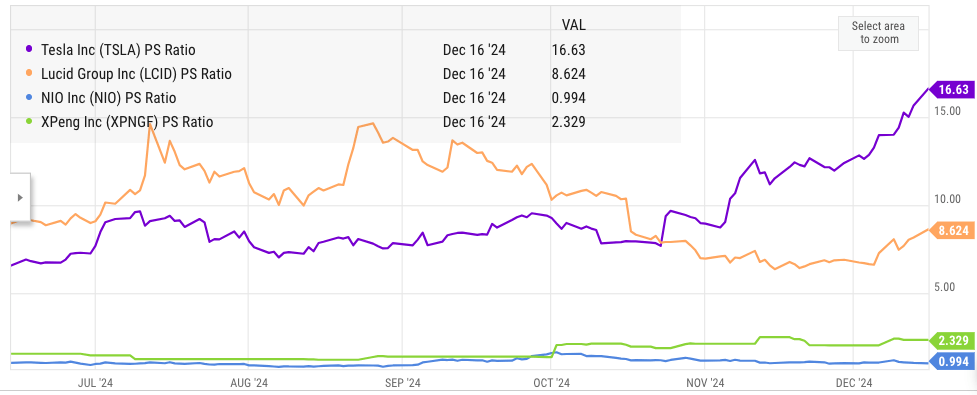

- NIO’s PS ratio is 1 compared to 16.5 for Tesla and more than 8 times for Lucid, which shows that a better macro climate could boost Wall Street sentiment and valuation multiple.

tang90246

NIO (NYSE:NIO) stock has seen another horrible year in 2024 but it is showing some silver linings. The recent quarterly earnings showed improvement in key metrics, which can boost the investor sentiment over the next few quarters. The gross margin of NIO increased to 10.7% in the recent earnings, up from 8% in the year-ago quarter, which is a big indicator of the cost optimization taking place within the company. We should note that the last few quarters saw a massive price war in China. Despite the price wars, NIO has been able to deliver improvement in gross margin and deliveries. In a prior article, it was mentioned that NIO’s cash reserves are sufficient to weather the current pricing wars in China.

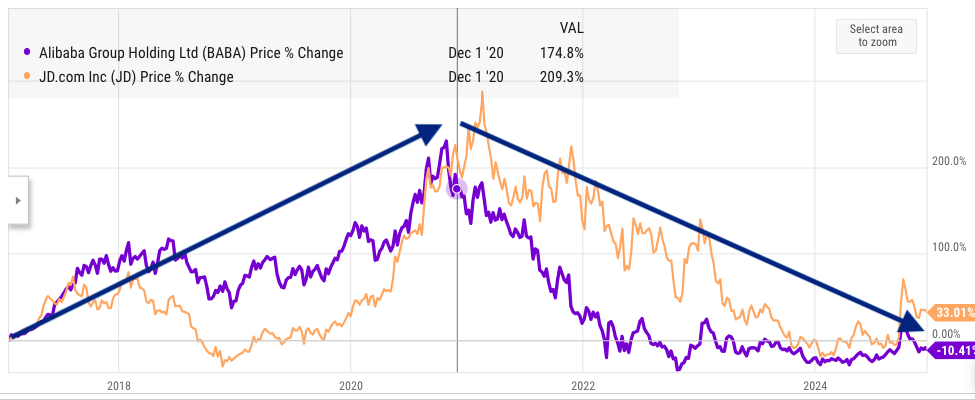

The ultra-hawkish foreign policy of the next Trump administration could also help NIO and other Chinese stocks. This reduces the geopolitical uncertainty, and any trade negotiations could deliver a strong tailwind. We saw a similar trend in the first term of Trump administration when stocks like Alibaba (BABA) showed price growth of 3X and then declined to 1/3rd during the recent Biden administration.

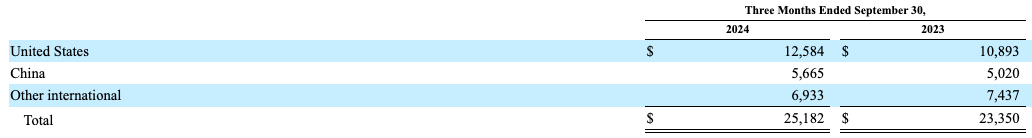

NIO’s PS ratio is a mere 1.0 compared with 16.5 for Tesla (TSLA) and 8.3 for Lucid (LCID). Tesla receives over 50% of its revenue from international markets, with a big chunk from China. NIO is still showing big losses, but this could change in 2025 as the margins improve, and the company launches new models which should increase the deliveries and revenue base. NIO stock is at a rock-bottom price, and it could see a big improvement in the near term if the next upcoming earnings meet Wall Street expectations.

A silver lining for the company

One of the best metrics in the recent quarter was the improvement in gross margin. This metric improved by 270 basis points compared to the year-ago quarter. This is not a small improvement when we look in the context of intense price wars in China. The only way NIO’s management could have pulled it off is through strong cost optimization.

Figure: Key metrics for NIO for gross margin and vehicle margin. Source: Company Filings

NIO recently announced 20,575 deliveries for November, which is a YoY increase of 28.9%. The YTD increase in deliveries has been 34.4% compared to year-ago period. This is a robust delivery momentum, especially as the company is focused on preserving its margins.

