Summary:

- OPEN continues to face significant macroeconomic headwinds, including elevated mortgage rates and sticky inflation, impacting its near-term recovery prospects.

- Despite some improvements in profit margins and ongoing cost-saving measures, the company’s cash burn and lowered revenue estimates suggest ongoing challenges.

- OPEN remains inherently undervalued, offering opportunistic investors with a potentially rich capital appreciation prospect, albeit possibly negated by aggressive short sellers.

- Given the potential volatility and lack of immediate recovery catalysts, we recommend observing from the sidelines for now.

Daniel Grizelj

Opendoor Technologies: Minimal Recovery Catalysts – More Uncertainties In The Near-Term

We previously covered Opendoor Technologies (NASDAQ:OPEN) in October 2024, discussing its stock underperformance compared to its peers/wider market, despite the potential tailwinds from the Fed’s recent pivot, with the headwinds attributed to the management’s underwhelming FQ3’24 guidance and expensive FQ2’24 inventory levels.

Even so, we had believed that the iBuying company might generate a robust FY2025 performance, if not earlier by FQ4’24, thanks to the moderating mortgage rates and higher mortgage-purchase applications, resulting in our Speculative Buy rating then.

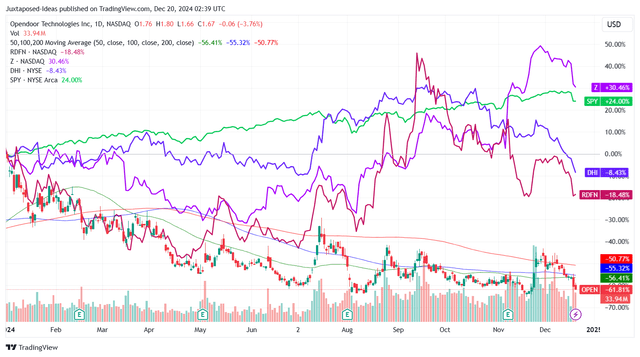

OPEN YTD Stock Price

Trading View

Since then, OPEN has continued to trade sideways between $1s and $2s, as the wide market offered a +2.1% return.

It is apparent that market sentiments surrounding the iBuying company has been pessimistic, despite the Fed’s outsized pivot by 50 basis points in the September 2024 FOMC meeting, by 25 basis points in November 2024, and by another 25 basis point cut in December 2024.

If anything, the Fed’s hawkish tone in the recent FOMC meeting is likely to set the stage for a tough FY2025 as well, with the still elevated inflation potentially triggering a prolonged macroeconomic uncertainty along with prolonged borrowing cost normalization.

The same has been priced in by the market, as most analysts expect the Fed to hold the Federal Target Rate steady for the upcoming FOMC meeting in January 2025.

These may also be the reasons why the 30Y Fixed Rate Mortgage Average in the US remains elevated at 6.72% by December 19, 2024 and the 15Y rate at 5.92%, up from the September 19, 2024 bottom levels of 6.09% and 5.15%, respectively, compared to 2019 averages of 4.13% and 3.28%.

With borrowing costs still elevated, inflation still elevated, and home prices still expensive, it is unsurprising why the resale home supply remains impacted prior to the materialization of the magic mortgage rates at 5%.

These may also be the reasons why OPEN has offered an underwhelming FQ4’24 guidance, with revenues of $950M (-32.1% QoQ/ -86.2% YoY), contribution margin of 2.1% (-1.7 points QoQ/ +1.6 YoY), and adj EBITDA margins of -6.8% (-4.1 points QoQ/ +2.2 YoY).

Even so, keen eyed readers may already see the notable improvements in its profit margins on a YoY basis, with it underscoring why the management’s “raised spreads back in May” and the ongoing operations “with elevated spread levels throughout Q3, prioritizing risk management” have worked as intended in minimizing cash burn.

At the same time, OPEN has already announced its separation from Mainstay in August 2024, with it expected to deliver $35M in annual cost savings, on top of the headcount reduction by -17% in November 2024, building upon the -18% laid off in November 2022 – with these efforts likely to be directly accretive to its bottom-lines in the intermediate term.

The iBuying company’s inventory levels have also moderated sequentially to healthier levels at an average price of $341.11K per home in FQ3’24 (-2.2% QoQ/ +4.2% YoY).

This development has naturally allowed OPEN to generate an improved profit spread from the quarter’s US Existing Home Median Sales Prices of $414.1K (-0.6% QoQ/ +3.3% YoY).

The same has been observed in the positive FQ3’24 contribution margins of 3.8% (-2.5 points QoQ/ -0.6 YoY) and stable adj EBITDA margins of -2.8% (-2.5 points QoQ/ -2.2 YoY).