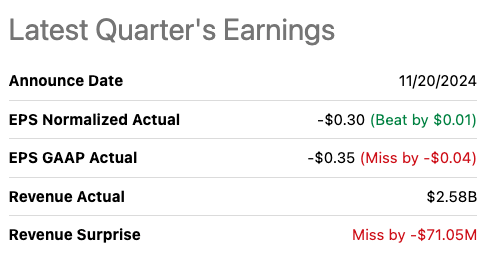

Seeking Alpha

Figure: NIO’s performance in the recent earnings. Source: Seeking Alpha

NIO reported missing revenue estimates in the recent quarter. However, this did not cause another correction in the stock. This could show that most of the negative news has already been priced in.

Strong revenue growth projection

NIO’s delivery base is still quite small compared to bigger competitors like BYD (OTCPK:BYDDF) or Tesla. Hence, it is very important for the company to deliver strong revenue growth, which can help it build economies of scale in the long term. The forward revenue projection for the fiscal year ending Dec 2025 is $13.5 billion, which would be equal to 43.6% YoY growth. This is a very strong growth projection and shows that Wall Street is optimistic that NIO will be able to deliver good products in the near term. NIO has already captured a good market share in the premium category and is now looking to expand in the affordable category.

Seeking Alpha

Figure: NIO’s revenue projections for the next few years. Source: Seeking Alpha

The forward price-to-sales ratio for fiscal year ending Dec 2026 is only 0.57. This is close to some of the older legacy automakers, which have very low revenue growth and have a low electric vehicle market share. We can assume that one of the key reasons behind the lower valuation multiple of NIO is the geopolitical uncertainty and tariff wars, which could hurt NIO’s prospects.

Tailwind in the next White House administration

Most of the analysts have mentioned the foreign policy of the next White House administration as a big challenge for Chinese stocks. However, I believe the ultra-hawkish foreign policy position of the next Trump administration could be a big tailwind for NIO and other Chinese stocks.

There are two reasons for my thinking the ultra-hawkish foreign policy is a tailwind:

1. Taiwan and South China Sea conflict: A big part of Wall Street bearishness towards Chinese stocks is related to the potential of active conflict in Taiwan and South China Sea. A hawkish policy by the Trump administration can reduce this geopolitical uncertainty. During the first term of Trump administration, we saw this issue receive less focus.

2. Tariffs and negotiations: Despite the tough negotiations, we saw a more amicable relationship during the first term of Trump administration. Visits by the leaders of the two countries between 2017-2021 also helped reduce the geopolitical tensions.

The jury is still out on how Wall Street will interpret the foreign policy of the next White House administration. However, as shown below, there is a clear sign that several major Chinese stocks gained a tailwind due to a clear geopolitical strategy by the White House during the first term.

Despite the rhetoric and threat of tariffs, the hawkish position should reduce the extreme geopolitical uncertainty. We have seen this in the first term between 2017-2021. During this time, key Chinese stocks like Alibaba saw price growth of 3X whereas in the next administration, the price declined to 1/3X between 2021-Present.

Ycharts

Figure: Performance of Alibaba and JD stock in the last two presidential terms. Source: Ycharts

Big Chinese stocks like Alibaba and JD faced a similar trend where they showed bullish momentum between 2017-2021 and then a bearish correction between 2021-Present. Past trends might not be repeated again but it is likely that a hawkish foreign policy can bring a bit more geopolitical certainty.

It should also be noted that Tesla receives over 50% of its revenue from international markets. From China alone, Tesla receives close to 20% of its revenue base. Hence, any geopolitical tensions should be reflected in Tesla, which we do not see at the current point.

Tesla Filings

Figure: Tesla’s revenue from different regions. Source: Tesla Filings

NIO’s rock-bottom price

One of the most attractive factors for NIO stock is the rock-bottom price. It is trading at a PS ratio of 1.0. The forward PS ratio for fiscal year ending Dec 2026 is only 0.57. This is quite low for a high-growth company. Tesla is trading at a PS ratio of 16.5 despite having lower revenue growth projections. Even Lucid is trading at a PS ratio of over 8.

Ycharts

Figure: PS ratio of NIO, XPeng, Tesla and Lucid. Source: Ycharts

NIO has been able to weather a very tough price war in China and still able to improve its margins. This is a good indicator of the ability to deliver better numbers once the macro conditions improve in China.

There are certainly risks associated with NIO stock. The company is still burning cash and faces an uphill task in increasing deliveries against well-established brands like Tesla and BYD. NIO’s entry into the affordable category will also put pressure on margins in the near term. European Union has recently imposed tariffs of up to 45.3% on Chinese-built electric vehicles, which can hurt NIO in the near term.

Despite these risks, NIO stock seems quite attractive when we look at the forward revenue growth and margin expansion capability. The management has mentioned that they will try to deliver a vehicle margin of 15% from the next quarter. The rock-bottom stock price also means that most of the negative news is priced in and any positive macro news could help deliver a bullish sentiment for the stock.

Investor Takeaway

NIO has delivered mixed results in the recent quarter. Despite missing revenue estimates, NIO has been able to show improvement in gross margin. New affordable models by the company should also deliver robust growth in the next few quarters. The next White House administration might have more rhetoric towards China but we could see a lower geopolitical uncertainty due to the foreign policy. This could help improve Wall Street’s sentiment towards NIO and other Chinese stocks.

The PS ratio of NIO is only 1 compared to 16.5 for Tesla. This is a massive difference, especially when we look at the forward revenue growth projections of these companies. NIO stock can be a good option for investors looking to enter the EV sector, and the modest valuation is another positive for this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.