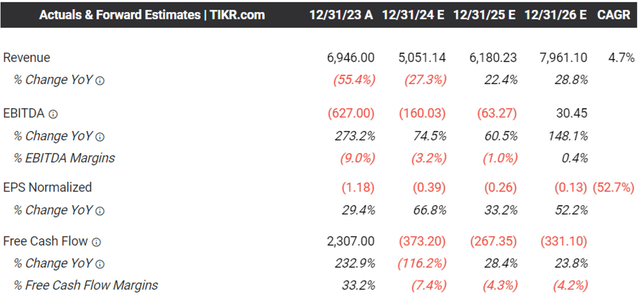

The Consensus Forward Estimates

Tikr Terminal

Even so, given the mixed macroeconomic environment, while OPEN may have highlighted their focus “on reducing net losses and ultimately achieving adjusted net income profitability,” it is apparent that the cash burn may continue for a little longer, as observed in the consensus forward estimates above.

Combined with the likely to be higher for longer borrowing costs, we can understand why the stock has underperformed as it has, while naturally failing to ride the recent “broader stock market rally following Donald Trump’s 2024 presidential election win.”

So, Is OPEN Stock A Buy, Sell, or Hold?

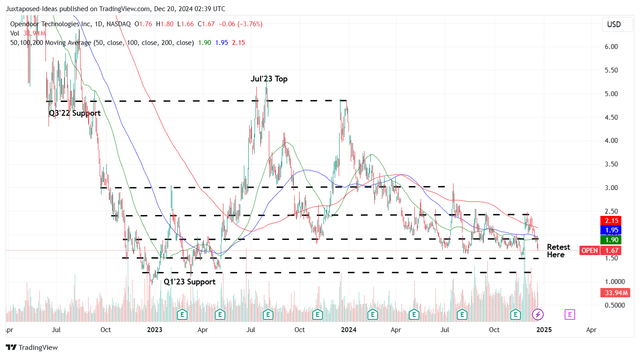

OPEN 2Y Stock Price

Trading View

For now, OPEN has continued to chart lower lows since June 2024, with the stock seemingly on its way to retest the next support levels of $1.50s or worst, the Q1’23 support levels of $1.25s.

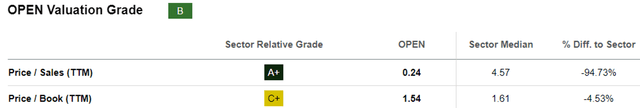

OPEN Valuations

Seeking Alpha

If anything, the macroeconomic headwinds have also contributed to OPEN’s lowered consensus forward estimates from the prior projected FY2026 revenues of $9.46B to $7.96B by the time of writing.

Even then, thanks to its penny stock status, it is undeniable that the iBuying company is extremely cheap at TTM Price/ Sales of 0.24x, compared to the prior article at 0.30x and the sector median of 4.57x.

Even when compared to Redfin (RDFN) at TTM Price/Sales valuations of 0.94x and Zillow (Z) at 7.79x, it is undeniable that OPEN offers opportunistic investors with a rich capital appreciation prospect, upon the normalization in macroeconomic outlook and improvements in its profit margins over the next few years.

When will this happen? Well, the outlook appears to be bleak in the near-term indeed, given the still elevated inflationary pressure, with the Fed projecting inflation to moderate only to 2.2% by 2026 compared to the favored number of 2%.

If anything, the President Trump elect has already highlighted his plans to propose higher import tariffs by up to “60% on China and imposing tariffs of up to 20% on all $3 trillion of US imports,” with it likely to trigger an elongated inflationary pressure in the intermediate term.

This development may naturally impact OPEN’s prospects as an iBuying company, given its sensitivity to mortgage rates and eventually, home buying/ selling activities.

The same has been highlighted by the management, in which Q3’24 has brought forth “further deterioration in key housing market indicators,” as “listing rates continued to decline and clearance rates declined more than seasonally typical. Overall, the housing market is on track to experience the lowest level of existing home sales since 1995 for a second consecutive year.”

Pending further US policy clarity in 2025, we believe that OPEN is likely to continue trading sideways at best, otherwise, hit new lows in the mean time.

Assuming the worst and the stock falls below the NASDAQ requirement of $1.00 per share, the iBuying company may be issued with a deficiency notice and eventually, face potential delisting as well.

While we remain encouraged by OPEN’s recent executions, we believe that it may have been too late and too little, with there remaining little catalysts for near-term recovery, worsened by the still elevated short interest of 9.87% by the time of writing.

As a result of the potential volatility, we prefer to downgrade to a Hold (Neutral) instead.

It may be more prudent to stand on the sidelines and observe for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.